Decentralized alternate Hyperliquid delisted perpetual futures for the Solana-based meme coin JELLYJELLY on Wednesday, describing the transfer as crucial to making sure its community’s integrity amid a looming liquidation disaster.

Hyperliquid makes use of its personal high-speed blockchain, constructed upon the Ethereum layer-2 community Arbitrum, and the challenge stated its networks’ validators had convened to take “decisive motion,” in a submit on X (previously Twitter).

The choice got here after a Hyperliquid consumer opened a $6 million 20x leveraged brief on JELLYJELLY that turned poisonous because the meme coin’s value rose. On X, spectators speculated that the consumer could have deliberately tried to liquidate themselves, forcing the decentralized alternate to take over the unhealthy wager because it spiraled uncontrolled.

On Thursday, JELLYJELLY’s value surged as excessive as $0.043, in response to the crypto information supplier CoinGecko. Round 2:30pm Japanese Time, it was altering arms round $0.023, displaying a 73% soar in worth over the previous day.

Although Hyperliquid stated the choice to delist JELLYJELLY was a collective selection, the transfer sparked criticism as some merchants and trade observers argued that it conflicted with decentralized finance, or DeFi, norms.

“Let’s cease pretending Hyperliquid is decentralized,” Arthur Hayes, co-founder and former CEO of the crypto alternate BitMEX, stated on X.

Customers that had JELLYJELLY positions on the platform can be “made entire from the Hyperliquid Basis” at a later date, Hyperliquid stated within the submit. The Hyperliquid Basis is a definite entity that’s chargeable for governing the challenge’s general route.

Because the decentralized alternate started unwinding the poisonous JELLYJELLY wager, a community-owned vault dubbed the Hyperliquidity Supplier (HLP) quickly took a success.

The vault, the place customers can pool funds and probably earn a return because the HLP executes buying and selling methods and accrues platform charges, noticed its all-time earnings dip by $11 million, in response to Hyperliquid’s web site. These losses had been subsequently reversed.

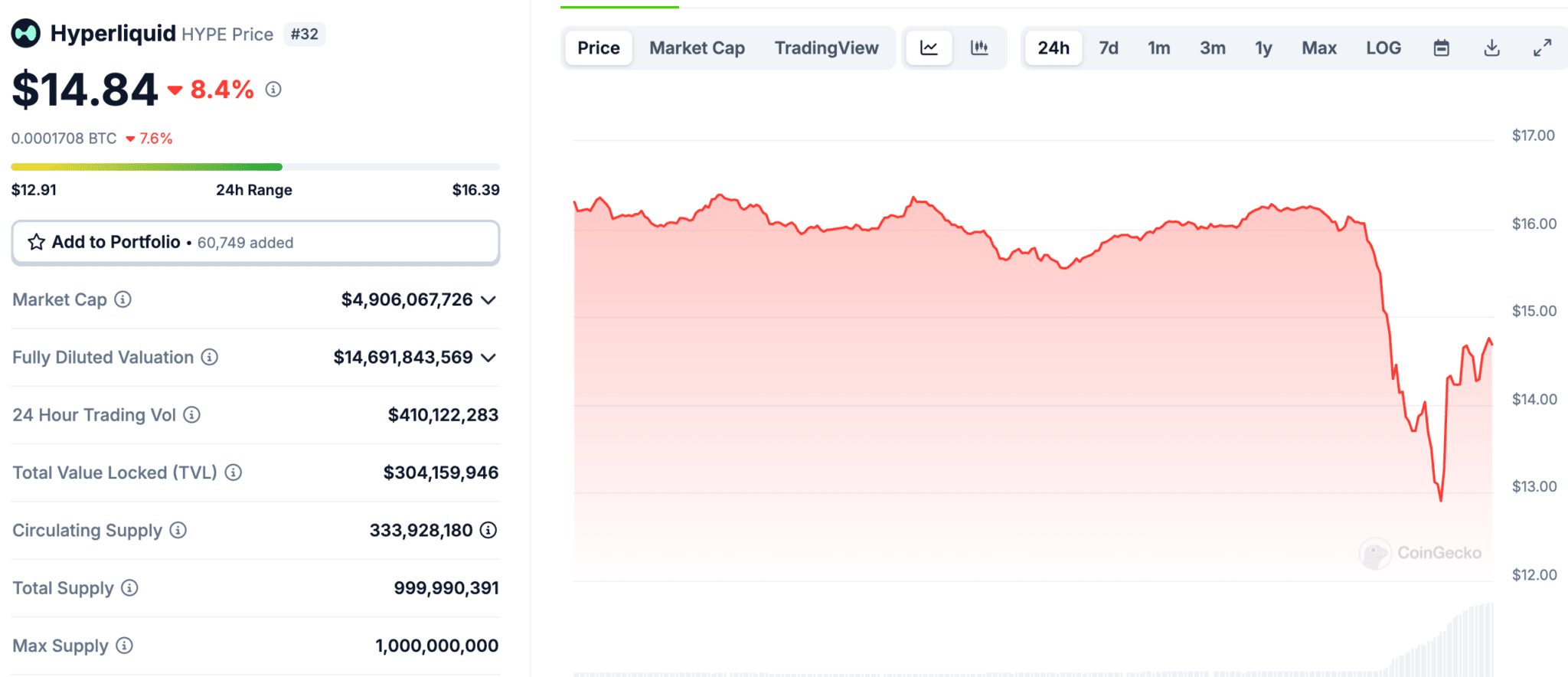

Nonetheless, the event spooked the marketplace for HYPE. The cryptocurrency, which is Hyperliquid’s native token, noticed its value fall almost 14% over the previous day to $13.85, as of this writing.

The drama surrounding Hyperliquid on Thursday echoed a $4 million loss that the HLP sustained earlier this month. A consumer on the decentralized alternate made $1.8 million by liquidating themselves, sticking the HLP with one other unhealthy wager as an alternative of promoting.

When an investor takes on leverage, they’re borrowing funds to regulate a bigger place than they might in any other case. That place is commonly secured by collateral, which will be robotically offered by an alternate to cowl losses if a leveraged wager sours past a sure level.

Earlier this month, Hyperliquid stated that it will scale back the quantity of leverage that merchants may entry for Bitcoin and Ethereum. The challenge additionally stated it will improve upkeep margin necessities for leveraged bets teetering towards liquidation.

When Hyperliquid’s validators opted to delist JELLYJELLY on Thursday, $3.7 million in JELLYJELLY positions had been settled at a value of $0.0095 per token.

Doug Colkitt, founding father of the decentralized buying and selling protocol Ambient Finance, stated on X that overriding JELLYJELLY’s so-called oracle value left “the attacker with a small loss.”

On Thursday, crypto exchanges Binance and OKX launched perpetual futures contracts for JELLYJELLY, permitting their customers to take a position on the meme coin that was launched as a part of a advertising and marketing marketing campaign for a podcast app months in the past.

The value of meme cash, which commerce on little greater than vibes, will typically soar when an alternate decides to record them. Some X customers urged, with out offering proof, that the crypto exchanges had been trying to “bury a competitor” amid the liquidation drama.

Relating to the centralization of Hyperliquid’s community, specialists raised issues after North Korean-linked wallets began utilizing the platform in December. On the time, the community had simply 4 validators.

Binance and OKX didn’t instantly reply to a request for remark from Decrypt.

Edited by Andrew Hayward

Each day Debrief Publication

Begin on daily basis with the highest information tales proper now, plus authentic options, a podcast, movies and extra.