As President-Elect Donald Trump prepares to imagine workplace, the crypto business is carefully watching his administration’s potential picks for key monetary regulatory positions. With guarantees to finish the “conflict on crypto” initiated beneath the Biden administration, Trump is predicted to overtake management on the Securities and Trade Fee (SEC) and different monetary companies.

Will Dan Gallagher Lead The “Peace With Crypto”?

In keeping with Reuters, Trump’s transition staff is contemplating Dan Gallagher, a former Republican SEC commissioner from 2011 to 2015 and the present Chief Authorized and Compliance Officer at Robinhood Markets Inc., as a front-runner for the SEC chair place. Gallagher is very regarded amongst crypto executives who contributed thousands and thousands to Trump’s marketing campaign.

Additionally into consideration is Paul Atkins, one other former Republican SEC commissioner and the CEO of Patomak World Companions, a consultancy agency. Atkins served on Trump’s transition staff in 2016 and was beforehand a contender for the SEC chair position. Robert Stebbins, a associate at Willkie Farr & Gallagher and former SEC basic counsel throughout Trump’s first time period, can be being mentioned for prime monetary regulatory roles.

“President-Elect Trump will start making selections on who will serve in his second Administration quickly. These selections will probably be introduced when they’re made,” Karoline Leavitt, Trump’s nationwide press secretary, advised Reuters.

In the meantime, present SEC commissioner Mark Uyeda has publicly expressed his intention to assist Trump’s agenda to finish the regulatory crackdown on crypto. Uyeda, who has served on the fee since 2022, is prone to grow to be the performing chair when Trump takes workplace in January, in keeping with a FOX Enterprise report.

“The Fee’s conflict on crypto should finish, together with crypto enforcement actions solely based mostly on a failure to register with no allegation of fraud or hurt. President Trump and the American citizens have despatched a transparent message. Beginning in 2025, the SEC’s position is to hold out that mandate,” Uyeda advised FOX Enterprise.

Uyeda’s stance aligns with Trump’s marketing campaign promise to halt the aggressive enforcement actions initiated by present SEC Chair Gary Gensler. Underneath Gensler’s management, the SEC has introduced over 100 enforcement actions towards corporations prior to now three years, focusing on each fraudulent actions and unregistered securities choices.

Whereas some instances concerned clear situations of fraud and cash laundering—resembling the costs towards Sam Bankman-Fried, founding father of the now-bankrupt change FTX—others have focused established corporations like Coinbase, Ripple, Kraken, ConsenSys, and Cumberland DRW for allegedly promoting unregistered securities.

Gensler has maintained that each one tokens, besides Bitcoin, are securities falling beneath the SEC’s jurisdiction—a place that has confronted important opposition from the business, authorized specialists, and members of Congress. Together with his time period set to finish in 2026, Gensler has indicated he’ll step down when the brand new administration takes over.

Hester Peirce, one other Republican SEC Commissioner recognized for her pro-crypto views and dubbed “Crypto Mother,” was initially seen as a powerful candidate for the SEC chair. Nonetheless, sources point out that she shouldn’t be within the position. As a substitute, Peirce is reportedly eager on main an inner “crypto process power” geared toward re-evaluating the SEC’s method to digital belongings and fostering open dialogue with business stakeholders.

Peirce has been a vocal advocate for “secure harbor” provisions that might permit crypto corporations to function beneath regulatory oversight with out the fast risk of enforcement actions. A staffer for Peirce declined to touch upon her intentions.

Uyeda has additionally criticized the SEC’s present method to crypto regulation, describing it as a “catastrophe for the entire business” throughout an look on FOX Enterprise. “We’ve been sending this ‘coverage by enforcement,’ we’ve performed nothing to supply steerage on it,” he stated.

At press time, the entire crypto market cap stood at $2,512 trillion.

