Understanding Bitcoin Corrections within the Wake of the Latest All-Time Excessive

Bitcoin lately reached a formidable new all-time excessive of $99,800 (supply: eToro) capturing consideration and sparking pleasure throughout the crypto market.

Regardless of this, as we’ve seen in previous cycles, record-breaking highs typically pave the best way for inevitable corrections. Bitcoin has skilled a drawdown of almost XX% in latest days—a notable decline, however one which’s traditionally typical throughout bull markets..

A Acquainted Sample in Bitcoin Bull Markets

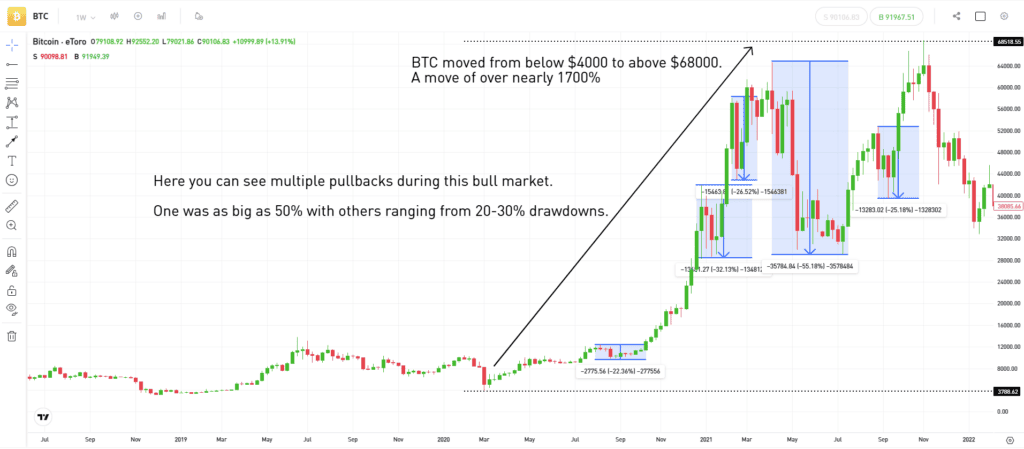

Corrections, particularly in unstable property like Bitcoin, are par for the course. If we glance again on the 2017 bull market, there have been a minimum of seven drawdowns of 30% or extra, every met with preliminary fear however in the end resulting in increased worth ranges.

Supply: eToroPicture created by Sam North, eToro analystPrevious efficiency just isn’t a sign of future outcomes.

Within the 2020-2021 bull market, this sample repeated with over a dozen 10%+ drawdowns.

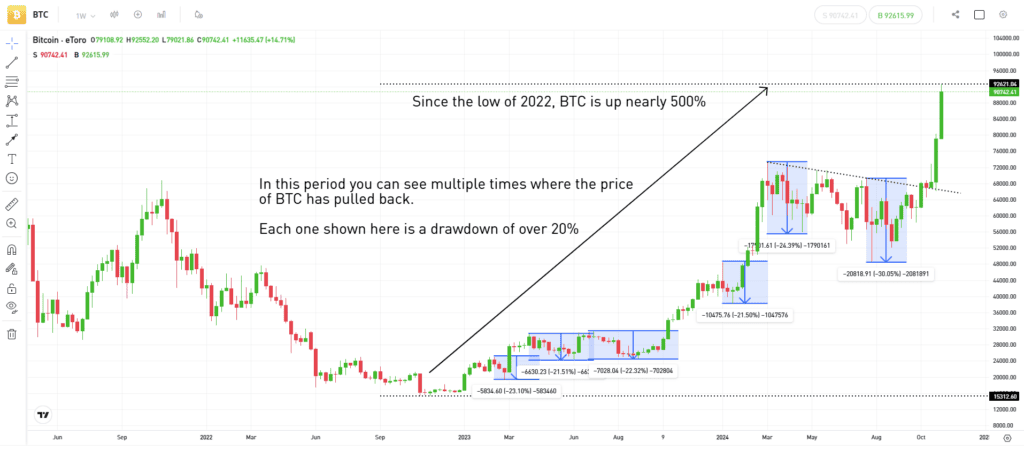

Supply: eToroPicture created by Sam North, eToro analystPrevious efficiency just isn’t a sign of future outcomes.

