Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In a brand new publication titled The Mustard Seed, Joe Burnett—Director of Market Analysis at Unchained—outlines a thesis that envisions Bitcoin reaching $10 million per coin by 2035. This inaugural quarterly letter takes the lengthy view, specializing in “time arbitrage” because it surveys the place Bitcoin, know-how, and human civilization might stand a decade from now.

Burnett’s argument revolves round two principal transformations that, he contends, are setting the stage for an unprecedented migration of worldwide capital into Bitcoin: (1) the “Nice Movement of Capital” into an asset with absolute shortage, and (2) the “Acceleration of Deflationary Expertise” as AI and robotics reshape total industries.

A Lengthy-Time period Perspective On Bitcoin

Most financial commentary zooms in on the following earnings report or the speedy value volatility. In distinction, The Mustard Seed proclaims its mission clearly: “Not like most monetary commentary that fixates on the following quarter or subsequent 12 months, this letter takes the lengthy view—figuring out profound shifts earlier than they change into consensus.”

On the core of Burnett’s outlook is the remark that the worldwide monetary system—comprising roughly $900 trillion in complete belongings—faces ongoing dangers of “dilution or devaluation.” Bonds, currencies, equities, gold, and actual property every have expansionary or inflationary elements that erode their store-of-value perform:

Gold ($20 trillion): Mined at roughly 2% yearly, growing provide and slowly diluting its shortage.

Actual Property ($300 trillion): Expands at round 2.4% per 12 months as a consequence of new improvement.

Equities ($110 trillion): Firm income are consistently eroded by competitors and market saturation, contributing to devaluation threat.

Fastened Earnings & Fiat ($230 trillion): Structurally topic to inflation, which reduces buying energy over time.

Burnett describes this phenomenon as capital “looking for a decrease potential vitality state,” likening the method to water cascading down a waterfall. In his view, all pre-Bitcoin asset courses had been successfully “open bounties” for dilution or devaluation. Wealth managers might distribute capital amongst actual property, bonds, gold, or shares, however every class carried a mechanism by which its actual worth might erode.

Associated Studying

Enter Bitcoin, with its 21-million-coin arduous cap. Burnett sees this digital asset as the primary financial instrument incapable of being diluted or devalued from inside. Provide is mounted; demand, if it grows, can instantly translate into value appreciation. He cites Michael Saylor’s “waterfall analogy”: “Capital naturally seeks the bottom potential vitality state—simply as water flows downhill. Earlier than bitcoin, wealth had no true escape from dilution or devaluation. Wealth saved in each asset class acted as a market bounty, incentivizing dilution or devaluation.”

As quickly as Bitcoin turned widely known, says Burnett, the sport modified for capital allocation. Very similar to discovering an untapped reservoir far under present water basins, the worldwide wealth provide discovered a brand new outlet—one that can’t be augmented or diluted.

For example Bitcoin’s distinctive provide dynamics, The Mustard Seed attracts a parallel with the halving cycle. In 2009, miners acquired 50 BTC per block—akin to Niagara Falls at full pressure. As of in the present day, the reward dropped to three.125 BTC, harking back to halving the Falls’ movement repeatedly till it’s considerably lowered. In 2065, Bitcoin’s newly minted provide might be negligible in comparison with its complete quantity, mirroring a waterfall lowered to a trickle.

Although Burnett concedes that makes an attempt to quantify Bitcoin’s international adoption depend on unsure assumptions, he references two fashions: the Energy Legislation Mannequin which tasks $1.8 million per BTC by 2035 and Michael Saylor’s Bitcoin mannequin which suggests $2.1 million per BTC by 2035.

He counters that these projections may be “too conservative” as a result of they usually assume diminishing returns. In a world of accelerating technological adoption—and a rising realization of Bitcoin’s properties—value targets might overshoot these fashions considerably.

The Acceleration Of Deflationary Expertise

A second main catalyst for Bitcoin’s upside potential, per The Mustard Seed, is the deflationary wave introduced on by AI, automation, and robotics. These improvements quickly improve productiveness, decrease prices, and make items and companies extra considerable. By 2035, Burnett believes international prices in a number of key sectors might endure dramatic reductions.

