Just lately, the general public’s consideration was captured by the “12 Days of OpenAI” occasion, throughout which OpenAI unveiled new developments in its AI fashions day-after-day. Customers’ calls for are clear: we wish AI to be sooner, smarter, and extra succesful. This naturally performs into Nvidia’s palms. Nevertheless, because the race for technological dominance accelerates, an sudden impediment has emerged – a scarcity of power.

Whereas Nvidia, the enormous growing essentially the most highly effective AI chips, has seen its shares rise a formidable 178% this yr, the true winner has been Vistra Corp. If this identify doesn’t ring a bell, you’ve missed one of the vital worthwhile AI investments of the yr. This firm’s shares have risen by over 280% in 2023. So, what’s behind this staggering development?

Vistra’s shares have surged by 280% this yr, pushed by rising investor optimism.

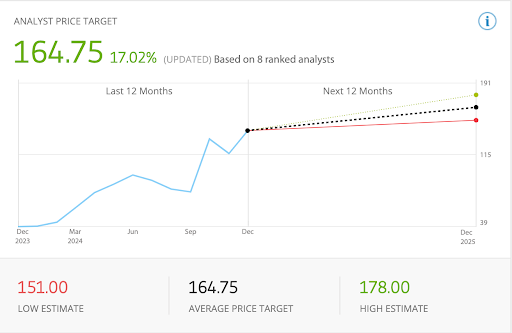

Wall Avenue has set a goal worth of $164 per share, indicating a 24% development potential. All 10 analysts charge it as a “Robust Purchase.”

The demand for renewable power, spurred by the growth of information facilities, significantly in Texas, represents a key development alternative for Vistra.

Why is computing energy not AI’s largest impediment?

Synthetic intelligence requires monumental computing energy, which drives the demand for essentially the most superior AI chips. Nevertheless, extra highly effective chips devour extra power and generate extra warmth, requiring complicated cooling techniques. This considerably will increase their power consumption.

Because the AI techniques market grows exponentially, so does the necessity for brand spanking new knowledge facilities. See the place I’m going with this? The growth of this sector is drastically rising the demand for electrical energy. However not simply any electrical energy – hyperscalers want inexperienced power sources, each for tax incentives and stakeholder pursuits, which is why their focus is popping to renewable power sources.

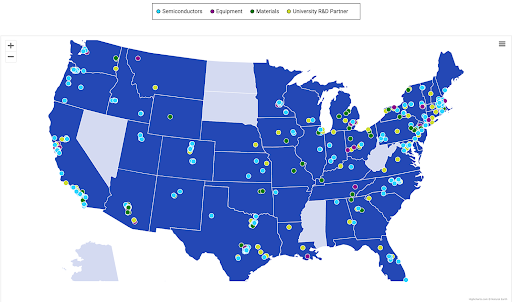

Map of information facilities within the USA (datacentermap.com)

However rising consumption just isn’t the one issue boosting renewable power demand. Knowledge facilities, which devour large quantities of power, are extremely concentrated in only a few areas in the USA.

The most popular areas are Virginia, Texas, and California. Due to this, enormous quantities of demand are being positioned on small sections of the facility grid, that are already nearing their limits.

In Texas, builders are lured in by good transmission infrastructure and low actual property prices. In its electrical energy grid, known as ERCOT, the share of information heart associated demand is anticipated to succeed in 10% of total consumption in 2025. Whereas this gives a major alternative for electrical energy suppliers, it additionally creates challenges.

To keep away from damaging impacts on distribution networks and households, knowledge facilities are transferring nearer to energy sources, generally known as co-location. This has led to a major enhance in demand for renewable power in a handful of key areas.

Which brings us to Vistra.

How does Vistra match into this?

Vistra is without doubt one of the largest renewable power suppliers in Texas. Its portfolio contains a variety of sources – from pure fuel and nuclear power to wind and photo voltaic, together with battery storage. The demand from knowledge facilities in Texas is a robust tailwind for the corporate.

Vistra’s purchasers already embody hyperscalers reminiscent of Microsoft and Amazon. Two different unspecified hyperscalers are already in discussions with Vistra to construct new pure fuel energy vegetation co-located with knowledge facilities to make sure most effectivity and pace. Co-location, the follow of constructing knowledge facilities in shut proximity to energy vegetation, additionally reduces transmission loss and alleviates strain on the grid. However increasingly tech companies are in search of dependable power sources, and it’s not only for knowledge facilities.

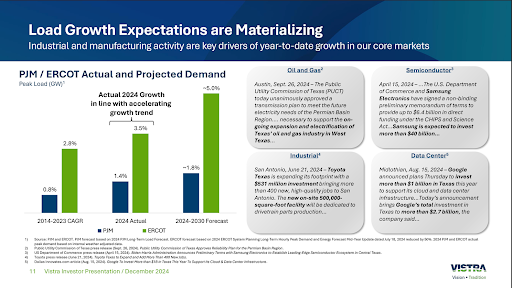

Map of chip factories within the US (semiconductors.org)

The chart above reveals the distribution of chip manufacturing amenities within the US. For lots of the similar components that apply to knowledge facilities, along with it’s favorable laws and advantageous geographical place inside the US, Texas is a scorching spot for chip manufacturing amenities.

Corporations are additionally leveraging Biden’s CHIPS Act to fund their growth on this area, such because the not too long ago finalized plant financing for Samsung and Texas Devices.

Vistra’s massive footprint within the area has allowed it to profit from rising demand, leading to income and earnings development far above the sector median. However demand that outpaces provide has brought on clients to search for alternative routes of powering their amenities.

Nuclear energy attracts tech giants

Conventional renewable sources, reminiscent of photo voltaic and wind energy, have a significant disadvantage – their output fluctuates. Photo voltaic panels gained’t generate power when the solar isn’t shining, and climate is a threat issue for each. It is a drawback for knowledge facilities, which require dependable 24/7 energy. The answer is likely to be a step again – to nuclear power.

(vistracorp.com)

Whereas curiosity in nuclear power has been on the decline, these market developments are fuelling a resurgence. Small modular reactors, or SMR, have attracted the eye of giants reminiscent of Microsoft to produce nuclear power to knowledge facilities. Nuclear vegetation are a great answer for knowledge facilities because of their capacity to provide massive quantities of clear power with out interruption.

Vistra is in a good place right here with its Comanche Peak nuclear energy plant in Texas, which has the potential to change into a key hub for powering energy-intensive technological infrastructure. Comanche Peak, a two-unit facility with a capability of two,400 megawatts, has not too long ago acquired approval from the Nuclear Regulatory Fee to increase its operation by way of 2053.

What’s subsequent for Vistra in 2025?

Buyers will probably be eager to see how demand for synthetic intelligence continues to evolve. Alerts from tech giants like Amazon, Google, Microsoft, and Meta are clear – all of them goal to take the lead in AI and are prepared to take a position billions. The growth of information facilities will proceed, that means additional development in power demand.

(eToro)

Wall Avenue is putting excessive bets on the corporate. 10 out of 10 analysts charge the inventory as a “sturdy purchase”, with even essentially the most pessimistic estimate nonetheless above the present inventory worth.

Will Vistra shock buyers in 2025 because it did this yr? That may rely upon how the corporate leverages the rising demand for power for knowledge facilities and secures key offers with tech giants. Moreover, with a ahead P/E ratio that’s practically double the trade median, excessive expectations appear to already be priced in.