Alisa Davidson

Printed: June 05, 2025 at 11:09 am Up to date: June 05, 2025 at 11:09 am

Edited and fact-checked:

June 05, 2025 at 11:09 am

In Temporary

The article critiques contemporary knowledge from Grayscale, key developments like stablecoins and subnets, standout initiatives, 2025 token launches, and forecasts of potential 3x development by 2026 as regulation and actual income fashions take form.

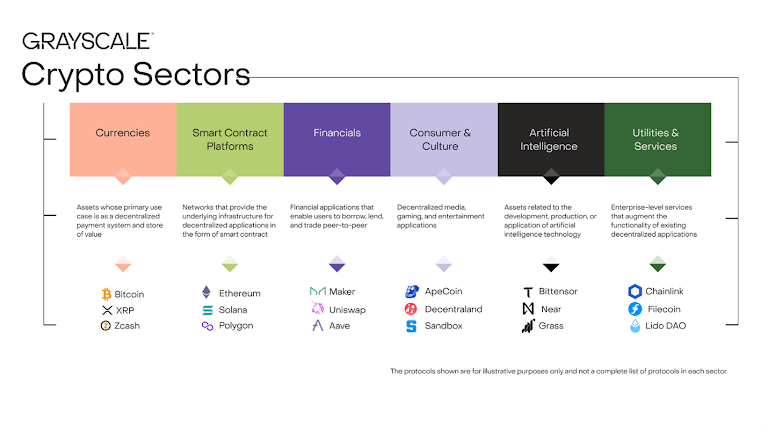

In simply two years, the AI crypto sector has expanded from $4.5 billion in 2023 to almost $20 billion in 2025. This represents a fourfold enhance in worth, pushed by technical breakthroughs, institutional consideration, and early however rising use circumstances. Regardless of its quick tempo, this phase nonetheless holds a small share of the crypto panorama—solely 0.67% of the whole market.

By comparability, the Financials sector, which incorporates DeFi platforms and tokenized funding instruments, has reached round $519 billion. That hole highlights each the early nature of AI crypto and its potential to scale.

A brand new report by Grayscale (a digital asset administration agency centered on crypto funding merchandise), led by Analysis Director Zach Pandl and Analyst Will Ogden Moore, breaks down the important thing forces behind the expansion. From stablecoin integrations, and AI agent microtransactions, to distributed AI coaching and revenue-producing protocols, this sector is shifting from hype to basis.

This text explores what’s taking place throughout the AI crypto house, what’s coming subsequent, and the way its share of the Web3 economic system could develop considerably within the subsequent two years.

Progress and Token Efficiency

The AI crypto sector, which incorporates tokens constructed round synthetic intelligence applied sciences, has expanded quickly over the past two years. Its complete market cap grew from $4.5 billion in 2023 to almost $20 billion in 2025, marking a greater than fourfold enhance.

However the sector’s efficiency hasn’t been constant throughout all tokens. ElizaOS dropped sharply — down by 80%. These large variations present that whereas the sector is rising quick, it’s nonetheless early, risky, and pushed by experimentation.

Stablecoins May Energy AI Agent Funds

AI brokers might want to make plenty of quick, small funds. For that, stablecoins are very best — they’re low-cost to ship, simple to program, and don’t change worth.

Some large corporations are already engaged on this. Coinbase, a crypto change and pockets platform, launched a brand new device to assist AI use stablecoins in funds. Meta, Stripe, and several other giant banks are exploring the identical path.

Within the U.S., lawmakers are discussing new payments just like the GENIUS stablecoin invoice and the crypto market construction invoice. If these move, extra instruments for AI and crypto may launch sooner.

Decentralized AI Coaching: Prime Mind Leads the Method

One main pattern is distributed AI coaching. As an alternative of utilizing one large knowledge middle, some initiatives use idle GPUs all around the world to coach giant fashions. Prime Mind is doing simply that.

