February 5, 2025

The next publish comprises a recap of stories, initiatives, and necessary updates from the Spartan Council and Core Contributors from final week.

👉TLDR

SIP-420: Protocol Owned SNAX — That is in its last audit stage. See under for a refresher on the contents of this proposal.Synthetix Leveraged Token Rally rewards program: Week 3 of 5 has simply begun, with one other 15,000 $OP and 30,000 $USDC up for grabs. See final week’s leaderboard under.Discord alpha about free $OP bets from Additional time: Synthetix struck a deal (thanks Burt!) final week with Additional time Markets in order that the primary 250 addresses to commerce on Synthetix Leverage for the remainder of the week (ended February 3), would earn a free 10 $OP wager on Additional time.Cease Loss and Take Revenue order varieties have been added to Synthetix Exchange1-click buying and selling and account abstraction is in last testing stagesArbitrum deprecation is close to completionFenway updates: Synthetix is transitioning from being solely a liquidity service to taking cost of the product growth (frontend UX developments are off the charts, Synthetix vaults as a brand new product is bringing many optimistic adjustments).V4 is coming: Synthetix V4 will ship a buying and selling expertise that’s aggressive with different on-chain DEX’s with out making a few of the centralization tradeoffs that opponents have needed to make. Buying and selling and LP exercise on V3 on Base will proceed. See extra particulars under.Synthetix Trade new instruments and docs: Now there may be a better strategy to modify your positions with restrict orders on Optimism. The brand new pencil icons on Synthetix Trade enable modification by means of market, restrict, and cease orders.New Perps markets are stay: $VELO, by Velodrome, and $VVV, by Venice.Rewards for sUSD depositors on Infinex nonetheless ongoing: Rewards have been simply DOUBLED to 10,000 OP and 10,000 SNX being distributed weekly. See outcomes from final week’s Patron NFT drawing under.Synthetix efficiency comparability thread on X: 🥇SOLBULL 3X Leveraged Tokens vs. 🥈SOL Perps vs. 🥉SOL Spot. See full outcomes of efficiency comparability under.

Spartan Council and SIP updates

Throughout final week’s sync the Council mentioned some product updates, together with SIP-420 which is in its last audit stage. Massive issues are cooking with this implementation and we’ll be maintaining with its development, so keep tuned for updates. However simply as a refresher:

This SIP was proposed by Kain to introduce a delegated staking system the place SNX holders can contribute their current debt positions to a protocol-owned pool, permitting the protocol to handle debt and generate yield, whereas providing stakers higher incentives.That is speculated to make staking a lot simpler and extra accessible by providing decrease dangers, greater returns, and long-term rewards, like liquidity incentives and treasury collateral redistribution (it was proposed that 10 million SNX from the treasury be used as staking incentives).Burt Rock additionally posted an excellent thread about this SIP on X, so remember to verify that out as properly!

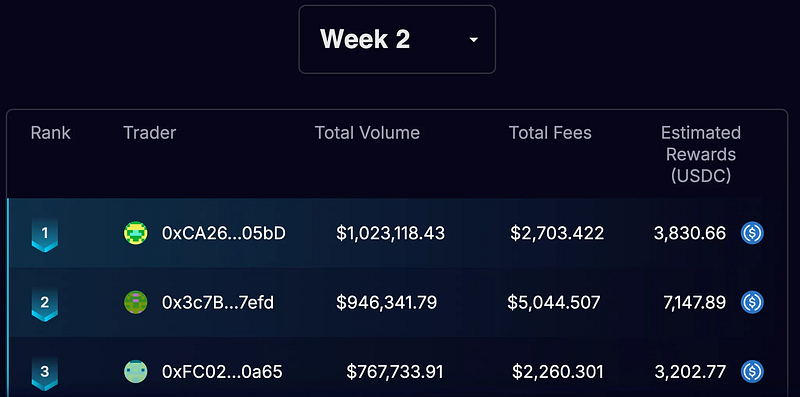

Subsequent up, as we talked about final week, the Synthetix Leveraged Token Rally rewards program is ongoing and is at the moment in its last swing. Now we have simply entered week 3 of 5, so in the event you missed out on the final couple of weeks it’s not too late to hitch! This week one other 15,000 $OP and 30,000 $USDC are up for grabs — simply mint Leveraged Tokens at http://leverage.synthetix.io and climb the leaderboard. Right here’s a take a look at final week’s high merchants and the rewards they took house:

Weekly rewards accumulate all through the occasion, and contributors can declare them of their dashboard after Week 5. Don’t miss out!

Talking of lacking out, did you catch the Discord alpha about free $OP bets from Additional time?? Synthetix struck a deal final week with Additional time Markets in order that the primary 250 addresses to commerce on Synthetix Leverage for the remainder of the week (up till this previous Monday morning), would earn a free 10 $OP wager on Additional time. Shout out to our associates at Additional time! Simply in time for the Tremendous Bowl within the states.

