Este artículo también está disponible en español.

Ripple’s XRP has been the topic of current media consideration, and for good motive. The cryptocurrency has skilled a major enhance in 2024, with a acquire of over 258% because the begin of the 12 months.

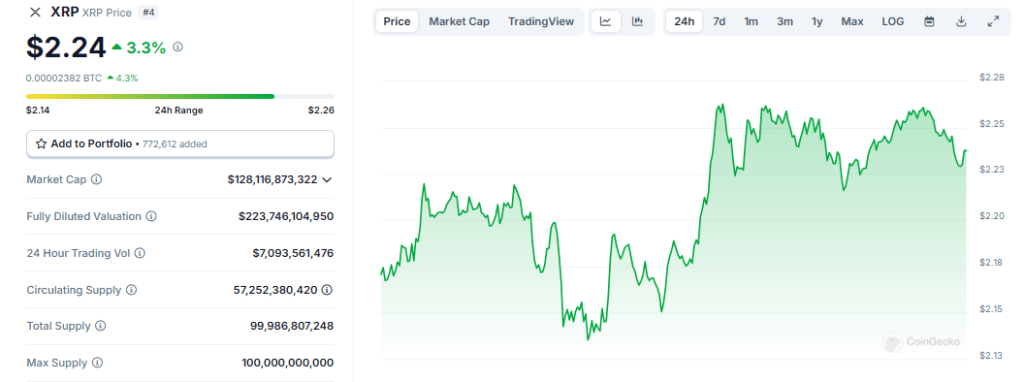

XRP’s worth had risen considerably from its low of $0.22 in early 2021 to roughly $2.30 as of mid-December. XRP has now surpassed stablecoin Tether (USDT) to grow to be the third-largest cryptocurrency by market capitalization, a testomony to its extraordinary development.

Associated Studying

Linda Jones, a well known wealth mentor, has simply these days delivered her most present publication, which has generated quite a lot of pleasure amongst members of the worldwide crypto group.

The Starting Of A New Know-how Cycle

Jones underscores that we’re on the inception of a brand new technological cycle. She contends that digital property are poised to revolutionize asset tokenization and cash, very like the web remodeled communication.

An excerpt from my weekly publication at present:

Digital property ought to outperform tech shares just like the Magnificent 7 (Apple, Alphabet, Google, Tesla, Meta, Amazon and Nvidia) by presumably as a lot as 10x, in my view.

Why?

There are seven causes I can consider:

1. We’re early…

— Linda P. Jones (@LindaPJones) December 19, 2024

Buyers who’re ready to undertake this emergent asset class might capitalize on substantial development prospects because of this transformation. Jones emphasizes that digital property have traditionally been essentially the most profitable asset class, with Bitcoin experiencing almost 30,000% enhance over the previous decade and XRP following intently behind with a 35,000% enhance throughout the identical interval.

Unexploited Market Potential

The present low adoption price of digital property is considered one of Jones’s most compelling arguments. She observes that solely 5% of people worldwide have invested in cryptocurrencies, indicating an enormous untapped market that’s awaiting growth.

Retail traders are at the moment higher positioned than institutional gamers since they can not totally enter the market due to regulatory boundaries. Nevertheless, Jones expects that institutional capital will quickly flood the market in response to the anticipated laws on crypto and stablecoins by early 2025.

The current proposal by US President-elect Donald Trump to exempt capital beneficial properties on digital property located in the US from taxation serves to bolster this optimism. This coverage has the potential to considerably enhance the potential of American initiatives similar to XRP and Cardano (ADA) by redirecting investments towards them whether it is applied.

Associated Studying

A Favorable Political Surroundings

Political change can also be favoring digital property. Jones notes David Sacks’ appointment as Crypto and AI czar, citing his pro-crypto stance as PayPal COO. This management change exhibits a dedication to selling cryptocurrencies.

$XRP gonna make historical past subsequent 12 months

— Bitstamp (@Bitstamp) December 20, 2024

Furthermore, Congress has these days grown way more pro-crypto, creating an surroundings match for regulatory readability and growth.

As XRP and different digital property collect tempo in entrance of adjusting guidelines and extra investor belief, Jones expects 2025 to be a decisive 12 months for them. Different enterprise leaders share her emotions; they consider that XRP might grow to be historic on this 12 months.

Featured picture from DALL-E, chart from TradingView