The UK’s Monetary Conduct Authority (FCA) is exploring restrictions on UK residents buying cryptocurrencies on credit score, and is now in search of public suggestions on this and different proposed regulatory measures.

“We’re contemplating a spread of restrictions, together with limiting the usage of bank cards to immediately purchase cryptoassets, and utilizing a credit score line offered by an e-money agency to take action,” the dialogue paper titled Regulating Cryptoassets Actions famous.

Nonetheless, the British company would exempt authorised stablecoin purchases from these credit score restrictions.

You might also like: FCA Will Be Clear with Its CFDs Information Requirement

Britain’s Transfer In direction of Crypto Laws

The proposal got here just a few days after the UK authorities introduced its plans to control the native cryptocurrency business. In line with a current YouGov survey, the variety of Britons buying cryptocurrencies greater than doubled, from 6 per cent in 2022 to 14 per cent final yr.

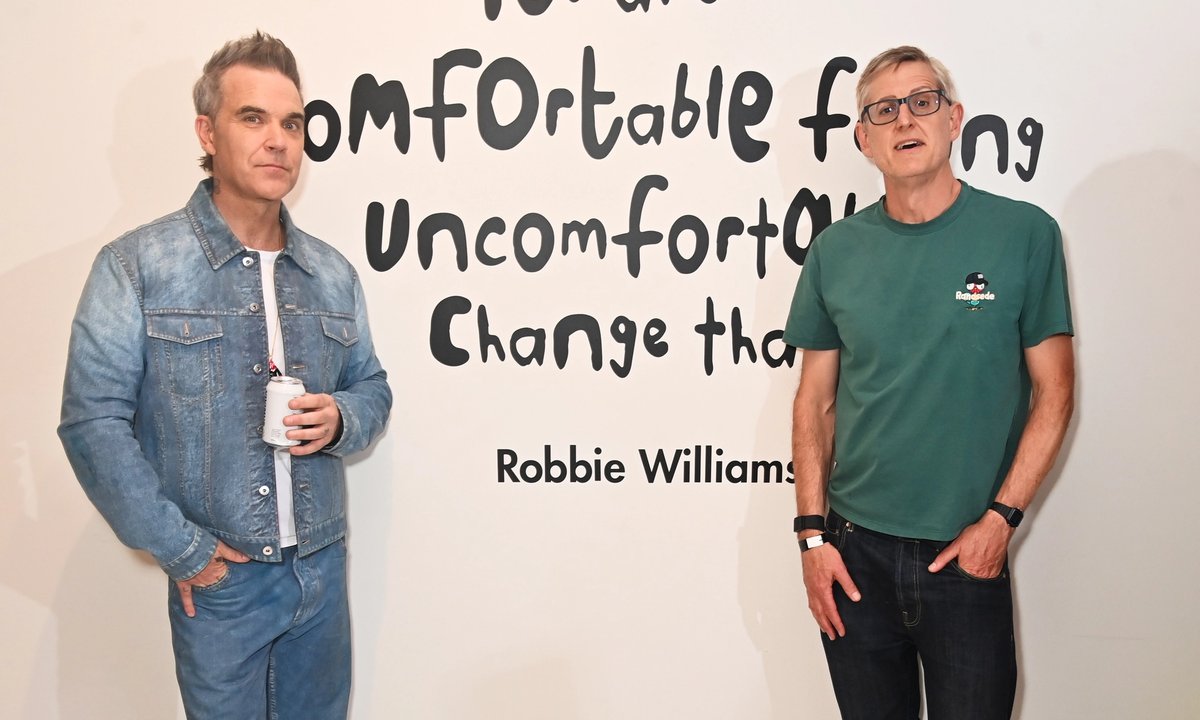

David Geale, Government Director of Funds and Digital Finance on the FCA

“Crypto is a rising business. Presently largely unregulated, we need to create a crypto regime that provides corporations the readability they should safely innovate, whereas delivering applicable ranges of market integrity and client safety,” mentioned David Geale, Government Director of Funds and Digital Finance on the FCA.

