Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Solana is buying and selling at important ranges after a number of days of attempting to decisively break above the important thing $155–$160 resistance zone. Bulls are slowly constructing momentum, because the broader crypto market reveals indicators of energy and hints at the potential for a sustained rally. Nonetheless, international dangers stay elevated, notably as no clear decision has been reached within the ongoing US-China commerce battle, which continues to form macroeconomic sentiment and investor conduct.

Associated Studying

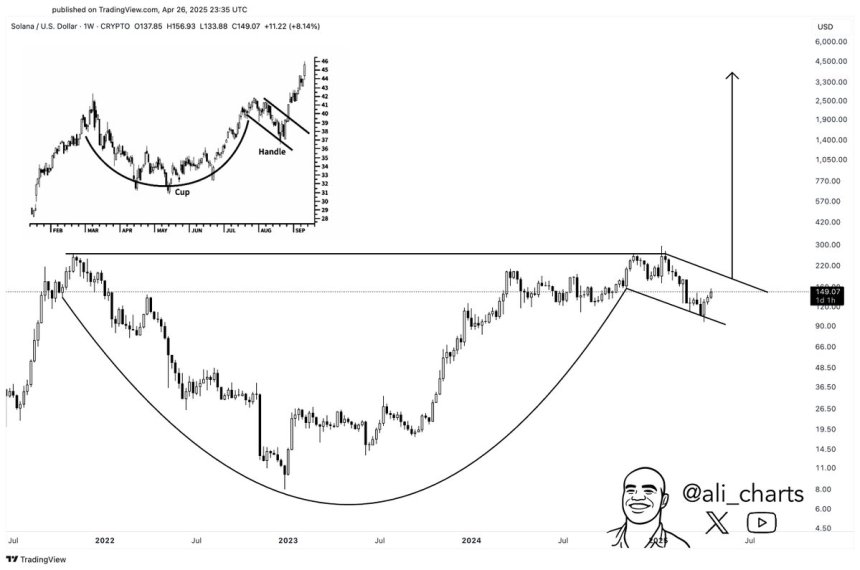

Regardless of the unsure backdrop, technical indicators are starting to favor a bullish outlook for Solana. Prime analyst Ali Martinez shared new insights, highlighting that when zooming out, Solana seems to be forming a textbook-perfect cup and deal with sample — a traditional technical setup sometimes related to main bullish breakouts. If validated, this sample may set the stage for a robust upside transfer within the coming weeks.

Nonetheless, warning is warranted, as broader market volatility and unresolved geopolitical tensions may disrupt the growing momentum. The subsequent few days might be pivotal for Solana’s pattern, as bulls should defend key ranges and construct sufficient strain to aim a real breakout above resistance.

Solana Reveals Energy Amid Shifting Market Dynamics

Solana is up 58% since early April, exhibiting spectacular restoration momentum as market dynamics begin to shift. After months of weak spot and promoting strain, Solana is now rising as one of many stronger performers amongst main altcoins. Analysts are intently watching the $160 degree, with many calling for a decisive breakout that would unlock additional positive aspects. Nonetheless, dangers stay elevated. The broader macroeconomic surroundings stays unstable, with international commerce conflicts and monetary market volatility weighing on investor sentiment.

Solana has been notably delicate to this uncertainty. Since January, SOL misplaced over 65% of its worth, highlighting the rising promoting strain and speculative conduct that dominated the market throughout the first quarter of 2025. Regardless of this, the current surge has shifted short-term momentum again in favor of the bulls, providing hope for a broader restoration if key ranges are reclaimed.

Martinez’s evaluation helps a bullish outlook for Solana. He factors out that zooming out reveals Solana is forming a textbook-perfect cup and deal with sample. This traditional technical construction typically precedes robust upward actions, particularly when accompanied by rising quantity and supportive macro situations. If confirmed, this setup may mark the start of a significant rally for SOL within the weeks forward.

Associated Studying

SOL Value Motion Stays Tight Beneath Key Resistance

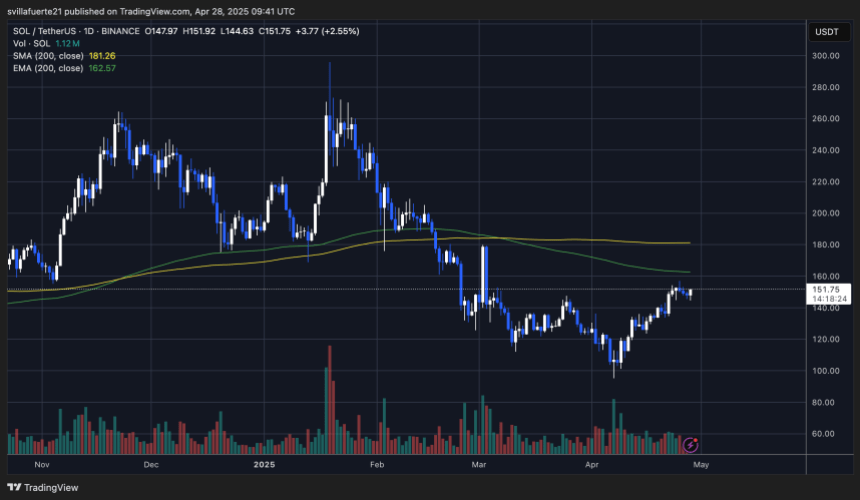

Solana (SOL) is buying and selling at $151 after a number of days of consolidation beneath the essential $160 resistance zone. Bulls have managed to defend current positive aspects, however momentum has slowed as the worth struggles to push larger. Reclaiming the $160 degree is important for bulls to regain full management and proceed the restoration. A clear breakout above $160 may set off a rally towards the $180 mark, which aligns with the 200-day transferring common (MA) — a important technical barrier that, if flipped into help, would verify a robust pattern reversal.

Nonetheless, dangers stay elevated if bulls fail to reclaim the $160 resistance quickly. A failure at this zone may expose SOL to a deeper correction, probably dragging the worth again towards the $120–$100 help space. This is able to not solely erase current positive aspects however may additionally injury market sentiment, slowing Solana’s restoration efforts.

Associated Studying

For now, consolidation just under resistance means that consumers try to construct energy. Nonetheless, the following few days might be important to find out whether or not SOL can break larger or enter one other corrective part. All eyes stay on the $160 breakout degree because the battle between bulls and bears intensifies.

Featured picture from Dall-E, chart from TradingView