BlackRock’s USD Institutional Digital Liquidity Fund, identified on-chain as BUIDL, reached $1 billion in tokenized belongings as of March 2025, per information from rwa.xyz.

On March 13, the fund minted over $206 million in new tokens as liquidity continues to movement into the fund.

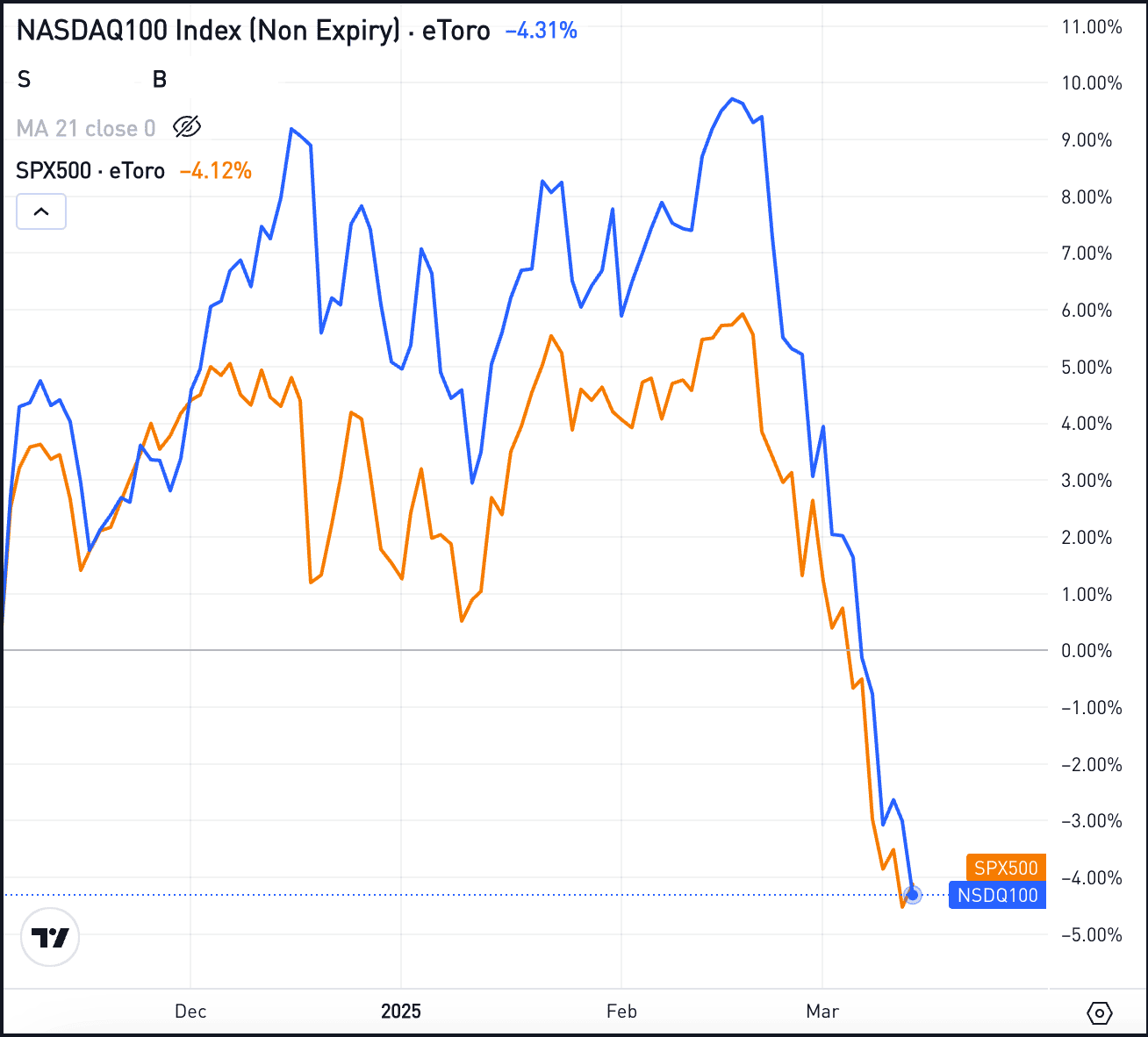

Whereas Bitcoin and the broader crypto market is down over the previous month, BlackRock’s BUIDL is hovering. The milestone marks a 56% improve inside 30 days, reflecting rising institutional confidence in tokenized real-world belongings (RWAs).

Launched in March 2024 by means of Securitize’s digital issuance platform, BlackRock’s BUIDL fund primarily invests in U.S. Treasury debt and financial institution deposits denominated in USD. Focused particularly towards U.S. certified purchasers, BUIDL offers token holders an APY of roughly 4.5%, managed at charges ranging between 0.20% and 0.50%.

The fund at the moment has 61 holders, a 19.6% improve previously month, highlighting regular investor demand regardless of latest fluctuations in broader digital asset markets. Whereas month-to-month lively addresses dropped barely to 19, complete month-to-month switch quantity surged to over $269 million, suggesting substantial institutional engagement in token transfers.

Ethereum stays the first blockchain on the fund, internet hosting roughly 825 million tokens throughout two predominant contracts. Smaller allocations additionally exist on Avalanche, Aptos, Polygon, Optimism, and Arbitrum networks inside BlackRock’s multi-chain method for asset distribution. Ethereum’s dominance, with round $267 million in mixed token worth from its two largest holders, underlines the continued choice amongst institutional buyers for Ethereum-based tokenization.

In response to rwa.xyz, Tokenization of RWAs has surged industry-wide, with international on-chain RWAs reaching $18.34 billion, a rise of over 18% in 30 days. BlackRock’s fast asset progress throughout the BUIDL fund parallels broader market traits of establishments integrating blockchain-based devices to optimize liquidity and yield, using blockchain efficiencies to streamline conventional treasury administration.

BlackRock’s BUIDL has crossed a notable threshold, and the broader institutional adoption of on-chain U.S. Treasuries and different tokenized monetary devices signifies a deepening recognition of blockchain as a viable infrastructure for conventional asset lessons.

BlackRock’s achievement of $1 billion in on-chain belongings firmly positions its BUIDL fund among the many most influential institutional blockchain initiatives.

Talked about on this article