XRP, the native token of Ripple Labs, is constantly gaining consideration from crypto fanatics and appears poised for a major rally. At the moment, on January 7, 2024, a distinguished crypto professional made a put up on X (previously Twitter) and made a daring prediction for XRP.

Professional Says Purchase Sign for XRP

In a put up, the professional famous that the final time a technical indicator named Supertrend flipped to bullish on the 12-hour time-frame, XRP skyrocketed by 470%. Now, the altcoin has as soon as once more flipped bullish and flashing purchase sign. This put up on X is gaining widespread consideration from crypto fanatics throughout the globe, as they’re anticipating an analogous sort of rally this time as effectively.

Nonetheless, this indicator flipped throughout a interval when XRP appeared regular and gave the impression to be struggling to achieve momentum.

At press time, XRP is buying and selling close to $2.41 and has skilled a modest value surge of 0.81% prior to now 24 hours. Throughout the identical interval, its buying and selling quantity jumped 10%, indicating an increase in participation from merchants and traders in comparison with yesterday.

XRP Value Motion and Key Ranges

In response to professional technical evaluation, XRP has been consolidating in a decent vary between $2.37 and $2.46 for the final 5 days, following the breakout of a bullish pennant sample on the each day time-frame.

Based mostly on the latest value motion, if XRP breaches this consolidation and closes a each day candle above the $2.48 mark, there’s a robust risk it may soar by 85% to succeed in the $4.54 degree sooner or later.

Buyers and Merchants Rising Curiosity

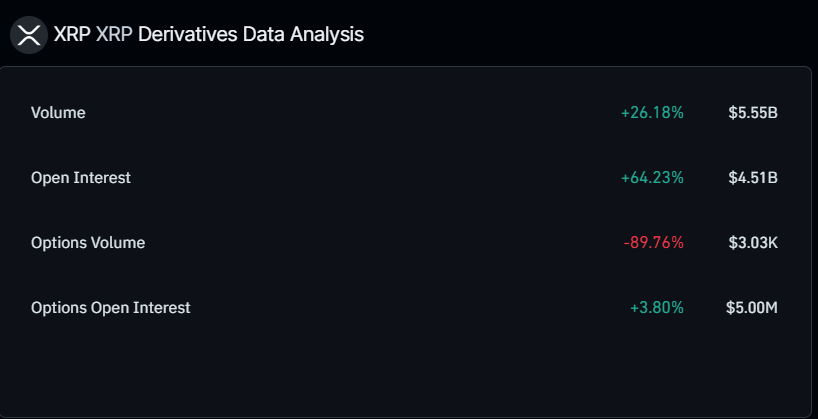

As of now, merchants and long-term holders appear extra within the altcoin, as reported by the on-chain analytics agency Coinglass.

Information from spot influx/outflow revealed that in the identical consolidation interval, exchanges witnessed an outflow of a major $38.02 million value of XRP. This means that long-term holders proceed to build up the altcoin regardless of the consolidation.

Nonetheless, outflow refers back to the motion of property from exchanges to long-term holders’ wallets, indicating potential shopping for alternatives and upside momentum.