Inventory market volatility is nothing new, however 2025 is proving to be a yr the place buyers are pressured to rethink their playbook. The outdated technique of merely driving mega-cap tech shares to victory is giving method to a extra balanced strategy—one which favors diversification, high quality, and sensible hedging.

Slightly than concentrating danger in a handful of overvalued names, buyers could wish to unfold their bets. Diversified ETFs are gaining traction as a method to hedge in opposition to single-stock danger, whereas world markets, significantly Europe, Asia and Japan, particularly, are attracting contemporary capital. With company reforms in Japan and undervalued alternatives in European equities, worldwide publicity is again on the radar, serving to diversify away from US’s focus danger.

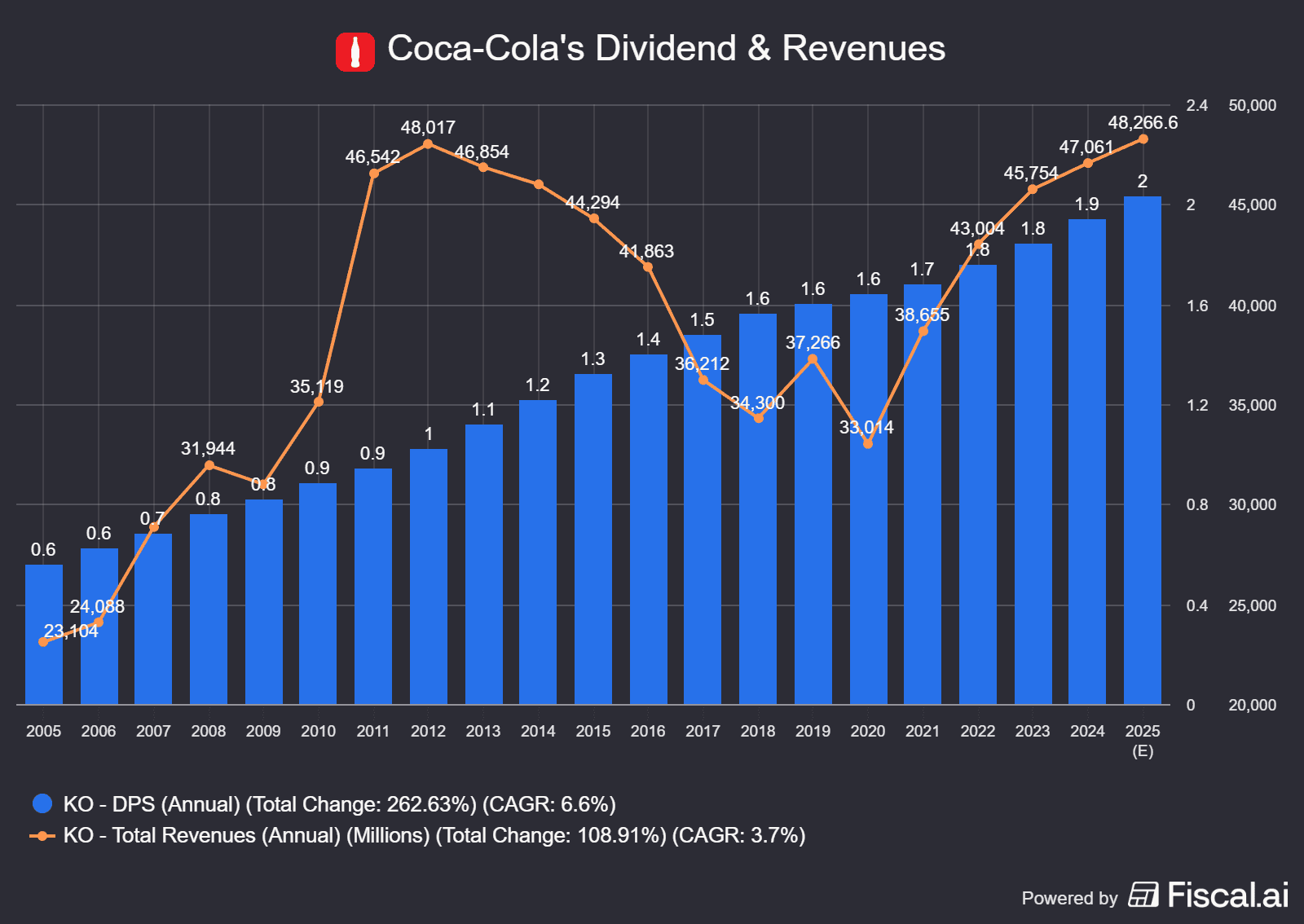

In the meantime, fundamentals are taking heart stage. Buyers burned by speculative frenzies could take into account pivoting towards high-quality corporations with stable stability sheets, robust money flows, and resilient earnings – prioritising substance over hype.

Sector shifts are additionally underway. Defensive performs like healthcare, utilities, and client staples are seeing renewed curiosity as buyers search shelter from market swings. Financials, lengthy battered by uncertainty, are displaying indicators of life, buoyed by rising web curiosity margins and an bettering lending atmosphere. In the meantime, defence shares are benefiting from hovering world army spending, whereas clear vitality continues to attract capital, fueled by authorities incentives and long-term coverage help.

Hedging is one other vital piece of the puzzle. With inflation considerations nonetheless lingering and price lower expectations shifting, buyers are turning to gold and commodities as a buffer. Bond ETFs are additionally making a comeback, providing regular earnings and portfolio stability amid the uncertainty.

Even crypto, as soon as dismissed as a high-risk outlier, has discovered its place within the dialog. In unstable occasions, it’s sensible to stay with the crypto blue-chips. Bitcoin and ethereum stay the go-to holdings for a lot of buyers. Why? They’ve the most important networks, probably the most adoption, and severe institutional backing.

The underside line? The times of tech single-handedly driving the market could also be behind us. As a substitute, 2025 is shaping as much as be a yr of broader management, the place high quality, resilience, and strategic diversification take precedence. Buyers who adapt to this new actuality, enjoying each defence and offence, are those almost definitely to prosper in the long term.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.