Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Though Bitcoin (BTC) seems to have stalled within the mid-$100,000 vary, on-chain information signifies that the highest cryptocurrency’s bullish momentum is much from over. BTC just lately hit a brand new all-time excessive (ATH) of $111,980, prompting a number of crypto analysts to forecast even increased costs within the close to time period.

Bitcoin Rally Far From Over, Knowledge Suggests

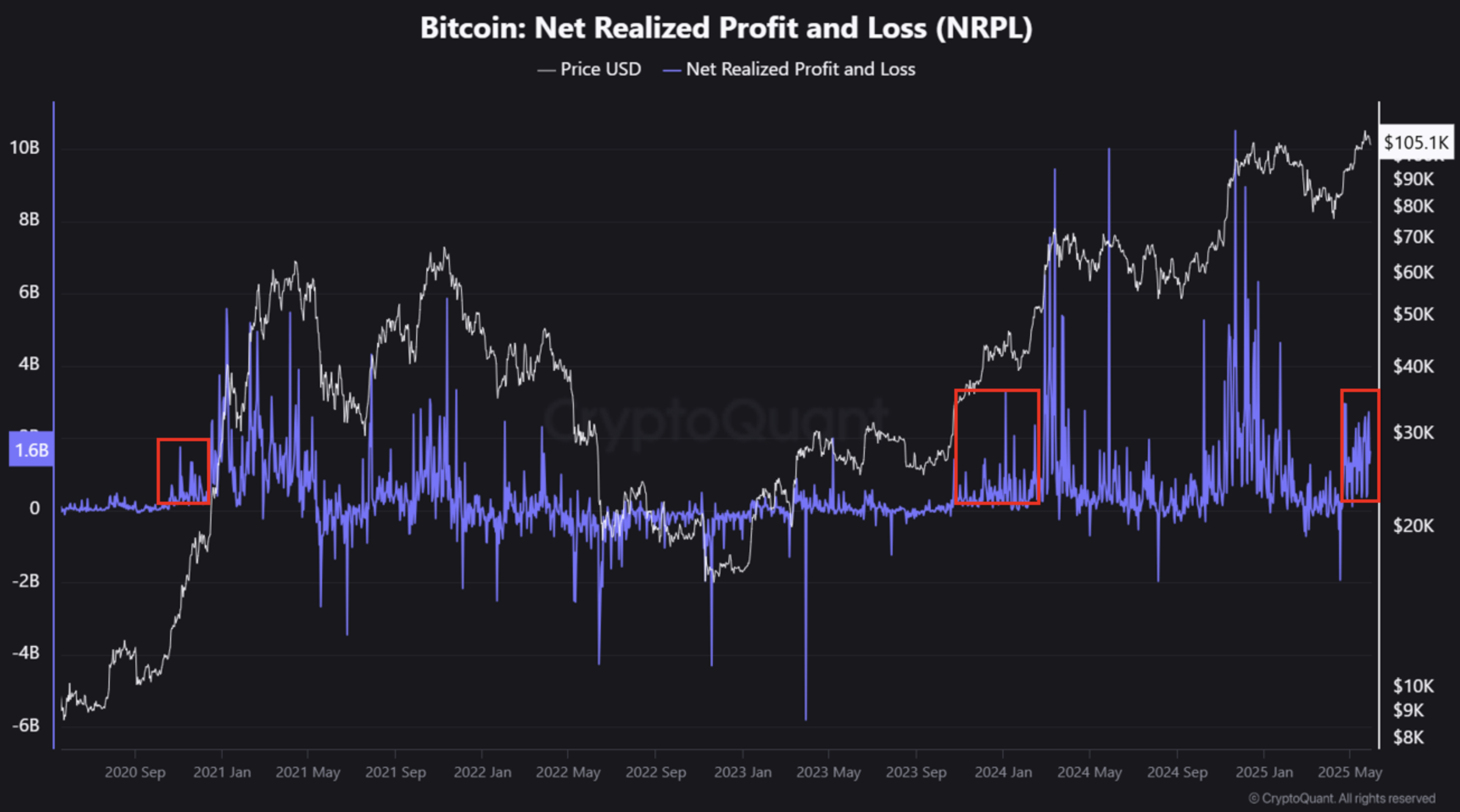

In response to a current CryptoQuant Quicktake submit by contributor Crypto Dan, Bitcoin remains to be “extremely probably” to proceed its upward trajectory. The analyst shared the Bitcoin Web Realized Revenue/Loss (NRPL) chart to assist this outlook.

Associated Studying

The NRPL chart highlights the dimensions of realized earnings and losses by market members who’re promoting BTC. A comparatively low NRPL throughout value will increase usually indicators that profit-taking is proscribed, usually indicating the continuation of a bullish development.

Within the chart, the present degree of revenue realization is highlighted in right-most crimson field. Whereas the current value surge might set off a short-term correction, the extent of realized earnings doesn’t counsel the tip of the continued upward cycle. As Dan famous:

In comparison with the NRPL spikes at previous cycle peaks, this spherical of profit-taking is comparatively restricted. Particularly, when in comparison with the actions on the highs in March and November 2024, the present degree of revenue realization is notably decrease.

Dan concluded that the present degree of profit-taking doesn’t level to a serious development reversal. As an alternative, Bitcoin is poised to proceed climbing, doubtlessly concentrating on ranges past $120,000 within the coming weeks.

Regardless of the optimism, some market watchers stay cautious. Famous crypto analyst Ali Martinez just lately urged that Bitcoin’s present value motion could be a bull lure, with BTC liable to falling under the $100,000 threshold.

For the uninitiated, a bull lure refers to when the asset briefly breaks above a well-established resistance vary, main merchants to consider a breakout is going on, however then shortly reverses and falls again under the resistance degree. This transfer usually performs out to lure in lengthy positions earlier than liquidating them as the worth drops again into the earlier vary.

Bitcoin Promoting Strain Weak, Retail But To Arrive

On a extra constructive word, a number of on-chain indicators counsel Bitcoin just isn’t but close to its cycle prime. Notably, retail investor participation within the present rally stays restricted – an indication that the market should have room for a second wave of capital influx.

Associated Studying

Likewise, Binance influx information reveals that sure investor teams will not be desirous to promote their BTC, presumably anticipating additional positive aspects. At press time, BTC is buying and selling at $105,659, down 2.5% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com