In short

Wall Avenue titans like Jamie Dimon and Warren Buffett have criticized the asset.

Early Bitcoiner Adam Again says even techies and programmers discover the cryptocurrency onerous to know.

Again pointed to skepticism round Bitcoin’s digital nature and grassroots origins.

Bitcoin—as soon as an arcane tech largely utilized by individuals wanting to purchase illicit items on the darkish net—has now gained institutional acceptance.

With everybody from Wall Avenue giants like BlackRock to the U.S. authorities getting concerned, the main cryptocurrency is now extra mainstream than ever. You’ll be able to even purchase burgers with it.

So it begs the query: Why is it nonetheless so onerous for some individuals to know and settle for? With conventional finance heavyweights like investor Warren Buffett and JPMorgan Chase CEO Jamie Dimon slamming the asset, it is seems that some individuals won’t ever be open to Bitcoin.

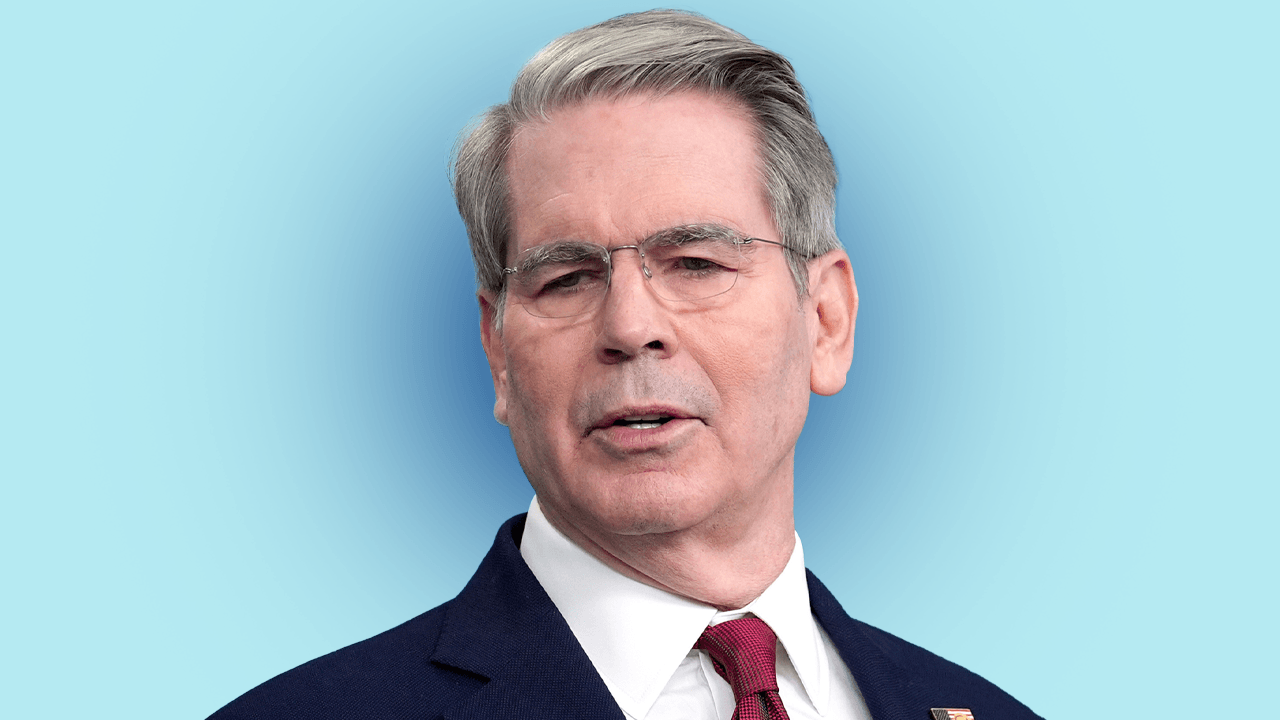

Chatting with Decrypt, Blockstream CEO and well-known early Bitcoiner Adam Again mentioned that that is nothing new—and that even techies wrestle to get their head across the cryptocurrency.

Calling continued skepticism “complicated,” Again used the instance of cypherpunks again within the day who appeared bored with Bitcoin. He thought it was “loopy” that a few of them didn’t get onboard.

“You understood all about code, peer-to-peer networks, privateness, public key cryptography, and safe sockets layer,” he added. “Like, you may have an enormous leg up in understanding this, and you are not . What offers?”

Cypherpunk Again—who had an e-mail alternate with the cryptocurrency’s mysterious, pseudonymous creator Satoshi Nakamoto in 2008—mentioned the truth that so-called digital gold is not bodily is likely to be why some individuals stay suspicious of Bitcoin in any case these years.

“Some are skeptical about one thing that is not bodily and but has a shortage,” he commented, including that the coin continues to be backed by bodily sources like vitality and mining gear.

Bitcoin is a digital funds system and digital foreign money, and solely 21 million digital cash will ever be minted into existence, because of the undertaking’s super-secure cryptographic engineering.

Nonetheless, JP Morgan CEO Jamie Dimon expressed cynicism over the main crypto’s code.

In a 2023 interview, Dimon requested: “How have you learnt it is gonna cease at 21 million? Everybody says that,” earlier than including, “Bitcoin itself is a hyped-up fraud.” In fact, the billionaire banker additionally mentioned his agency used the blockchain—a expertise created by Satoshi.

The most important and oldest cryptocurrency was created with world banking failures in thoughts, with the unique white paper launched in the course of the 2008 recession. A message referencing a newspaper article masking the scenario was even inscribed on the community’s genesis block.

Now, Bitcoin advocates argue that the cryptocurrency can work as a real inflation hedge resulting from its shortage.

Again added that “for individuals who the institution order is working,” they might by no means perceive the potential advantages of Bitcoin, nor could they belief one thing “extra grassroots” in nature than fiat foreign money and conventional finance.

“If they have a high-paying job, they’re working their means up the profession ladder, issues do not look too costly for them, and so they can afford mortgages,” mentioned Again, “then perhaps they do not really feel it.”

Edited by Andrew Hayward

Each day Debrief E-newsletter

Begin each day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.