However getting again to final week’s Spartan Council sync, the crew additionally mentioned how Cease Loss and Take Revenue order varieties have been added to Synthetix Trade, and 1-click buying and selling and account abstraction is in last testing phases. The Arbitrum deprecation can also be close to completion (all LPs and merchants are being suggested to withdraw and exit the system forward of anticipated liquidation ratio will increase to speed up the wind down).

Fenway additionally introduced up how Synthetix is at an attention-grabbing level within the protocol’s growth, because the core mission is altering from being solely a liquidity service to taking cost of the product growth. The frontend (Synthetix Trade) has seen quite a lot of UX enhancements, and there are extra to come back over the subsequent couple of months. He added that Synthetix vaults as a brand new product will allow customers to execute funding price arbitrage and foundation commerce seize methods, and the plan is to construct person pleasant UIs for this product to make it extra accessible for typical merchants.

Additionally, Fenway introduced that incentives for customers holding sUSD on Infinex can be doubling final week — the APY rising from 25% to 50%.

AND…V4 is coming! Synthetix V4 will ship a buying and selling expertise that’s aggressive with different on-chain DEX’s with out making a few of the centralization tradeoffs that some opponents have needed to make. V4 might be deployed on SNAX Chain, and SIP-420 will unencumber some liquidity to assist get this going (through a decreased c-ratio) and help extra OI proper from the launch. Buying and selling and LP exercise on V3 on Base will proceed, however anticipate extra particulars about all of this within the coming weeks.

Subsequent, the Synthetix Trade crew has been arduous at work on some sizzling new instruments and docs. They’ve listened to your suggestions and have applied a better strategy to modify your positions with restrict orders on Optimism. The brand new pencil icons on Synthetix Trade enable modification by means of market, restrict, and cease orders. You possibly can scale in or out of trades simply, utilizing market or conditional orders — all with out depositing any further margin.

Talking of Synthetix Trade, a few new Perps markets are actually stay: $VELO, by Velodrome, and $VVV, by Venice.

And don’t neglect — Infinex sUSD depositor rewards are nonetheless occurring! Rewards have been really simply DOUBLED to 10,000 OP and 10,000 SNX being distributed weekly. Final week there have been 334 customers who deposited $1,000 or extra sUSD and certified for the week 2 random Patron NFT drawing — and the winner was Cyberdruid! However everyone seems to be profitable with these rewards. 😉

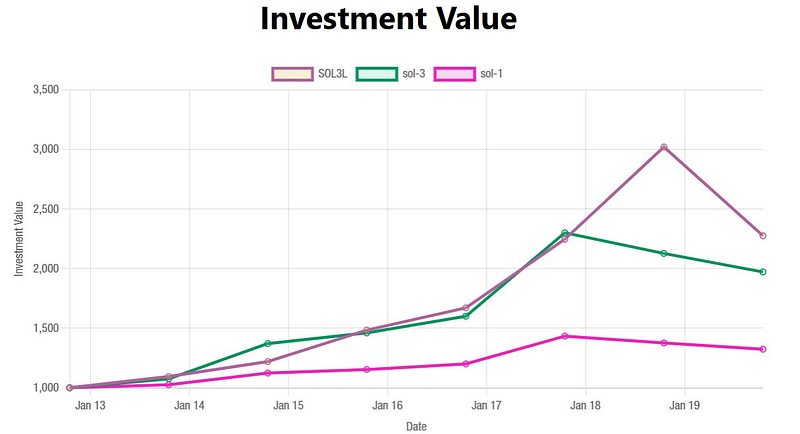

Lastly, Synthetix not too long ago posted a thread on X that goes by means of a efficiency comparability of SOLBULL 3X Leveraged Tokens, SOL Perps, and SOL Spot. These 3 other ways to lengthy SOL have been backtested over a 7-day span (January 13 — January 20) to see which carried out greatest and assist customers higher examine buying and selling choices.

🥉Third place: SOL Spot, with a $1,000 spot purchase of SOL being price roughly $1,324 for a worth improve of +32.4%.🥈Second place: the 3x SOL Perp lengthy with $1,000, ending at $1,972 with a +97.2% worth improve.🥇First place: the SOLBULL 3x Leveraged Token, ending at $2,276 with a +127.6% worth improve.

Take into accout, nevertheless, that this comparability doesn’t account for Perps funding or account for charges (which may differ from platform to platform). However, with all charges being equal on this check, the Leveraged Token was the strongest performer over this time interval because it mechanically rebalances, taking unrealized PnL to extend the place whereas sustaining the leverage issue of 3x.