Cryptos trended decrease final week, pushed largely by risk-off sentiments on newly launched Fed assembly notes and financial knowledge.

The Fed expressed warning round inflation, particularly as Trump’s insurance policies will kick in after his inauguration on Jan. 20.

In the meantime, spot crypto ETFs logged outflows from Wednesday, Jan. 8.

Bitcoin

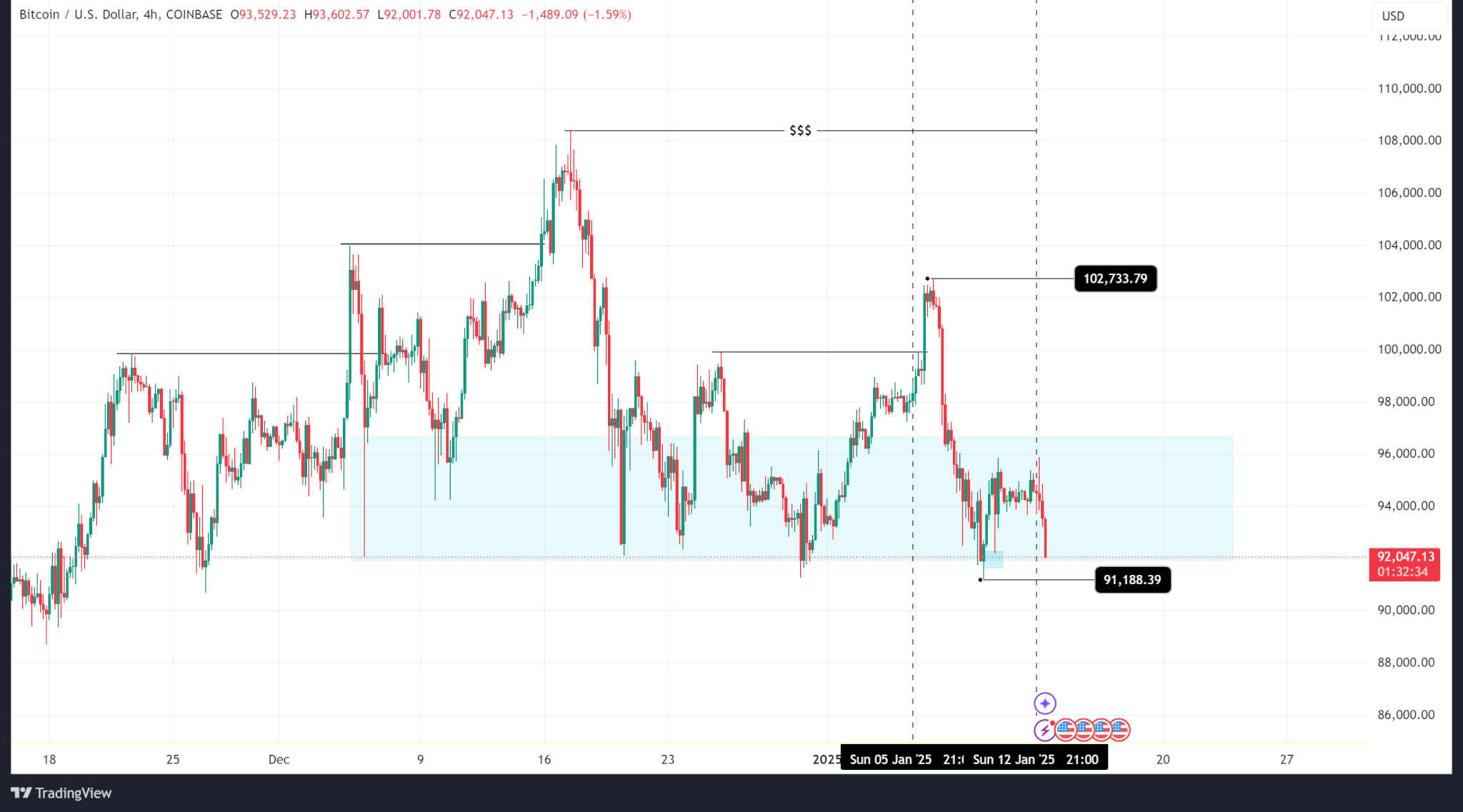

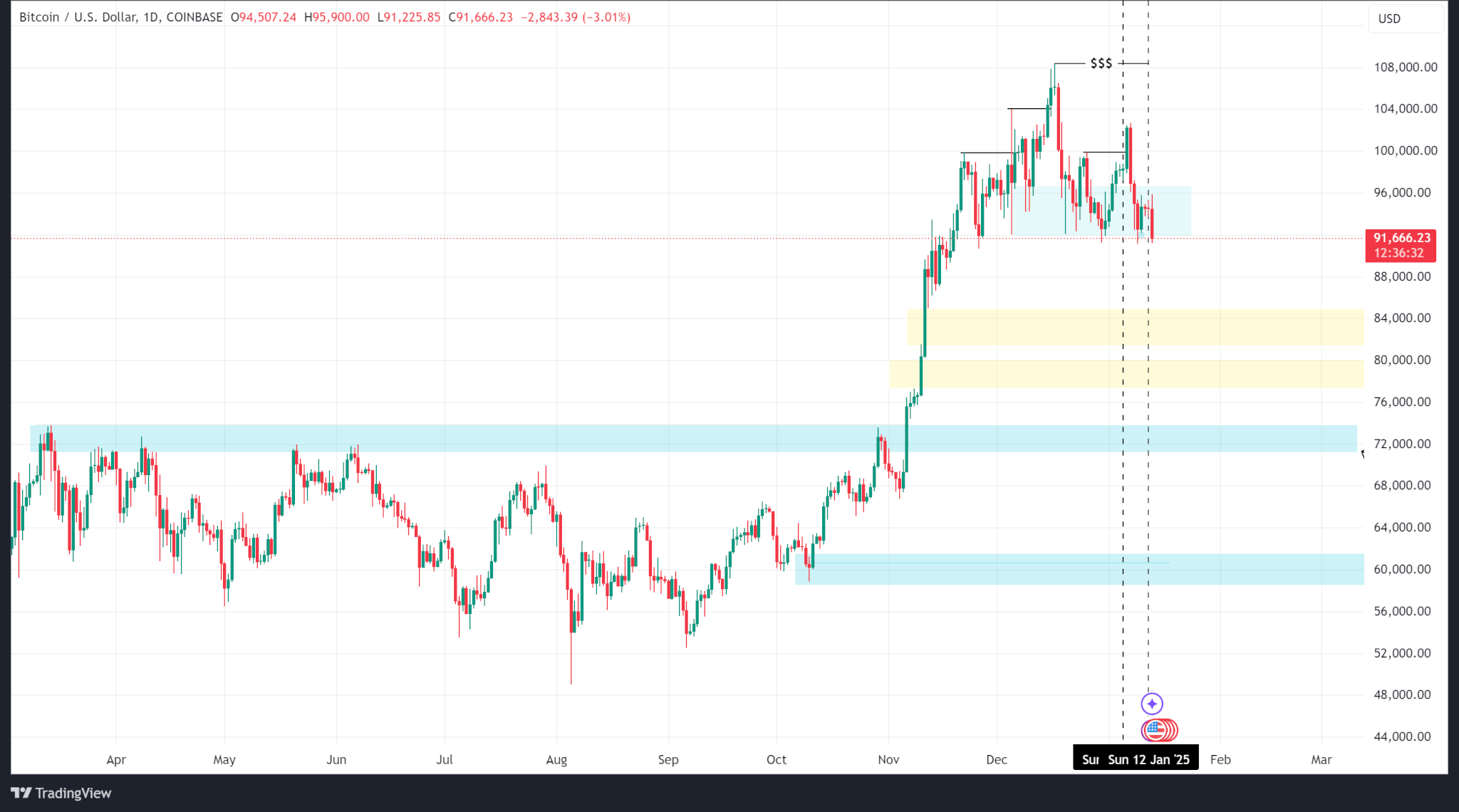

Bitcoin’s worth logged a unfavourable week falling from a excessive of $102,733 to a low of $91,188 earlier than finally closing at $94,547.

