Tariff talks and headline volatility proceed to weigh on the markets, as traders attempt to get by way of key occasions and discover the positives.

Thursday’s TLDR

Tariffs sink yesterday’s rally

Nvidia delivers earnings beat

Charting Goldman Sachs

What’s occurring?

Markets had been rockin’ yesterday afternoon. At their highs, the S&P 500 was up 0.9% and the Nasdaq 100 was up 1.3%. Each indices had been trying to snap a four-day shedding streak and had been on monitor to take action with a robust upward punch.

Then President Trump’s tariff talks began to hit the tape within the afternoon.

At first, markets solely tipped decrease. However by late afternoon, each indices had been within the pink earlier than finally eking out minor beneficial properties on the finish of the day.

Between Nvidia’s earnings after the shut and the tariff discuss — which requires tariffs on Mexico and Canada to enter impact on April 2nd, and for a spherical of 25% tariffs to be utilized to the EU — traders’ temper shifted rapidly from morning hype to risk-off within the afternoon.

Now although, we’re seeing a little bit of a reduction rally this morning.

Nvidia delivered stable outcomes (extra on this within the “What Wall Road is watching” part), whereas traders are beginning to view tariffs as a negotiating tactic fairly than the beginning of a full-blown commerce warfare.

Let’s get by way of GDP at this time and the PCE report tomorrow.

Need to obtain these insights straight to your inbox?

Join right here

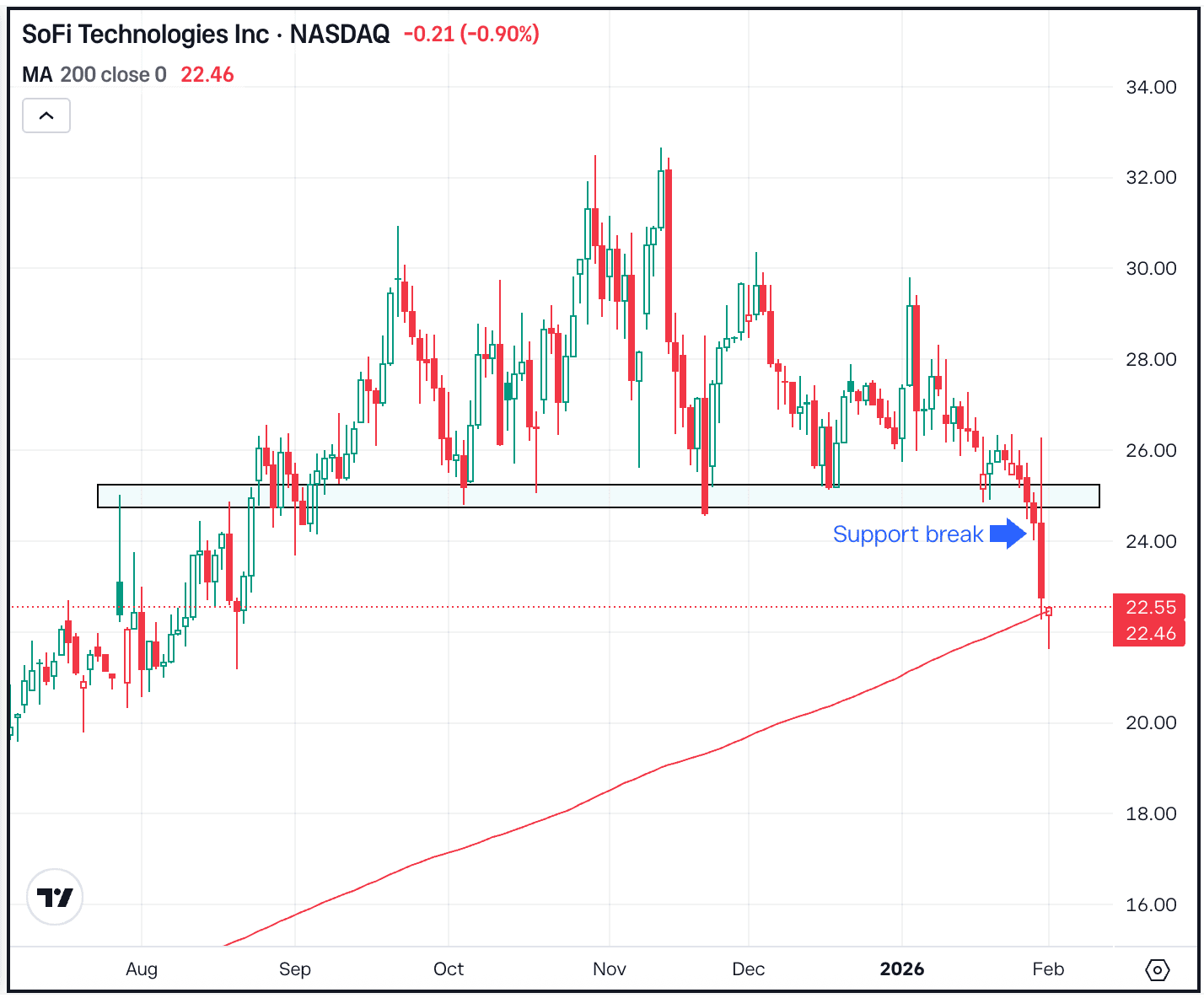

The setup — Goldman Sachs

Goldman Sachs had an explosive begin to 2025, rallying over 17% at one level this 12 months. Shares have since pulled again, falling from a report excessive close to $672 to a latest low of $606.

For now, the inventory is discovering help across the 50-day transferring common and a previous resistance zone between $600 and $610. The large query is, will this prior resistance zone act as present help?

If GS can keep above the $600 degree, bulls might find a way regain momentum and look for a bigger bounce to the upside. Keep in mind, financials are doing properly this 12 months and are the third-best performing sector within the S&P 500 to this point in 2025, up 5.2%.

Nonetheless, if the inventory is unable to search out help and breaks under $600, the inventory may see extra draw back promoting strain.

Analysts count on about 14% earnings development this 12 months, whereas shares commerce at roughly 13 instances 2025 earnings expectations.

What Wall Road is watching

NVDA – Nvidia beat on This fall income and earnings estimates, and spoke optimistically about its Blackwell shipments. The agency delivered a robust income outlook, however administration’s gross margin steering of 71% was barely under estimates of 72%. They stated the main focus is on maximizing Blackwell shipments proper now, an evidence traders appear okay with on condition that shares are up barely in pre-market buying and selling. Try Nvidia’s chart.

SNOW – Shares of Snowflake are popping this morning, up about 12% after the agency delivered a top- and bottom-line earnings beat final night time. Earnings of 30 cents a share simply beat expectations of 18 cents a share, whereas administration’s outlook was stable.

AI – C3.ai inventory is down barely this morning after the agency’s earnings report. The corporate beat on earnings and income expectations, however its outlook left traders wanting somewhat extra.

Disclaimer:

Please be aware that because of market volatility, among the costs might have already been reached and eventualities performed out.