The Each day Breakdown seems on the latest professionals and cons from the Fed assembly, whereas digging into the Magnificent 7’s strategy to DeepSeek.

Thursday’s TLDR

The Fed left charges unchanged

Large Tech earnings talked AI

MSFT bulls search for help

What’s taking place?

There was one thing for each kind of investor yesterday, so I’ll attempt to give the TLDR synopsis right here.

First, as anticipated the Fed stored charges unchanged. Chair Powell reiterated the Fed’s expectation that inflation will progressively proceed to chill to their 2% goal, however added that they aren’t in a rush to decrease rates of interest right now. That is sensible as inflation hasn’t been shifting decrease and because the Fed has reduce charges by 100 foundation factors since September.

That reads a bit hawkish, however on the plus aspect, Powell mentioned the economic system and the labor market stay on stable footing, whereas client spending stays resilient. These are all large positives for the US.

On the AI and DeepSeek entrance, firms like Microsoft and Meta supplied some coloration on these subjects after they reported earnings final evening.

Each firms nonetheless plan to speculate closely in AI — which is sweet for chipmakers — though Meta CEO Mark Zuckerberg mentioned it’s nonetheless too early to foretell how new opponents like DeepSeek will impression Meta’s AI investments. If it’s too early for Zuck to foretell, then it’s positively too early for us. Nonetheless, these firms stay optimistic about the way forward for AI.

Need to obtain these insights straight to your inbox?

Join right here

The setup — Microsoft

Of the three Magnificent 7 holdings that reported final evening — MSFT, META and TSLA — Microsoft is the one one which’s buying and selling decrease within the pre-market. That’s regardless of the corporate beating on earnings and income estimates.

