The dimensions and recognition of the Bitcoin choices market have made it probably the greatest instruments for gauging market sentiment and predicting volatility. Earlier CryptoSlate evaluation discovered that choices wielded an outsized affect over Bitcoin’s worth volatility and had been chargeable for a lot of the volatility we’ve seen this quarter.

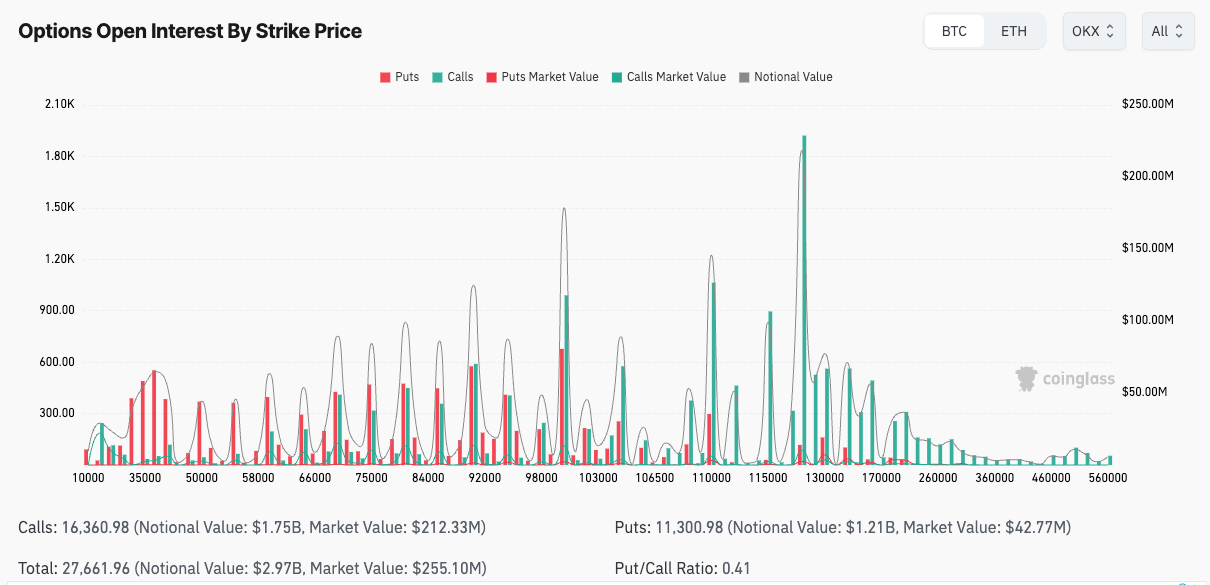

Choices information has proven a big focus of open curiosity (OI) on the $120,000 strike worth for contracts expiring on the finish of the 12 months. This explicit strike worth has garnered important consideration from merchants, with over $640 million in OI on Deribit alone. This OI far surpasses the exercise we’ve seen at neighboring strikes throughout most platforms. Such a heavy deal with a single strike worth reveals speculators are optimistic a few worth improve however creates a chance of excessive volatility within the coming weeks.

Open curiosity in strike costs far above the present spot worth of Bitcoin can point out that merchants are keen to wager on extraordinary worth actions. Whereas Bitcoin’s worth at press time stays considerably under the $120,000 degree, fastened at round $107,000, the choices delta can present a clearer perspective on the chance of such bets materializing.

Delta, a key choices metric, represents the sensitivity of an possibility’s worth to modifications within the underlying asset and may also function an approximation of the choice’s chance of expiring within the cash. For the $120,000 strike expiring on December 27, the delta sits at roughly 0.10, suggesting a ten% likelihood that Bitcoin will attain or exceed this worth by 12 months’s finish, information from Kaiko confirmed.

As choices are forward-looking, they supply perception into the place merchants consider the market may transfer and the way risky they anticipate it to be. A excessive focus of open curiosity at a specific strike and substantial quantity present which ranges merchants see as important. On this case, the $120,000 strike emerges as a most well-liked level.

That is significantly important as a result of choices exercise usually precedes spot market traits, as merchants use choices to hedge, speculate, or capitalize on anticipated volatility. Excessive open curiosity on such a excessive strike worth reveals the market is making ready for a pointy worth improve.

The dimensions of Deribit’s OI reveals the dominance of crypto-specific platforms within the Bitcoin choices market. Whereas CME, Binance, and OKX all supply choices buying and selling, Deribit stays the clear chief, significantly for high-strike calls.

On Deribit, open curiosity is extremely concentrated not solely at $120,000 but in addition at different key psychological ranges, equivalent to $100,000, $110,000, and $130,000. This clustering signifies that merchants are hedging or speculating round key worth thresholds, possible anticipating important worth motion in the previous couple of weeks of the 12 months. When mixed with low deltas, the information reveals merchants are betting on low-probability, high-reward outcomes.

The disparity between Deribit’s choices information and the exercise on platforms like CME displays a transparent divide between institutional and retail participation. Whereas CME information displays a extra conservative positioning amongst institutional merchants, the speculative exercise on Deribit factors to the next urge for food for threat amongst crypto-native members. This reveals the significance of monitoring a number of platforms when analyzing the choices market. Deribit, because the chief in liquidity and open curiosity, usually units the tone for Bitcoin choices traits, whereas conventional platforms present a complementary view of institutional flows.

From a volatility perspective, choices strike worth information and open curiosity ranges are equally essential for understanding how the market is pricing threat. The focus of exercise at distant strikes means that merchants anticipate Bitcoin’s worth to exhibit excessive ranges of volatility main into the tip of the 12 months. Choices, significantly out-of-the-money calls, usually function cheap bets on excessive strikes. Substantial OI at strikes far above the present spot worth signifies that merchants anticipate worth swings massive sufficient to justify these positions, even when the chance of success stays low.

The put up Choices merchants wager large on Bitcoin reaching $120K regardless of low odds appeared first on CryptoSlate.