Avalanche (AVAX) is a high-performance Layer 1 blockchain platform identified for its near-instant transaction finality and structure that helps the creation of customizable subnets.

To make a short-term value prediction for AVAX, it’s important to contemplate each latest value actions and basic components comparable to strategic partnerships, ecosystem growth, updates from the Avalanche/Ava Labs staff, institutional capital flows, and total market developments.

Under is a abstract of essentially the most up-to-date data relating to these components.

AVAX Value Efficiency Overview

AVAX has skilled a notable restoration because the starting of 2025. As of Could, the token is buying and selling within the $24–$25 vary, reflecting a 25% to 50% enhance in comparison with early Could. This marks a rebound from its decline in the beginning of the 12 months, when AVAX dropped to round $19–$20, following a earlier peak of almost $60 in March 2024.

Community indicators additionally level to a strengthening ecosystem. The variety of energetic addresses on Avalanche has surpassed 2 million, setting a brand new all-time excessive. Transaction quantity on the community has risen by over 185%, whereas pockets exercise has surged by 700% within the first half of 2025 – underscoring renewed consumer engagement and rising on-chain exercise.

Supply: Dune

Strategic Partnerships and Notable Collaborations

Avalanche continues to draw high-profile companions throughout numerous industries, reinforcing its place as a flexible Layer 1 blockchain.

In sports activities, FIFA – the worldwide authority on soccer, has partnered with Avalanche to develop a devoted blockchain community for issuing digital collectibles and enhancing fan engagement.

Within the leisure sector, the music platform EVEN – that includes artists comparable to J. Cole and 6LACK, has launched its personal Layer 1 blockchain on Avalanche utilizing Ava Labs’ AvaCloud service.

In the meantime, the launch of the Avalanche Card (in collaboration with Rain and Meta) permits customers in Latin America and different rising markets to spend crypto identical to a standard Visa card.

Conventional finance can also be more and more tapping into Avalanche’s infrastructure. Japan’s SMBC financial institution, along with Fireblocks and TIS, has signed an settlement to discover issuing a stablecoin for B2B funds on the Avalanche community.

