Strong volatility continues to take over the broader crypto market, inflicting a sluggishness in Bitcoin‘s worth prior to now few weeks. This bearish efficiency has been ongoing because the flagship asset hit a brand new all-time excessive in January this 12 months. In the meantime, seasoned traders have persistently bought the asset in mild of this waning worth motion.

Whales Hold Stacking Up Bitcoin

Bitcoin’s worth dynamics might have displayed weak point in the previous couple of weeks, falling to get better its upward momentum to its present all-time excessive. Nevertheless, many traders are nonetheless bullish concerning the asset’s future efficiency as they reveal renewed curiosity in BTC.

Amid unfavorable market situations, Santiment, a number one intelligence and on-chain knowledge platform, has reported constant shopping for exercise amongst massive Bitcoin traders, or whales. The variety of BTC whale pockets addresses has risen to new ranges despite the cryptocurrency’s steady pricing points.

Particularly, the expansion is noticed amongst massive traders holding between 1,000 BTC and 10,000 BTC, indicating confidence in its long-term potential. “And whereas costs proceed ranging as March attracts to an in depth, whale wallets (particularly 1,000-10,000 BTC holders) proceed rising in quantity,” the platform said.

This improvement comes as BTC’s market worth fluctuates between the $81,000 and $84,000 worth vary on Monday. Since massive traders are accumulating Bitcoin throughout volatility, it means that these holders are benefiting from the current market downturn in anticipation of future worth rebounds.

Information from the on-chain platform exhibits that the amount of BTC whale pockets addresses containing 1,000 BTC to 10,000 BTC has prolonged to 1993, marking its highest stage since December 2024. Moreover, Santiment revealed a further 50 wallets prior to now few weeks, which represents about 2.6% development.

Traditionally, massive traders’ exercise has influenced BTC’s worth actions, growing optimism a few shift towards the upside. Ought to this pattern persist on the $81,000 and $84,000 worth vary, it’d present a strong help zone for BTC, permitting the asset to assemble momentum for a rebound within the quick time period.

Because the market fluctuates, Santiment has attributed the bearish improvement to a number of unfavorable components. Nevertheless, it could be seen as a small indication of confidence as some of the important stakeholder tiers in crypto has risen by +2.6% inside the final 5 weeks.

BTC To Recuperate All-Time Excessive

BTC whale traders is likely to be taking a strategic method to safe positive factors sooner or later because it gears up for a rebound. Crypto analyst Captain Faibik has predicted that the asset may bear a rally shortly to its present all-time excessive of $109,000.

Captain Faibik foresees a breakout from a 4-month Falling Wedge sample to push BTC again to the extent. In line with the skilled, BTC’s approaching the top of the continuing correction section is an indication that it’s making ready for its subsequent main transfer.

The analyst expects the rally to kick off in early April and attain $109,000 by the top of April. Within the meantime, massive gamers hold accumulating BTC whereas new traders await one other worth dip.

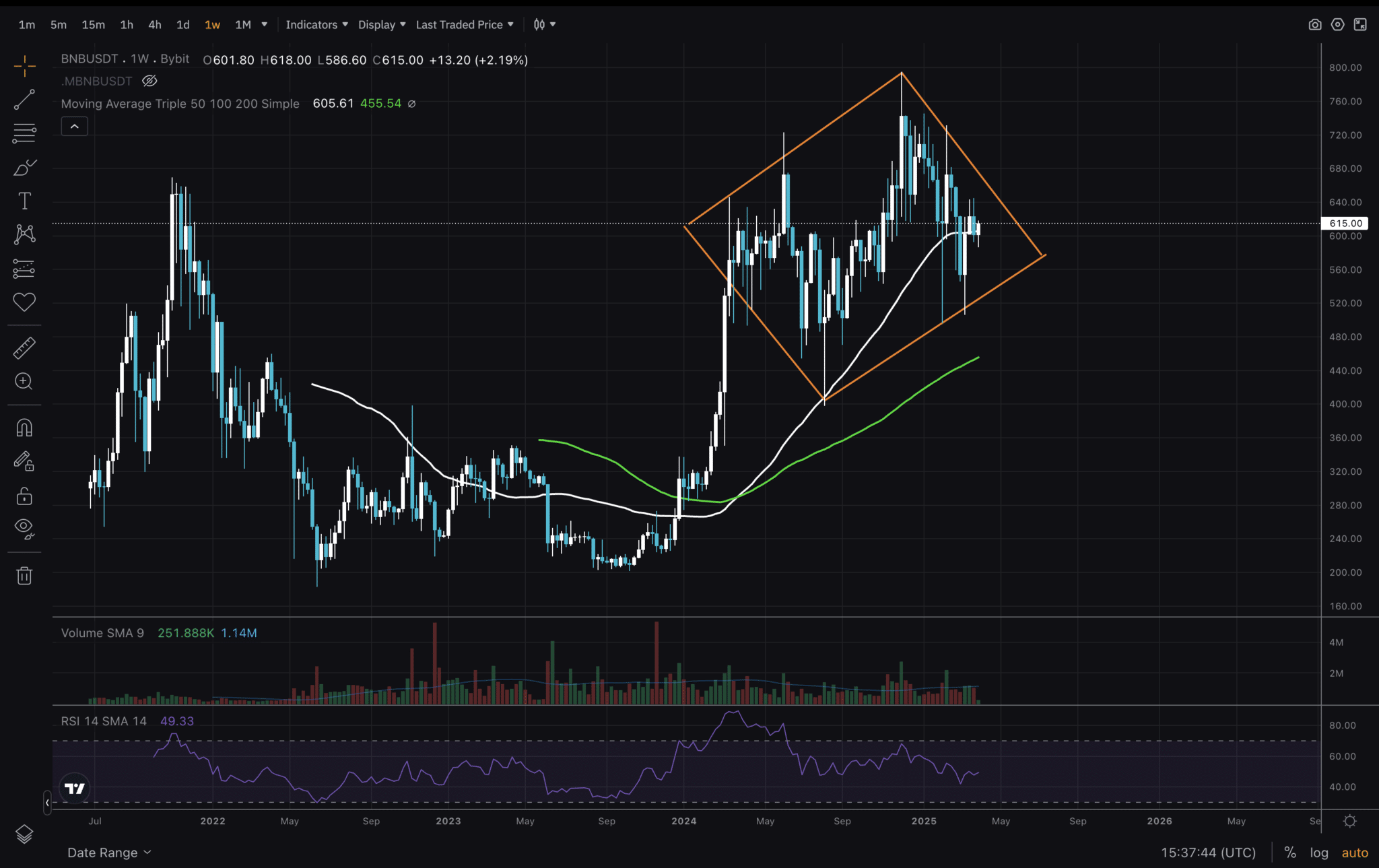

Featured picture from Adobe Inventory, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

_id_beb7c7a1-e3e4-4e7a-9ff2-747d82a6f8c5_size900.jpg)