Technical evaluation exhibits a break above the final decrease excessive and a push again down into the H4 demand zone, which implies that though the worth took a bearish flip, it’s nonetheless in total bullish territory.

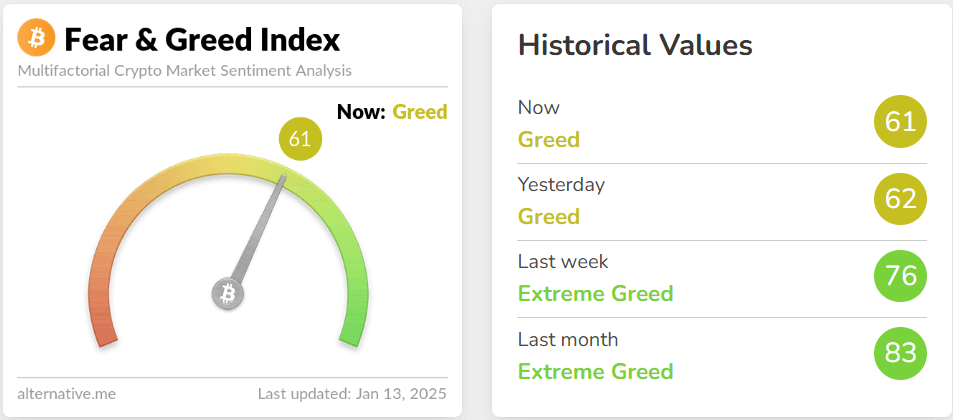

A lot of this bearish sentiment is pushed by bleak financial expectations. The Fed assembly minutes, launched on Jan. 8, confirmed that the reserve financial institution is cautious about inflation it expects will observe Trump’s insurance policies.

As such, the chance of continued charge cuts has dwindled, with some analysts seeing an finish to cuts early this yr. The market’s response displays this up to date risk-off sentiment.

