Victoria d’Este

Revealed: April 21, 2025 at 12:59 pm Up to date: April 21, 2025 at 1:00 pm

Edited and fact-checked:

April 21, 2025 at 12:59 pm

In Temporary

Final week, Bitcoin lastly broke out, Ethereum cautiously adopted, and Toncoin quietly constructed momentum, all hinting the crypto market may be waking up for actual.

Appears like we’ve been holding our breath for weeks – ready for one thing to interrupt, transfer, or a minimum of blink. Nicely, this previous week lastly delivered. Bitcoin shook off the chop and made a correct transfer, and all of the sudden the entire market began performing prefer it remembered how one can commerce. Ethereum’s attempting to maintain up, nonetheless cautious. TON? Nonetheless watching from the sidelines – however with one eye on BTC. Let’s stroll by means of what simply occurred and what it may be establishing.

Bitcoin (BTC)

Bitcoin simply popped out of its week-long holding sample prefer it had someplace to be, ripping previous $87,500 after days of sideways grinding between $83K and $86K.

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

The breakout didn’t come out of nowhere. It’s been brewing – a mixture of commerce coverage reduction, ETF flows turning the nook, and a noticeable return of institutional consumers.

Saylor

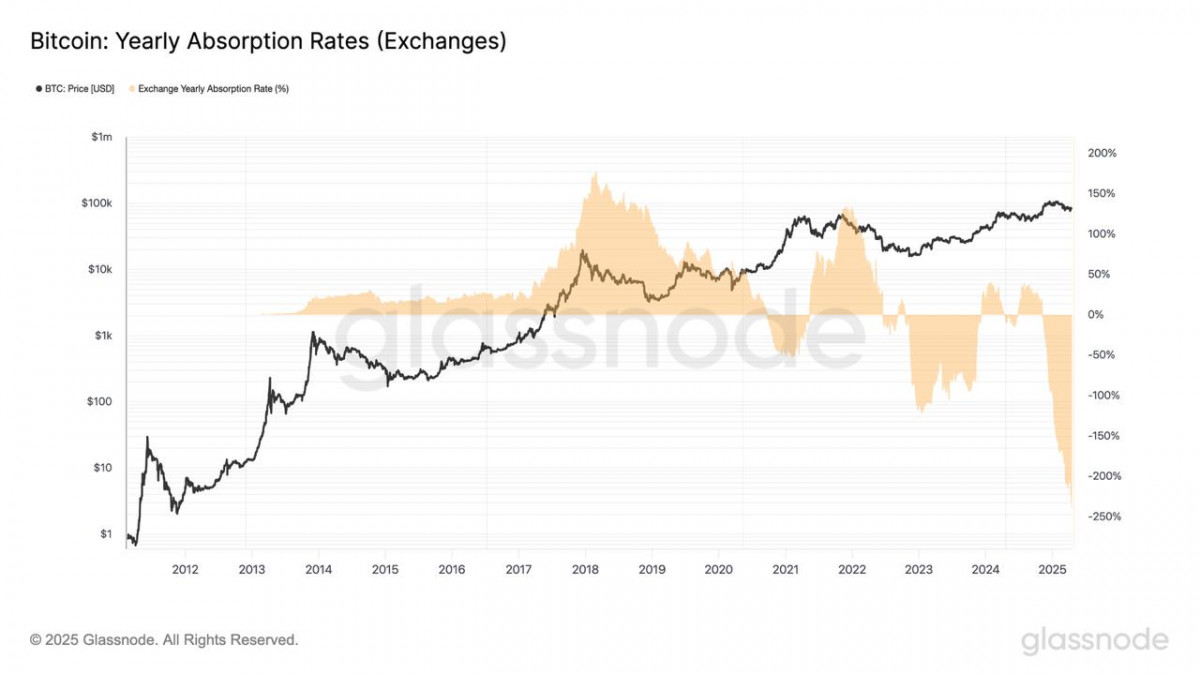

Saylor’s again in with one other $285 million purchase, ETF inflows have stopped bleeding for now, and whales have reportedly absorbed 3x the newly mined BTC provide this month.

Bitcoin yearly absorption charges. Supply: Glassnode

In the meantime, Trump’s tariff pullbacks on tech items gave threat belongings a purpose to breathe. Toss within the Fed’s surprisingly comfortable tone on stablecoin regulation, and all of the sudden BTC’s trying prefer it’s again on offense.

So, momentum’s robust, but it surely’s working scorching – RSI is already screaming overbought on the 4H. That mentioned, if we keep above $85K for lengthy sufficient, the following push to $90K might come ahead of folks anticipate. Proper now, markets are performing like they’ve shaken off the early April stoop – a minimum of for now.