Adidas’ “Speedfactories” minimize sneaker manufacturing from months to days. The scaling of 3D printing and AI-driven meeting traces might slash manufacturing prices by 10x. 3D-printed properties already go up 50x quicker at far decrease prices. Superior supply-chain automation, mixed with AI logistics, might make high quality housing 10x cheaper. Autonomous ride-hailing can probably scale back fares by 90% by eradicating labor prices and bettering effectivity.

Burnett underscores that, underneath a fiat system, pure deflation is commonly “artificially suppressed.” Financial insurance policies—like persistent inflation and stimulus—inflate costs, masking know-how’s actual influence on reducing prices.

Bitcoin, alternatively, would let deflation “run its course,” growing buying energy for holders as items change into extra inexpensive. In his phrases: “An individual holding 0.1 BTC in the present day (~$10,000) might see its buying energy improve 100x or extra by 2035 as items and companies change into exponentially cheaper.”

For example how provide progress erodes a retailer of worth over time, Burnett revisits gold’s efficiency since 1970. Gold’s nominal value from $36 per ounce to roughly $2,900 per ounce in 2025 seems substantial, however that value achieve was constantly diluted by the annual 2% improve in gold’s general provide. Over 5 many years, the worldwide inventory of gold virtually tripled.

If gold’s provide had been static, its value would have hit $8,618 per ounce by 2025, in keeping with Burnett’s calculations. This provide constraint would have bolstered gold’s shortage, presumably pushing demand and value even increased than $8,618.

Associated Studying

Bitcoin, against this, incorporates exactly the mounted provide situation that gold by no means had. Any new demand won’t spur extra coin issuance and thus ought to drive the worth upward extra instantly.

Burnett’s forecast for a $10 million Bitcoin by 2035 would indicate a complete market cap of $200 trillion. Whereas that determine sounds colossal, he factors out that it represents solely about 11% of worldwide wealth—assuming international wealth continues to broaden at a ~7% annual charge. From this vantage level, allocating round 11% of the world’s belongings into what The Mustard Seed calls “one of the best long-term retailer of worth asset” won’t be far-fetched. “Each previous retailer of worth has perpetually expanded in provide to satisfy demand. Bitcoin is the primary that can’t.”

A key piece of the puzzle is the safety price range for Bitcoin: miner income. By 2035, Bitcoin’s block subsidy might be all the way down to 0.78125 BTC per block. At $10 million per coin, miners might earn $411 billion in mixture income annually. Since miners promote the Bitcoin they earn to cowl prices, the market must take in $411 billion of newly mined BTC yearly.

Burnett attracts a parallel with the worldwide wine market, which was valued at $385 billion in 2023 and is projected to achieve $528 billion by 2030. If a “mundane” sector like wine can maintain that stage of shopper demand, an business securing the world’s main digital retailer of worth reaching related scale, he argues, is effectively inside cause.Regardless of public notion that Bitcoin is turning into mainstream, Burnett highlights an underreported metric: “The variety of individuals worldwide with $100,000 or extra in bitcoin is simply 400,000… that’s 0.005% of the worldwide inhabitants—simply 5 in 100,000 individuals.”

In the meantime, research would possibly present round 39% of Individuals have some stage of “direct or oblique” Bitcoin publicity, however this determine contains any fractional possession—comparable to holding shares of Bitcoin-related equities or ETFs by mutual funds and pension plans. Actual, substantial adoption stays area of interest. “If Bitcoin is one of the best long-term financial savings know-how, we’d anticipate anybody with substantial financial savings to carry a considerable quantity of bitcoin. But in the present day, nearly nobody does.”

Burnett emphasizes that the highway to $10 million doesn’t require Bitcoin to supplant all cash worldwide—solely to “take in a significant share of worldwide wealth.” The technique for forward-looking traders, he contends, is easy however non-trivial: ignore short-term noise, deal with the multi-year horizon, and act earlier than international consciousness of Bitcoin’s properties turns into common. “Those that can see previous the short-term volatility and deal with the larger image will acknowledge bitcoin as essentially the most uneven and missed guess in international markets.”