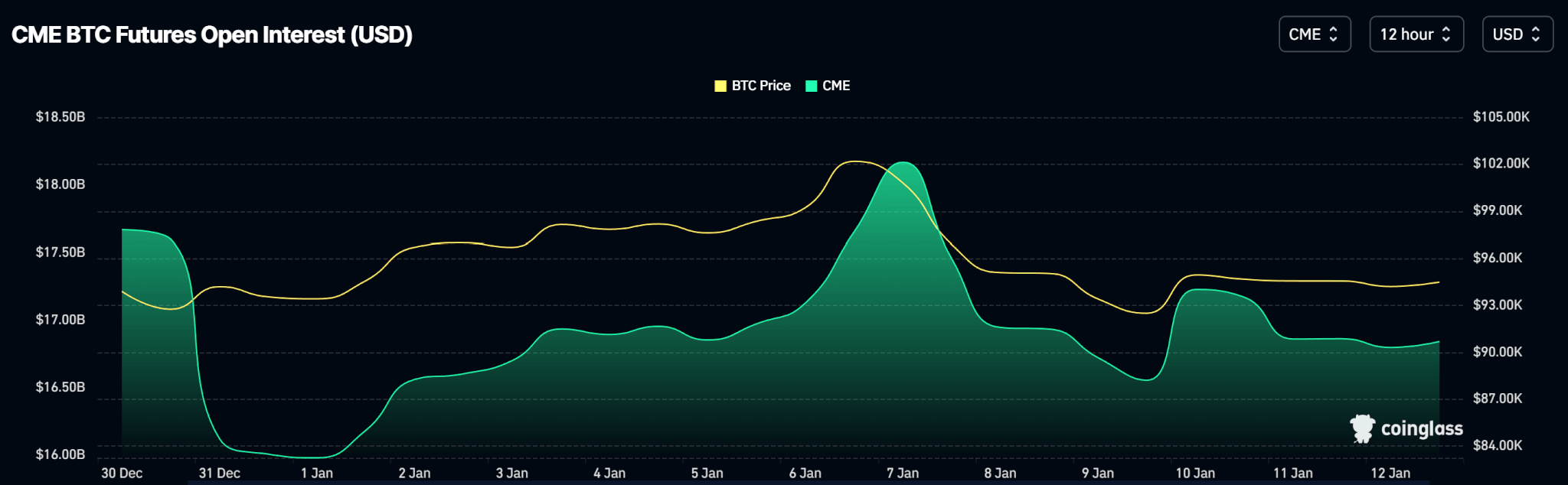

Bitcoin’s open curiosity chart exhibits a decline in open contracts between Wednesday and now. Open curiosity hit a weekly excessive on Tuesday at $18.16Bn on the CME, fell to a low on Thursday ($16.55Bn), and mellowed out the remainder of the week.

In the meantime, spot Bitcoin ETFs logged outflows after the discharge of the Fed’s assembly minutes on Wednesday. Outflows totalled $718.20Mn whereas inflows totalled $1.03Bn.

Outlook

Bitcoin’s worth presently hovers across the backside of the demand zone. If it breaks under, worth could possibly be pushed all the way down to $85,100 the place a good worth hole may act as help.

BTC trades at $91,622 as of publishing.

