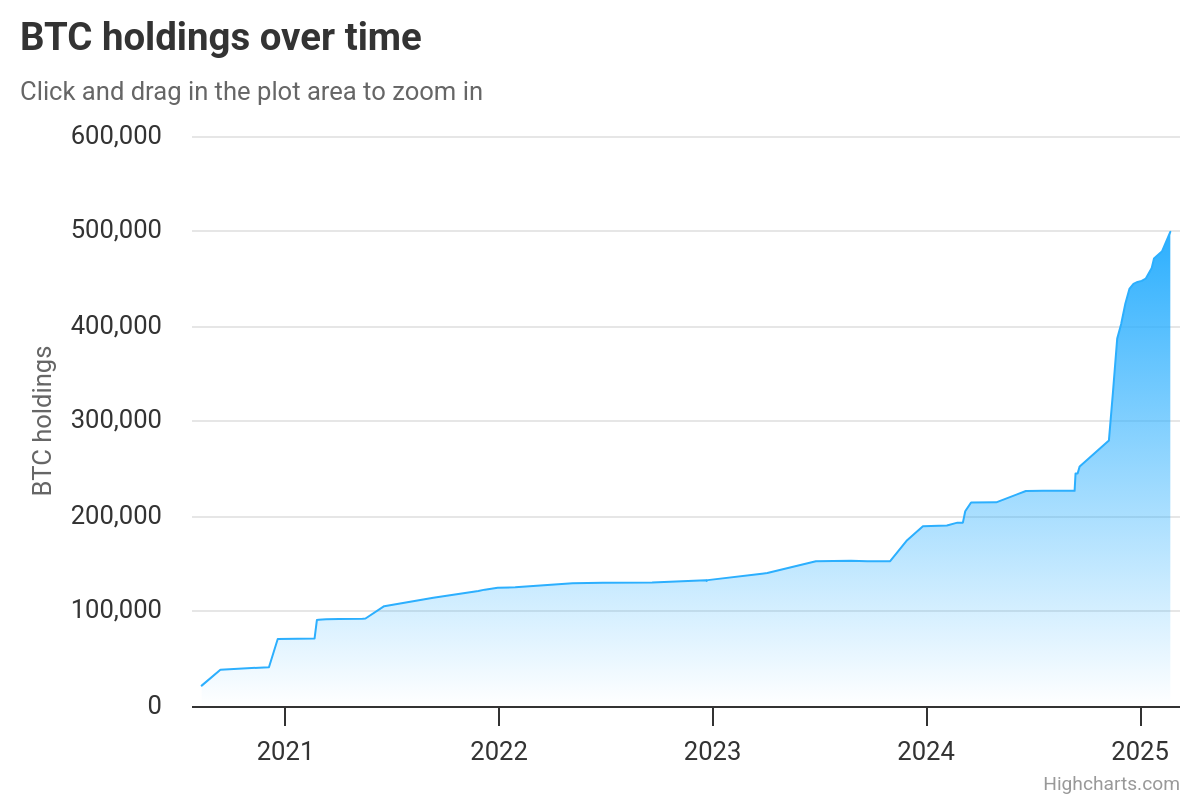

Technique has a particular place within the crypto group. When the corporate first entered the Bitcoin market, few public companies have been keen to take the danger. However below Michael Saylor’s management, Technique adopted an aggressive Bitcoin funding technique. In the present day, it holds 499,096 BTC.

The corporate made headlines when Bitcoin briefly crossed the $100K milestone. Nevertheless, since February 4, BTC has not closed above this stage. The value now stands at $88,724.95, down 11.26% from its peak. This raises an necessary query – has Bitcoin’s decline affected Technique’s inventory? And has Saylor’s technique hit a roadblock?

Technique’s Greenback-Value Averaging Strategy

Technique follows a Greenback-Value Averaging (DCA) technique, the place it buys Bitcoin in common intervals as a substitute of creating one massive buy. This explains why the corporate purchased BTC even when costs have been between $95K and $106K.

Nevertheless, Bitcoin has dropped considerably since its peak of $106K—down 16.28% general.

In early February, BTC traded at $100,621.97.On February 2, it briefly closed above $101,305.27.February 3 noticed a 3.49% drop.Between February 5 and 23, BTC stayed between $98,290.71 and $95,678.10.On February 24, it fell under this vary, dropping 12.48% in three days.Though BTC rebounded 11.77% between March 1 and a pair of, it didn’t get better fully.On March 3, BTC noticed one other 8.49% decline.

Now, Bitcoin remains to be struggling to get again above $100K.

Additionally Learn : Bitcoin Value Prediction 2025: Will BTC Break $100K Once more? ,

Technique’s $1 Billion Unrealized Loss

Due to its aggressive shopping for, Technique is now going through $1 billion in unrealized losses. The largest loss got here from a $1.11 billion Bitcoin buy at a median worth of $105,596 per BTC.