“Our purpose is to drive sustainable, long-term progress of crypto within the UK.”

Learn extra: UK Targets Crypto Exchanges With New Guidelines as Adoption Triples to 12%

Presently, the FCA requires all regionally operated crypto corporations to register with it. Nonetheless, its oversight is restricted to anti-money laundering guidelines, the monetary promotions regime, and client safety laws.

Regardless of the obligatory registration requirement, the FCA rejected 86 per cent of purposes from crypto corporations within the 12 months ending April 2024. Within the ongoing monetary yr, nonetheless, the rejection fee has declined to 75 per cent.

Controlling the Operations of Crypto Platforms

The British regulator has additionally raised issues about market abuse, disclosures, stablecoins, custody, and prudential issues.

It proposes that each one crypto buying and selling platforms should deal with trades equally, separate their proprietary buying and selling actions from these of retail prospects, and be clear about pricing and commerce executions. Moreover, the dialogue paper proposed banning buying and selling platforms from paying intermediaries for order circulation.

The FCA would additionally require crypto corporations providing companies within the UK to function by way of an authorised native authorized entity. Moreover, shoppers with staked cryptocurrencies that suffer losses as a consequence of third-party actions should be compensated.

Though the regulator doesn’t intend to cowl decentralised finance operations run solely by traces of code, any such platform with a “clear controlling individual” would fall below the scope of UK crypto rules.

The UK’s Monetary Conduct Authority (FCA) is exploring restrictions on UK residents buying cryptocurrencies on credit score, and is now in search of public suggestions on this and different proposed regulatory measures.

“We’re contemplating a spread of restrictions, together with limiting the usage of bank cards to immediately purchase cryptoassets, and utilizing a credit score line offered by an e-money agency to take action,” the dialogue paper titled Regulating Cryptoassets Actions famous.

Nonetheless, the British company would exempt authorised stablecoin purchases from these credit score restrictions.

You might also like: FCA Will Be Clear with Its CFDs Information Requirement

Britain’s Transfer In direction of Crypto Laws

The proposal got here just a few days after the UK authorities introduced its plans to control the native cryptocurrency business. In line with a current YouGov survey, the variety of Britons buying cryptocurrencies greater than doubled, from 6 per cent in 2022 to 14 per cent final yr.

David Geale, Government Director of Funds and Digital Finance on the FCA

“Crypto is a rising business. Presently largely unregulated, we need to create a crypto regime that provides corporations the readability they should safely innovate, whereas delivering applicable ranges of market integrity and client safety,” mentioned David Geale, Government Director of Funds and Digital Finance on the FCA.

“Our purpose is to drive sustainable, long-term progress of crypto within the UK.”

Learn extra: UK Targets Crypto Exchanges With New Guidelines as Adoption Triples to 12%

Presently, the FCA requires all regionally operated crypto corporations to register with it. Nonetheless, its oversight is restricted to anti-money laundering guidelines, the monetary promotions regime, and client safety laws.

Regardless of the obligatory registration requirement, the FCA rejected 86 per cent of purposes from crypto corporations within the 12 months ending April 2024. Within the ongoing monetary yr, nonetheless, the rejection fee has declined to 75 per cent.

Controlling the Operations of Crypto Platforms

The British regulator has additionally raised issues about market abuse, disclosures, stablecoins, custody, and prudential issues.

It proposes that each one crypto buying and selling platforms should deal with trades equally, separate their proprietary buying and selling actions from these of retail prospects, and be clear about pricing and commerce executions. Moreover, the dialogue paper proposed banning buying and selling platforms from paying intermediaries for order circulation.

The FCA would additionally require crypto corporations providing companies within the UK to function by way of an authorised native authorized entity. Moreover, shoppers with staked cryptocurrencies that suffer losses as a consequence of third-party actions should be compensated.

Though the regulator doesn’t intend to cowl decentralised finance operations run solely by traces of code, any such platform with a “clear controlling individual” would fall below the scope of UK crypto rules.

_id_beb7c7a1-e3e4-4e7a-9ff2-747d82a6f8c5_size900.jpg)