In recent times, investor consideration has been fixated on the “Magnificent Seven,” particularly Nvidia, whose shares have skyrocketed by lots of of %. The explosive rise of synthetic intelligence (AI) throughout industries has radically remodeled the funding panorama and propelled company earnings to new heights. This has attracted investments value lots of of billions of {dollars}.

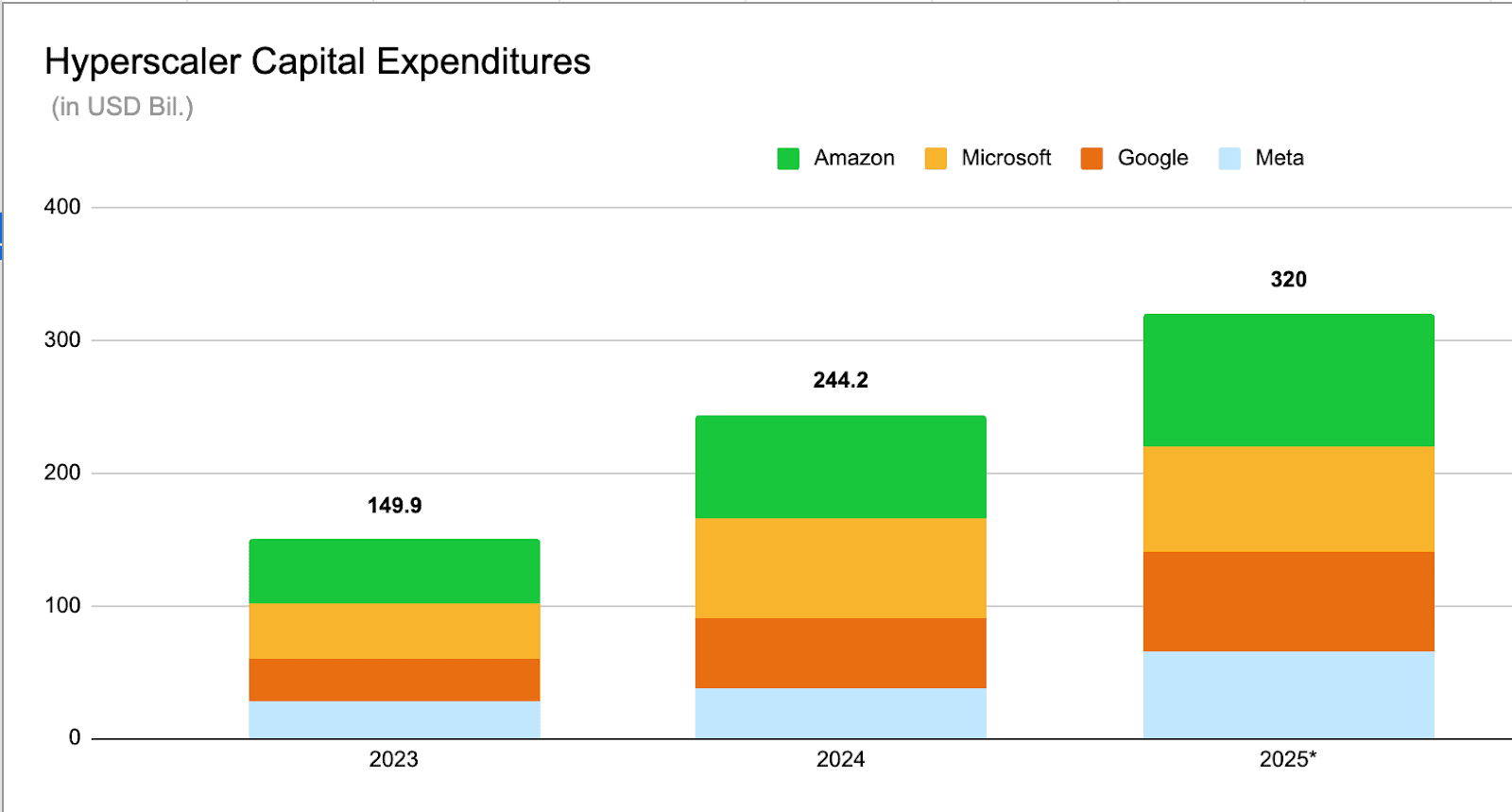

Supply: publiccomps

However the AI revolution isn’t nearly cloud gamers and chipmakers. Information facilities — or as Nvidia CEO Jensen Huang calls them, “AI factories” — are large amenities that require way over simply top-tier chips. Let’s check out the businesses quietly benefiting within the background from the rising AI funding growth.