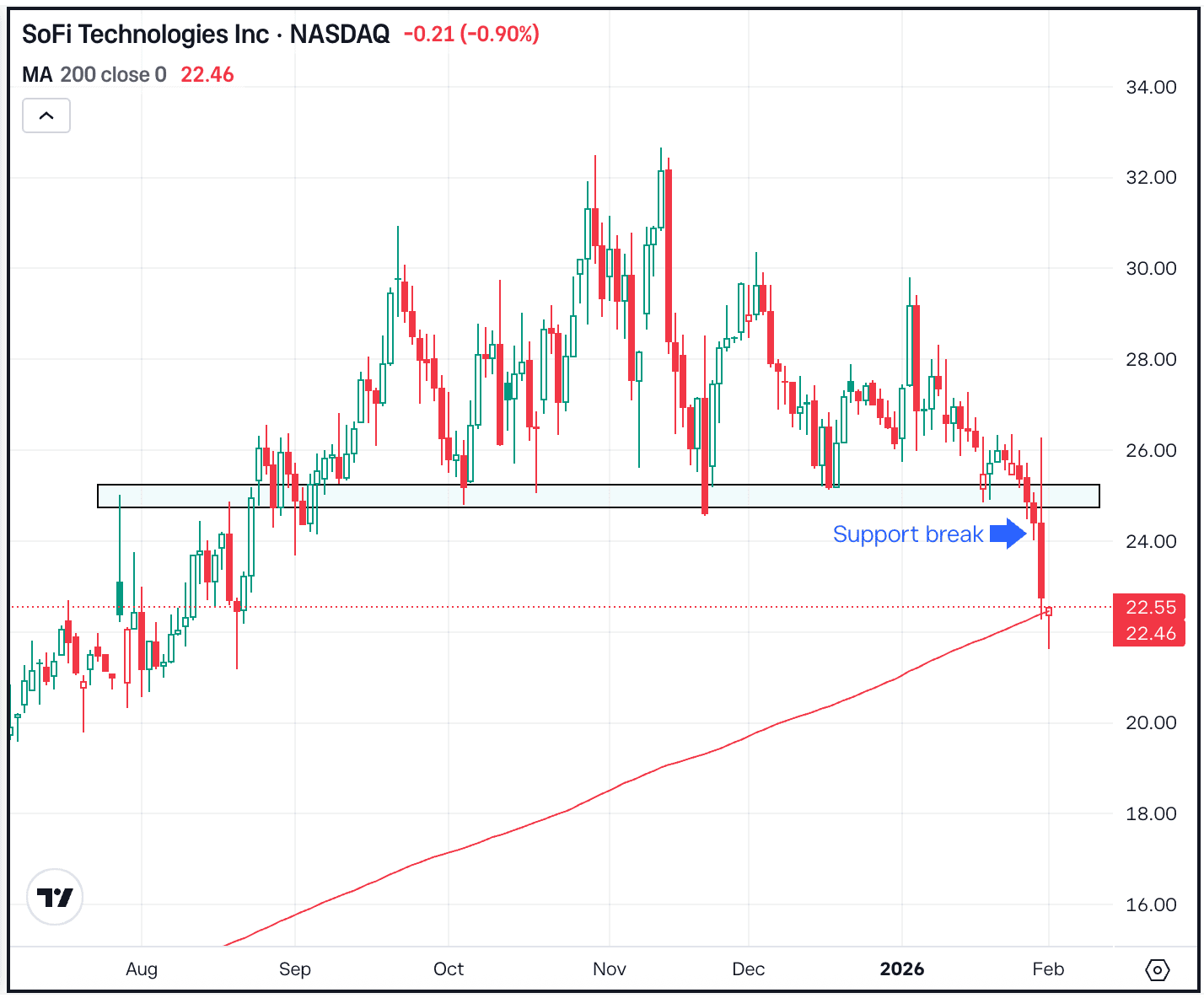

By now, I don’t want to focus on that MSFT has been consolidating in a big sideways sample for a number of quarters. That’s evident whenever you have a look at the chart under.

As an alternative, I’m taking a look at the place help may come into play this week.

Shares are presently buying and selling close to $425 within the pre-market, proper close to the inventory’s 50-day and 200-day shifting averages. I first need to see if MSFT is ready to discover help close to these measures.

If not, a transfer into the $410 to $415 space may very well be in play. Not solely has this zone been help for the final a number of months, nevertheless it’s additionally the place the inventory finds uptrend help going all the way in which again to its low in Could 2023.

It’s doable that neither help stage holds and MSFT’s momentum turns decidedly bearish. Nonetheless, these are the 2 foremost technical ranges I’ll be watching this week.

Choices

On a dip, shopping for calls or name spreads could also be one approach to make the most of a pullback. For name consumers, it could be advantageous to have ample time till the choice’s expiration.

For those who aren’t feeling so bullish or who’re on the lookout for a deeper pullback, places or put spreads may very well be one approach to take benefit.

To be taught extra about choices, think about visiting the eToro Academy.

What Wall Road is watching

TSLA – Shares of Tesla are shifting barely larger in pre-market buying and selling after a bumpy after-hours journey. That’s as the corporate missed on earnings and income expectations, however CEO Elon Musk spoke optimistically about robotics, AI, and autonomous driving sooner or later.

SBUX – Starbucks inventory hit recent one-year highs on Wednesday, climbing greater than 8% after the agency delivered a top- and bottom-line earnings beat underneath new CEO Brian Niccol. Whereas income was flat yr over yr, earnings took a large hit, falling greater than 25% from the identical interval a yr in the past as the corporate focuses on its turnaround plan.

AAPL – Apple inventory will likely be in focus tonight — alongside Intel — as each firms report earnings after the shut. Whereas AAPL shares have executed effectively over the previous few classes, the inventory remains to be down about 4.5% yr so far. Try Apple’s chart.

Disclaimer:

Please notice that attributable to market volatility, a number of the costs could have already been reached and situations performed out.

The put up AI Worries vs. The Fed appeared first on eToro.