Victoria d’Este

Printed: April 28, 2025 at 11:57 am Up to date: April 28, 2025 at 11:57 am

Edited and fact-checked:

April 28, 2025 at 11:57 am

In Transient

Bitcoin, Ethereum, and Toncoin rallied final week with BTC main on ETF inflows, ETH exhibiting quiet accumulation, and TON constructing real-world use instances, all whereas crypto markets reached key determination factors.

Bitcoin (BTC)

Should you have been watching Bitcoin final week, you most likely felt that acquainted momentum begin to construct once more. We noticed a clear carry from round $85,000 as much as $94,000 – and right now, we’re holding only a hair above $94,300 after touching $94,451. Not unhealthy for per week’s work, proper?

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

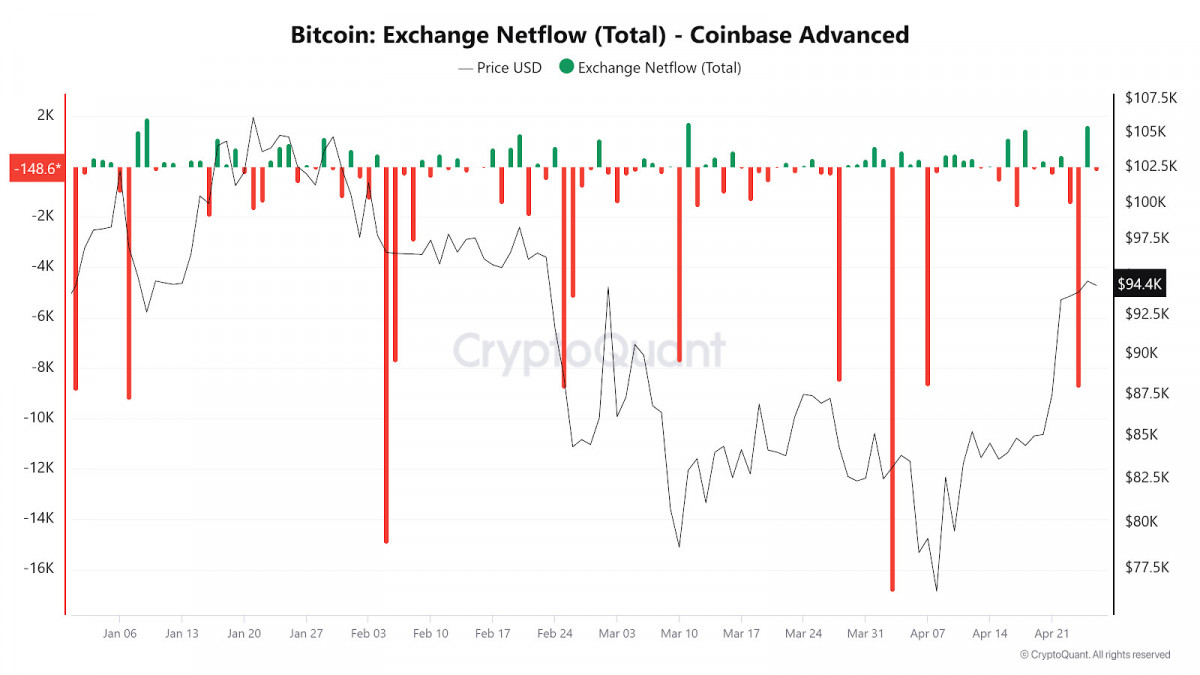

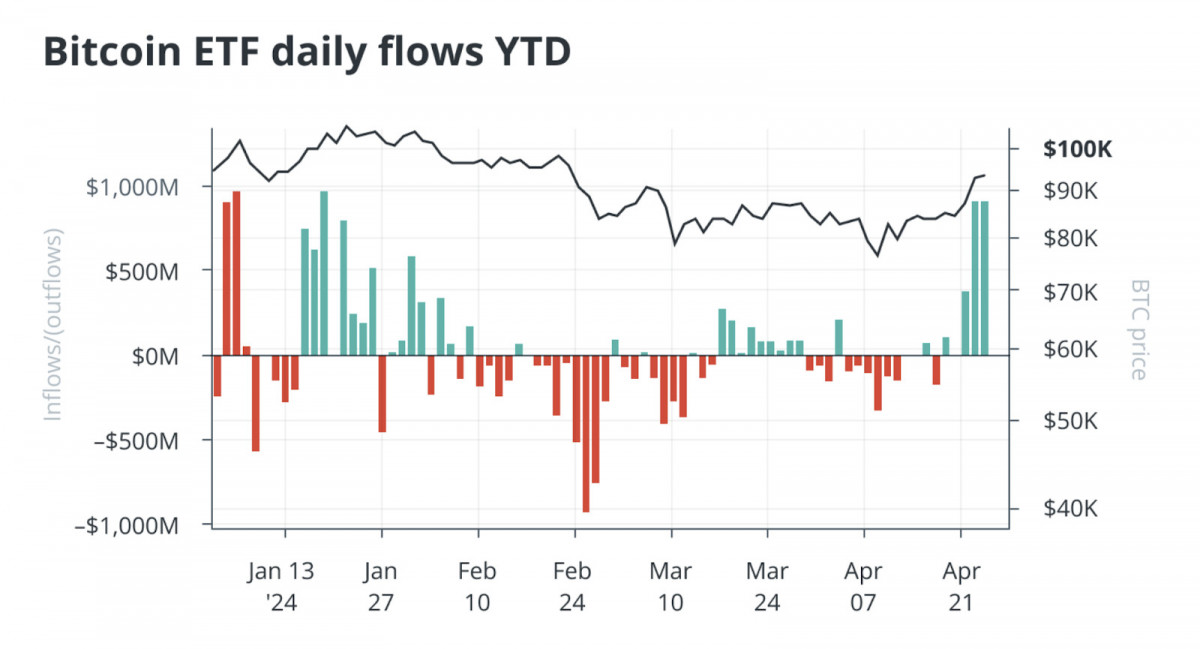

What’s extra fascinating, although, is how managed the transfer has been. The ETF inflows flipped constructive once more – roughly $3 billion final week – and you’ll see how value responded. No frantic pumps, no blow-off spikes. Simply regular strain up.

