The crypto market is as soon as once more abuzz as Pump.enjoyable prepares to formally debut its native token.

The venture, broadly credited with popularizing the present “meme 2.0” wave, has attracted each pleasure and skepticism forward of its token technology occasion (TGE). Whereas the advertising and marketing firepower and cultural affect of Pump.enjoyable are plain, the query looms giant: what can we moderately anticipate from the token’s worth efficiency post-TGE?

To reply that, we flip to historical past. A cautious examination of main TGE performances within the final euphoric market cycle – notably throughout the late levels of the 2021 bull run, gives worthwhile perception into what the Pump.enjoyable token might face within the weeks and months forward.

Pump.enjoyable: The Narrative Engine of 2025

What separates Pump.enjoyable from most of the 2021-era tasks is its meme-native id and cultural virality. Relatively than promising to “revolutionize finance” with advanced architectures, Pump.enjoyable gives creators and communities a simple solution to launch meme tokens immediately on Solana.

Its success is plain: over 100,000 meme tokens have been minted utilizing the platform, and buying and selling volumes routinely compete with prime decentralized exchanges.

Now, the platform goals to capitalize on that momentum with an bold token sale. The main points are putting:

Goal increase: $1 billionImplied FDV: $4 billionAllocation: 25% of provide bought in TGE, with the remaining going to crew, ecosystem, and neighborhood incentives.

Learn extra: Pump.enjoyable to Launch Token & Airdrop, Targets $1B Increase at $4B Valuation

Supply: Kaito

It’s a daring transfer that underscores each the platform’s confidence and the speculative nature of the market cycle it operates in.

The 2021 Case Research: Hovering Excessive, Then Falling Quick

The latter half of 2021 noticed a frenzy of high-profile crypto token launches. Whereas many of those tasks boasted sturdy fundamentals and spectacular consumer metrics, the timing of their TGE – on the peak of market exuberance, in the end set the stage for dramatic post-launch downturns.

A number of key indicators assist this view: Bitcoin dominance (BTC.D) has climbed above 56% for the primary time since early 2021, signaling a rotation from altcoins again into BTC.

Ethereum has rallied almost 45% in Might alone, pushed partly by ETF hypothesis. In the meantime, meme cash like PEPE and WIF soared, mirroring previous cycle peaks pushed by hypothesis.

In 2017 and 2021, rising BTC dominance signaled altcoin exits earlier than main market corrections. Relatively than marking renewed bullishness, it signaled warning, suggesting that the broader market had exhausted its danger urge for food.

Immediately’s metrics recommend Pump.enjoyable might face comparable hype-driven decline in coming weeks.

Take Move (FLOW) as an example. Launched at $9.90, CVX hit $43.35 then fell to $0.40 by 2025—simply 3.8% ROI.

Or think about Casper (CSPR), which launched in Might 2021 at $1.29. Regardless of briefly peaking above $5, CSPR now trades close to $0.012 – down greater than 99% from its launch worth. The same trajectory befell Osmosis (OSMO) and dYdX (DYDX), each of which misplaced over 95% from their post-TGE highs.

Even prime platforms like Convex Finance struggled as soon as the bear market took maintain. Regardless of hitting $60.33 in early 2022, CVX now sits under its launch worth of $3.01.

ChallengeTGE DateTGE WorthATH WorthPresent WorthFLOW27/1/20219.943.5 (4/5/2021)0.375CSPR11/5/20211.295.12 (11/5/2021)0.0122OSMO19/6/2021526.8 (3/12/2021)0.214CVX15/5/20213.0160.33 (1/1/2022)2.7dYdX8/9/202114.327.66 (30/9/2021)0.574

Tasks launching late in bull markets typically crash as hype fades and sentiment weakens.

Echoes of the Previous: Is Pump.enjoyable Overvalued at Launch?

With a $4 billion absolutely diluted valuation at TGE, Pump.enjoyable would immediately develop into one of many prime meme tokens by market cap – probably putting it in the identical class as PEPE, DOGE, and BONK.

But in contrast to DOGE, which has over a decade of brand name recognition, or PEPE, which advanced right into a cultural image, Pump.enjoyable’s worth proposition is tied virtually completely to platform utilization and meme market momentum.

This raises considerations much like these confronted by 2021 tokens: excessive TGE valuation, comparatively quick monitor file, and heavy insider allocation.

Traditionally, such setups are inclined to end in intense early buying and selling volatility, adopted by sustained promote strain as early patrons search to appreciate positive factors and unlocks start to hit the market.

That stated, Pump.enjoyable’s newest platform metrics paint a compelling image of consumer exercise and development:

Buying and selling payment income in 2025: $296.1 million, surpassing Ethereum’s $249.1 million and main all protocols in weekly income for 9 consecutive weeks.Tokens minted per thirty days: Over 10 million in April 2025, averaging ~30,000 new tokens per day.Day by day lively customers (DAU): Over 156,000 as of Might 2025.

