As blockchain know-how has taken the world by storm over the previous few years, Decentralized Finance (DeFi) has emerged as considered one of its most transformative improvements with vital implications for the monetary sector.

DeFi guarantees better accessibility by trustless platforms (i.e. requiring no counterparty resembling a financial institution), transparency, and effectivity in comparison with conventional monetary (TradFi) techniques.

Nonetheless, its speedy progress and decentralized nature have raised vital regulatory challenges. The query of whether or not DeFi ought to be regulated is advanced, involving issues of innovation, shopper safety, and monetary stability.

However first…

What’s DeFi?

DeFi platforms present monetary companies like financial savings and loans by good contracts on blockchain networks. As self-executing agreements, good contracts scale back human error, corruption, and censorship. Customers can lend or borrow funds with out conventional banking intermediaries, as seen on platforms like Aave and Compound, and the likes of PancakeSwap and SushiSwap for yield farming. In future, we may even see DeFi prolong to capital market investments and insurance coverage merchandise.

DeFi affords a number of advantages: it democratizes entry to monetary companies for unbanked populations, offers transparency by public blockchain ledgers, enhances effectivity by automating processes through good contracts, and fosters innovation by enabling monetary devices with extra advanced logic.

Nonetheless, DeFi additionally poses dangers: operational dangers from good contract bugs and hacks, regulatory uncertainty that hinders progress, and challenges in countering illicit actions like cash laundering on account of its decentralized nature.

The Case for Regulation of DeFi

The case for regulating DeFi centres on shopper safety, monetary stability, and combating illicit actions. The DeFi area has skilled vital losses on account of hacks, rug pulls, and protocol failures.

Regulating DeFi can deliver the next advantages.

Regulation can assist shield customers who usually lack the technical data to know DeFi dangers. Good contract vulnerabilities, impermanent loss in DeFi liquidity swimming pools, and rug pulls (the place builders abandon a venture after stealing traders’ funds) are only a few of the risks. Regulation can mandate transparency, require good contract audits, and implement accountability for fraudulent actions. This could assist construct belief and encourage broader adoption.