The corporate’s most up-to-date Bitcoin buy was on February 24, when it purchased 20,356 BTC for $1.99 billion. Presently, Technique’s complete Bitcoin holdings are value $44.63 billion.

If Bitcoin doesn’t get better quickly, Technique may need to reassess its strategy. Will Saylor proceed to purchase extra, or will the corporate take a unique route? For now, all eyes are on Bitcoin’s subsequent transfer.

Keep forward with breaking information, skilled evaluation, and real-time updates on the most recent traits in Bitcoin, altcoins, DeFi, NFTs, and extra.

FAQs

As of now, MicroStrategy holds 499,096 BTC, valued at roughly $44.6 billion, regardless of market fluctuations.

Sure, latest BTC worth drops have led to over $1 billion in unrealized losses, with a major loss from a $1.11B buy at $105,596 per BTC.

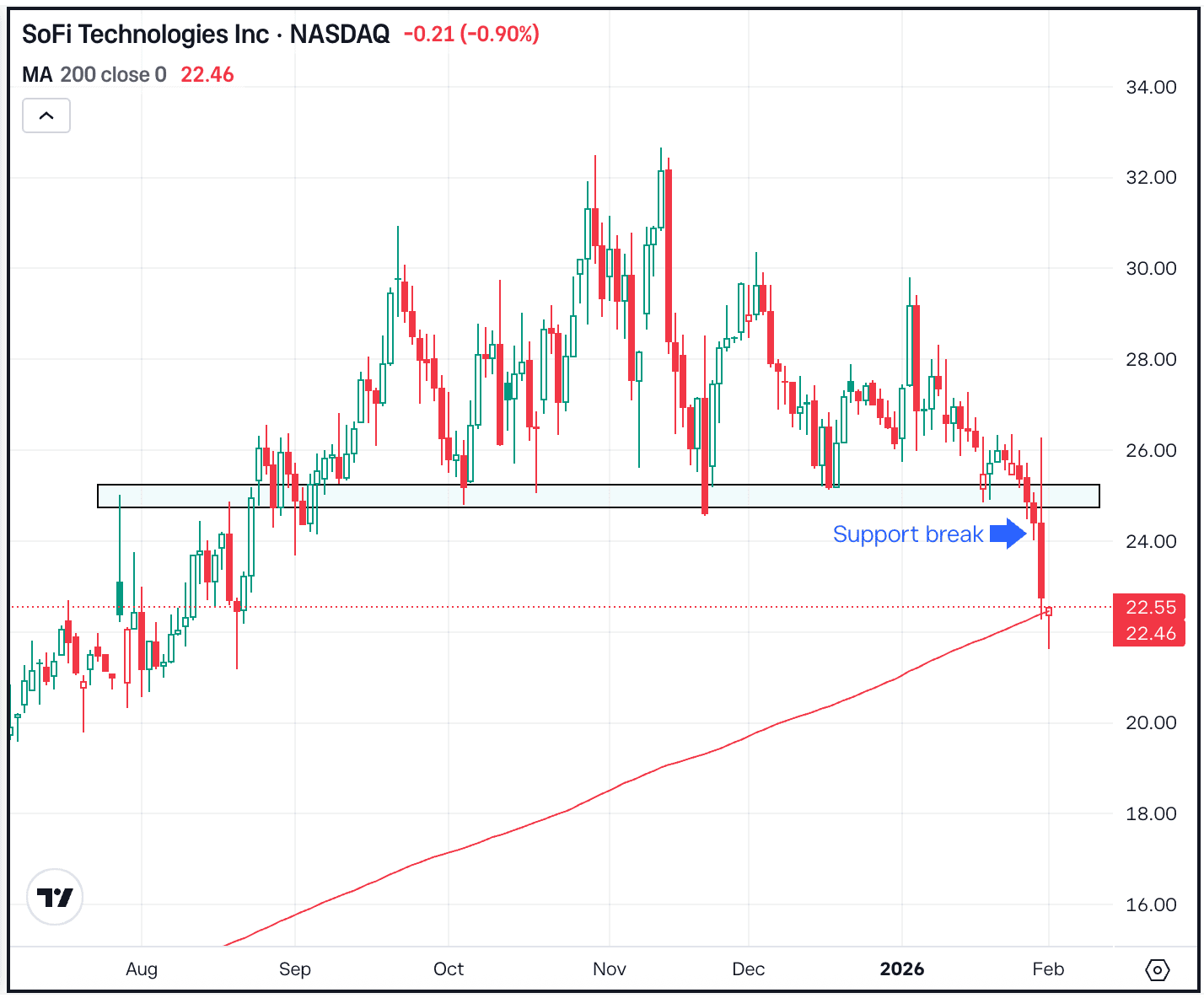

MicroStrategy’s inventory (MSTR) typically strikes with Bitcoin, rising throughout BTC rallies and going through sell-offs throughout main corrections.