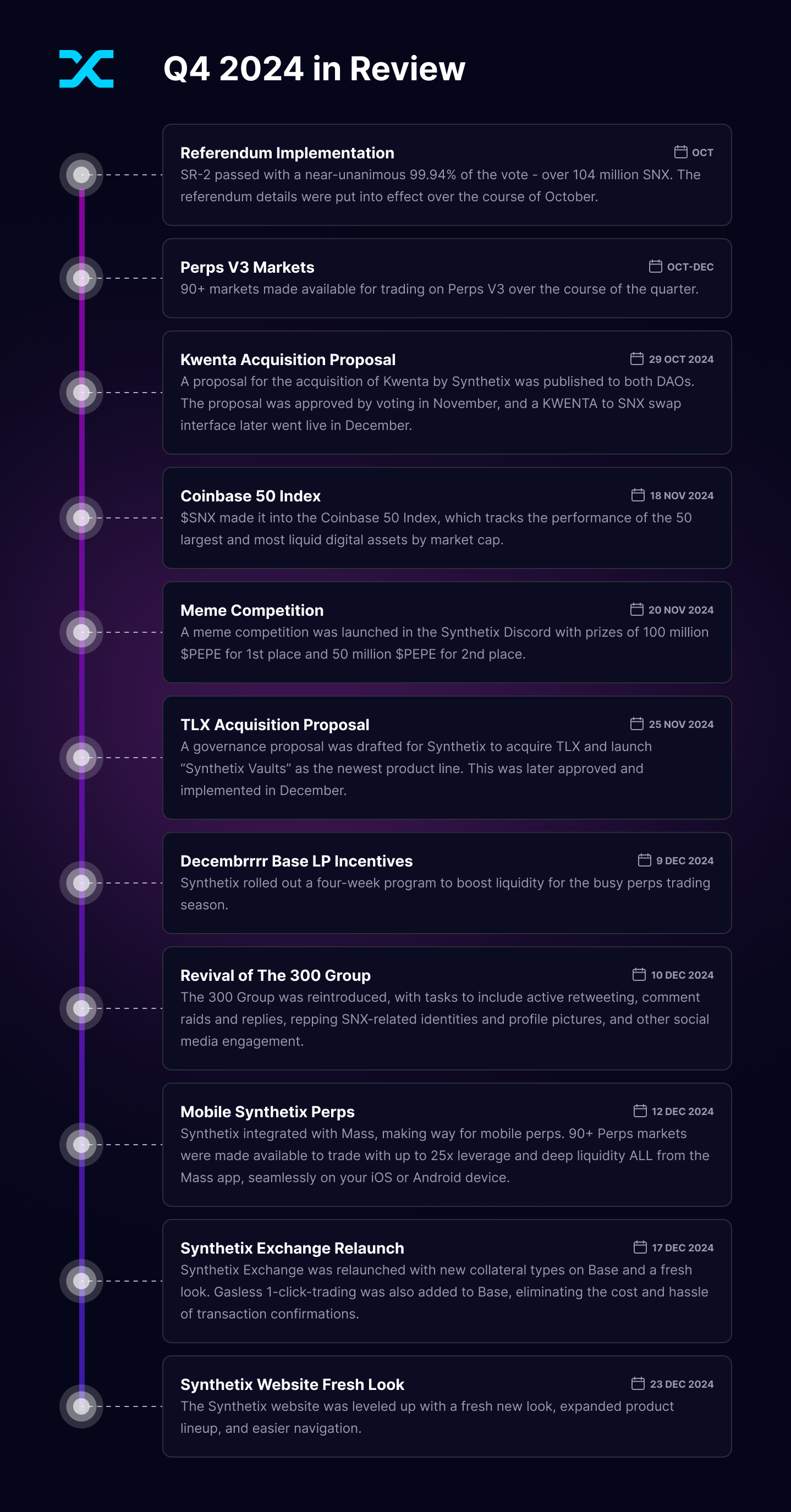

Quarterly Report for Synthetix, Quarter 4 of 2024: October — December.

👉This autumn Highlights

⭐ Spartan Council/CCs: Referendum, Protocol Acquisitions

Synthetix has made outstanding progress over the previous few months, reinforcing its place as a pacesetter within the DeFi house. Key developments, together with the launch of multi-collateral Perps on Arbitrum, strategic acquisitions, and governance enhancements, spotlight the protocol’s dedication to innovation, scalability, and delivering a superior consumer expertise. These achievements underscore Synthetix’s adaptability and dedication to addressing the evolving wants of the market. Let’s take a better take a look at some standout highlights from this transformative interval.