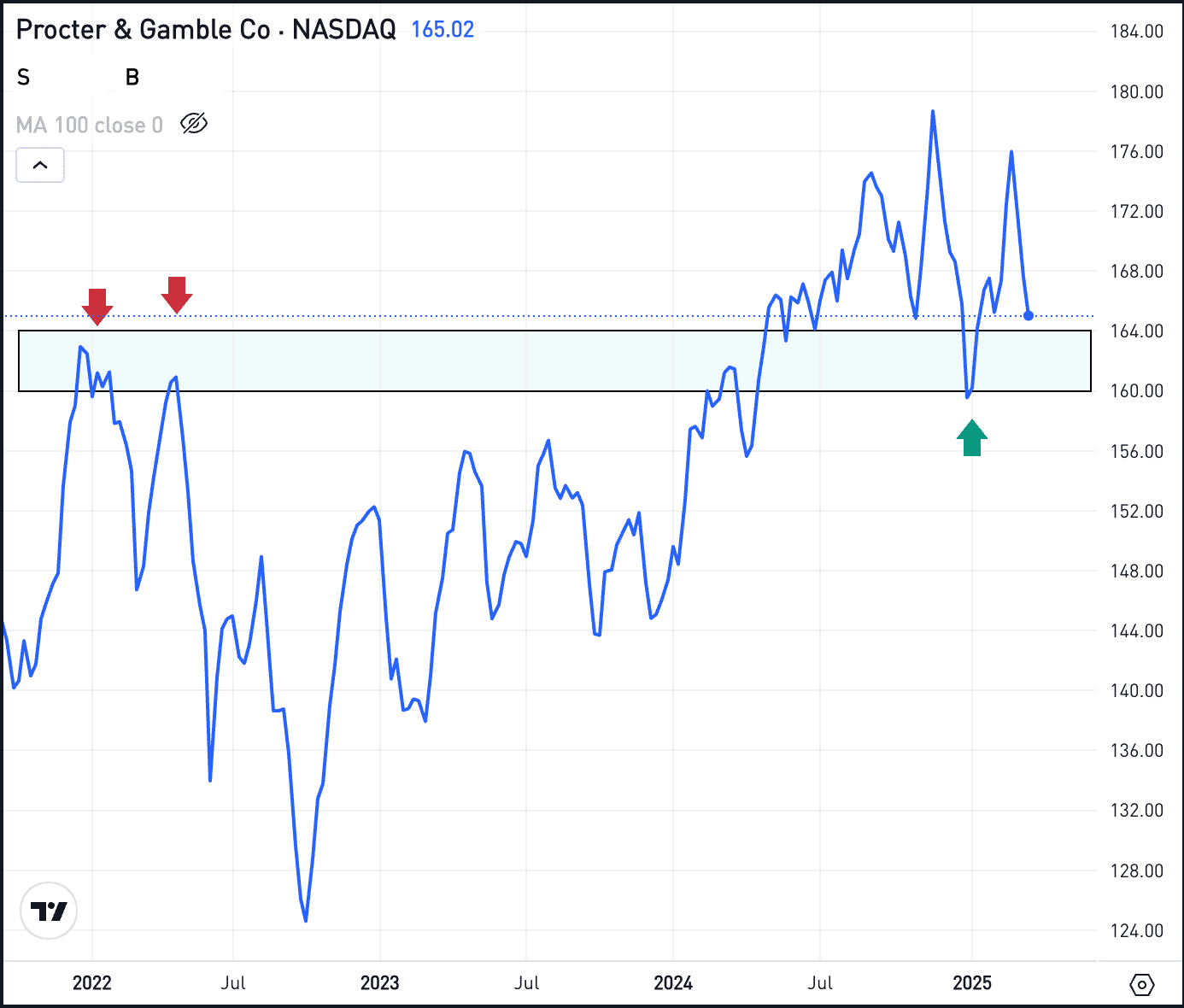

DeFi’s speedy progress raises considerations about its impression on international monetary stability. Knowledge from DefiLlama reveals that the Complete Worth Locked (TVL) in DeFi surged from below $1 billion in 2020 to over $160 billion in 2022 (it’s at present hovering across the USD100 billion mark in Q1 2025). Regulation can mitigate systemic dangers by imposing capital and liquidity necessities, limiting leverage, and guaranteeing disaster administration mechanisms.

Combatting illicit actions

Like TradFi, DeFi is used for illicit actions like cash laundering and tax evasion. However in contrast to TradFi, there aren’t any Know Your Buyer (KYC) and Anti-Cash Laundering (AML) measures to make it troublesome. Regulation can require DeFi platforms to implement KYC/AML procedures, lowering their enchantment to criminals.

Total, the argument usually made is that regulation could make DeFi safer and extra reliable by addressing its dangers and integrating it into the broader monetary system.

The Problem of Regulating DeFi

Extreme or inappropriate regulation may have adversarial results. Except for stifling innovation, it will drive DeFi actions underground, making them tougher to observe and management.

DeFi thrives on its skill to experiment and iterate quickly. Imposing heavy compliance burdens may deter builders from constructing new protocols or growing new improvements. It may additionally create unfair benefits for TradFi incumbents, which have already got armies of compliance professionals as they search to compete with blockchain-native DeFi startups.

Imposing stringent KYC and AML rules on DeFi might scale back among the benefits of DeFi over TradFi, resembling democratization of finance through permissionless entry. It additionally raises considerations about privateness and censorship resistance, that are core tenets of the DeFi motion. Putting a stability between stopping illicit actions and preserving person privateness will probably be a major problem for policymakers.

By far, the most important problem for policymakers within the context of DeFi is that DeFi’s decentralized nature implies that, in contrast to TradFi, DeFi usually lacks a central entity to control. Moreover, the technological complexity of good contracts and blockchain know-how requires specialised regulatory approaches that haven’t but been developed. This complexity underscores the necessity for revolutionary regulatory methods tailor-made to DeFi’s distinctive traits.

Trying forward

Regulating DeFi requires a fragile stability between innovation, shopper safety, and monetary stability. To keep away from stifling DeFi’s potential, regulators ought to take into account integrating regulatory necessities into blockchain protocols themselves, thus utilizing “embedded regulation” to automate compliance inside good contracts. This strategy leverages blockchain know-how’s “Code is Legislation” precept to make sure compliance with out unnecessarily hindering innovation.

Till a well-considered strategy is developed, regulators ought to proceed with utmost warning. They need to keep away from the urge to hurry into regulating a fast-moving space that they’ve but to know. Putting the fitting stability includes dialogue, flexibility, and rethinking conventional regulatory fashions.

In conclusion, DeFi holds the promise to remodel finance for the higher — but, as with every revolution, considerate stewardship could possibly be key to unlocking its full transformative potential.

Olu Omoyele is the founder & CEO of DeFi Planet. Chain of Ideas is his month-to-month column on the cryptoverse.

Disclaimer: This piece is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you need to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”