Ethereum

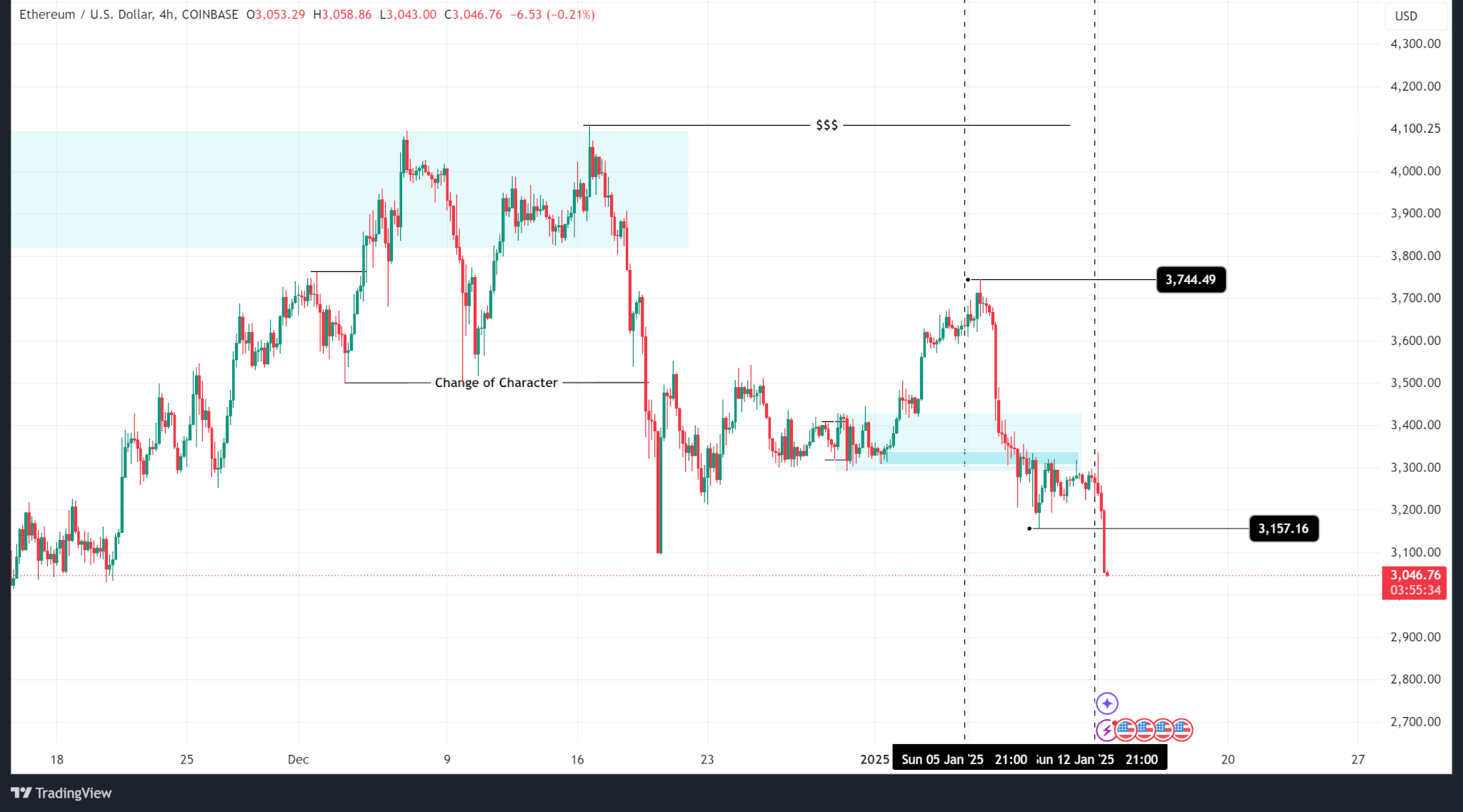

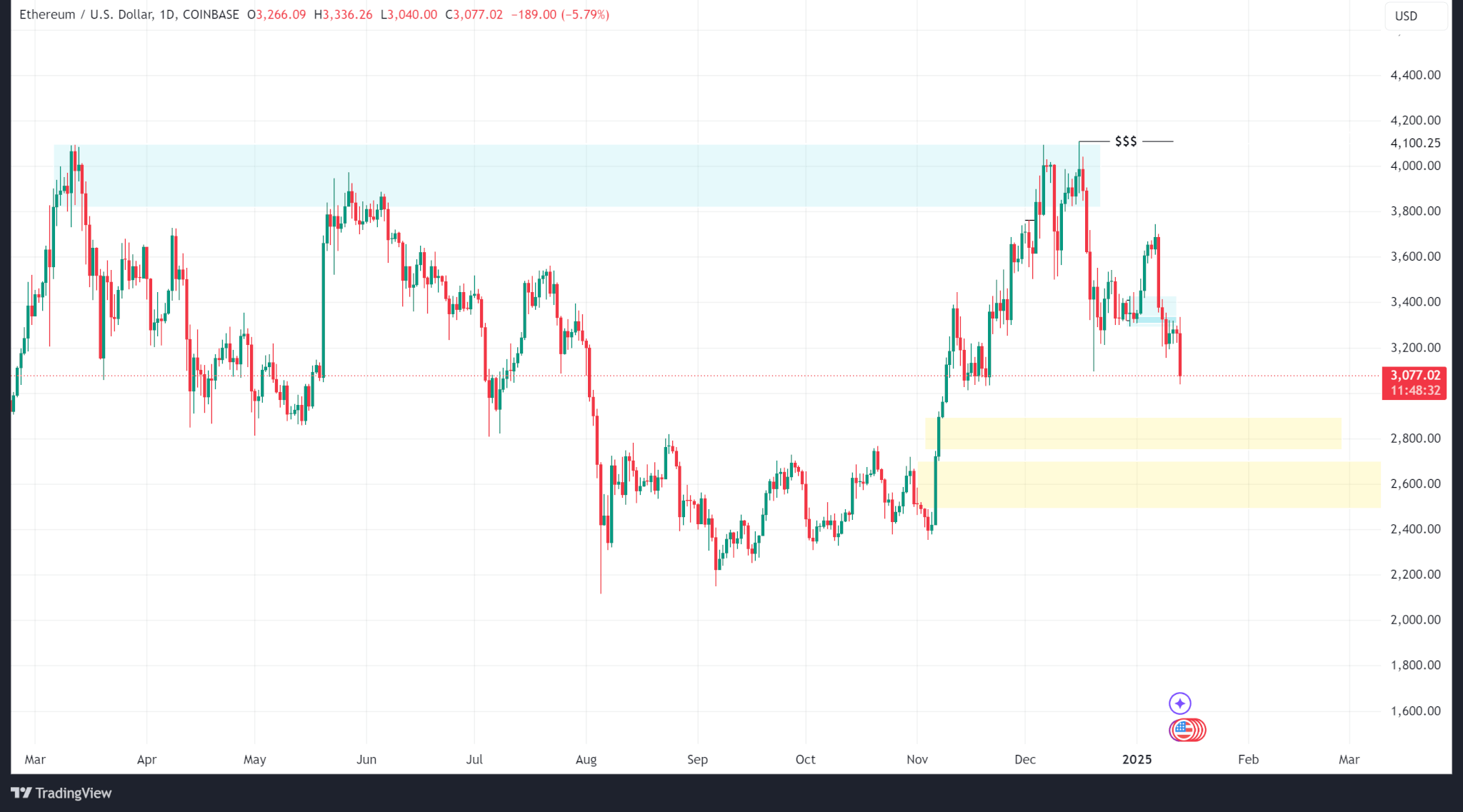

Ethereum’s worth additionally logged a unfavourable week, falling from a excessive of $3,744 to a low of $3,157 earlier than closing at $3,236. ETH worth motion examined March 2024’s excessive of $4,089 in early Dec 2024 however failed to interrupt above and has been logging decrease lows since.

