Ethereum (ETH) has tumbled to a 4-year low in opposition to Bitcoin (BTC), additional eroding investor confidence within the second-largest cryptocurrency by market cap. The final time ETH was this weak in opposition to BTC was again in December 2020.

Ethereum Continues To Lose Floor To Bitcoin

Ethereum hit a recent multi-year low in opposition to the main cryptocurrency, because the ETH/BTC buying and selling pair – often known as the ETH/BTC ratio – dropped to 0.02284. The next month-to-month chart illustrates how ETH has been on a constant downtrend in opposition to BTC for the previous 4 consecutive months.

Including to ETH’s struggles is its declining market dominance. On the time of writing, the sensible contract token’s market dominance stands at 8.6%. For context, ETH’s market dominance was hovering barely above 18% in March 2024.

ETH’s persistent underperformance relative to BTC turns into clear when evaluating historic ratios. In 2017, one BTC may purchase roughly six ETH. In 2025, one BTC now buys as a lot as 42 ETH.

Information from crypto exchange-traded funds (ETF) tracker SoSoValue additionally reveals that Ethereum ETFs are seeing a pointy decline in curiosity, seemingly pushed by ETH’s sluggish value efficiency over the previous two to 3 years.

The next chart illustrates how the full web asset worth in Ethereum ETFs has plunged from $14.28 billion on December 15, to $6.65 billion as of March 9. In that very same interval, ETH’s value has greater than halved, dropping from $4,043 to only above $1,800 on the time of writing.

As ETH struggles to reclaim the vital $2,000 value stage, seasoned crypto analyst Ali Martinez has recognized key resistance zones. In an X publish, Martinez famous that ETH faces heavy resistance between $2,250 and $2,610, the place over 12 million traders bought greater than 65 million ETH.

Can ETH Stage A Comeback?

One other indicator of waning investor confidence is the declining proportion of staked ETH within the community. A latest report highlighted that ETH staking has dropped sharply from its November 2024 peak.

Furthermore, value evaluation based mostly on MVRV Pricing Bands suggests that if ETH fails to interrupt above $2,060, it may slide additional, probably reaching as little as $1,440. Ethereum whales – wallets holding greater than 10,000 ETH – additionally look like dropping confidence, with some massive holders offloading their belongings.

Nevertheless, on a brighter notice, extreme bearish sentiment round ETH may spark a brief squeeze, probably propelling the cryptocurrency towards $3,000. At press time, ETH trades at $1,884, down 1.7% previously 24 hours.

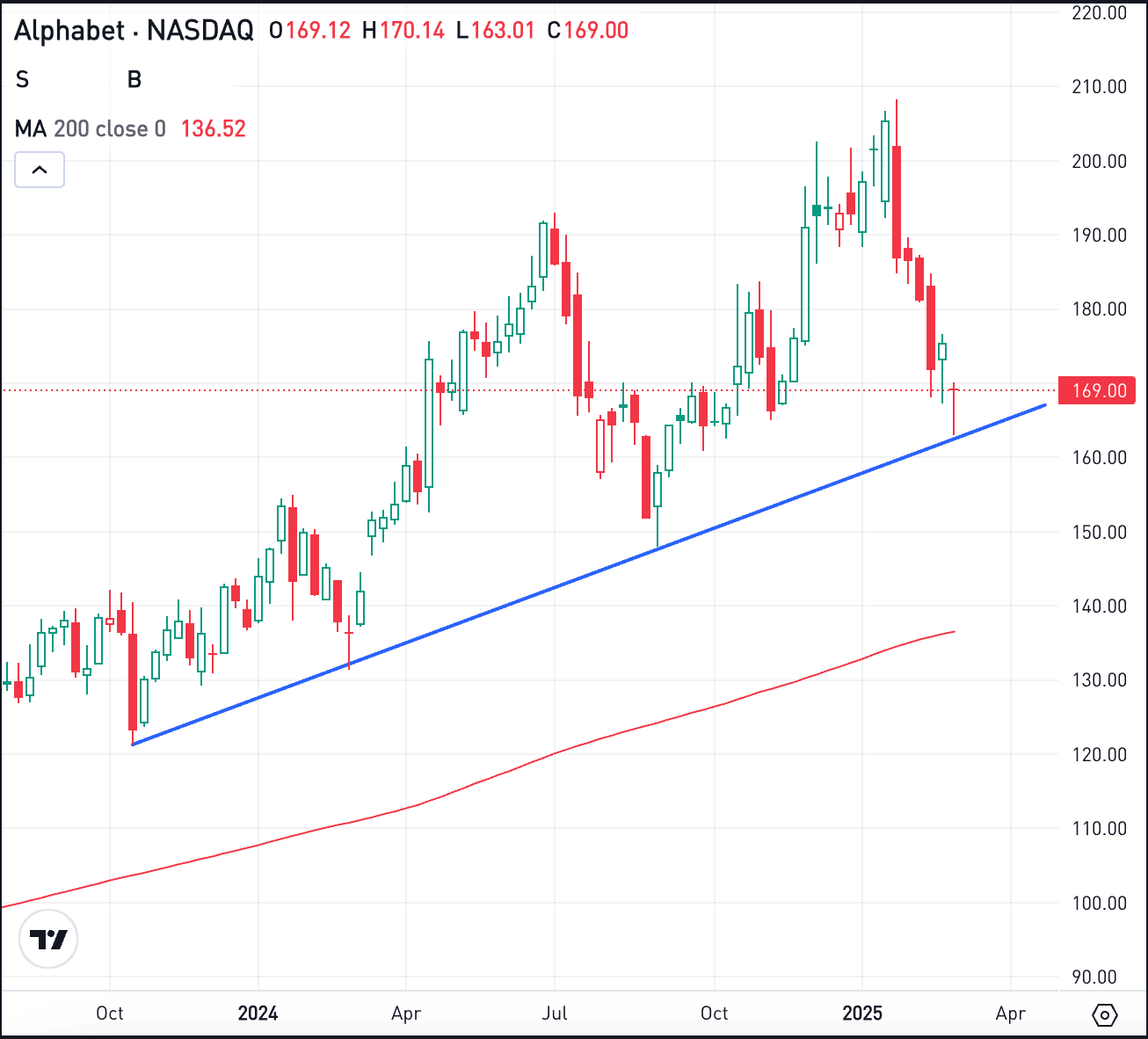

Featured Picture from Unsplash.com, Charts from SoSoValue.com and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.