One of the vital developments got here on the finish of the earlier quarter with the introduction of a referendum designed to reshape Synthetix’s governance and operational technique. By the top of November, the newly shaped council had accepted two main acquisitions: Kwenta and TLX. These choices aimed to unify the ecosystem below a single governance construction, making a direct line of accountability between Synthetix management and its flagship providing — Perps. Whereas the protocol stays dedicated to its authentic imaginative and prescient of delivering an open-source liquidity layer to DeFi, these acquisitions sign a strategic shift in the direction of tighter integration and enhanced oversight of its key merchandise.

The launch of multi-collateral Perps represents one other main milestone for Synthetix, considerably increasing its buying and selling capabilities. This characteristic permits merchants to make use of a wide range of property, together with WETH, tBTC, USDx, and Ethena’s USDe, as collateral, offering higher flexibility and entry to leverage. To drive adoption, the rollout was accompanied by buying and selling incentives and elevated revenue-sharing alternatives for liquidity suppliers, leading to a considerable enhance in buying and selling quantity in December. This long-awaited characteristic has positioned Synthetix as a stronger competitor within the on-chain derivatives market.

Moreover, Synthetix’s inclusion within the Coinbase 50 Index and, briefly, within the Grayscale DeFi Fund underscores its rising prominence within the DeFi ecosystem. Being listed on the Coinbase 50 Index locations Synthetix among the many most respected property accessible on one of many world’s largest cryptocurrency exchanges, enhancing its accessibility and visibility to a worldwide viewers. Equally, its recognition by the Grayscale DeFi Fund highlights Synthetix’s relevance and worth throughout the trade as a top-tier undertaking driving innovation in decentralized finance.

👉Challenges

Whereas the previous few months have been marked by vital progress for Synthetix, they haven’t been with out obstacles. These challenges have highlighted the complexities of balancing innovation with operational execution. From governance restructuring to the technical calls for of the V3 migration, in addition to sustaining transparency and addressing liquidity wants, the protocol has encountered hurdles that present helpful classes for its future trajectory. Let’s look again at among the key challenges from the quarter as we wrap up 2024.

Governance Rising Pains

There have been two massive preliminary guarantees within the Synthetix Reboot referendum that garnered overwhelming group help. The primary was a promise to revitalize group engagement and convey again a few of that early Synthetix spark, and the second was supply of a Synthetix 2025 roadmap by the top of 2024. The quarter started with robust momentum, as over 100 million SNX votes ratified the brand new governance construction outlined in SR-2. Governance conferences and city halls initially noticed sturdy attendance, signaling a want to construct on this momentum. Nonetheless, over time the consistency of communication faltered. Whereas vital work was taking place behind the scenes, together with two main acquisitions, the data pipeline from the Spartan Council to the group slowed, leaving gaps in transparency and engagement.

The Roadmap 2025 Problem

One of many referendum’s key early deliverables, the Synthetix 2025 roadmap, is but to be absolutely fleshed out. In September, earlier than SR-2 even handed, the incoming council shared a weblog put up outlining strategic aims for 2025. Whereas the outlined aims are bold, the dearth of specifics has made it tough to trace progress or maintain the council accountable (Aave’s not too long ago launched roadmap is an efficient instance of what to intention for).

Funding Strategic Acquisitions

The acquisitions of Kwenta and TLX sparked debates about find out how to fund these transactions. Each have been executed as token-for-token swaps, however questions arose about whether or not to make use of treasury SNX or mint new tokens, which might enhance the whole provide. Regardless of earlier councils opting to finish inflationary tokenomics with a view to enhance optics and appeal to passive buyers, the present council determined to mint simply over 12 million new SNX to fund these purchases, leading to a 4% provide inflation. This choice was not taken calmly; the rationale was that the acquisitions would generate future progress by enabling Synthetix to immediately handle the consumer expertise. Whereas the group has largely supported the strategic imaginative and prescient behind these strikes, the reintroduction of inflation sparked some dialogue about balancing short-term trade-offs with long-term good points.

By addressing these governance, transparency, and funding challenges, Synthetix has a chance to refine its processes and strengthen its place as a pacesetter in decentralized finance. These classes shall be vital because the protocol navigates its subsequent section of progress.

👉Protocol Stats

Overview of Synthetix This autumn Stats: October 2024 — December 2024.

👉Spartan Council

This autumn 2024 Spartan Councilors: Benjamin Celermajer (Fenway), Cavalier, coKaiynne, Jordan Momtazi, Kain Warwick, SpartanGlory

Regardless of just a few challenges, the Spartan Council was nonetheless chipping away at their new imaginative and prescient for Synthetix throughout This autumn. So let’s assessment every thing they have been in a position to accomplish over the course of the quarter.