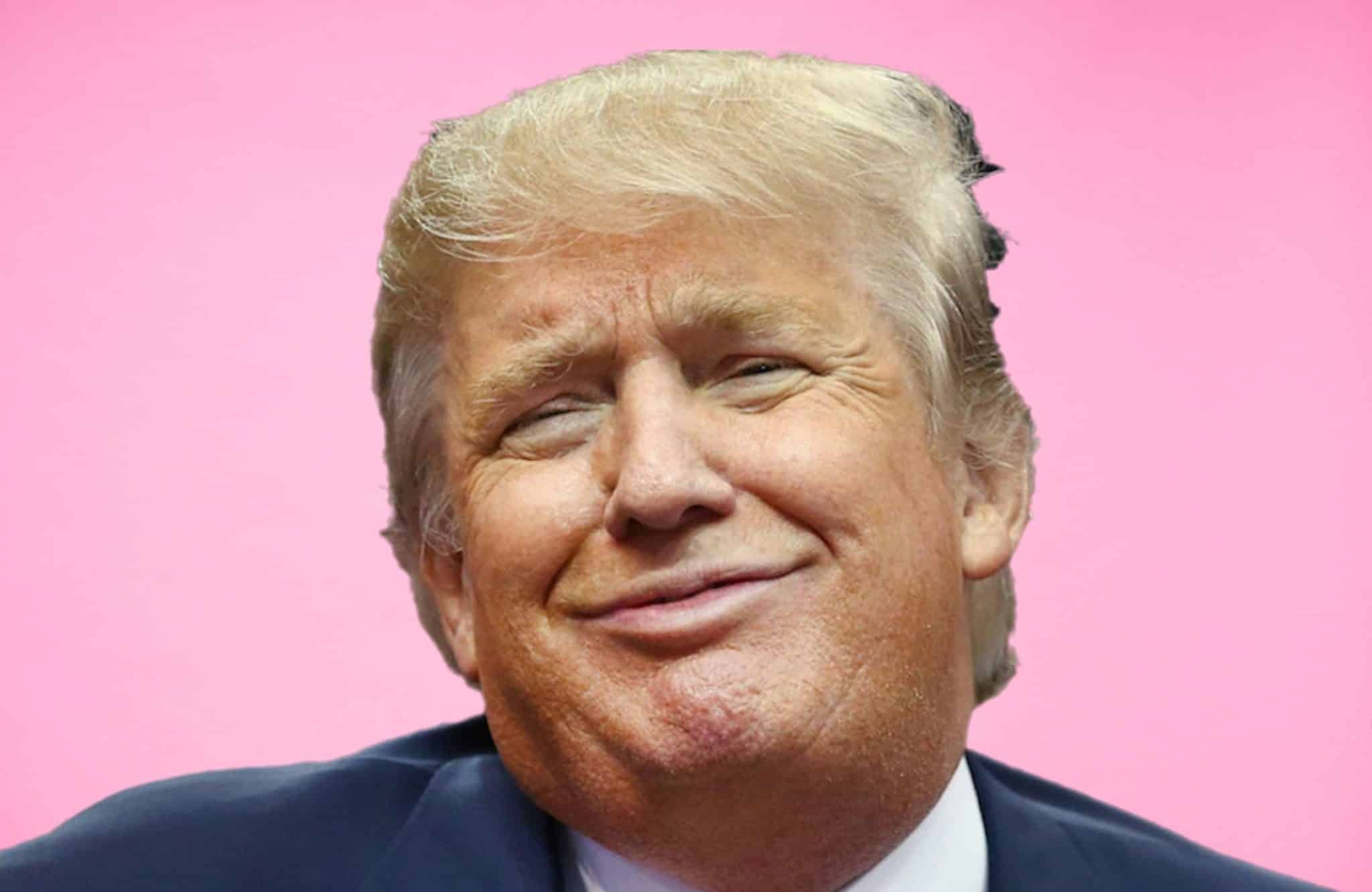

Featured picture from Los Angeles Occasions, chart from TradingView.com