Every drawdown marked moments for the market to breathe, recalibrate, and in the end set the stage for additional progress.

Supply: eToroPicture created by Sam North, eToro analystPrevious efficiency just isn’t a sign of future outcomes.

This yr, as Bitcoin rallied towards its latest excessive, we’ve already seen a number of corrections of 20% or extra—reminders that steep worth drops are part of Bitcoin’s progress cycle. The essential takeaway? Corrections don’t signify an finish to the bull market; they mirror the asset’s maturation and pure response to market dynamics.

Try eToro analyst Sam North, who has made a really fascinating video clip explaining clearly and intimately concerning the drawdown as an integral a part of a bullrun – what it means, what to search for and methods in which you’ll be able to take care of corrections.

Why Do These Corrections Occur?

Bitcoin’s inherent volatility is usually tied to the dearth of a standardized valuation mannequin. The worth fluctuates considerably as traders and establishments constantly assess Bitcoin’s worth, factoring in information, market sentiment, and macroeconomic shifts. Previously, excessive leverage in Bitcoin futures buying and selling amplified these actions, making each the upswings and downturns sharper.

However the panorama is evolving. Institutional adoption, exemplified by main gamers like BlackRock and their authorized spot Bitcoin ETF, might probably convey higher liquidity and stabilize a few of Bitcoin’s volatility over time. Nonetheless, corrections stay an important a part of market dynamics—even in an asset as established as Bitcoin.

The Worth of Diversification and Prudent Funding

Bitcoin’s wild worth fluctuations underline the significance of a well-diversified portfolio. Whereas Bitcoin is an attractive asset, particularly in bull markets, diversification helps traders handle danger throughout totally different property and sectors. Balancing your portfolio with quite a lot of asset lessons can present a security internet, permitting you to learn from Bitcoin’s progress potential whereas decreasing publicity to its worth swings.

It’s all about embracing each the Ups and the Downs

As we navigate this bull run, it’s important to keep in mind that Bitcoin’s path to new highs isn’t a straight line. These corrections are a part of its progress story. Traders who acknowledge this volatility as a pure incidence, slightly than a motive to panic, are higher positioned to take advantage of Bitcoin’s long-term potential. So, take a deep breath, keep knowledgeable, and preserve a diversified strategy—this journey is simply getting began.

Cryptoassets are advanced and carry a excessive danger of volatility and loss. Buying and selling or investing in cryptoassets might not be appropriate for all traders.

Don’t make investments except you’re ready to lose all the cash you make investments. This can be a high-risk funding, and you shouldn’t anticipate to be protected if one thing goes mistaken. Take 2 minutes to be taught extra.

Germany: Cryptoasset investing is very unstable and unregulated in some EU international locations. The service supplied is supplied by DLT Finance, a model of DLT Securities GmbH, which has outsourced the availability of companies or components thereof to eToro (Europe) Ltd. and integrated in Cyprus into its personal service provision. All actions requiring regulatory authorization, particularly monetary fee enterprise and proprietary buying and selling, together with the execution of orders on appropriate buying and selling venues or towards DLT Securities GmbH itself, resembling in market making, are supplied by DLT Securities GmbH. DLT Securities GmbH is a German funding agency in response to §2 (1) WpIG and is supervised as such by the Federal Monetary Supervisory Authority (BaFin). Tax on income could apply.

ASIC: eToro AUS Capital Restricted ACN 612 791 803 AFSL 491139. Crypto property are unregulated and extremely speculative. There is no such thing as a client safety. You danger shedding all your capital. Seek advice from our Phrases and Situations. See full disclaimer

France: Cryptoassets investing and custody are supplied by eToro (Europe) Ltd as a digital asset service supplier, registered with the AMF. Cryptoasset investing is very unstable. No client safety. Tax on income could apply.

Spain: Investments in crypto-assets should not regulated. They might not be acceptable for retail traders and the total quantity invested could also be misplaced. It is very important learn and perceive the dangers of this funding, that are defined intimately at this hyperlink.

EU: Cryptoasset investing is very unstable and unregulated in some EU international locations. Tax on income could apply.

UAE: Cryptoassets are advanced and carry a excessive danger of volatility and loss. Buying and selling or investing in cryptoassets might not be appropriate for all traders.

FSA: Crypto property are unregulated and extremely speculative. There is no such thing as a client safety. You danger shedding all your capital.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.