With Bitcoin now making six-figure territory really feel regular and better costs a seeming inevitability, the evaluation of key on-chain information gives useful insights into the underlying well being of the market. By understanding these metrics, traders can higher anticipate worth actions and put together for potential market peaks and even any upcoming retracements.

Terminal Worth

The Terminal Worth metric, which includes the Coin Days Destroyed (CDD) whereas factoring in Bitcoin’s provide, has traditionally been a dependable indicator for predicting Bitcoin cycle peaks. Coin Days Destroyed measures the rate of cash being transferred, contemplating each the holding period and the amount of Bitcoin moved.

View Dwell Chart 🔍

Presently, the terminal worth has surpassed $185,000 and is prone to rise towards $200,000 because the cycle progresses. With Bitcoin already breaking $100,000, this implies we should have a number of months of optimistic worth motion forward.

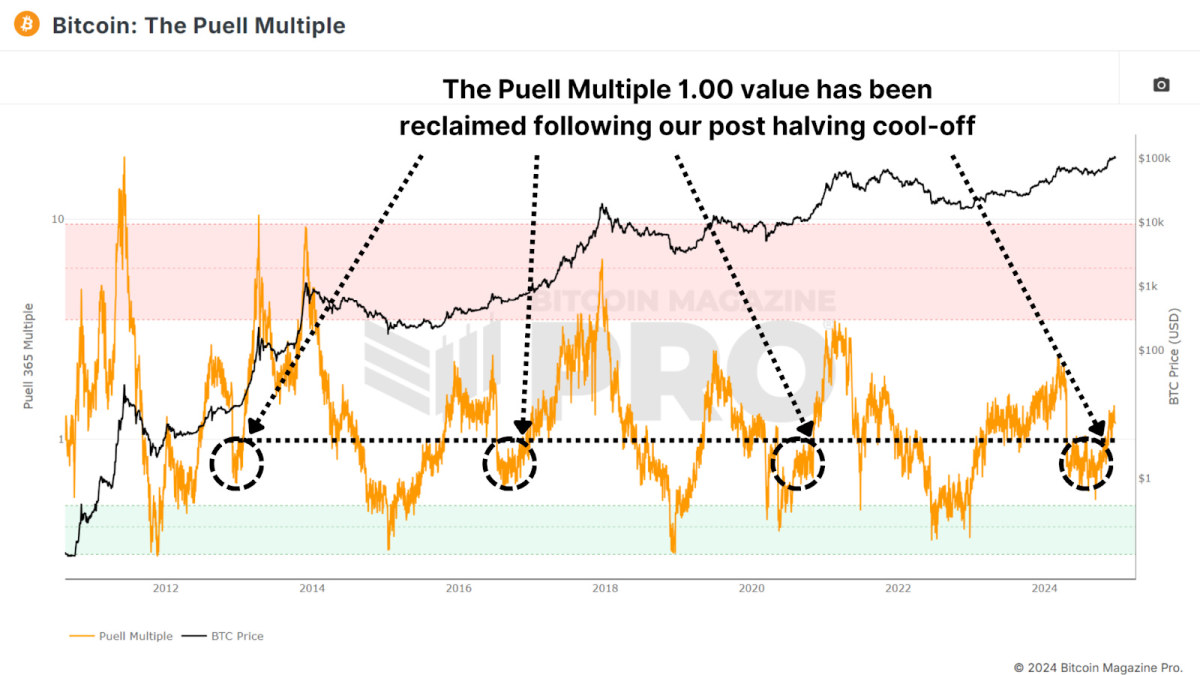

Puell A number of

The Puell A number of evaluates each day miner income (in USD) relative to its 365-day shifting common. After the halving occasion, miners skilled a pointy drop in income, making a interval of consolidation.

View Dwell Chart 🔍

Now, the Puell A number of has climbed again above 1, signaling a return to profitability for miners. Traditionally, surpassing this threshold has indicated the later levels of a bull cycle, usually marked by exponential worth rallies. The same sample was noticed throughout all earlier bull runs.