Bitcoin alternate netflows on Coinbase. Supply: CryptoQuant

It wasn’t simply ETF flows doing the heavy lifting both. The macro backdrop quietly improved: Trump’s push for tariff rollbacks and guarantees of slashing federal taxes helped danger urge for food throughout the board. Shares caught a bid, the greenback weakened, and Bitcoin leaned into that momentum prefer it ought to in a reflationary setup.

Supply: Bitcoin Journal Professional

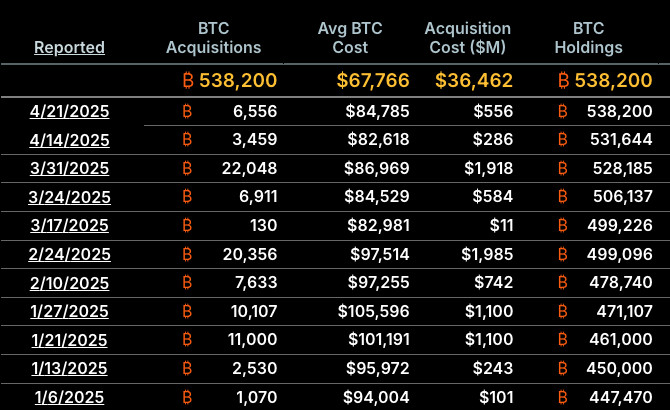

In the meantime, sentiment contained in the crypto market itself firmed up. Spot Bitcoin ETFs logged their strongest weekly inflows in over three months. Institutional shopping for wasn’t simply ticking up – it regarded aggressive. Technique’s contemporary $555 million Bitcoin purchase didn’t harm both, signaling that enormous treasury allocators are nonetheless hungry for publicity even at elevated ranges.

