This week’s version of Finovate World appears to be like at current fintech headlines from the South American nations of Argentina, Brazil, and Uruguay.

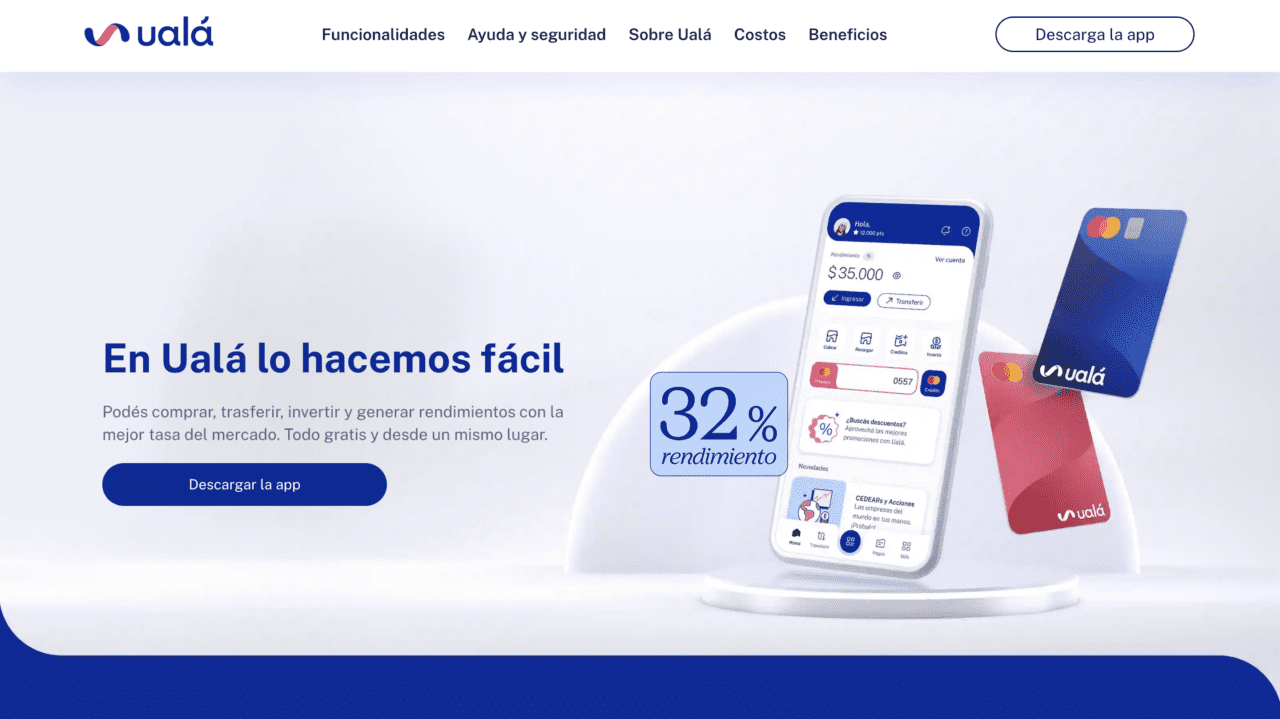

Ualá Raises $66 Million at $2.75 Billion Valuation

In a funding spherical that featured participation from Mexican media titan TelevisaUnivision, Argentina-based fintech Ualá has added $66 million in funding to its Collection E spherical. The extra funding brings the spherical’s whole to $366 million and offers the corporate a valuation of $2.75 billion.

The capital comes through an fairness sale and can be used to gasoline Ualá’s development all through Latin America—with a selected emphasis on enlargement in Mexico. Ualá Founder and Chief Government Officer Pierpaolo Barbieri praised the participation of TelevisaUnivision, which he referred to as a “very related and influential outlet, throughout Spanish-speaking markets however particularly in Mexico.” Barbieri added, “It’ll assist us create confidence and closeness with quite a lot of Mexicans that also don’t know us.”

The primary shut of the Collection E spherical was led by Allianz X, German insurance coverage firm Allianz SE’s enterprise capital arm. Additionally taking part within the first shut had been Stone Ridge Holdings Group and Pershing Sq. Basis. Further buyers within the extension spherical weren’t named.

Based in 2017 in Argentina, Ualá provides monetary companies together with fee accounts related to a world Mastercard pay as you go card, in addition to financial savings accounts, loans, investments, enterprise assortment options, and extra. The corporate has 9 million customers within the area, together with in nations corresponding to Argentina, Colombia, and Mexico.

Ualá started the yr by asserting the supply of six new mutual funds in its ecosystem, together with one fund denominated in {dollars}. In February, the corporate built-in a sophisticated synthetic intelligence platform, powered by OpenAI’s GPT-4, into its customer support course of.

dLocal companions with Temu, Belmoney

Uruguayan fintech and cross-border funds firm dLocal introduced a pair of partnerships in current days. First, dLocal launched a brand new collaboration with Europe-based, remittance-as-a-service (RaaS) supplier Belmoney. The objective of the partnership is to facilitate cross-border payouts, leveraging the mixing of greater than 900 native and different fee strategies (APMs) corresponding to credit score and debit playing cards, financial institution transfers, and immediate transactions. The collaboration can be designed to spice up service reliability and effectivity for these making cross-border transactions in nations together with Bangladesh, Ecuador, Peru, and Pakistan.

