Bitcoin constantly captures headlines, and over time, November 28 has emerged as a pivotal date in its historical past. On this present day in 2013 and 2017, Bitcoin surged to new ATHs, sparking international curiosity and investor enthusiasm. As we method November 28, 2024, the query arises: Can Bitcoin replicate its previous efficiency and soar past $100,000?

You heard it right here first… 🤞Nov 28, 2012 – First BTC Halving EventNov 28, 2013 – Bitcoin worth breaks $1,000Nov 28, 2017 – Bitcoin worth breaks $10,000 Nov 28, 2024 – Bitcoin worth breaks $100,000? 👀@DavidFBailey ship it! 💪🔥

— Mark Mason | markmason.btc (@MarkMoneyMason) November 27, 2024

A Look Again: November 28, 2013, and 2017

November 28, 2013: Bitcoin celebrated its first ATH by surpassing $1,000. This milestone was the results of a fast ascent fueled by rising consciousness, elevated adoption, and pleasure surrounding the disruptive potential of Bitcoin. On the time, Bitcoin was nonetheless a distinct segment asset, however crossing the $1,000 barrier established it as a severe contender within the monetary panorama, akin to a digital gold rush.

November 28, 2017: 4 years later, Bitcoin shattered the $10,000 mark, a big psychological and market-defining milestone. The 2017 rally was pushed by broader adoption, the Preliminary Coin Providing (ICO) growth, and rising curiosity from retail traders. By December, Bitcoin’s worth peaked close to $20,000, concluding a rare 12 months that left an enduring imprint available on the market.

These dates have turn out to be legendary in Bitcoin lore, symbolizing moments when Bitcoin exceeded expectations and overcame skeptics.

Why November 28? Understanding the Historic Context

The prominence of November 28 in Bitcoin’s historical past isn’t any mere coincidence. This date is intrinsically linked to Bitcoin’s four-year halving cycle, an occasion the place the block reward miners obtain is decreased by half. The primary halving occurred on November 28, 2012, initiating a sample that correlates with Bitcoin’s worth cycles. Halvings lower the speed at which new Bitcoins enter circulation, enhancing shortage and infrequently sparking bullish worth actions in subsequent years. The 2012 halving set the stage for the 2013 ATH, whereas the 2016 halving paved the best way for the 2017 bull run.

With the newest halving having taken place in April 2024, comparable market dynamics are anticipated to unfold, resulting in hypothesis that November 28, 2024, might witness one other ATH.

What Makes 2024 Particular?

A number of elements contribute to the optimism surrounding a possible ATH on November 28, 2024:

Publish-Halving Momentum

Traditionally, Bitcoin experiences vital worth development within the 12–18 months following a halving. With the April 2024 halving now behind us, the anticipated provide shock has already begun to affect the market. Early indicators recommend a gentle improve in demand, setting the stage for a possible record-breaking rally as we method the tip of the 12 months.