Technique’s Bitcoin acquisitions in 2025 up to now. Supply: Technique

Even worldwide flows gave somewhat tailwind: corporations like Metaplanet and a number of other Hong Kong gamers saved stacking BTC at tempo, including to the narrative that sovereign and company demand exterior the U.S. is quietly constructing.

Supply: Simon Gerovich

That mentioned, we’re now seeing the primary indicators that patrons could be getting somewhat winded. Worth motion has flattened out over the previous two days, and the RSI, which had been urgent close to the overbought zone, is beginning to drift decrease. Should you’re lengthy, it’s not a panic sign – however it’s one thing to respect. The simple cash on this leg appears to be made.

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

A clear break above $95,000 may re-ignite the rally towards six figures, no query. But when Bitcoin begins slipping below $93,000–92,500, that will sign that the pause is turning into a deeper pullback. Which means are the chances leaning? Proper now, it’s mainly at a choice level – and it’s taking its candy time making up its thoughts.

Ethereum (ETH)

Ethereum tracked alongside Bitcoin final week, however not with the identical conviction. It rose from roughly $1,580 to right now’s $1,804, tagging a neighborhood excessive at $1,809. First rate, positive – but it surely’s fairly clear ETH isn’t main this market proper now.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

Should you’ve been watching the ETH/BTC pair, you’ll know precisely what I imply. Ethereum has been underperforming Bitcoin for weeks, and that development hasn’t flipped but. Even now, whereas ETH/USD appears wholesome sufficient by itself, it’s not pushing tougher than Bitcoin.

Nonetheless, there are some things below the floor price being attentive to.