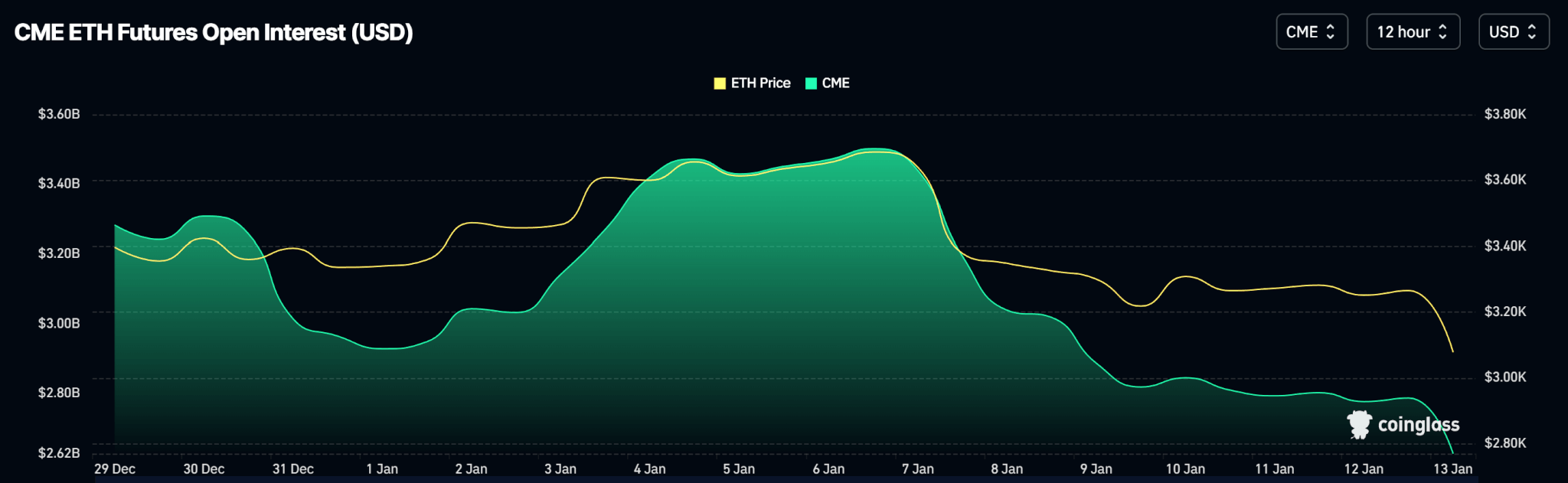

Open curiosity dropped from a Jan. 7 excessive of $3.50Bn and continued to say no till it was $2.63Bn as of this publication.

In the meantime, Ethereum spot ETFs logged a weekly web outflow of $186.00Mn following risk-off sentiments out there.

Outlook

As Ethereum’s worth continues to pattern decrease, the subsequent technical stage that would present help is the truthful worth hole on the $2,893 worth stage.

ETH trades at $3,071 as of publishing.

