The most important problem in worth investing just isn’t discovering low cost corporations, it’s discovering worth the place others don’t see it. With a 9% progress in 2024, it’s price analyzing the information reported to see if is a brilliant determination to have in our portfolios. Provided that the trade is presently buying and selling at 30x instances, whereas $TMV.DE is buying and selling at 15x we’ve got to provide them a search for the alternatives and an opportunity to show Mr. Market mistaken.

Supply: YT RealWear Acquires Almer Applied sciences, backed by TeamViewer.

Key highlights

TeamViewer ($TMV) reported a 9% income progress in 2024, demonstrating resilience within the distant entry market.

The acquisition of 1E, a pacesetter in Digital Worker Expertise (DEX) administration, for $720M might strengthen TeamViewer’s enterprise choices.

TeamViewer is making daring strikes into North America and APAC. Will this be the important thing to unlocking its subsequent section of progress?

Enterprise Overview

Teamviewer was based in 2005 in Germany and was designed to cut back journey time and permit distant duties on any system. To this point, it’s put in in almost 2.5 billion units, with multinational purchasers, resembling DHL, Coca-cola, Volvo, and BOBST. With 640.000 subscribers worldwide with a formidable retention fee of 100%. Thought-about essentially the most salient model amongst IT professionals for distant connectivity options by a TMV model survey (2021-2024 n=4000-4400 throughout 5-6 key markets).

Supply: Teamviewer This autumn/24Y presentation

TeamViewer operates on a subscription-based mannequin throughout a number of product classes, together with:

Distant Assist Options – Safe distant entry and troubleshooting.

Enterprise Connectivity Options – IT/OT integration for giant organizations.

Digital Worker Expertise (DEX) – Enhancing digital office effectivity.

Frontline Productiveness Options – AR and blended actuality instruments for industries.

By its partnership with RealWear, TeamViewer provides augmented actuality (AR) and blended actuality (MR) options to optimize operations in manufacturing, logistics, and after-sales providers, enhancing productiveness and effectivity.