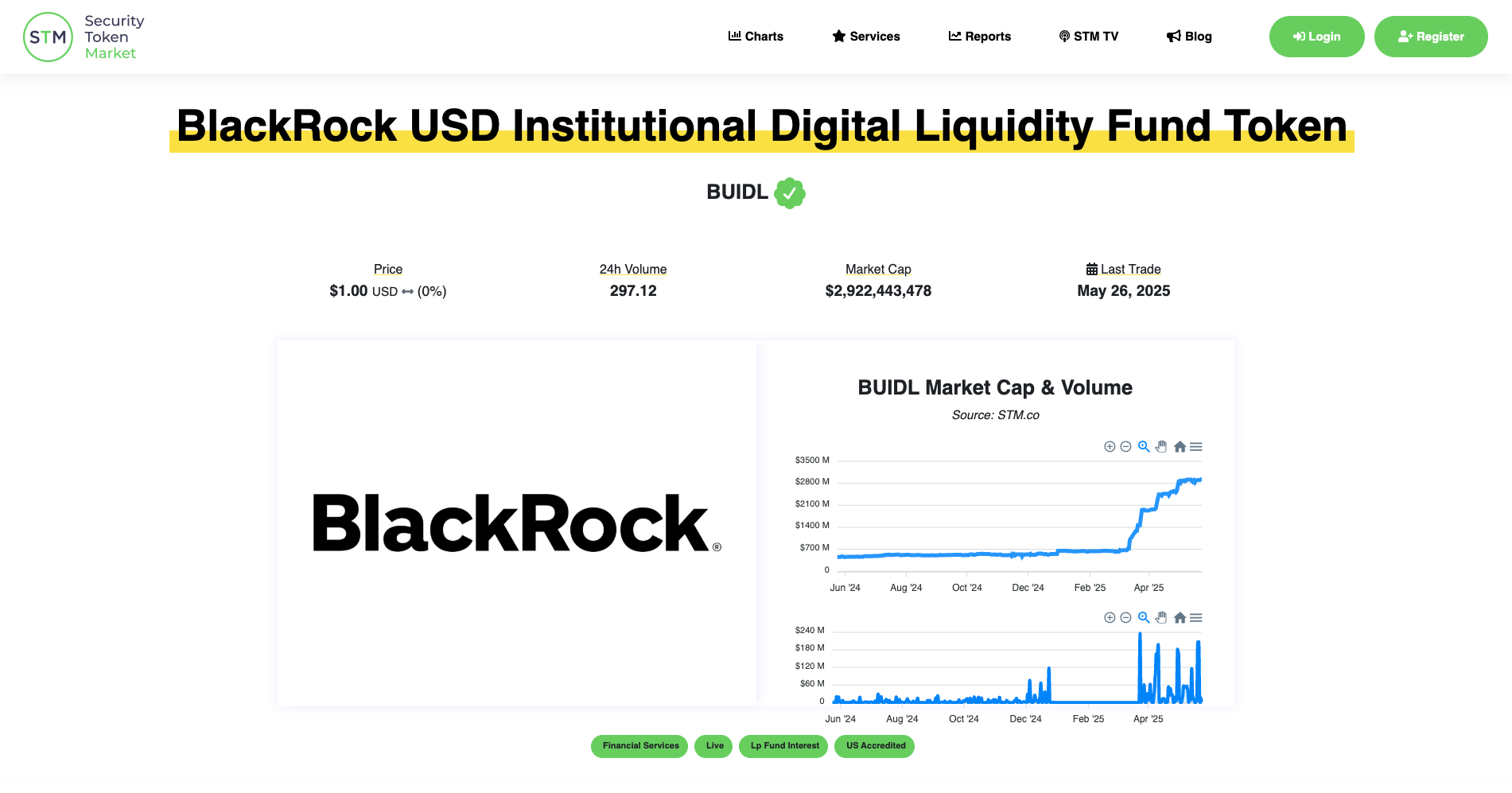

BlackRock’s tokenized asset fund, BUIDL – now valued at over $2 billion, has expanded to Avalanche by way of Securitize, making it the most important tokenized treasury fund on this planet. Moreover, asset administration agency VanEck is ready to launch a devoted Web3 fund targeted on the Avalanche ecosystem in June 2025.

One other noteworthy growth: VanEck’s tokenized treasury product VBILL (U.S. short-term T-bill deposits) has been launched on Avalanche alongside different networks. This transfer underscores rising institutional curiosity in Avalanche as a platform for real-world asset tokenization.

Avalanche Ecosystem Enlargement

Avalanche is actively constructing throughout a number of verticals, together with DeFi, GameFi, NFTs, and core infrastructure. Within the gaming house, a number of large-scale titles have chosen Avalanche for deployment.

Notably, MapleStory N- with over 180 million gamers globally, has migrated to Avalanche’s Henesys subnet, whereas Pixelmon has introduced plans to develop a cell recreation on the Avalanche community.

The 2024 rollout of Avalanche’s Avalanche 9000 (Etna) improve considerably lowered the price of launching a subnet – by as a lot as 90%. This discount has led to the creation of over 100 new subnets, every tailor-made for particular purposes, together with high-performance gaming, enterprise options, and personal networks.

Learn extra: Buying and selling with Free Crypto Indicators in Night Dealer Channel

In DeFi, Avalanche is increasing its help for Bitcoin-linked belongings. For instance, on Could 16, 2025, Solv Protocol launched SolvBTC.AVAX, an artificial BTC asset native to Avalanche. On the NFT entrance, FIFA Gather – FIFA’s official digital collectibles platform (NFT) is migrating to Avalanche’s Layer 1 chain, aiming to raise the worldwide fan expertise by enhanced digital possession.

To additional onboard new customers, Avalanche has partnered with Stripe to allow fiat onramps. This integration permits customers to buy AVAX immediately by way of bank card or financial institution switch. Stripe’s performance can also be embedded within the Core Pockets developed by Ava Labs, providing seamless entry for customers partaking with the Avalanche community.