It has already constructed fashions with over 30 billion parameters, which is a excessive quantity even for big corporations. This technique is cheaper and doesn’t depend on just some tech giants. If extra individuals undertake this mannequin, coaching AI may grow to be extra open and cost-effective.

Actual Income from AI Tasks

Many crypto initiatives are nonetheless in early testing. However some within the AI sector are already making actual income.

One instance is Grass. It collects internet knowledge and sells it to AI corporations. In line with Grayscale, Grass earns tens of tens of millions of {dollars} per yr. It’s additionally engaged on a client product, which may usher in much more customers and cash.

One other venture is Virtuals, which lets AI brokers commerce. Over the previous yr, it introduced in about $30 million in buying and selling charges. These numbers present that AI in crypto is not only idea — some initiatives are already working and incomes.

New Tokens Are Coming in 2025

Grayscale additionally factors to new tokens coming later this yr. These embody:

Gensyn, a platform for machine studying energy;

Prime, constructing instruments to run AI fashions and transfer knowledge;

Nous Analysis, a bunch centered on open-source fashions and community-driven networks.

These upcoming launches may carry extra builders and cash into the AI crypto house.

The Sector Is Nonetheless Small In comparison with the Complete Market

Even with sturdy development, the AI crypto sector remains to be small. Its $20 billion market cap is way lower than different elements of crypto:

Layer 1 chains: over $800 billion;

Stablecoins: greater than $130 billion;

DeFi and Financials: round $519 billion.

However Grayscale believes it is a good factor. Like DeFi in 2020, the AI sector is younger, filled with concepts, and able to evolve.

Huge Firms Be part of as Guidelines Turn out to be Clearer

Extra large names are coming into the house. Meta, Stripe, and Coinbase are all constructing instruments that join AI and crypto. Banks and cost methods are additionally becoming a member of. That is taking place as guidelines and legal guidelines get clearer.

Grayscale says this shift exhibits AI in crypto is now not nearly hype. It’s about constructing actual instruments and providers — issues individuals can use.

AI Crypto Sector Is Turning into a Key Layer of Web3

The bounce from $4.5B to $20B alerts a elementary change, not a short lived spike. With actual companies like Grass and Virtuals already getting cash, the house is gaining traction quick.

As Jensen Huang, CEO of Nvidia, stated:

“AI inference token era has surged tenfold in only one yr, and as AI brokers grow to be mainstream, the demand for AI computing will speed up. International locations world wide are recognizing AI as important infrastructure—similar to electrical energy and the web.”

This house isn’t simply rising. It’s laying the muse for a way digital instruments and finance will work collectively sooner or later. For traders, builders, and establishments, the AI crypto sector is rapidly turning into one of the crucial energetic and forward-moving elements of the Web3 world.

Forecast: What’s Coming in 2025 and Past?

Grayscale believes the AI crypto sector may develop to $50–75 billion by the tip of 2026. That may be round 2–3.5% of the whole crypto market, up from at present’s 0.67%.

What may drive this?

Extra stablecoin-based funds by AI;

A rising want for decentralized compute networks;

Tasks incomes cash by means of real-world use;

Legal guidelines that make it simpler for corporations to affix.

If decentralized AI coaching stays cheaper and extra scalable, it may compete with at present’s cloud giants.

These shifts counsel that AI in crypto is shifting from experimental ideas to infrastructure-level innovation. The main target is now not simply on hype or hypothesis. As an alternative, builders are fixing actual technical bottlenecks — from compute entry to cost logic — whereas traders are awaiting fashions that may scale and monetize.

Whether or not AI crypto reaches $50 billion or extra, the subsequent wave received’t be outlined by token launches alone. It would come all the way down to utility, sustainability, and the way properly these networks combine with the evolving web and regulatory frameworks. The foundations are being laid now — and 2025 would be the yr they start to carry weight.

Disclaimer

According to the Belief Undertaking pointers, please word that the knowledge offered on this web page is just not meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation if in case you have any doubts. For additional info, we advise referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.