Alvin Lang

Dec 13, 2024 04:20

Bitcoin has outperformed conventional property with a staggering 26,931.1% progress over the previous decade, highlighting its potential as a high-growth funding, in response to CoinGecko.

Bitcoin (BTC) has confirmed to be a formidable asset over the previous decade, reaching a unprecedented progress price of 26,931.1%, as reported by CoinGecko. This efficiency has far outstripped conventional asset lessons, together with shares, commodities, and bonds, positioning Bitcoin as a high-growth funding choice.

Yr-to-Date and Brief-Time period Efficiency

In 2024, Bitcoin has delivered a year-to-date (YTD) return of 129.0%, surpassing different property comparable to gold, which returned 32.2%, and the S&P 500 at 28.3%. Crude oil and US treasuries lagged, with crude oil displaying a slight unfavourable return of -0.13%, whereas 5-year and 10-year treasuries provided modest returns of 5.3% and eight.2%, respectively.

Over a 1-year interval, Bitcoin’s returns remained spectacular at 153.1%, outpacing gold’s 34.8% and the S&P 500’s 33.1%. This showcases Bitcoin’s resilience and progress potential amid market fluctuations. Treasuries, nonetheless, confirmed unfavourable returns, reflecting their sensitivity to financial situations.

Medium-Time period Funding Insights

Over three years, the efficiency dynamics shifted, with treasuries main on account of heightened financial stability preferences. 5-year treasuries returned a powerful 267.8%, and 10-year treasuries adopted with 218.0%. Bitcoin, regardless of being outpaced by bonds, nonetheless managed a stable 79.0% return, whereas gold achieved 53.1%.

In a 5-year timeframe, Bitcoin reasserted its dominance with a exceptional 1,283.6% return, underscoring its potential for substantial mid-term features. The S&P 500 and gold additionally supplied constant returns of 96.7% and 84.6%, respectively. Treasuries continued to ship robust returns, with 5-year and 10-year bonds reaching 157.1% and 149.9% respectively, whereas crude oil remained much less compelling at 25.3%.

Decade-Lengthy Dominance

Over a full 10-year interval, Bitcoin’s progress stood unmatched at 26,931.1%, affirming its transformative potential for early traders. Different property, whereas providing constant returns, fell considerably behind, with the S&P 500 at 193.3% and gold at 125.8%. Treasuries maintained their worth, with 5-year and 10-year bonds returning 157.1% and 86.8%. Crude oil, nonetheless, lagged with a mere 4.3% return.

Volatility and Correlation Evaluation

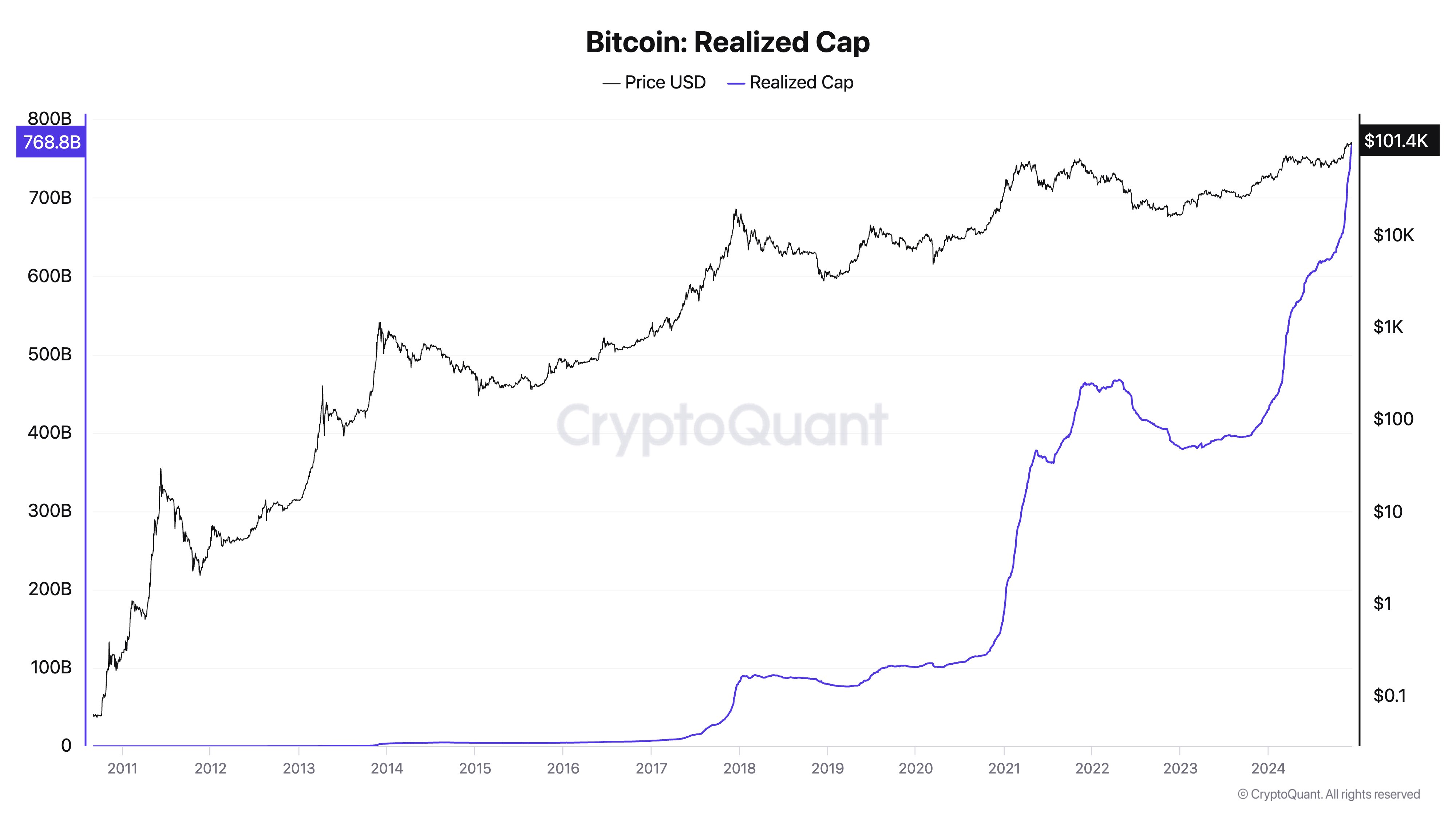

Regardless of its huge features, Bitcoin’s journey has been marked by vital volatility, with costs fluctuating between $172.15 and $103,679 over the last decade. This volatility underscores Bitcoin’s high-risk, high-reward nature, interesting to growth-focused traders however posing challenges for these in search of stability.

Bitcoin’s relationship with different main property reveals its distinctive market habits. Initially, Bitcoin’s correlation with the S&P 500 was minimal however has strengthened since 2020, aligning extra intently throughout main financial occasions. Conversely, Bitcoin’s correlation with gold has remained largely inverse, indicating impartial motion between these two property.

For extra detailed insights, go to the unique evaluation on CoinGecko.

Picture supply: Shutterstock