Elevated Institutional Adoption

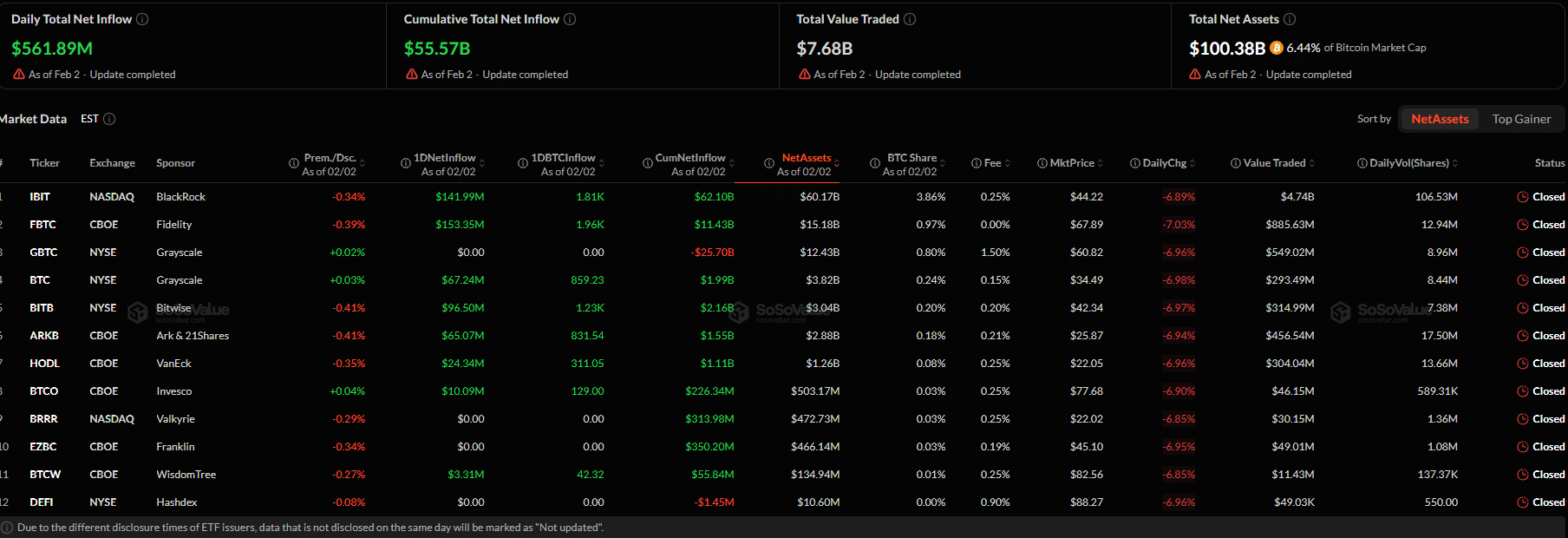

Since 2017, the funding panorama has advanced with main institutional gamers like BlackRock and Constancy getting into the Bitcoin market. The introduction of spot Bitcoin ETFs has injected billions of {dollars} in new liquidity, doubtlessly propelling costs to unprecedented ranges. In 2024, continued institutional curiosity and the launch of further monetary merchandise additional drove Bitcoin’s adoption and worth.

Geopolitical and Financial Elements

In an period marked by inflation, foreign money devaluation, and banking instability, Bitcoin’s attraction as a retailer of worth has intensified. Enhanced international adoption might additional amplify its upward trajectory, positioning Bitcoin as a hedge towards financial uncertainties. Current geopolitical tensions and financial insurance policies worldwide may additionally contribute to elevated investor curiosity in Bitcoin as a safe-haven asset.

Presidential Assist

Including to this momentum is the election of Donald Trump as the primary pro-Bitcoin U.S. President. President Trump’s administration has been notably supportive of Bitcoin, implementing insurance policies that favor adoption and integration. His pro-Bitcoin stance has additional legitimized Bitcoin within the eyes of many traders and establishments, fostering an atmosphere conducive to Bitcoin’s development.

Company Treasury Adoption

One other pivotal improvement in 2024 is the rising pattern of companies adopting Bitcoin as a part of their treasury reserves. Main corporations throughout varied industries are diversifying their property by allocating a portion of their treasury to Bitcoin. This shift not solely enhances company monetary methods but in addition drives demand for Bitcoin, contributing to its upward worth trajectory. Company adoption serves as a powerful endorsement of Bitcoin’s viability as a long-term funding and retailer of worth.

Market Sentiment

Bitcoin thrives on narratives and investor sentiment. The aspiration to succeed in $100,000 aligns with the prevailing optimism and pleasure as November 28, 2024, approaches. Social media discussions, technical evaluation, and psychological milestones all contribute to constructing momentum. The neighborhood’s perception in Bitcoin’s potential performs an important position in driving its worth ahead.

Challenges to Think about

Regardless of the promising elements, reaching $100,000 by November 28, 2024, shouldn’t be assured. Potential hurdles embrace:

Macroeconomic Uncertainties: World financial instability might impression investor confidence and market dynamics.Regulatory Challenges: Growing regulatory scrutiny and potential restrictions might hinder Bitcoin’s development.Market Volatility: Bitcoin stays inherently risky, and unexpected market shifts might disrupt upward momentum.Previous Efficiency Limitations: Historic traits don’t assure future outcomes, and the market stays unpredictable.

Will Historical past Repeat Itself?

Bitcoin’s historic efficiency on November 28 highlights its cyclical nature, providing a tantalizing glimpse into potential future traits. Nonetheless, whether or not the 2024 sample will proceed stays unsure. Reaching a $100,000 ATH wouldn’t solely display Bitcoin’s resilience but in addition reinforce its standing as a world monetary asset.

As November 28, 2024, approaches, one factor is obvious: Bitcoin’s journey is ongoing. Whether or not it reaches $100K or surpasses it, this date might as soon as once more turn out to be a landmark second within the annals of the world’s first digital foreign money.

What do you suppose? Will Bitcoin hit a brand new ATH on November 28, 2024?