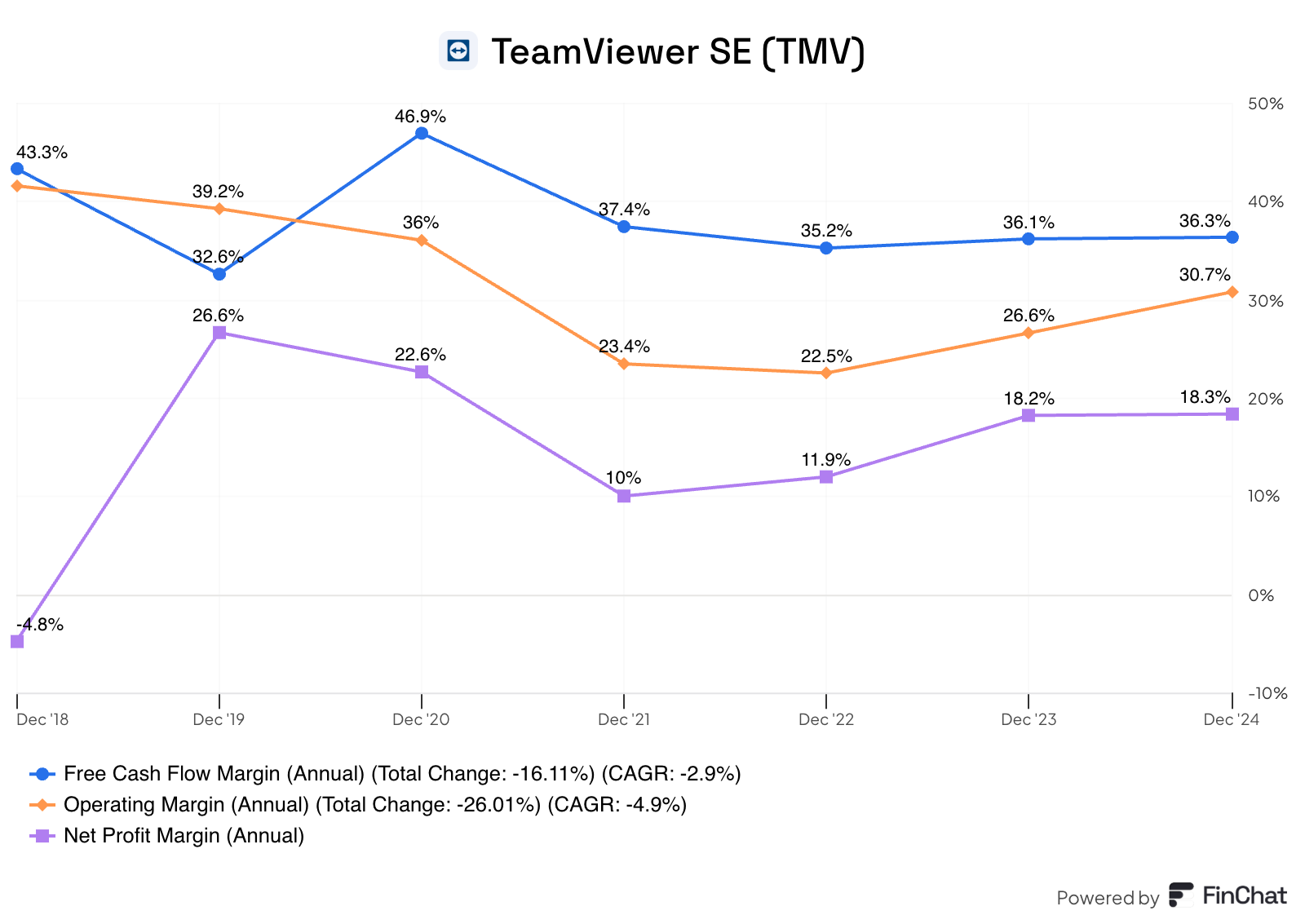

In 2024, TMV reported a income progress of 9% (in fixed foreign money), reaching €671.4 Million, being €520M from small and medium companies, and €151.4M from enterprises, this newest quantity had a progress of 24% highlighting the technique the place the corporate is searching for increase. The FCF margin has been sustainable by the years, with a 35% common.

Supply: Finchat

The latest acquisition of 1E the corporate chief in DEX administration instrument at an enterprise worth of USD 720 million, is trying to place Workforce Viewer as a broad IT/OT providers supplier. With the mixing of each applied sciences and groups, the mixed merchandise are anticipated to extend the whole addressable market and the all-in-one supplier.

Moreover, the corporate is dedicated to innovating with AI, this yr they launched “Session insights”, a characteristic that robotically summarizes distant help periods and supplies analytics. This characteristic is now built-in into Microsoft Groups and Copilot.

Wanting forward, to 2030, the World Financial Discussion board estimated that world digital jobs are going to extend by 25% from 73 Billion to 92 Billion, together with this, corporations are searching for extra to reinforce productiveness, which might improve the Complete Addressable Market to €22 Billion in 2028 a 13.6% greater than immediately quantity, and right here is the place we are able to see the explanation for the 1E acquisition, TeamViewer’s CEO even described it as “the quickest means of innovation” and this fashion use the momentum of the tech growth to turn out to be the IT/OT multi functional platform.

The number of rivals might go from AnyDesk, LogMeIn, or Microsoft Distant Desktop in distant management, in DEX providers, the primary competitor is Nexthink, in different providers we might point out Connectwise, however the primary distinction comes, within the capability now for the corporate to supply a number of providers with only one supplier. Giant enterprises typically want to consolidate service suppliers (even at a premium) slightly than managing a number of distributors, which may result in operational inefficiencies

Funding evaluation

By the strategic plan and mid-term targets, the administration expects double-digit income progress from 2027 onwards. Supported by the growth of augmented actuality, the revolution with AI in on-line providers, the now ample number of providers supplied with 1E, and the alternatives for growth in North America and APAC. Which makes a TAM growth to €22Bn a 13.6% improve to 2028.

The enterprise is dedicated to creating shareholder worth by share buybacks of €137.7m in 2024 and debt compensation of €85m.