Ethereum (ETH)

ETH is tagging alongside for the experience, reclaiming $1,650 after its personal model of the sideways shuffle.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

In comparison with Bitcoin’s clear breakout, Ethereum’s transfer feels extra like a reluctant follow-through. It’s up, certain – but it surely hasn’t actually damaged freed from the vary. That’s partly as a result of ETH has been quiet on the catalyst entrance. The SEC delayed choices on Ether staking ETFs, and Layer 2 adoption isn’t making headlines the best way it used to. Even Vitalik’s proposal to swap out the EVM for RISC-V – huge deal in dev circles – barely moved the needle.

Buterin offers numbers suggesting that implementing the proposal might result in effectivity beneficial properties of 100x. Supply: Vitalik Buterin

Nonetheless, there’s a silver lining: gasoline charges are at five-year lows. That’s nice for customers, but it surely additionally alerts skinny exercise throughout DeFi and NFTs.

Supply: Santiment

So ETH is caught on this bizarre center floor – buoyed by broader market optimism, however ready for a purpose to guide. Till that reveals up, anticipate it to maintain enjoying second fiddle to Bitcoin.

Toncoin (TON)

TON’s nonetheless within the room, simply not transferring but.

TON/USD 4H Chart. Supply: TradingView

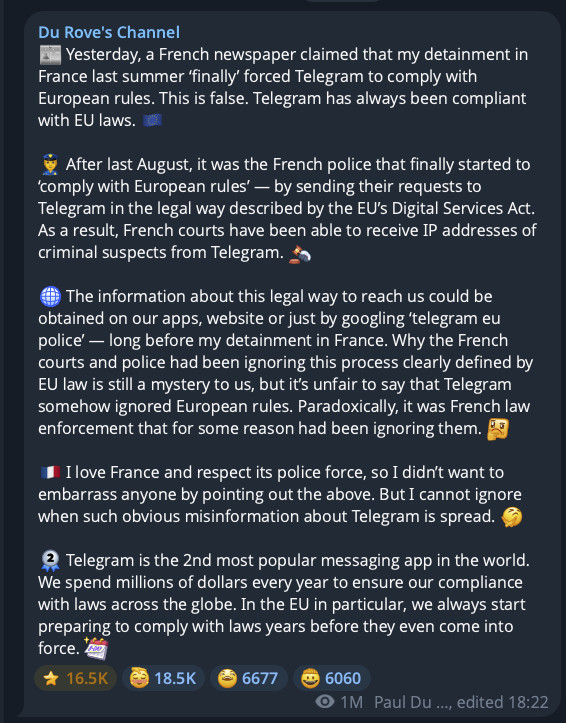

After holding a decent vary between $2.88 and $3.10, Toncoin lastly crept again above $3.00 – barely. It hasn’t adopted BTC or ETH with any actual conviction, however there’s regular upward stress. The basics are nonetheless quietly constructing. What’s totally different now’s the tone across the ecosystem. There was some preliminary concern over the continuing authorized investigation into Telegram founder Pavel Durov in France, however updates this week helped clear the air. Durov publicly reaffirmed that Telegram complies with EU legal guidelines and identified that French authorities have shifted to extra constructive communication since his 2024 detention. His authorized crew even described the case’s route as “constructive,” which calmed nerves throughout TON’s tight-knit group.

Supply: @rove

In the meantime, on the product facet, MyTonWallet quietly rolled out a brand new characteristic: limited-edition NFT playing cards that personalize pockets interfaces. Nothing groundbreaking but — however these low-key rollouts, paired with Telegram’s ongoing affect, are slowly tightening the basics beneath the worth.

So whereas TON hasn’t ripped like BTC, the groundwork is being laid. If Bitcoin retains driving increased, don’t be stunned if TON all of the sudden catches a bid and breaks the $3.10 ceiling it’s been nudging for days.

However for now, none of that has hit important mass. TON’s RSI is rising, however not euphoric, and the worth remains to be tucked beneath the 50 SMA. It’s the sort of chart that appears prefer it’s simply ready for Bitcoin to gentle the fuse. If BTC breaks above $90K and brings threat urge for food with it, TON in all probability rides the wave. Till then, it’s principally shadowing the majors.

What’s the market vibe?

As we are able to see, the sentiment has shifted. It’s not euphoria but, but it surely’s now not that uninteresting grind from earlier this month both. Macro uncertainty – tariffs, Powell, liquidity jitters – hasn’t vanished, however the market appears to have priced an excellent chunk of it in. BTC main the cost, ETH trailing with potential, and altcoins like TON simply waking up – this looks like a market that’s establishing for a correct transfer.

If Bitcoin can maintain this breakout and construct momentum above $88K, the remainder of the board would possibly lastly begin enjoying catch-up.

Disclaimer

In keeping with the Belief Challenge pointers, please observe that the knowledge offered on this web page shouldn’t be meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation in case you have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to jot down insightful articles for the broader viewers.