In October, the referendum to alter the Synthetix DAO construction and operations was carried out with the brand new Council members taking their seats. One of many greatest adjustments that SR-2 introduced was the consolidation of the three Councils (Spartan, Treasury, and Ambassador) into 1 Spartan Council made up of seven seats with equal voting energy — 4 elected and three employed Core Contributors (CCs). 3 of the 4 elected Council members have been made into Advisory Seats, stuffed by Kain Warwick, Jordan Momtazi, and SpartanGlory. And the final elected member was coKaiynne, who fills the Treasury Seat. The remaining CC seats have been stuffed by Fenway (Technique) and Cavalier (Operations), with the Technical CC seat nonetheless TBD.

SR-2 boasted future adjustments corresponding to:

Core working groupsSNX token redesignOperationalized SNAX ChainRenewed work on Synth TeleportersIncreased concentrate on enterprise improvement and marketingPerps V3 characteristic growth & V2X deprecationV3 Perp multichain proliferation

The implementation plan for the referendum started to happen over the course of This autumn, with enhancements designed to make SNX leaner, extra aligned, extra targeted and constant in each the quick and the long run.

Later within the month, a proposal was revealed for Synthetix to accumulate Kwenta, our main DEX by quantity. The motive behind the acquisition was to enhance Synthetix branding and market positioning, align strategic motivations, and merge the communities. This finally handed after being voted on by each protocols, and was enforce in November.

The implementation of the Kwenta acquisition later led to the frontend web site being rebranded to the Synthetix Change. The positioning was relaunched with a killer UI, deep liquidity, low charges, and a recent look, solidifying it because the flagship frontend for decentralized Perps. Gasless 1-click buying and selling was additionally delivered to Base, eradicating the requirement of signing a number of transactions.

Subsequent, a meme competitors was introduced in late November the place anybody might create a meme associated to Synthetix and be entered to win 100 million $PEPE for 1st place or 50 million $PEPE for 2nd place. CryptoNaz got here in first with their Conflict Canines format meme, and jojaysu positioned second with their Fudder Fridge meme. Hakari, Ethboi and ilbarri have been additionally awarded 100 SNX every from the Guardians for his or her entries. This competitors introduced quite a lot of curiosity again to the Synthetix Discord!

Shortly after the meme comp, one other acquisition proposal was submitted to the Spartan Council for consideration. It was proposed that Synthetix purchase TLX, a leveraged token protocol powered solely by the Synthetix V2X Perps platform on Optimism, and launch “Synthetix Vaults” as the most recent product line. This proposal was later accepted in December in an thrilling first step in the direction of producing native vaults that leverage the composability of Synthetix and provides customers frictionless entry to high-quality structured merchandise.

Because the final month of the quarter rolled in, Synthetix was simply ramping up with a number of extra thrilling ventures. Decembrrrr Base LP incentives was introduced to start out the month off robust — this was a four-week program to spice up liquidity through the busy perps buying and selling season. LPs have been in a position to unwrap new SNX and USDC rewards every week whereas incomes boosted buying and selling charges. Along with the motivation program, Synthetix additionally launched two key adjustments to enhance the LP expertise and enhance the attractiveness of passive stablecoins coming into the Synthetix ecosystem:

Extra Charges: The income share from V3 buying and selling elevated to 60%, up from the earlier 40%. This represented a 50% enhance, making certain liquidity suppliers have been being higher rewarded.Juicier Yields: Synthetix additionally added stataUSDC as an eligible asset for liquidity provision. StataUSDC is a static, non-rebasing model of Aave’s aUSDC token.

Subsequent, Cellular Synthetix Perps was introduced because of Mass, one of many protocol’s latest integrators. Mass is the all-in-one DeFi app for iOS & Android, designed to simplify decentralized buying and selling and asset administration, making Synthetix Perps V3 extra accessible than ever. And it was additionally introduced that the group must be looking out for a buying and selling competitors coming in January with 25,000 SNX & 25,000 OP in prizes.

Lastly, to finish the quarter with a bang, the Synthetix Web site received a recent new look and an expanded product lineup! All the things you want is now in a single place — Synthetix Change, liquidity alternatives, token leveraging, governance, stats, and extra. This cleaner, extra intuitive interface brings all of the Synthetix merchandise and websites collectively into one cohesive web page.

👉Finest Memes from This autumn

With the meme competitors this quarter, there was some further humor within the Synthetix Discord, so listed here are our favourite memes: