For the reason that starting of this yr, Ethereum has underperformed in comparison with main digital belongings out there. ETH’s underperformance has sparked considerations inside the group, with merchants discovering it troublesome to find out whether or not the altcoin is gearing up for a serious rally or additional draw back strain. Nonetheless, present worth motion exhibits that ETH is likely to be set for a worth rebound within the quick time period.

Chart Sample Hints At A Restoration For Ethereum

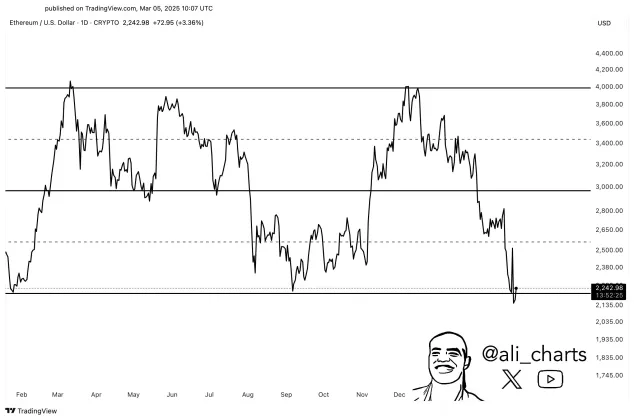

In an X (previously Twitter) put up, Ali Martinez, a seasoned technical skilled and dealer, highlighted a bullish improvement within the Ethereum chart. The skilled has identified the formation of a key chart sample, which may reignite upside momentum and push ETH towards key resistance ranges.

Delving into Ethereum‘s latest worth motion, a Parallel Channel sample has emerged within the 1-day timeframe. Particularly, a parallel channel is a technical chart sample created by connecting highs and lows with two parallel trendlines. This chart formation helps buyers and merchants decide the potential entry and exit factors in a cryptocurrency’s worth.

Presently, Ali Martinez famous that the altcoin is testing the decrease boundary of the important thing sample, the place it might safe sufficient energy to transition to the upside. Within the occasion that the sample triggers a bounce for ETH to reclaim the $2,350 stage, it’ll gas a robust restoration towards $3,000 and $4,000.

Because the asset assessments the sample’s decrease boundary, it exhibits that ETH is at a pivotal junction because it gears up for its subsequent transfer. With ETH hovering close to key resistance ranges, bullish momentum continues to construct, elevating the potential of a rebound for an important breakout.

Traders Reduce Again Their Publicity To ETH

Amid the bearish actions, on-chain information is displaying a lower in ETH publicity amongst buyers. A latest report from on-chain information and monetary platform Glassnode reveals that Ethereum buyers actively managed their publicity throughout this turbulent interval.

Ethereum retraced to the $2,050 space following a surge to about $2,500, ranges final seen in November 2023, in all probability contributing to the present shift in buyers’ habits. Taking a look at Glassnode’s chart within the 3-month view, there may be sturdy engagement from buyers with an preliminary value foundation on the $3,500 mark.

Information exhibits that these holders diligently diminished their publicity all through February as they stepped in on the native prime at $2,500 and the underside at $2,050. Moreover, these holders have diminished their preliminary value foundation by about 10% and presently maintain over 1.75 million ETH at $3,200.

Whilst Ethereum’s worth declines, this development has continued. On March 1, Glassnode famous that 500,000 ETH have been bought at $2,200 however have been promptly redistributed on the $2,500 native prime.

In the meantime, the $2,800 mark is the primary main resistance barrier, the place 800,000 ETH has been accrued. Glassnode expresses a lot significance to this stage as a worth restoration is prone to happen on this space.

Featured picture from Unsplash, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.