On-chain metrics underscore this momentum. Avalanche’s complete worth locked (TVL) has surged into the multi-billion-dollar vary, whereas the provision of native stablecoins (comparable to USDC and USDT) has grown 1.7x since March 2024 – highlighting strong capital influx and elevated community exercise.

Supply: DeFiLlama

Newest Developments from Ava Labs

The Avalanche Basis and Ava Labs- the core growth staff behind Avalanche, proceed to roll out new initiatives geared toward accelerating adoption and developer engagement throughout the ecosystem.

One main spotlight is the launch of Codebase Season 4, an incubation program designed to help Web3 startups constructing on Avalanche. This system underscores Avalanche’s dedication to nurturing early-stage innovation.

Latest bulletins on Avalanche’s official weblog replicate an energetic and strategic roadmap:

Could 15, 2025 – Utah, a brand new Layer 2 constructed for Unity by XSY, was launched.Could 20, 2025 – EVEN, the music platform, deployed its personal Avalanche Layer 1 chain.Could 22, 2025 – The FIFA Blockchain initiative was formally confirmed to be hosted on Avalanche.

Avalanche can also be increasing its attain by enterprise-friendly infrastructure. Its longstanding collaboration with Amazon Internet Providers (AWS), first introduced in 2023, permits companies to launch Avalanche nodes with only a few clicks. Moreover, there are plans to supply subnet deployment as a service by way of the AWS Market.

Avalanche’s AvaCloud – launched in 2024, has additionally been instrumental in democratizing entry to blockchain infrastructure. It permits builders and enterprises to launch customized blockchains with no need to handle complicated back-end operations.

Institutional capital is more and more flowing into the Avalanche ecosystem. Notably, VanEck is making ready to launch the PurposeBuilt Avalanche Fund, a devoted car for investing in Avalanche-native tasks, managed by the VanEck Digital Property Alpha fund.

VanEck has additionally launched a leveraged ETN (exchange-traded notice) primarily based on AVAX, offering European buyers simpler entry to Avalanche publicity, though the ETN is at the moment down roughly 36% year-to-date.

In abstract, institutional funding in Avalanche is on the rise – concentrating on key sectors comparable to DeFi, GameFi, and real-world asset tokenization (RWA). This sustained curiosity helps to put a stable basis for AVAX’s long-term worth and short-term value stability.

