Following a powerful 46% rally in latest days, Dogecoin (DOGE) has been making waves within the crypto panorama. It now seems that the meme coin is poised for an additional large rally within the coming days, because it has shaped a robust bullish value motion sample on its each day time-frame.

Dogecoin (DOGE) Technical Evaluation and Upcoming Ranges

In line with CoinPedia’s technical evaluation, DOGE is on the verge of breaking out of a vital resistance degree, the excessive of March 2024. Based mostly on latest value motion and historic momentum, if DOGE breaches this degree and closes a each day candle above it, there’s a robust risk it might soar by 50% to succeed in the $0.35 degree within the coming days.

Nonetheless, with the present market sentiment, this notable value rally might be simply potential. At the moment, DOGE is buying and selling above the 200 Exponential Transferring Common (EMA) on a each day time-frame, indicating an uptrend.

DOGE’s Bullish On-Chain Metrics

In addition to technical evaluation, on-chain metrics additional help DOGE’s bullish outlook. In line with the on-chain analytics agency IntoTheBlock, DOGE’s on-chain metrics, reminiscent of Internet Community Development, Within the Cash, Focus, and Massive Transactions Quantity, point out a bullish sign.

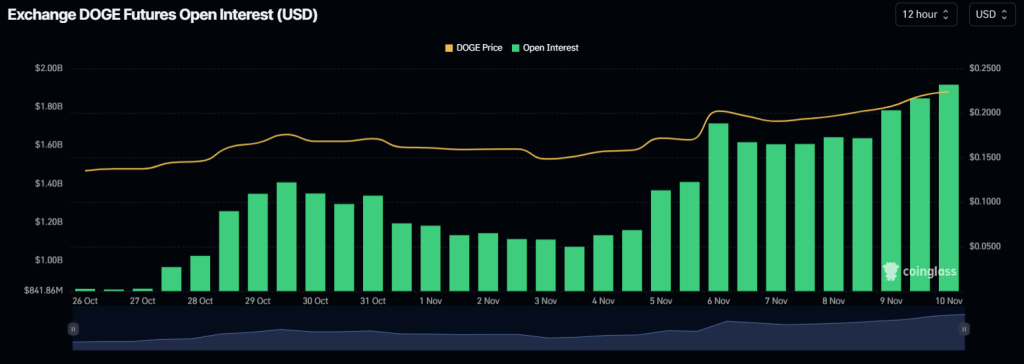

In addition to this, merchants are presently making notable bets on DOGE’s future contracts, as its open curiosity has jumped by 18% up to now 24 hours and 11% up to now 4 hours, in line with the on-chain analytics agency Coinglass. Moreover, DOGE’s Lengthy/Brief ratio presently stands at 1.02, indicating bullish sentiment amongst merchants.

By combining these on-chain metrics with technical evaluation, it seems that bulls are presently dominating the asset and will help DOGE in its upcoming rally within the coming days.

Present Value Momentum

At press time, DOGE is buying and selling close to $0.227 and has skilled a value enhance of over 14% up to now 24 hours. Throughout the identical interval, its buying and selling quantity rose by 23%, indicating heightened participation from merchants amid a possible upside rally.