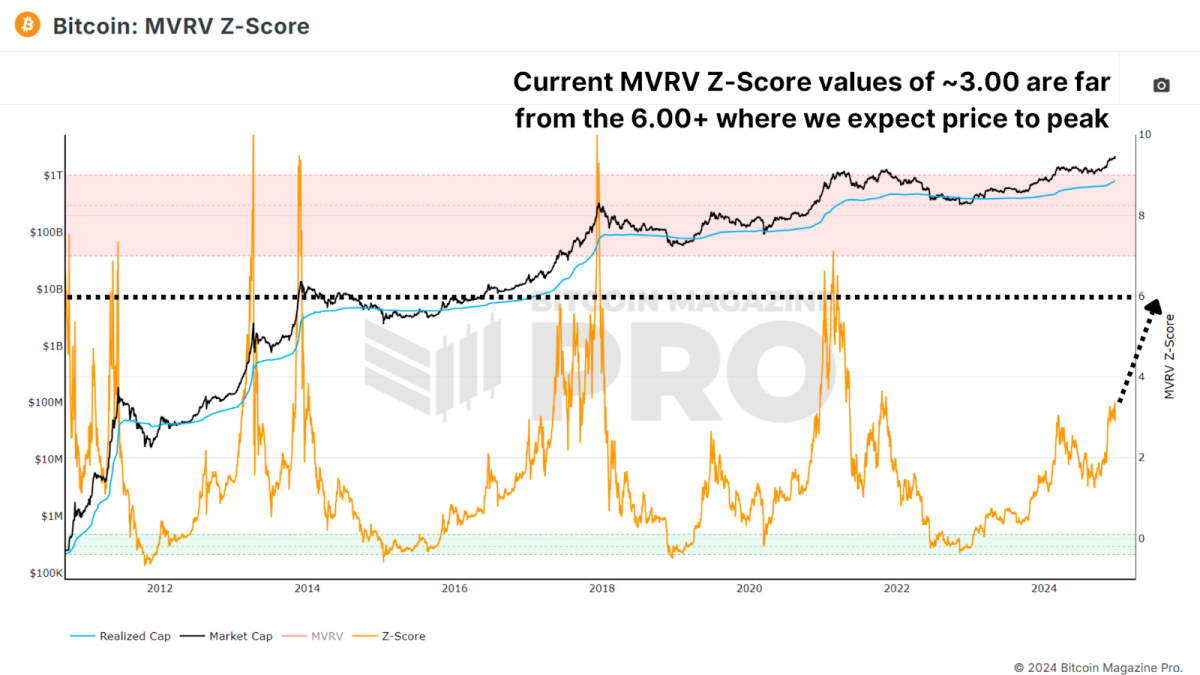

MVRV Z-Rating

The MVRV Z-Rating measures the market worth relative to the realized worth (common price foundation of Bitcoin holders). Standardized right into a Z-Rating to account for the asset’s volatility, it’s been extremely correct in figuring out cycle peaks and bottoms.

View Dwell Chart 🔍

Presently, Bitcoin’s MVRV Z-Rating stays beneath the overheated pink zone with a worth of round 3.00, signaling that there’s nonetheless room for development. Whereas diminishing peaks have been a development in latest cycles, the Z-Rating means that the market is much from reaching a euphoric high.

