Federal Reserve policymakers introduced that they have been holding the federal funds price regular after the Federal Open Market Committee (FOMC) assembly on Wednesday. The goal vary stays unchanged at 4.25% to 4.5%.

The final time the FOMC lower charges was at its December assembly, when it lowered the goal vary by 25 foundation factors, or 0.25%.

The federal funds price is the borrowing price that banks cost one another for loans. A decrease price ripples out to decrease borrowing prices on bank cards and private loans, although banks individually select how to reply to price modifications. The common bank card rate of interest is at the moment round 21%, whereas automotive mortgage charges for brand new automobiles are round 6%.

Federal Reserve Chair Jerome Powell mentioned at a information convention following the FOMC assembly that inflation, which was at an annual price of two.4% in March, was nonetheless above its 2% goal and that the Fed was taking a “wait and see” strategy to its financial coverage changes.

Associated: Core Inflation Is at Its Lowest Degree in 4 Years — However Will the Fed Minimize Charges? Consultants Count on the Company to ‘Keep Humble and Knowledge-Dependent’

“There’s simply a lot that we do not know, I believe, and we’re in a superb place to attend and see, is the factor,” Powell said on the information convention. “We do not have to be in a rush. The economic system is resilient and doing pretty nicely.”

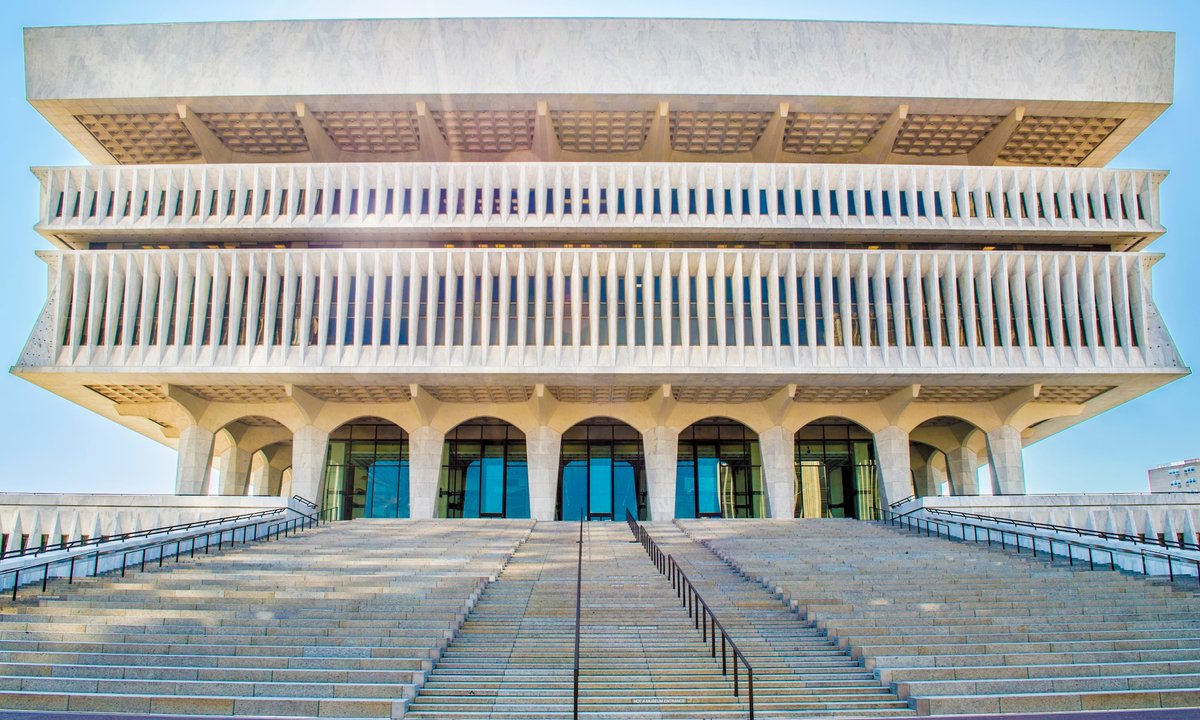

Federal Reserve Chair Jerome Powell. Photograph by Andrew Harnik/Getty Photos

Business consultants aren’t shocked. Ed Yardeni, head of Yardeni Analysis consultancy, instructed NBC Information that the most effective factor for the Fed to do was to attend and see if inflation or unemployment poses extra of an issue down the road.

“The proof up to now is that, for now, it is prone to be extra of a value drawback than a labor market drawback,” Yardeni instructed the outlet.

Associated: Are Amazon’s Costs Going Up? This is How the Firm’s CEO Answered Questions About Tariffs.

Final month, President Donald Trump levied a ten% tariff on all buying and selling companions and a tariff as excessive as 145% on China that would have an effect on client costs.

Powell famous on the information convention that there was “quite a lot of uncertainty” about tariff insurance policies and said that the Fed would fastidiously monitor the consequences of tariffs on inflation and unemployment.

The following assembly is on June 17 and 18, and consultants are already anticipating the Fed to maintain charges regular. Barclays estimates that the Fed will maintain charges the identical in June and make its first price lower in July, whereas Morgan Stanley anticipates no price cuts this 12 months, per USA In the present day.

What does the Fed’s resolution imply for mortgage charges?

Melissa Cohn, regional vp of William Raveis Mortgage, instructed Entrepreneur in an electronic mail that she predicts mortgage charges ought to decrease this week as a result of the Fed determined to carry charges regular.

“Mortgage charges will drop a bit this week as bonds have cheered the Fed’s resolution to go away charges alone,” Cohn said.

Cohn additionally famous that Might could be “a really telling month” because the Fed will get a greater concept of the influence of tariffs on the economic system.

“Now, it is again to data-watching and, after all, to see the place the tariff negotiations find yourself,” Cohn said.