“Our partnership with dLocal is a game-changer within the remittance house,” Belmoney CEO and Founder Bruno Pedras stated. “By integrating with dLocal’s complete community, we are able to considerably decrease prices, enhance transaction speeds, and supply a greater cross-border funds expertise for each senders and recipients.”

Second, dLocal introduced that it has shaped a strategic partnership with Temu, the worldwide e-commerce platform of China’s PDD Holdings. Collectively, the 2 firms search to supply buyers in Africa, Asia, and Latin America with new seamless and safe fee choices which can be suited to native preferences. Thousands and thousands of shoppers in 15 rising markets in these areas stand to profit from the collaboration.

“By partnering with dLocal, we’re excited to increase these advantages to hundreds of thousands of shoppers in rising markets, guaranteeing that extra individuals can get pleasure from accessible, handy purchasing experiences,” a Temu spokesperson stated in a press release.

Launched in 2022, Temu is a web based market that provides shopper items at considerably discounted costs. Transport items immediately from the Folks’s Republic of China, Temu reportedly has greater than 292 million month-to-month lively customers of its app worldwide. The app was among the many hottest in US app shops for each iOS and Android in 2024.

Based in 2016, dLocal is headquartered in Montevideo, Uruguay. The nation’s first unicorn, dLocal provides an all-in-one fee platform that allows firms to simply accept and disburse a variety of native fee strategies and currencies. In 2024, the corporate processed greater than $25 billion value of funds. dLocal works with 700+ retailers, helps 900 fee strategies, and operates in additional than 40 nations. A publicly traded firm on the Nasdaq alternate below the ticker DLO, dLocal has a market capitalization of $2.7 billion. Sebastián Kanovich is CEO.

Ant Worldwide’s Bettr brings embedded funds companies to ecommerce retailers in Brazil

Talking of partnerships between companies in Asia and Latin America, we discovered this week that Bettr, Ant Worldwide’s AI-driven lending enterprise, has gone dwell in Brazil. Bettr will assist broaden lending alternatives for small and medium-sized enterprises (SMEs) by working with native companions corresponding to AliExpress. By this partnership, Bettr will introduce a brand new financing resolution, Bettr Working Capital, for native retailers engaged on AliExpress’s platform.

“This collaboration reinforces our dedication to serving to small and medium-sized companies thrive by offering accessible and environment friendly monetary instruments that may take their operations to the subsequent stage,” LatAm director of AliExpress Briza Bueno stated. “On this means, we’re not solely supporting the person development of those entrepreneurs but in addition contributing to the development of e-commerce within the nation.”

Bettr Working Capital can be launched progressively; the primary spherical of disbursements started this week. The expertise analyzes service provider gross sales data and different unstructured enterprise information from AliExpress to make smarter, tailor-made, extra reasonably priced mortgage options. This may assist small and medium-sized companies higher handle money move and broaden into new markets.

Headquartered in Singapore, Ant Worldwide is a world digital funds and monetary expertise supplier. Bettr is the corporate’s digital lending enterprise, which makes a speciality of serving micro, small, and medium-sized enterprises (MSMEs). The agency combines rising applied sciences like AI and data-driven credit score modeling to supply safe monetary options that higher match borrower wants.

Right here is our take a look at fintech innovation all over the world.

Latin America and the Caribbean

Asia-Pacific

Indonesian ride-hailing service InDrive teamed up with Singapore’s Fingular and Indonesia’s Sharia-compliant P2P lending platform Ammana to launch its new inDrive.Cash app.

Malaysian wealth administration platform Versa raised $6.8 million in Collection A funding.

Japan’s worldwide fee model JCB partnered with built-in fee supplier First Money Answer, increasing JCB Card acceptance in Germany.

Sub-Saharan Africa

African funds expertise large Flutterwave built-in with Pay With Financial institution Switch to assist companies in Ghana.

Mastercard prolonged its collaboration with London-based Paymentology to spice up monetary inclusion in South Africa.

Compliance and fraud prevention platform Sumsub introduced a partnership with the Affiliation of Fintechs in Kenya.

Central and Japanese Europe

Lithuanian identification verification supplier iDenfy introduced a collaboration with mobility supplier Evemo.

Estonian fintech Hoovi raised €8 million in funding through a structured bond situation from Finland’s Multitude Worldwide Financial institution.

Moldova-based digital pockets and digital cash establishment (EMI) Paynet partnered with open banking companies supplier Salt Edge.

Center East and Northern Africa

Israeli fintech FINQ turned the primary Israeli firm to safe a US Securities and Alternate Fee (SEC) Registered Investor Advisor (RIA) license with out relocating to the US.

Egyptian fintech Fawry inked a strategic settlement with Contact Monetary Holding to broaden entry to Purchase Now, Pay Later (BNPL) companies.

MENA-based fee service supplier Telr secured a Retail Cost Providers license from the UAE’s central financial institution.

Central and Southern Asia

Photograph by Juan Cruz Palacio Mir

Views: 23