Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Crypto markets edged decrease Monday following a stark warning from Goldman Sachs, which raised its 12-month US recession likelihood to 35%, citing rising tariffs, weakening progress, and deteriorating sentiment. The reassessment follows the agency’s second upward revision in March to its 2025 US tariff expectations, signaling an more and more fraught macroeconomic setting with direct implications for threat belongings — together with cryptocurrencies.

Within the be aware titled “US Economics Analyst: A Additional Enhance in Our Tariff Assumptions”, Goldman economists Alec Phillips, Tim Walker, and David Mericle define their rationale: “We now count on the common US tariff fee to rise 15pp in 2025 […] nearly your entire revision displays a extra aggressive assumption for ‘reciprocal’ tariffs.”

Goldman anticipates that President Trump will announce across-the-board reciprocal tariffs averaging 15% on April 2. Adjusted for product and nation exclusions, the efficient rise in common tariffs is anticipated to be round 9 share factors.

The influence on the macro outlook is stark: Goldman has downgraded its 2025 US GDP progress forecast by 0.5pp to 1.0% (This fall/This fall), lifted its 12 months finish core PCE inflation forecast to three.5% (+0.5pp), and elevated its unemployment projection to 4.5% (+0.3pp). These revisions replicate a stagnating progress setting paired with inflationary pressures — a mixture that constrains financial stimulus choices.

The financial institution attributes the rise in recession likelihood to 3 key elements: a decrease progress baseline; deteriorating family and enterprise confidence; and “statements from White Home officers indicating higher willingness to tolerate near-term financial weak spot.”

Regardless of traditionally poor predictive energy from sentiment measures, Goldman writes: “We’re much less dismissive of the current decline as a result of financial fundamentals aren’t as robust as in prior years. Most significantly, actual earnings progress has already slowed sharply and we count on it to common just one.4% this 12 months.”

Implications For Crypto

Whereas digital belongings have lengthy been considered as uncorrelated to conventional macroeconomic variables, that narrative has developed. Bitcoin, specifically, has change into more and more conscious of broader macro circumstances — notably liquidity, threat sentiment, and actual yields.

Associated Studying

Because the yield curve inverts as soon as once more — a basic recession sign — macro analysts are warning of a singular coverage dilemma. As @ecoinometrics famous on X: “The yield curve is inverting once more, a standard recession sign. However not like previous cycles, the Fed is unlikely to hurry to QE as a consequence of inflation issues. This creates a double problem for Bitcoin: potential risk-off strain with out the stimulus aid that sometimes follows. Bitcoin could be very a lot pushed by macro today. It’s behaving like a high-beta play on the NASDAQ 100.”

Nevertheless, not everybody agrees {that a} recession poses a net-negative threat for crypto. In a current interview, Robbie Mitchnick, International Head of Digital Property at BlackRock, supplied a nuanced view of Bitcoin’s macro sensitivity: “Financial fears. I imply, I don’t know if we have now a recession or not, however a recession could be a giant catalyst for Bitcoin […] It’s catalyzed by extra fiscal spending and debt and deficit accumulation. That occurs in a recession. It’s catalyzed by decrease rates of interest and financial stimulus. That tends to occur in a recession.”

Mitchnick acknowledges the short-term constraints — the wealth impact, diminished disposable earnings, and excessive correlations with equities — however maintains that structurally, Bitcoin advantages from the long-term penalties of recessionary coverage responses. “Bitcoin is lengthy liquidity within the system… and to some extent over simply fears of common social dysfunction […] that too, sadly, is one thing that may come up in a recession.”

He provides that present market reactions could not replicate Bitcoin’s true positioning: “The market has nearly, it appears, gotten this in some methods not notably effectively calibrated… however that’s the place the chance is available in for schooling in a market and an asset class that’s nonetheless very nascent.”

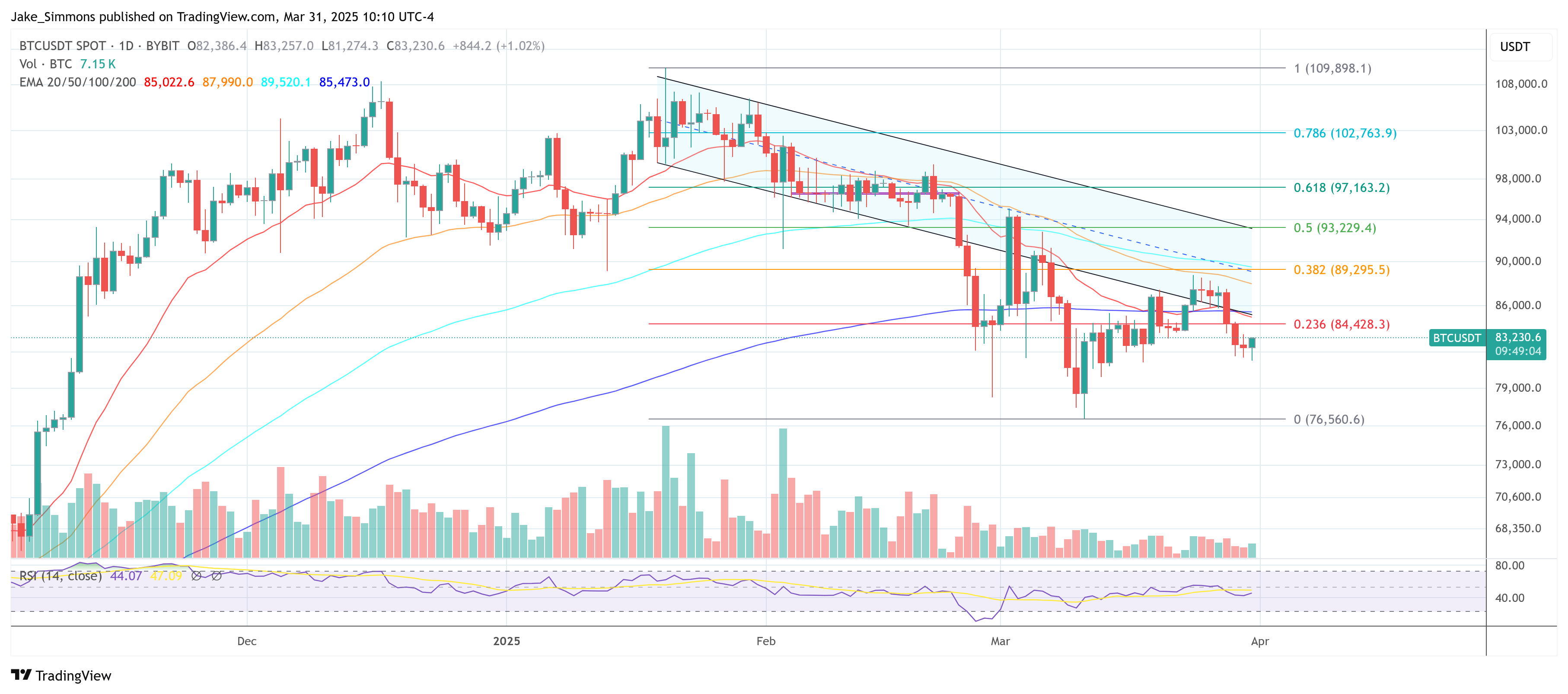

At press time, BTC traded at $83,230.

Featured picture from iStock, chart from TradingView.com