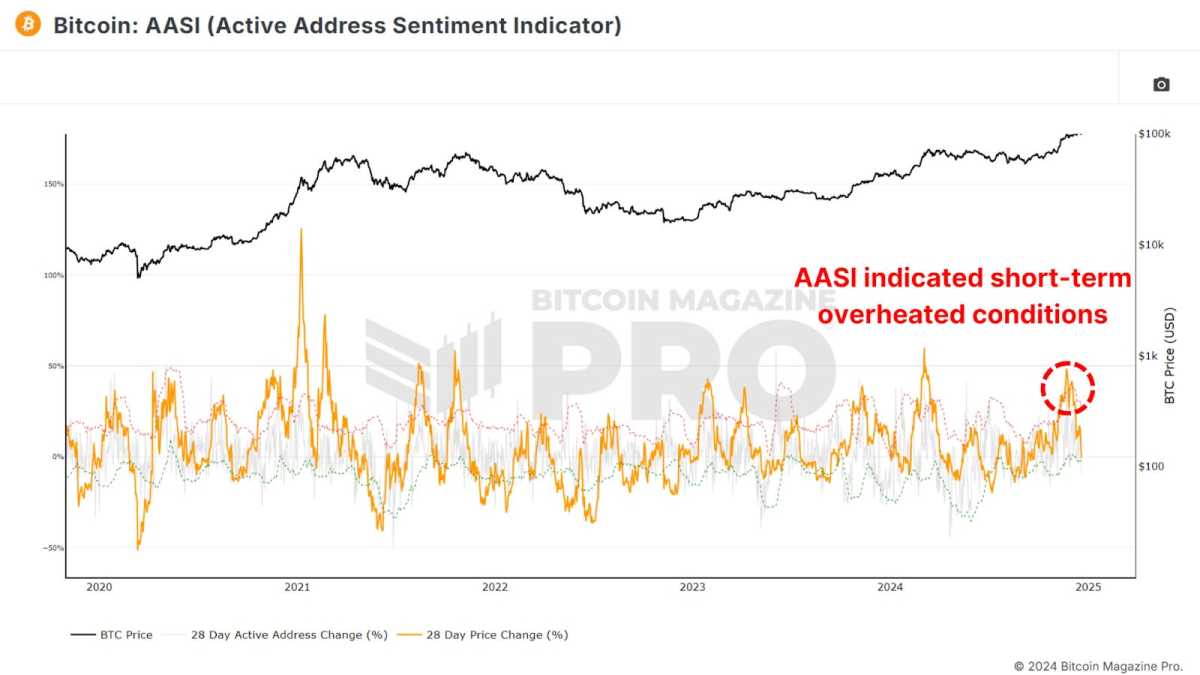

Lively Handle Sentiment

This metric tracks the 28-day proportion change in lively community addresses alongside the value change over the identical interval. When worth development outpaces community exercise, it suggests the market could also be short-term overbought, because the optimistic worth motion will not be sustainable given community utilization.

View Dwell Chart 🔍

Current information reveals a slight cooling after Bitcoin’s speedy climb from $50,000 to $100,000, indicating a wholesome consolidation interval. This pause is probably going setting the stage for sustained long-term development and doesn’t point out we needs to be medium to long-term bearish.

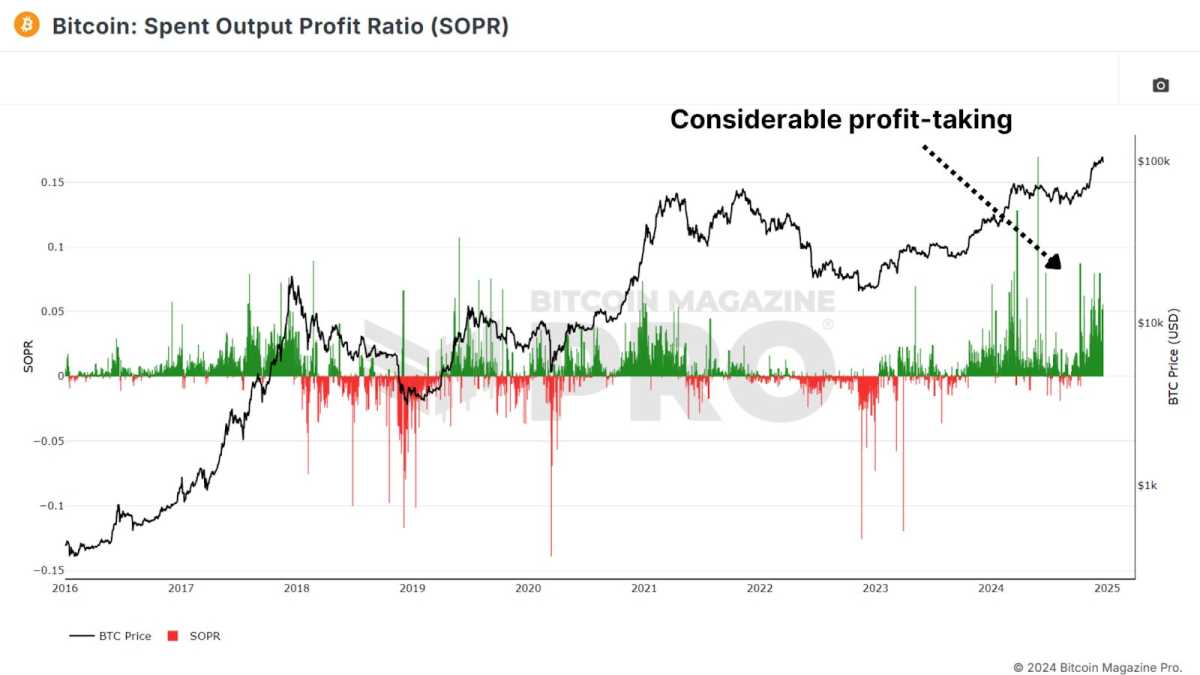

Spent Output Revenue Ratio

The Spent Output Revenue Ratio (SOPR) measures realized income from Bitcoin transactions. Current information reveals an uptick in profit-taking, probably indicating we’re coming into the latter levels of the cycle.