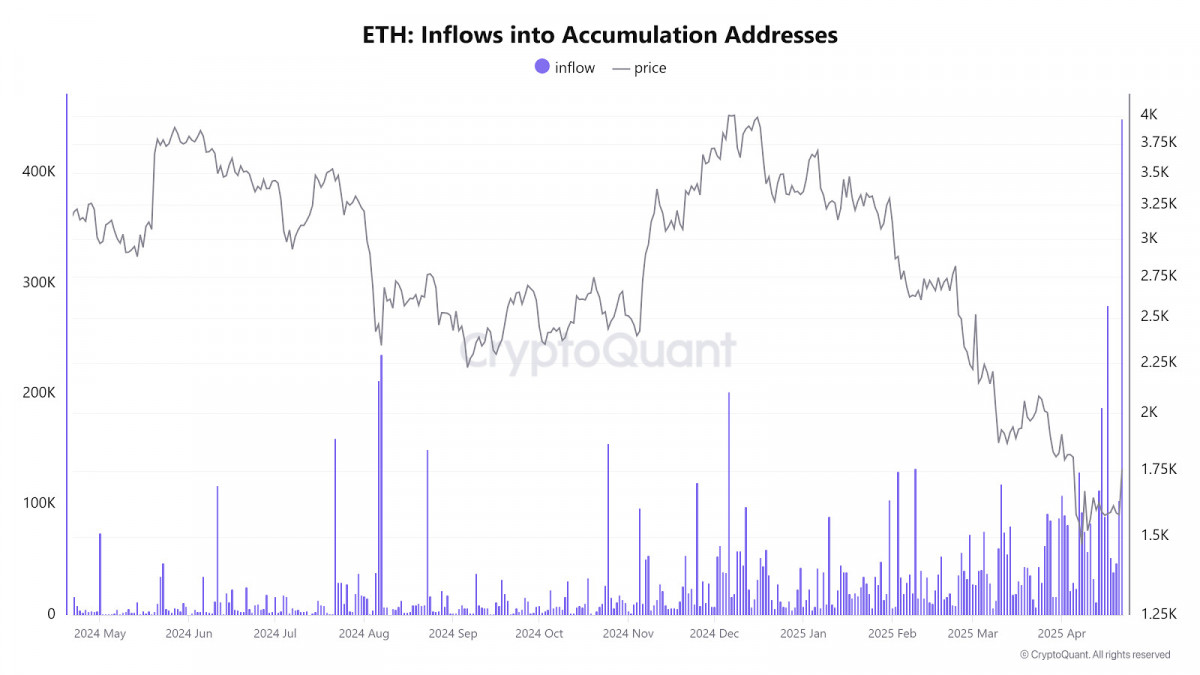

Galaxy dumps Ether, however not all of it. Supply: Arkham

Alternate balances for ETH are dropping once more – a basic signal of accumulation. And simply final week, accumulation addresses pulled in over 449,000 ETH in a single day. That’s a critical quantity. It doesn’t assure an instantaneous breakout, however when massive wallets begin rising like that, it often means somebody’s positioning for one thing down the road.

Ethereum inflows into accumulation addresses. Supply: CryptoQuant

On the event facet, Ethereum isn’t precisely sleeping both. Validators signed off on testing a 4x gasoline restrict improve forward of the upcoming Fusaka exhausting fork. If that sticks, Ethereum’s base layer may quickly deal with much more transactions – a crucial transfer as competitors from quicker L2s and alt-L1s heats up.

Mantle’s mETH yields 3.78%. Supply: DeFILlama

In the meantime, establishments haven’t misplaced curiosity ither. Securitize and Mantle launched a brand new fund final week that particularly consists of ETH, together with BTC and SOL. It’s a reminder that even when merchants are chasing quicker returns elsewhere, Ethereum nonetheless holds a seat on the desk for greater cash.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

Technically, ETH is sitting in a slim band between $1,780 and $1,825. A clear breakout above $1,850 may open issues up for a stronger run – but when Bitcoin stumbles, ETH most likely gained’t be spared. For now, it’s nonetheless very a lot in Bitcoin’s orbit.

Toncoin (TON)

Should you regarded away from Bitcoin and Ethereum for a second final week, you might need caught what was brewing over in Toncoin – and for those who didn’t, it’s most likely price revisiting.

TON/USDT 4H Chart. Supply: TradingView

The information move stayed busy by means of the week. For one, MyTonWallet introduced plans to roll out financial institution playing cards. It’s a small headline for now – but when it truly occurs, it may make it simpler for on a regular basis customers to bridge between crypto and real-world spending. It’s yet another piece of infrastructure that might quietly push Toncoin from “speculative token” territory into one thing somewhat extra usable.

Management adjustments additionally caught some consideration. The TON Basis appointed Maximilian Krain, a co-founder of MoonPay, as their new CEO. Management adjustments don’t transfer value charts in a single day – however they will form the tone and technique for months to come back. MoonPay constructed a fame for connecting conventional funds with crypto entry. Might Krain deliver a few of that very same pragmatism to TON? Regardless of the final result, it’s one thing price watching.

Supply: Coindesk

Technically, Toncoin’s construction appears clear. It climbed from about $2.85 final week to round $3.2455 right now, after briefly touching $3.25. Not a vertical moonshot – however regular, credible power. The RSI by no means overheated, and value held effectively above the 50-period transferring common all through the transfer.

If Bitcoin stays secure or retains grinding larger, Toncoin appears prefer it has room to stretch towards $3.50 or $3.70 with out an excessive amount of friction. However – and it’s price repeating – if Bitcoin stumbles, historical past says TON will possible really feel a few of that strain too. It’s nonetheless tethered to the broader market currents, irrespective of how robust its fundamentals are getting.

Disclaimer

Consistent with the Belief Challenge pointers, please word that the data supplied on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Creator

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.