Section One in all AI: Compute Energy

Earlier than your ChatGPT immediate turns right into a significant response, a number of key processes happen:

Your knowledge is shipped to the cloud, the place it’s processed by high-performance chips in knowledge facilities. This stage entails firms like Nvidia, AMD or Broadcom, which specialise in growing superior GPUs, CPUs, and accelerators — important elements for the huge computations AI fashions demand.

Whereas main cloud gamers are the biggest prospects of those corporations, many at the moment are growing their very own chips to save lots of prices. Amazon has its Trainium and Inferentia chips, Google has Tensor, and Microsoft has Maia. These might grow to be critical rivals to established chip giants. On the similar time, they current a chance for TSMC, the dominant participant in chip manufacturing.

Section Two of AI: Infrastructure

To perform, these chips require huge technological infrastructure. They should talk with each other, retailer knowledge, and function repeatedly — all whereas consuming huge quantities of electrical energy and producing warmth. This creates alternatives throughout a number of sectors:

Networking gear – Essential for transferring big volumes of information and enabling server communication. Moreover Nvidia’s personal options, rivals right here embody Broadcom, Cisco, and Arista.

Information storage and reminiscence – AI fashions should retailer huge quantities of information. Excessive-speed reminiscence chips like HBM3 or superior SSDs face relentless demand. Key gamers embody Micron and Samsung.

Servers, cooling, and backup energy – These guarantee uninterrupted operation of information facilities. AI fashions require cutting-edge cooling methods and specialised servers. Main firms right here embody SuperMicro and Dell.

Renewable power – Information facilities have excessive power wants and depend on constant energy provide. This advantages power suppliers, significantly in areas like Texas or Virginia. Corporations like Vistra and NRG Vitality are already seeing a transparent uptick in demand.

Section Three of AI: Purposes

As soon as firms safe the infrastructure from phases one and two, the important thing query turns into: How can AI drive income and revenue development? This section at present consists of software program firms that may use AI to spice up the effectivity of their merchandise. Examples embody:

Social media and promoting – AI improves advert concentrating on and content material personalization

Cybersecurity – AI helps detect and block cyber threats

E-commerce – AI personalizes presents, enhances buyer help, and optimizes logistics

Healthcare – AI assists in diagnostics, drug analysis, and enhancing affected person care

Media – AI generates content material, analyzes traits, and automates manufacturing

Mobility – AI powers autonomous driving, seen as the longer term by many automobile firms

Corporations on this third section are sometimes extra resilient to geopolitical dangers, comparable to commerce wars. That is the place a few of the greatest funding alternatives might emerge within the coming years.

Supply: eToro

As we are able to see, AI investments proceed to surge. The 4 largest cloud giants within the U.S. alone plan to take a position greater than $300 billion subsequent 12 months, with a good portion directed towards AI infrastructure. On high of that, governments are supporting AI improvement — within the U.S., as an illustration, by the Stargate undertaking, which is already channeling the primary tranche of a deliberate $500 billion funding over the subsequent 4 years.

A lot of this capital might profit smaller, specialised firms that concentrate on key elements of the AI ecosystem — from networking and power to servers, software program, and purposes. The AI revolution continues to be in its early days, and extra funding alternatives are more likely to emerge within the years forward.

Whereas Nvidia and different tech giants dominate the headlines, the true funding gems typically lie within the shadows — among the many enablers of infrastructure, power, and supporting applied sciences. Hold a watch not simply on the chips, but in addition on the businesses powering this technological revolution behind the scenes.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.