Solana

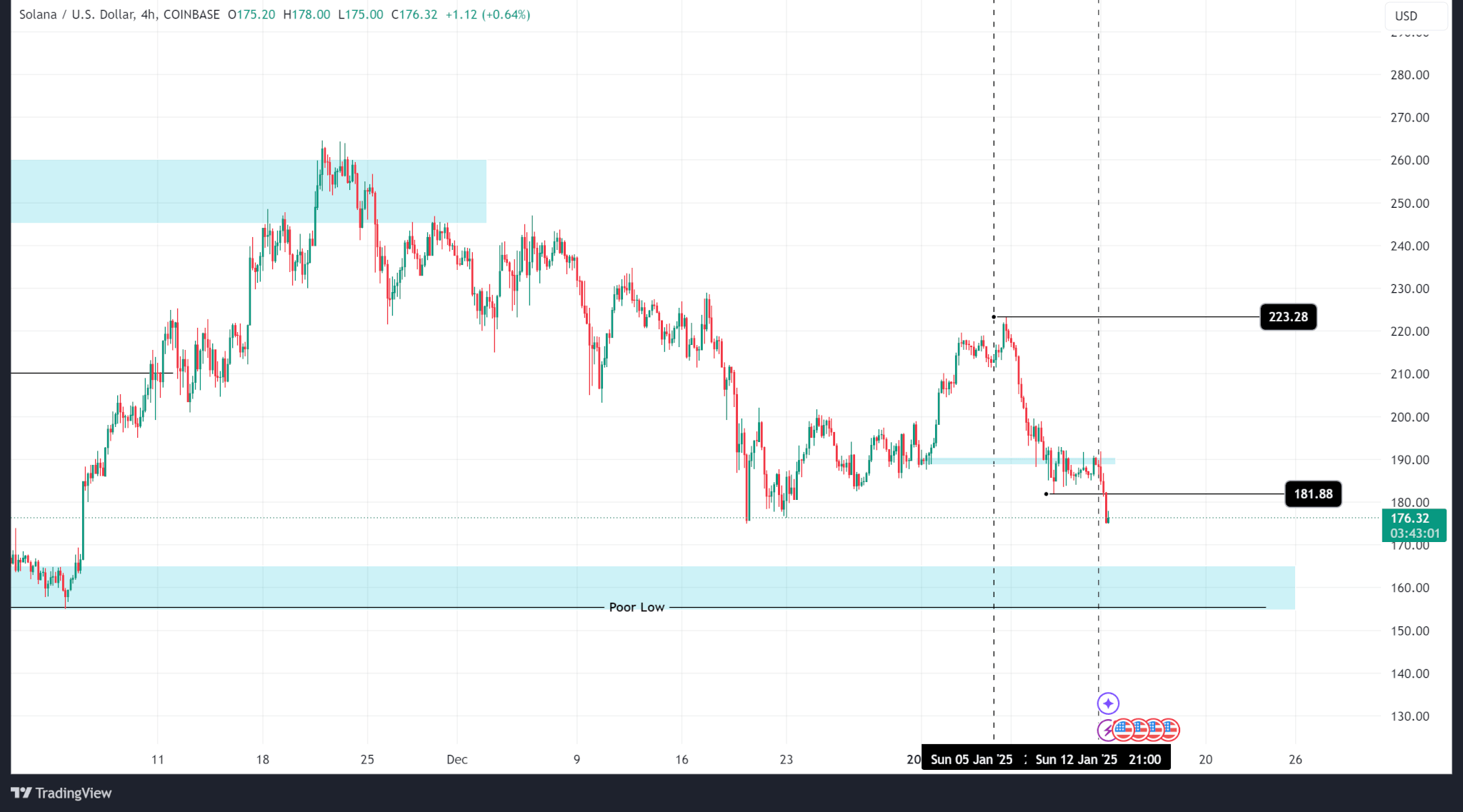

Solana’s worth fell from a weekly excessive of $223 to a weekly low of $181 earlier than finally closing at $188, logging a complete lack of 12.53%. SOL continues to pattern decrease after failing to shut above its all-time excessive of $260.

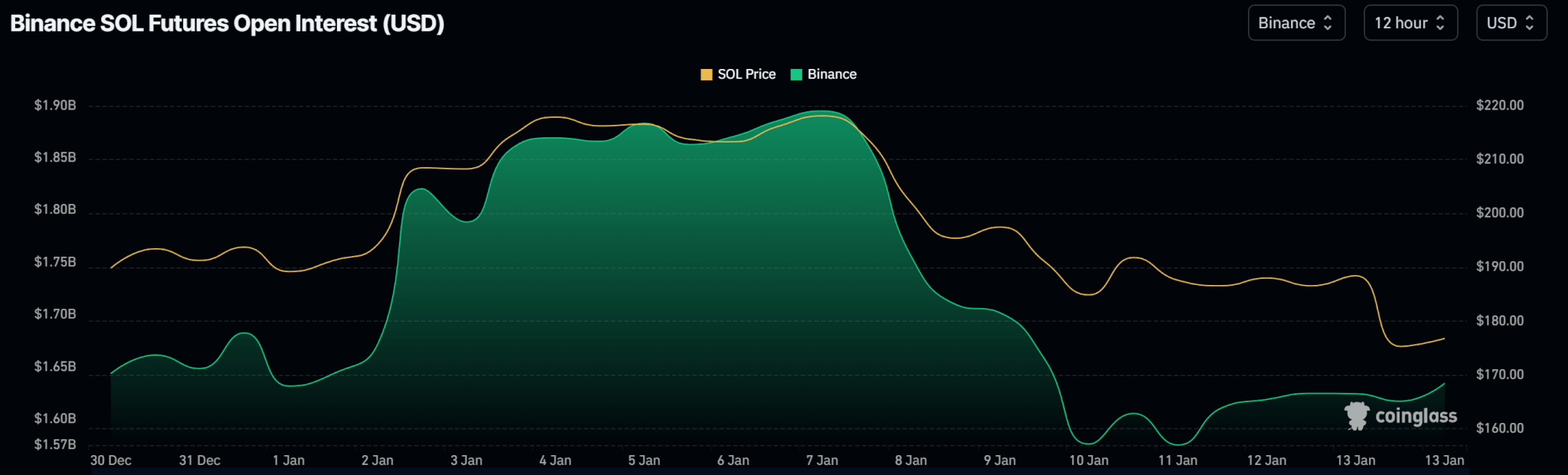

Open curiosity knowledge exhibits a steep fall from $1.89Bn on Binance on Jan. 7 to $1.58Bn on Jan. 10. As of this publication, OI ranges have improved to $1.63Bn.

Outlook

The subsequent technical help zone is on the $164 worth stage. Nevertheless, though the order block is a help, it’s a poor low that could possibly be taken out even when worth reverses from that zone.

SOL trades at $176 as of publishing.