View Dwell Chart 🔍

One caveat to think about is the rising use of Bitcoin ETFs and spinoff merchandise. Buyers could also be shifting from self-custody to ETFs for ease of use and tax benefits, which may affect SOPR values.

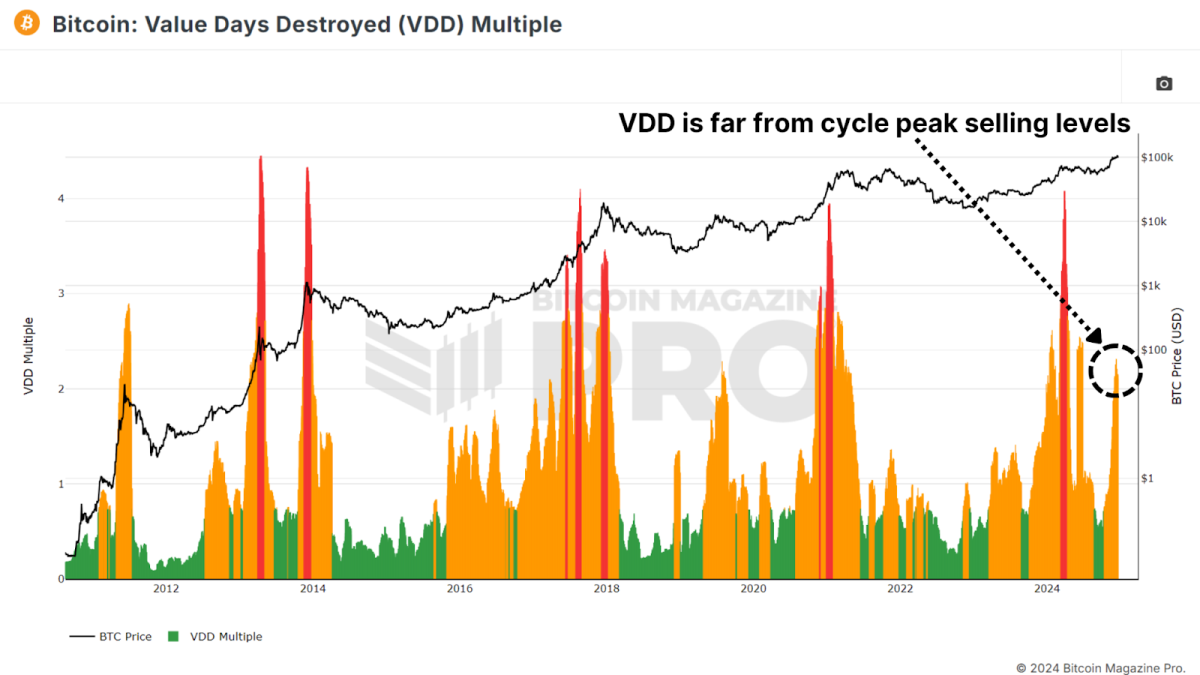

Worth Days Destroyed

Worth Days Destroyed (VDD) A number of expands on CDD by weighting bigger, long-term holders. When this metric enters the overheated pink zone, it usually alerts main worth peaks because the market’s largest and most skilled individuals start cashing out.

View Dwell Chart 🔍

Whereas Bitcoin’s present VDD ranges point out a barely overheated market, historical past suggests it may maintain this vary for months earlier than a peak. For instance, in 2017, VDD indicated overbought situations almost a 12 months earlier than the cycle’s high.

Conclusion

Taken collectively, these metrics recommend that Bitcoin is coming into the latter levels of its bull market. Whereas some indicators level to short-term cooling or slight overextension, most spotlight substantial remaining upside all through 2025. Key resistance ranges for this cycle might emerge between $150,000 and $200,000, with metrics like SOPR and VDD offering clearer alerts as we strategy the height.

For a extra in-depth look into this matter, take a look at a latest YouTube video right here: What’s Taking place On-chain: Bitcoin Replace

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.