Este artículo también está disponible en español.

Ethereum (ETH), the second-largest cryptocurrency by market cap, is flashing a number of bullish alerts that counsel a possible upside transfer. Nonetheless, rising trade reserves are tempering this optimism.

Has Ethereum Shaped A Native Backside?

Ethereum has dropped almost 20% over the previous two weeks, falling from roughly $2,805 on February 23 to only above $2,200 on the time of writing. This decline has worn out $80 billion from ETH’s market cap.

Associated Studying

Regardless of this sharp pullback, crypto analysts are pointing to a number of bullish indicators that might sign an impending value reversal. Crypto analyst Merlijn The Dealer, for example, has highlighted that ETH is following the Wyckoff Reaccumulation Sample.

For these unfamiliar, the Wyckoff Reaccumulation Sample is a technical evaluation technique developed by Richard Wyckoff. Within the context of ETH’s present value motion, this sample means that the asset could also be coming into an accumulation section earlier than a possible upward motion.

The analyst additional famous that the “spring section” has simply been triggered – indicating a attainable bear lure the place a quick dip beneath help ranges misleads sellers, doubtlessly setting the stage for a rally. A bounce from this degree may see ETH climb to $4,000.

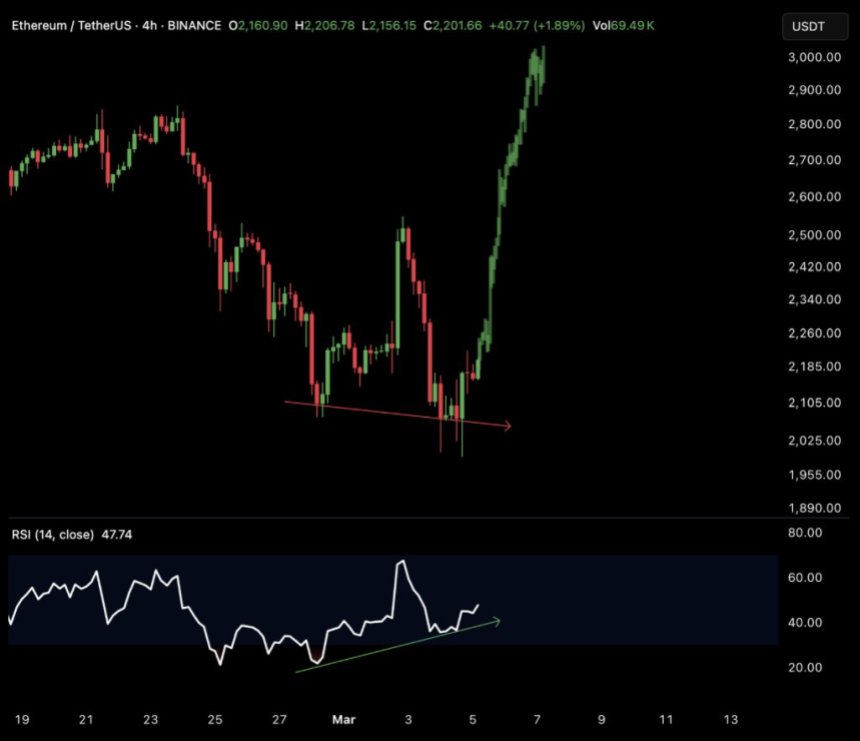

In a separate X publish, Merlijn The Dealer additionally pointed to a bullish divergence in Ethereum’s 4-hour chart. In accordance with the analyst, ETH’s subsequent instant goal is $2,700 earlier than shifting greater. Fellow crypto analyst CryptoGoos echoed these sentiments.

Past technical indicators, whale exercise has added to the bullish sentiment surrounding ETH. In an X publish, crypto analyst Ted famous:

Ethereum whale purchased 17,855 ETH price $36,000,000 at a median value of $2,054. Complete holding $2,530,000,000 Ethereum. You assume that is taking place? Suppose once more.

