Este artículo también está disponible en español.

Ethereum has had a tough 12 months, however latest insights from business insiders point out a attainable comeback. Matthew Sigel, VanEck’s Head of Digital Property Analysis, just lately indicated that Ethereum is oversold.

He thinks that elevating speculative curiosity within the altcoin will allow its comeback. This comes as Ether tries to meet up with rivals corresponding to Bitcoin and Solana, which far exceeded it in 2024.

Associated Studying

A Shift In Market Sentiment

Sigel spoke on The Tie’s newest episode wherein he hopes Ethereum will go in the suitable route. He additionally famous that, though Ethereum faces issues, notably concerning EIP-4844 wherein it modifications its financial mannequin, alternatives can nonetheless emerge for a “backside.”

.@matthew_sigel “I believe ETH is oversold…Hypothesis will come again to this market and I don’t suppose it’s going to disregard Ethereum.” https://t.co/5pMcZBLzfi

— VanEck (@vaneck_us) November 7, 2024

The market is now a bit of conservative, however Sigel sees the commodity drifting again into hypothesis, bringing value again up and advocates to the commerce once more.

That additionally locations it according to bigger Ethereum expectations. Analysts are even anticipating ETH to commerce between $2,199 and $3,019 in 2024, with some anticipating a spike to above $5,000 by 2025.

Pleasure generated earlier this 12 months by acceptance of spot Ethereum ETFs has introduced a regulated gateway to buyers for getting into the market, each retail and institutional buyers. This improvement could trigger large inflows into Ethereum with huge monetary inflows, additional buttressing its value.

Technical Evaluation And Value Predictions

In line with the newest technical evaluation, Ethereum should break above $3,000 to maintain its bullish sentiment, and lots of analysts imagine this may occasionally nicely open roads for a brand new file excessive. In line with the Ethereum Rainbow Chart, we will see all kinds of attainable costs for the next years, with estimates reaching as excessive as $12,000 by 2030.

Nevertheless, some are involved about Ethereum’s long-term financial technique. Sigel mentioned that Layer-2 networks have began to assert extra of Ethereum’s blockspace, leading to decrease transaction charges and revenue.

This improvement has led some buyers to lose religion in Ethereum as a deflationary asset. If this development continues with out modifications to hyperlink Layer-2 networks extra intently with Ethereum’s ecosystem, VanEck’s long-term value targets could also be jeopardized.

Associated Studying

The Highway Forward For Ethereum

Regardless of these issues, commentators categorical a real feeling of optimism about Ethereum’s future. The prospect of contemporary speculative exercise, together with the regulatory certainty given by ETF approvals, may very well be precisely the spark for a big comeback. Because the market evolves and reacts to those developments, buyers are in search of indicators {that a} constructive development will return to Ethereum.

Whereas Ethereum confronts challenges, consultants imagine {that a} mixture of accelerating curiosity and good market situations may pave the best way for a resurgence in 2024 and past.

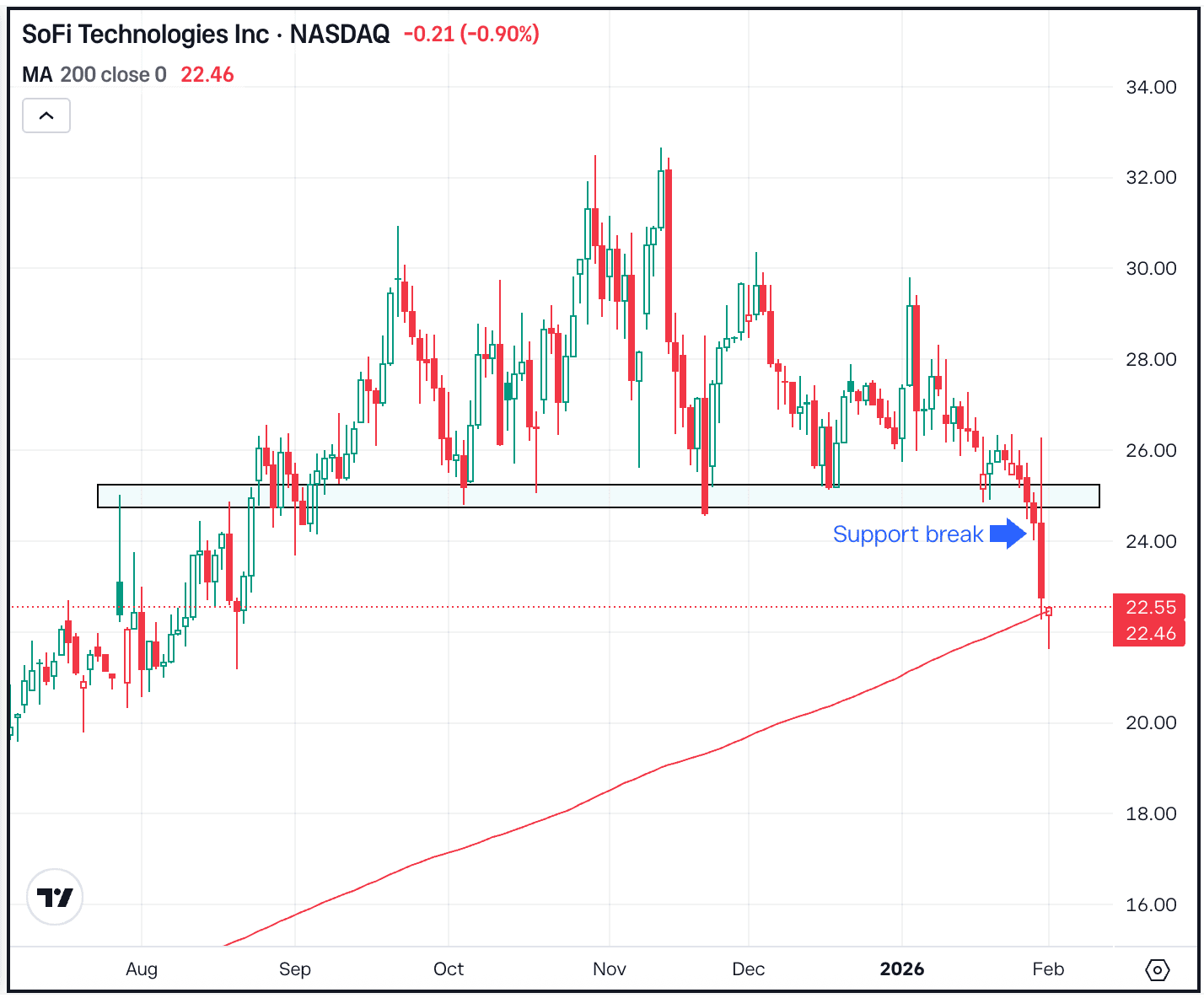

Featured picture from DALL-E, chart from TradingView