Please see this week’s market overview from eToro’s international analyst group, which incorporates the newest market knowledge and the home funding view.

In focus: key macroeconomic knowledge releases and the This autumn earnings season

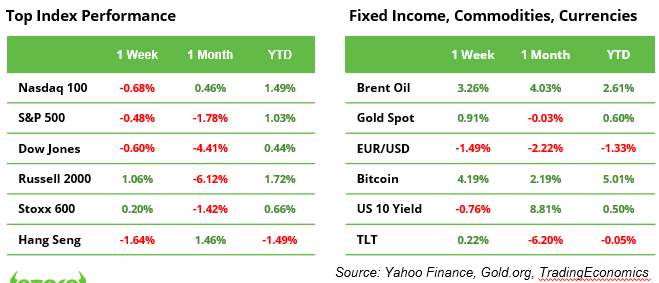

After a December marked by declining inventory market averages resulting from profit-taking and progress issues, main fairness indices superior within the first two buying and selling days of 2025. The Nasdaq 100 rose by 1.5%, the S&P 500 by 1.0%, the Dow Jones by 0.4%, and the small-cap Russell 2000 gained 1.7%. In the meantime, Bitcoin surged 5.0%, Brent crude oil elevated by 2.6%, and gold gained 0.6%.

This week, buyers will deal with two key themes to evaluate whether or not asset progress can proceed in January: a sequence of macroeconomic knowledge releases and steerage for the This autumn earnings season. The US will launch labour market statistics, together with job openings, non-farm payroll additions, and unemployment figures, in addition to contemporary knowledge on PMI, sturdy items orders, and the Fed minutes of the assembly held in December. Delta Airways can be within the highlight as one of many first firms to report earnings. In the meantime, eurozone international locations are set to publish inflation figures, probably shedding mild on the tempo of future ECB rate of interest cuts.

A key occasion this week is the annual Client Electronics Present (CES) in Las Vegas, operating from 6 to 10 January, beginning with a keynote speech by NVIDIA CEO Jensen Huang on Monday night. On Thursday 9 January, US inventory markets will stay closed in honour of former President Jimmy Carter, who handed away on the age of 100.

Unchecked US greenback rally: how lengthy will it final?

The US greenback stays in excessive demand. The EUR/USD pair fell beneath 1.03 final week, with many analysts now predicting parity. This development is pushed by a robust US financial system and the so-called “Trump Commerce.” An 8% rise within the US Greenback Index made 2024 the strongest 12 months since 2015.

Traditionally, throughout Trump’s first time period, the greenback depreciated in three of 4 years, with its steepest decline in 2017 (see chart beneath). Might historical past repeat itself? A lot is dependent upon whether or not Trump takes a softer stance or continues his powerful “America First” commerce insurance policies. Trump’s aggressive method depends on a sturdy financial system. If progress falters, he might must pivot. A extra conciliatory commerce coverage with Europe and China might decrease inflation expectations, cut back bond yields, immediate quicker Fed fee cuts, and weaken the greenback.

Be aware: Within the coming two weeks, politics might overshadow financial fundamentals in shaping the greenback’s path. With the January 20 inauguration looming, markets stay in a holding sample.

Supply: TradingView

Per week filled with potential turning factors for the markets

The US NFP report and unemployment fee on Friday are the important thing highlights of the week. Non-farm payrolls are anticipated to indicate a 150K improve, with unemployment forecast at 4.2%. Since Q2 2024, there have been indicators of a cooling labour market, and buyers are eager to see if this development persevered in December. On Tuesday, the ISM Companies PMI knowledge can be launched . The ISM index lately fell to 52.1. Additional weak spot might dampen inventory market rallies whereas rising the chance of fee cuts. Markets at present anticipate one to 2 fee cuts in 2025. Minutes of the newest FOMC assembly can be launched on Wednesday. On Friday afternoon, focus will shift to client confidence, which has risen for 5 consecutive months. Can this development proceed? In Europe, inflation knowledge for the Eurozone can be launched on Tuesday morning. The CPI has climbed from 1.7% to 2.2% over two months. For merchants, a sharper rise in inflation might reignite issues and shift consideration again to ECB coverage changes.

Don’t consider the deal with AI will diminish this 12 months!

Though the 12 months is simply two buying and selling days previous, key AI shares have already delivered spectacular returns. NVIDIA has gained 8%, chip designer Arm is up 14%, and foundry TSMC has risen 6%. South Korean semiconductor firm SK Hynix elevated its complete return for the 12 months to 16% this morning. A serious catalyst for this surge was a weblog submit by Microsoft President Brad Smith, revealing the corporate expects to take a position $80 billion in AI knowledge centres throughout fiscal 12 months 2025. This unprecedented spending highlights the immense alternatives within the AI sector. “Picks and shovels” performs, similar to the businesses talked about, stand to profit considerably from the continued AI race. Nevertheless, the last word chief within the client section stays unsure.

Earnings and occasions

Macro

7 Jan. Eurozone Inflation and Unemployment; US PMI, JOLTS job openings

8 Jan. FOMC minutes

9 Jan. Germany Stability of Commerce

10 Jan. Non-farm payrolls, Unemployment

11 Jan. China Inflation, Stability of Commerce

Earnings

8 Jan. Albertsons

10 Jan. Walgreens Boots Alliance, Delta Airways, Constellation Manufacturers

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.