In different phrases, it’s about “front-running the capital migration” whereas Bitcoin’s person base remains to be comparatively minuscule and the overwhelming majority of conventional wealth stays in legacy belongings.

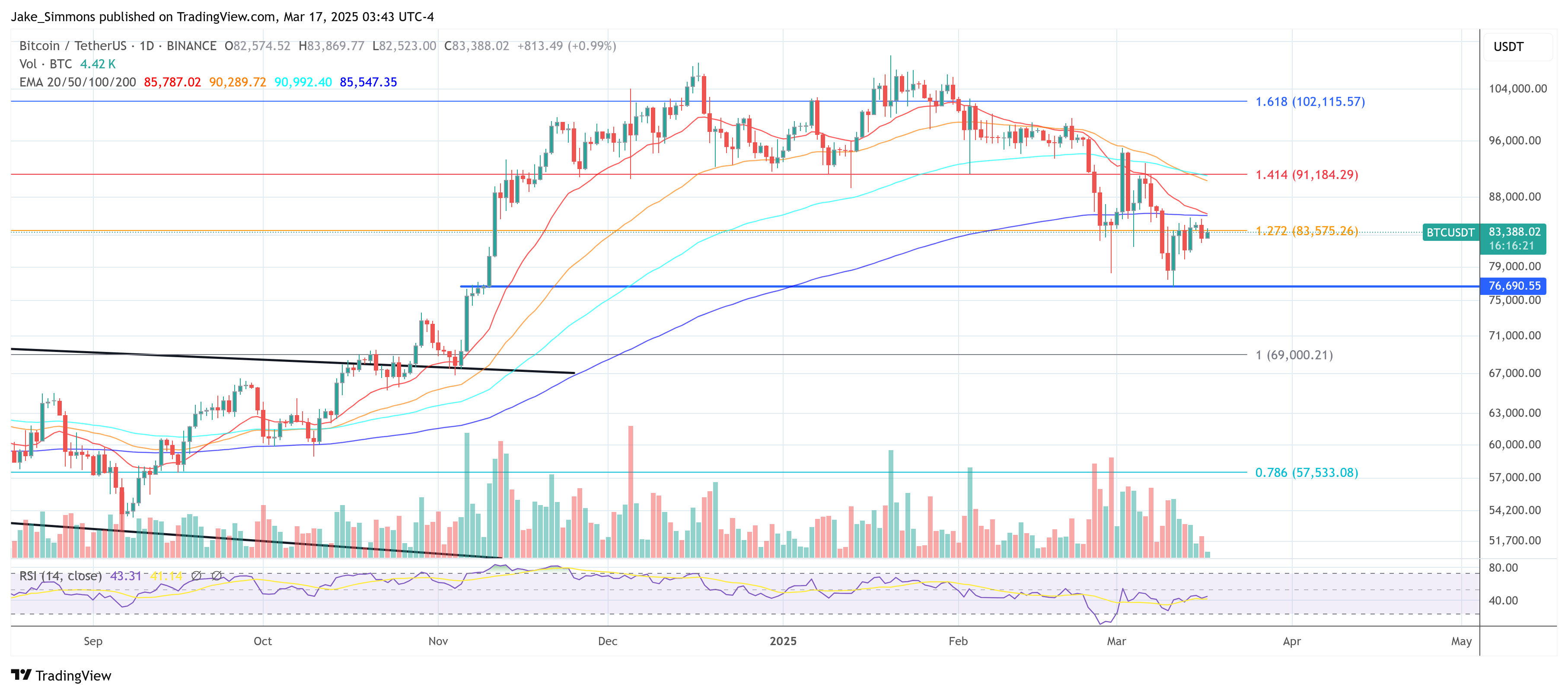

At press time, BTC traded at $83,388.

Featured picture created with DALL.E, chart from TradingView.com