Ripple

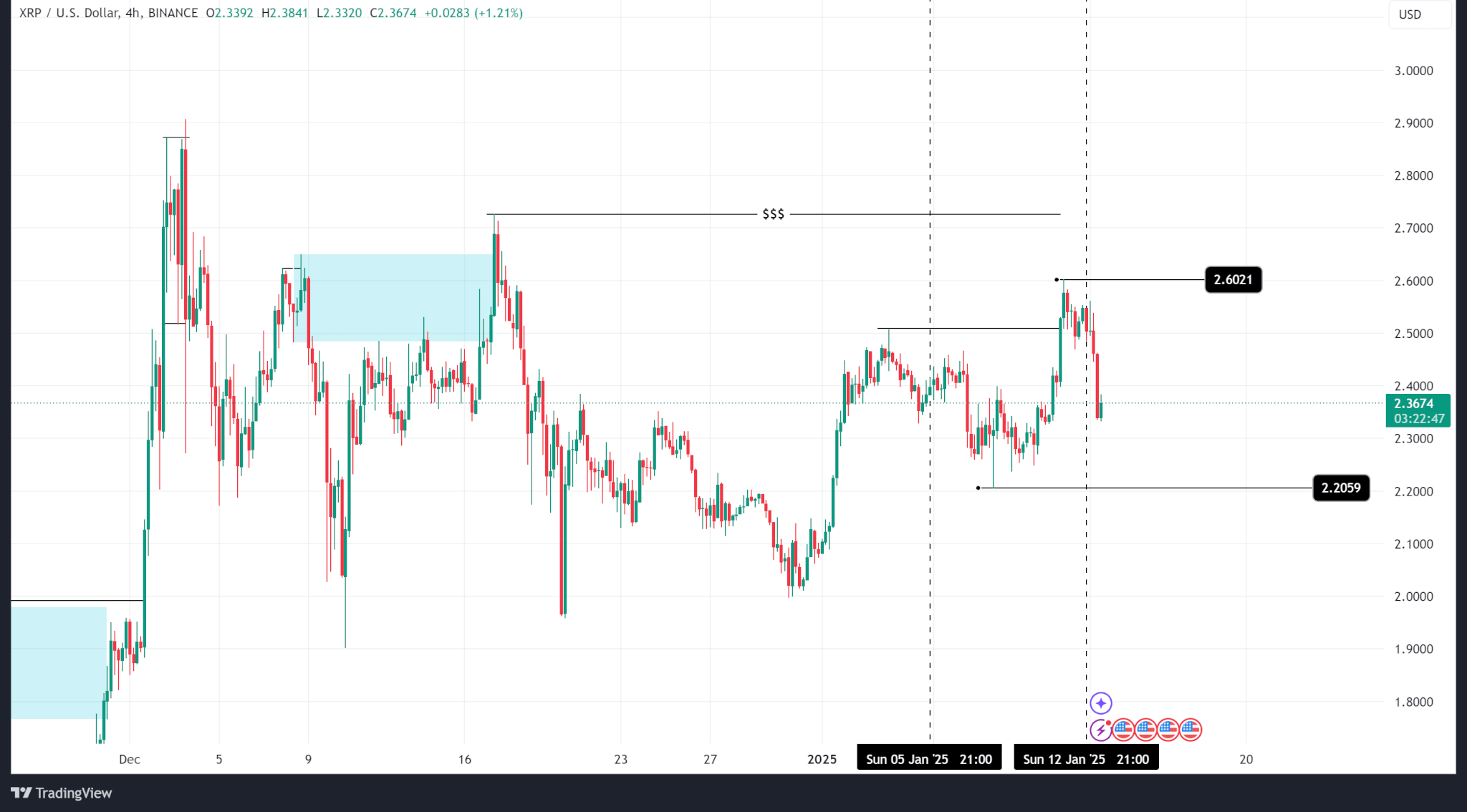

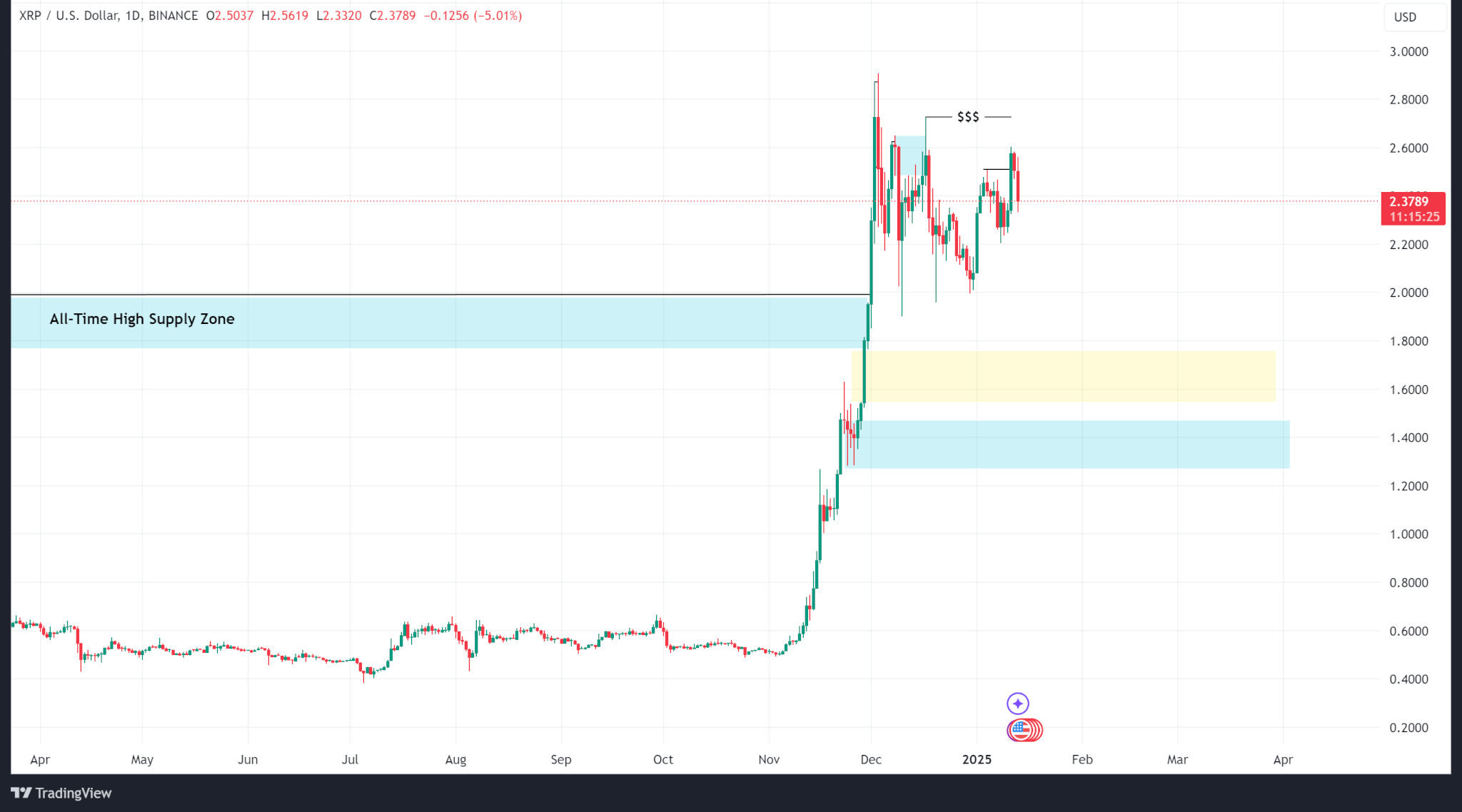

Ripple’s worth fared higher final week, closing larger at $2.55 from $2.38 initially of the week as worth continued to log larger highs. Zooming out, the worth continues to vary between $1.90 and $2.90 because the market cools.

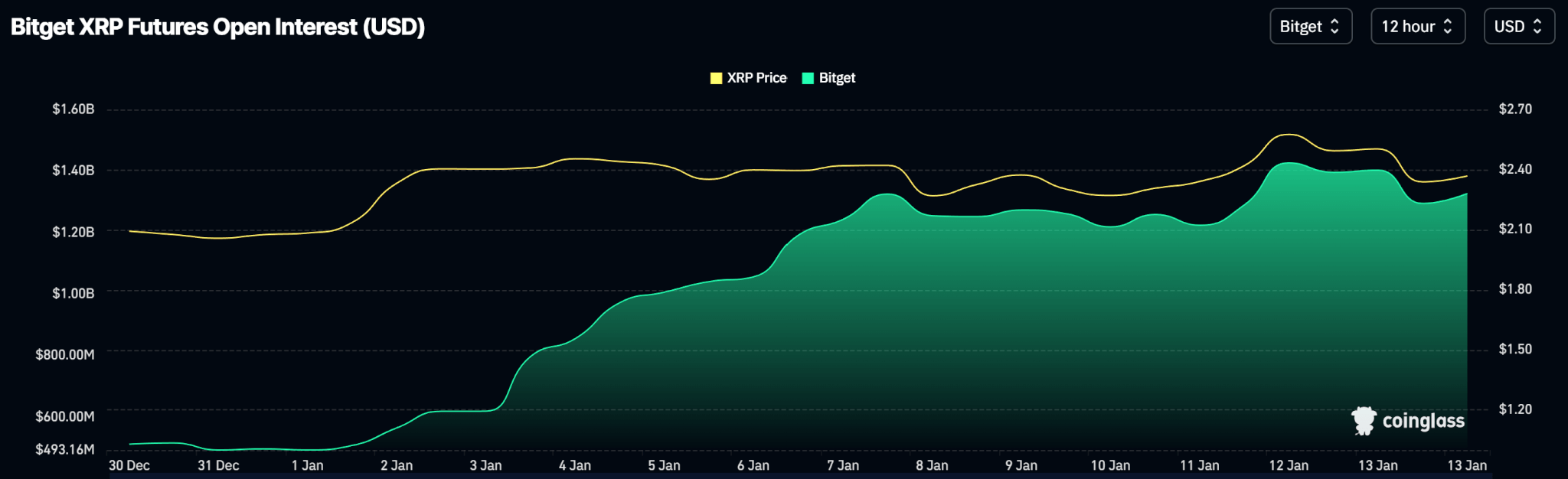

Open curiosity rose on Bitget, the alternate with the best XRP by-product buying and selling quantity, during the last week, supporting upward worth motion as optimistic information round Ripple’s case with the SEC boosted sentiments.

Outlook

Ripple’s worth is buoyed by information across the SEC’s lawsuit in opposition to its mother or father firm, a case which could possibly be thrown out with the outgoing administration.

Nevertheless, technical evaluation exhibits that XRP trades at a premium and a pullback is predicted. The almost certainly ranges are the truthful worth hole at $1.75 and the order block at $1.46.

XRP trades at $2.37 as of publishing.