Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin is wrapping up the week with power, buying and selling above the $105,000 mark after a pointy rally that pushed costs to a brand new all-time excessive close to $112,000. The transfer reignited bullish momentum throughout the market, with merchants and analysts now turning their focus to what might be the following section of this cycle.

Associated Studying

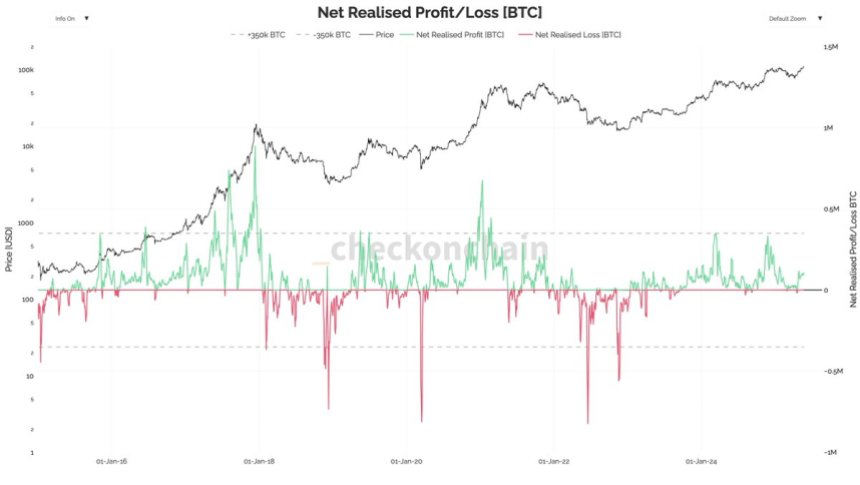

Regardless of the aggressive push increased, on-chain knowledge suggests the market stays wholesome. High analyst Darkfost highlighted that web realized income are nonetheless inside regular ranges for a bull run. In keeping with his evaluation, profit-taking just isn’t an indication of weak point—it’s a crucial a part of market construction throughout uptrends. “That is what retains traders engaged and prevents parabolic exhaustion,” he famous.

The latest worth motion factors to a possible shift in market dynamics, as Bitcoin breaks out of its post-halving consolidation section. With weekly help forming above $105K and realized revenue metrics staying in test, bulls are eyeing increased ranges. If this momentum holds, the $112K rejection might solely be a short-term hurdle. As all the time, volatility stays in play—however this week’s shut sends a powerful sign: the bull market construction continues to be intact.

Bitcoin Has Room To Develop As It Prepares For Historic Weekly Shut

Bitcoin is on monitor to file its highest weekly shut in historical past, signaling rising power because it prepares for what many consider might be the following main bullish section. After surging to a brand new all-time excessive close to $112,000 earlier this week, BTC is now stabilizing above the $105,000 stage—positioning itself above key short-term help going into subsequent week.

Nonetheless, whereas worth motion paints a bullish image, macroeconomic situations proceed to pose dangers. Excessive rates of interest, tightening monetary situations, and broader market uncertainty stay main components. Traders are cautiously optimistic, however volatility may rapidly return if world threat sentiment deteriorates.

On-chain knowledge gives a extra grounded view of the present cycle. In keeping with Darkfost, CryptoQuant knowledge reveals that realized income at present stand at 104,000 BTC, or round $11 billion. Whereas that quantity could appear massive, it’s nonetheless effectively beneath the historic hazard zone of 350,000 BTC—a stage that sometimes alerts euphoric situations or overheating.

This means the market stays in a wholesome profit-taking zone. “Revenue-taking just isn’t a purple flag throughout a bull market,” Darkfost famous. “It’s crucial. It helps preserve momentum and retains contributors engaged.”

The approaching week shall be vital. A confirmed weekly shut above $105K may solidify this stage as new help and set the stage for additional upside. But when bulls fail to carry floor, the rally dangers dropping steam. For now, Bitcoin seems sturdy, however the market is coming into a zone the place conviction shall be examined.

Associated Studying

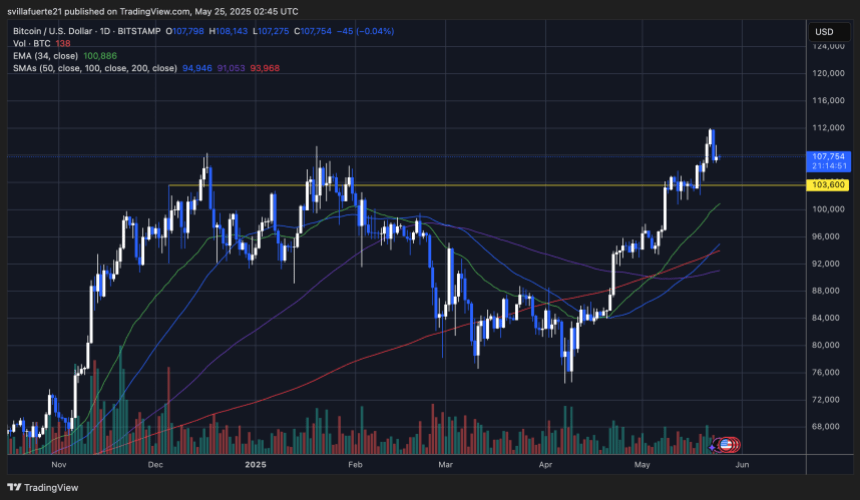

BTC Holds Key Help After Rejection From New ATH

Bitcoin is at present buying and selling round $107,750 after a unstable week that noticed costs hit a brand new all-time excessive close to $112,000. The each day chart reveals BTC pulling again from overbought situations however holding firmly above the 34-day EMA at $100,886—a stage that has persistently acted as dynamic help throughout this uptrend.

Worth stays effectively above the 50, 100, and 200-day SMAs, confirming a powerful bullish construction. The important thing horizontal help at $103,600—now reclaimed—is one other essential zone. This stage beforehand acted as a resistance ceiling through the March-April vary and now serves as a possible launchpad if BTC consolidates above it.

Quantity seems to be declining barely on the pullback, which can counsel this can be a wholesome retrace moderately than a reversal. So long as Bitcoin maintains above the $103,600–$105,000 zone, bulls stay in management. A deeper correction would discover preliminary help across the 34 EMA after which the 100 SMA close to $91,000.

Associated Studying

For now, the bullish pattern stays intact. Nonetheless, rejection at $112K and slowing momentum name for warning. A weekly shut above $105K would affirm power, whereas a break beneath $103K may set off short-term weak point.

Featured picture from Dall-E, chart from TradingView