Rising Alternate Reserves Might Spoil The Occasion

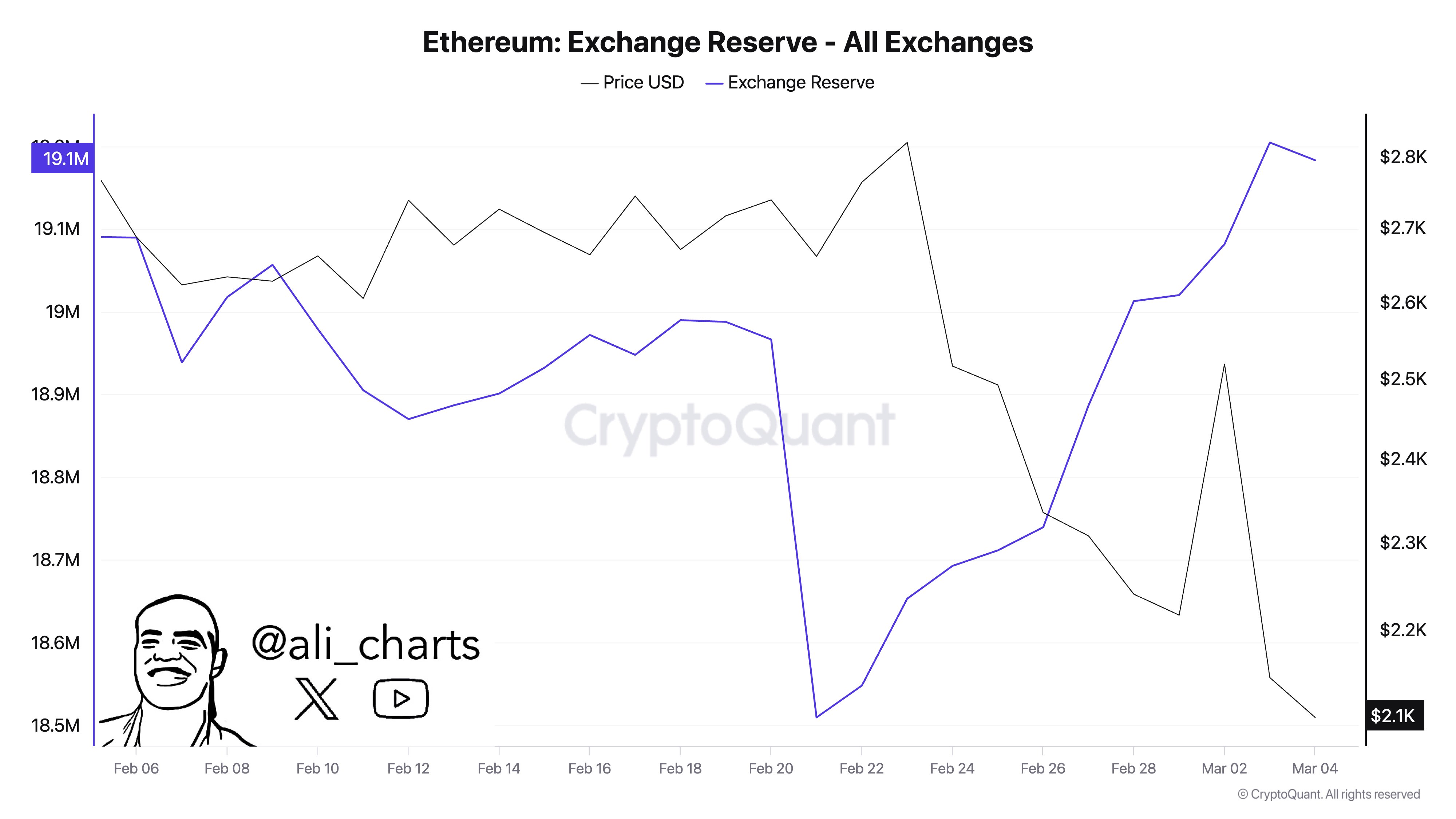

On the bearish aspect, crypto analyst Ali Martinez pointed out that ETH reserves on exchanges have been steadily rising. Over the previous two weeks, greater than 610,000 ETH has been transferred to exchanges, which may enhance promoting stress.

Martinez’s evaluation aligns with a current report that discovered that regardless of ETH’s Relative Energy Index (RSI) being at a multi-year low, there may nonetheless be additional draw back in retailer for the digital forex.

Associated Studying

Certainly, ETH has been marred by important bearish sentiment as a consequence of its comparatively weak value efficiency over the previous two years in comparison with cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP.

Nonetheless, excessive bearish sentiment may act as a contrarian sign, setting the stage for a shock rally. At press time, ETH trades at $2,200, up 6% prior to now 24 hours.

Featured picture from Unsplash, charts from X and Tradingview.com