Technical Evaluation: Awaiting Breakout Affirmation

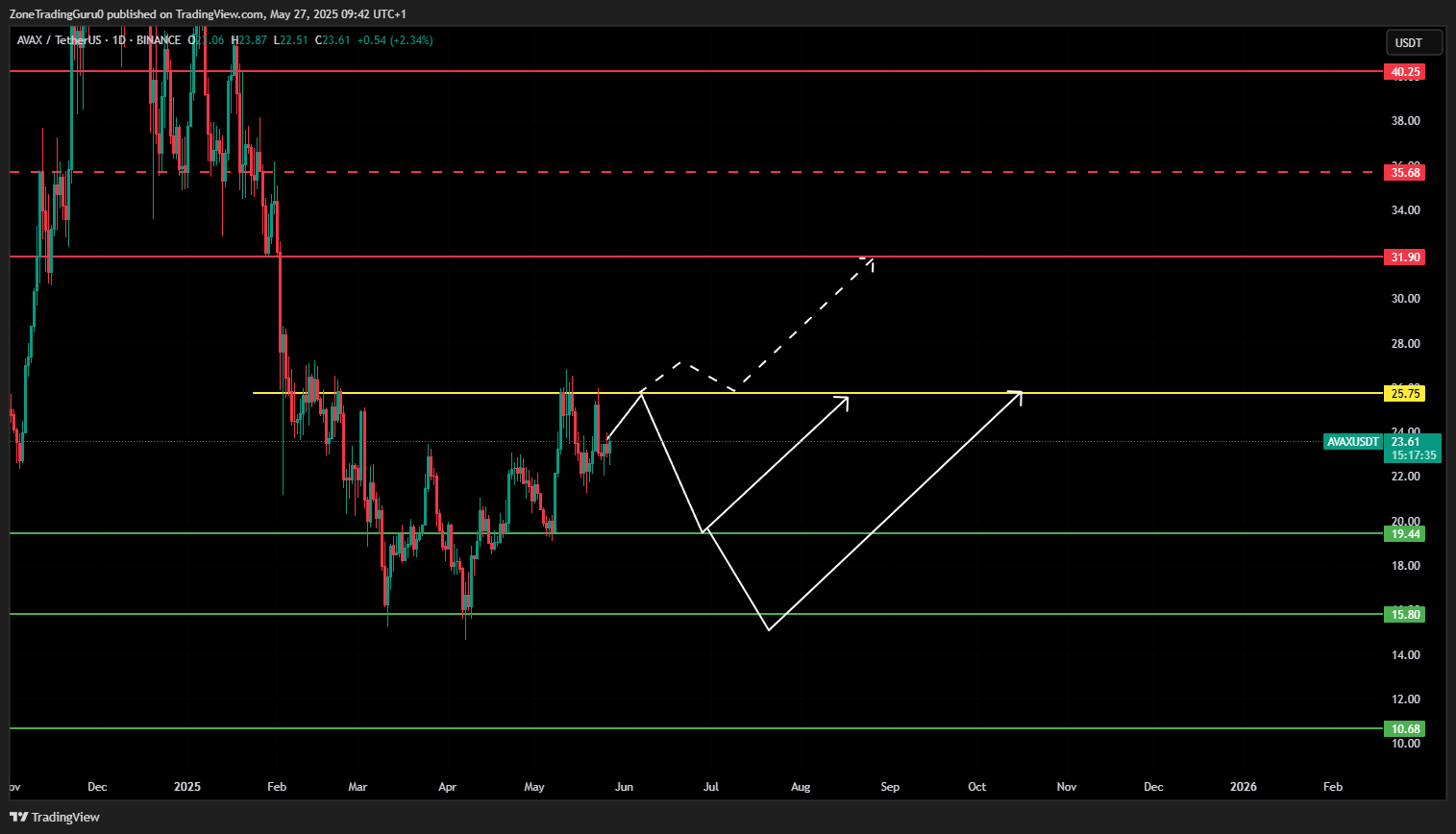

Presently, AVAX is caught between a key resistance at $25.75 and a broad help zone starting from $19.44 to $14.77. The $25.75 stage is essentially the most essential threshold to observe.

If AVAX prints a day by day (D1) candle that closes decisively above this stage, the value might rapidly transfer towards $31.90. A confirmed breakout above $31.90 might then open the trail to increased resistance ranges at $35.70, $40.25, and even $44.13.

Alternatively, if AVAX fails to interrupt by $25.75, there’s a danger of a downward transfer towards the help vary between $19.44 and $15.80.

If the $15.80 help can’t maintain, value might revisit the earlier low round $10.68. These help zones can provide scalp-buying alternatives, however merchants should handle danger tightly as a result of volatility and closeness to key resistance.

Supply: TradingView

AVAX Value Prediction: Quick-term Oulook

If optimistic developments proceed to emerge, comparable to ecosystem-wide initiatives, infrastructure upgrades, and new institutional partnerships – AVAX might preserve its upward momentum. Within the close to time period, the token is prone to check a key resistance zone within the $27–$30 vary.

Wanting forward, the potential for U.S. Federal Reserve price cuts, notably if confirmed within the June 2025 FOMC assembly, might function a broader catalyst for danger belongings. Ought to this happen, AVAX, together with main altcoins like SOL and ETH, might see a big revaluation upward, supported by elevated market liquidity and renewed investor confidence.

Traditionally, AVAX tends to reflect broader market developments. As a high-beta asset, its value usually follows the efficiency of flagship cryptocurrencies, notably Bitcoin. When BTC experiences sharp rallies or corrections, it usually triggers capital flows into or out of altcoins – together with Avalanche.

Analysts like Andre Dragosch (Wharton) have underscored this dynamic, noting that previous Fed price cuts—sometimes seen as liquidity-boosting occasions—usually gasoline short-term surges in Bitcoin and Ethereum. In such eventualities, AVAX stands to profit because it takes half within the broader altcoin rally cycle.

Learn extra: Dogecoin Value Prediction in June 2025