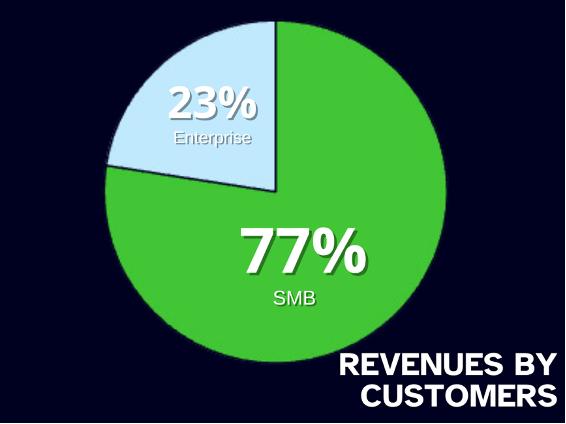

For enterprises switching prices are excessive and with 23% of the shoppers being high-value enterprises, a quantity that elevated in 2024 by 24%, we’ve got to contemplate this as an element to long-term dedication from their purchasers and the power in pricing energy, offering Teamviewer with a robust aggressive MOAT.

Supply: Teamviewer This autumn/24Y presentation

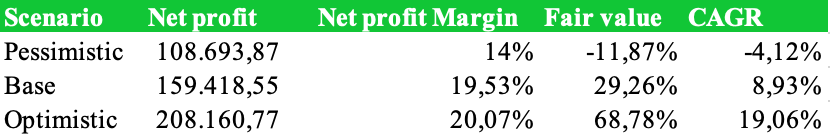

The value/earnings ratio for TMV.DE is 15x. We’ve created three totally different situations giving the corporate a a number of of 15x (the common of the market), within the constructive state of affairs we used the estimation that the corporate expects a 70% progress of their internet revenue from now to the yr 2028, as they mentioned of their outcomes This autumn/2024. This might imply a internet revenue margin of 20%.

Within the low vary, within the pessimistic state of affairs, we estimate the worst-case state of affairs the place the corporate doesn’t obtain its objectives and can be harmed by competitors and macroeconomic elements. On this one, we might receive a lack of -11% given a internet revenue margin a bit excessive in contrast with their worst two years in 2021, and 2022 respectively 10% and 11%.

However the most certainly state of affairs bearing in mind its sort of enterprise: is subscription-based. The place they’ve long-term contracts with blue chip corporations, and due to this we consider their estimations are reliable and achievable. The difficulty right here is that if we belief within the functionality of the corporate to implement and execute appropriately the plan, scale back prices, and create shareholder worth, on this case, we’ll obtain a return of +68%.

Dangers

Macroeconomic occasions: In 2021 after the pandemic, the retention in subscriptions fell from 100% to 88%, affecting the income of the enterprise and this made the value of the share fall 75% in only one yr. I take into account that, due to these dangers, TMV.DE focuses extra on enterprise progress than industrial progress.

Technological competitors: Within the IT providers trade, there are fixed improvements that would make our corporations lose their aggressive benefit. The priority with TMVW is that the acquisition of 1E was due to stagnation of their functionality to provide innovation by themselves, their product is now not related, or they will’t preserve the income progress, or it was a technique to create an ecosystem in IT providers sector to reinforce the client expertise.

Valuation of 1E acquisition: The valuation for the acquisition was $ 720M, with a $77M Annual recurring income, which implies a bit of greater than 9x Gross sales. A quantity that appears aggressive for my part, however right here the query is, was the administration seeing hidden synergies that justify the value?

Solvency dangers: with a debt/fairness ratio of 6.5 they’re above the utmost accepted, that is attributable to the brand new acquisitions and so they’re dedicated to decreasing the debt within the coming years.

Market growth dangers: the brand new goal within the North America and Oceania growth might current challenges, with cheaper rivals (resembling Connectwise, and Anydesk with their growth plan) and excessive advertising and marketing and gross sales expenditure.

Failure within the execution of the plan: With any plan, corporations have the danger of the objectives not being achieved, that is why we’ve got to be very conservative when analyzing their estimations.

Conclusion

Know-how is the long run, advances in the best way we work and talk, all the time trying the enhancements in our high quality of labor, effectivity in journey time, with digital entry to manage any system worldwide, with using AI throughout our conferences to create dwell studies, and using AR to enhance logistic procedures.

TeamViewer is commonly ignored on account of its measurement and rising competitors, however its stable income progress, share buybacks, and enterprise focus recommend it’s removed from being an out of date firm. The acquisition of 1E provides new capabilities and provides of providers but additionally raises valuation issues. The important thing query stays: Is TeamViewer’s imaginative and prescient of an end-to-end IT/OT ecosystem sufficient to take care of progress? I do consider so, that’s why TMV is a major a part of my portfolio.

What do you concentrate on TeamViewer’s future with this data I gave immediately? Let’s talk about this in my profile!

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding targets or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.