Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

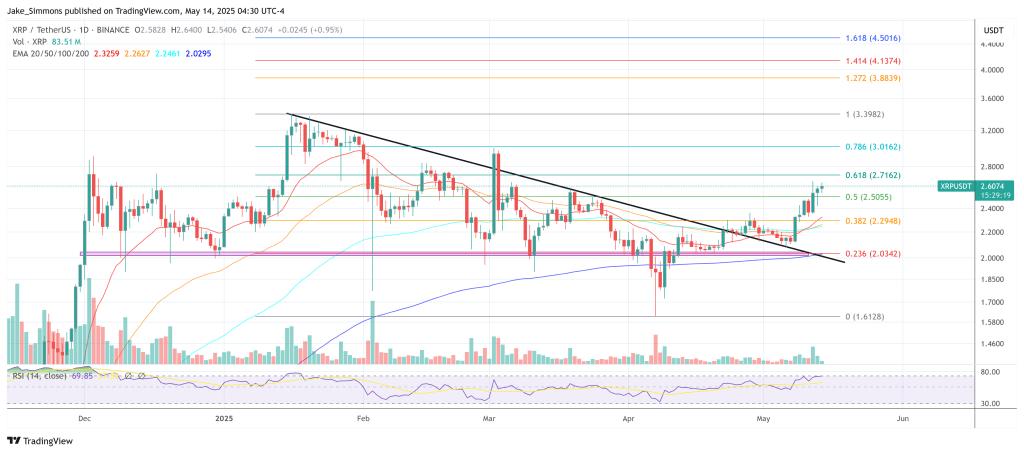

Veteran wave technician “BigMike7335” (@Michael_EWpro) argues that the XRP token has simply accomplished a textbook reversal on the each day chart. In a publish that accompanied the chart proven under, the strategist quipped, “When you have been busy being all enthusiastic about COIN being added to ES, XRP determined to breakout.”

XRP Breakout Confirmed

The annotated Bitstamp each day reveals value clawing again to $2.5717, a 21% achieve during the last seven periods that decisively lifts the token by a six-month neckline sitting fractionally above $2.40. That horizontal barrier—colored purple on the chart—coincides with the highest of a skinny, downward-slanted Ichimoku cloud. Thursday’s shut positioned the candle not solely above the Kumo but additionally above the 50-day EMA (orange), the 100-day EMA (aqua) and the 200-day SMA (darkish blue), stacking the moving-average ribbon in a traditional bullish configuration.

The thrust completes an inverted head-and-shoulders that shaped inside wave (iv) of a bigger five-wave advance. The April swing low nearly tagged the 0.382 Fibonacci retracement of all the November-to-February impulse at $1.56732; wave “c” of that corrective leg created the sample’s head, with symmetric shoulders in mid-March and early-Might. Measured-move arithmetic from the formation’s $0.80 depth tasks roughly $3.58—Large Mike bins the goal at $3.57638, precisely the place the white arrow terminates on his chart and the place the dashed vertical line identifies Wednesday, 18 June 2025 as a believable time window.

Associated Studying

Market-profile knowledge on the precise flank strengthen the case: the heaviest quantity node (inexperienced and tan bars) sits between $2.30 and $2.50, that means the breakout thrust has already cleared the zone of biggest historic order circulate. Above $2.80 the profile thins dramatically, implying scant overhead provide till the prior cycle’s higher channel rail close to $3.00 and, finally, the $3.57 goal.

Momentum gauges again the transfer. Every day RSI has reclaimed the 60-line and is rising briskly with out but coming into overbought territory, whereas the stochastic oscillator has punched by its sign line and is accelerating towards the higher band—affirmation that impulse moderately than mere quick protecting is at work.

Associated Studying

Key threat markers stay under. Dashed help at $1.66027—the decrease fringe of the December–Might broadening wedge—stays key; a failure to carry that stage would invalidate the breakout thesis. Till then, the chart now presents bullish merchants a traditional post-neckline retest state of affairs, with the analyst eyeing $3.57 because the technical terminus of wave (v).

For now, XRP bulls lastly have a construction that justifies optimism—and, as Large Mike notes, they did it whereas the remainder of the market was distracted by the inclusion of Coinbase (COIN) within the S&P 500 on Tuesday.

At press time, XRP traded at $2.60.

Featured picture created with DALL.E, chart from TradingView.com