On Tuesday, Matthew Sigel, the top of digital asset analysis at asset administration agency and crypto exchange-traded fund (ETF) issuer VanEck, formally endorsed President-elect Donald Trump’s proposal for a nationwide strategic Bitcoin reserve.

Main Monetary Gamers Align

This endorsement comes as discussions about BCT’s function in US financial coverage are intensifying, most notably with Dennis Porter, co-founder and CEO of the non-profit Satoshi Motion Fund (SAF), reaffirming BlackRock’s help for the strategic Bitcoin reserve.

Porter emphasised that the Trump administration is actively working in direction of creating this reserve by means of an govt order, highlighting a big alignment amongst main monetary gamers and lawmakers relating to Bitcoin’s future.

Throughout a collection of social media posts on X (previously Twitter), Porter additionally outlined a collection of steps he believes will facilitate the institution of the strategic Bitcoin reserve, suggesting that the method will start with Trump appointing a pro-Bitcoin Treasury Secretary.

Key Steps For Establishing A US Strategic Bitcoin Reserve

Porter asserts that Donald Trump would then signal an govt order to create the reserve, which might additionally contain halting the public sale of Bitcoin at present held by the US Marshals Service.

The subsequent part would see the Treasury take in these Bitcoin property and place them into the Alternate Stabilization Fund. Over time, the Treasury would proceed to build up Bitcoin for the reserve.

Porter additionally famous the significance of legislative help, stating that since govt orders might be simply reversed, it might be essential for Congress to move a proper invoice establishing the strategic reserve, spearheaded by pro-crypto Senator Cynthia Lummis.

The potential for a US strategic Bitcoin reserve has generated substantial pleasure available in the market, contributing to Bitcoin’s current surge to an all-time excessive of $94,000.

This displays rising confidence amongst buyers and hypothesis that such authorities actions might result in important shopping for stress and additional institutional adoption.

On the time of writing, BTC has fallen again to $93,380 after hitting its new all-time excessive, marking a 40% enhance in simply two weeks.

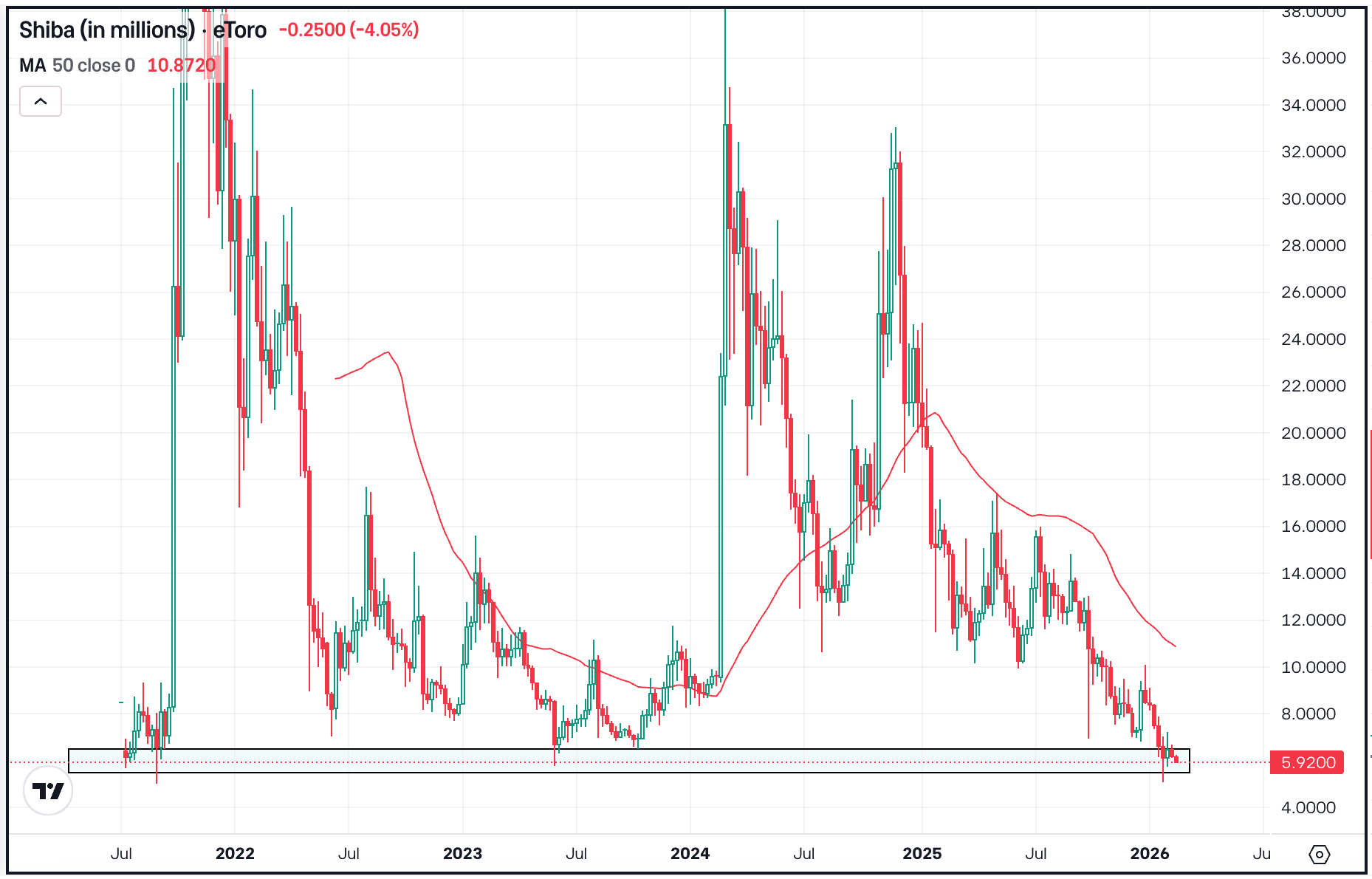

Featured picture from DALL-E, chart from TradingView.com