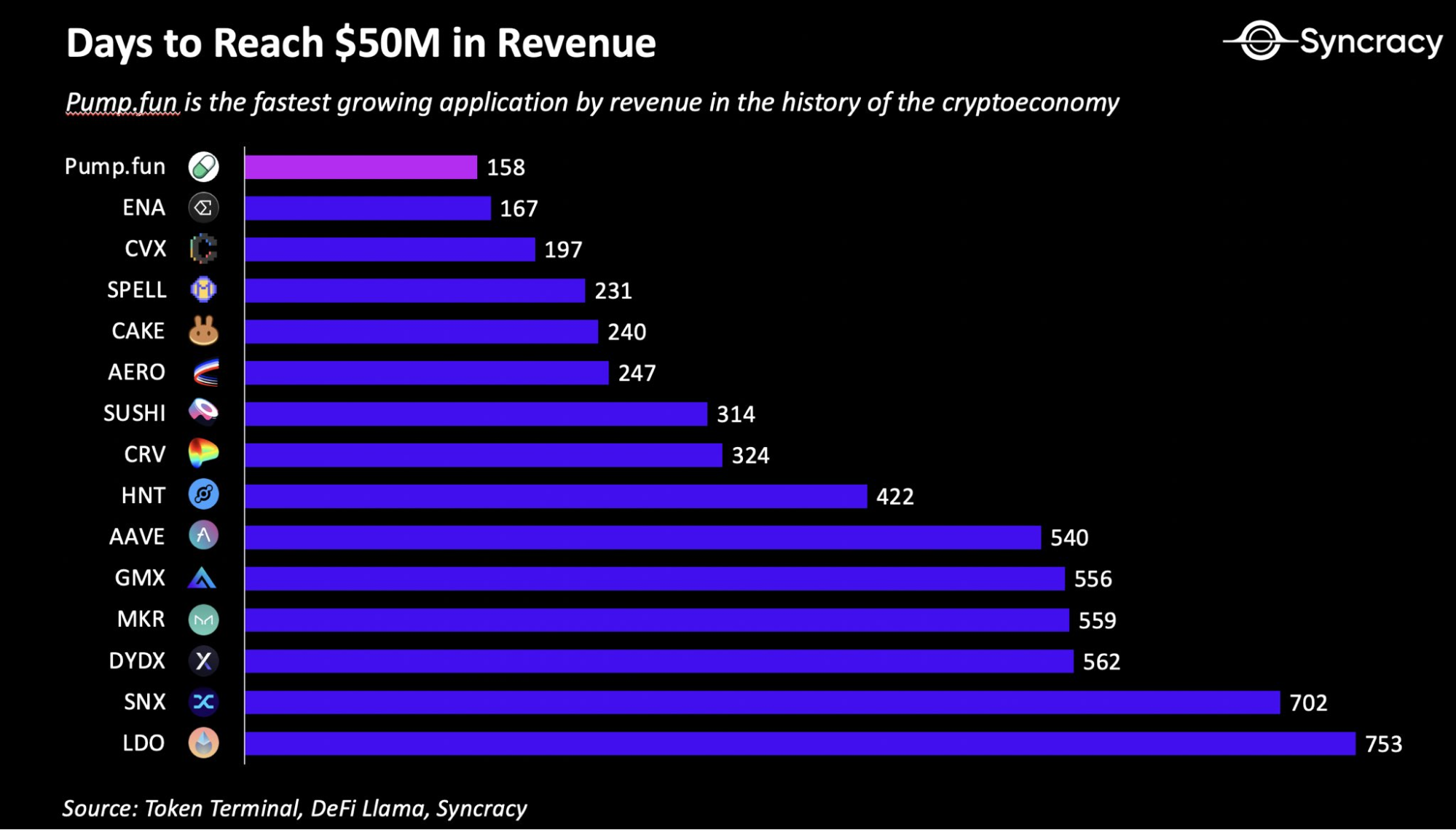

Supply: Syncracy

Nonetheless, these spectacular metrics increase questions on long-term sustainability. Many tokens on Pump.enjoyable exist for only some days, catering to short-term hypothesis quite than neighborhood constructing.

The explosive development in token creation might shortly result in oversaturation, echoing the fates of earlier hype-driven ecosystems.

Potential Worth Pathways: Situations Put up-TGE

Assuming Pump.enjoyable launches at an preliminary market cap of roughly $1 billion primarily based on circulating provide, the token might observe one among a number of paths relying on market sentiment and investor conduct.

In a bullish case, harking back to dYdX’s launch, the token would possibly see a pointy worth surge pushed by hype and FOMO, probably peaking at 2–3 instances its TGE worth inside days.

This might seemingly be adopted by a gradual decline as early buyers lock in earnings and vesting schedules start to launch extra tokens into circulation.

A extra impartial consequence might mirror Osmosis, the place the token trades sideways or experiences modest development for a brief interval. Retail curiosity would possibly preserve it afloat, however constant promote strain from seed buyers might push the value again towards TGE ranges inside two to a few months.

The bearish case, much like Casper’s trajectory, would contain the market rejecting the excessive valuation outright. This might set off a swift wave of promoting, notably if preliminary liquidity is skinny.

The token would possibly then fall 80–90% from its launch worth inside a number of months, reflecting broader considerations over sustainability and overvaluation.

Conclusion

Pump.enjoyable’s token launch is ready to be some of the talked-about occasions of this cycle. It combines meme tradition, Solana’s revival, and airdrop-fueled engagement into one extremely speculative package deal. Whereas short-term volatility might create alternatives for savvy merchants, long-term holders must be cautious of coming into at peak valuations.

Historical past means that tokens launched throughout euphoric phases, particularly these with excessive FDV and aggressive personal allocations – typically face brutal corrections.

Except Pump.enjoyable can ship sustained platform development, novel use circumstances for its token, and disciplined emission schedules, it dangers changing into one other cautionary story of bull market exuberance.

Learn extra: Buying and selling with Free Crypto Alerts in Night Dealer Channel