President Donald Trump’s return to the White Home is reigniting debates throughout monetary markets — particularly on the planet of crypto. Because the Trump Bitcoin narrative features traction, traders are intently watching how his insurance policies, public statements, and political model may form the way forward for digital property.

His affect on conventional markets is well-documented, however his latest statements and actions have made the cryptocurrency neighborhood marvel: How may Trump’s resurgence impression Bitcoin (BTC)? This text examines the implications of Trump’s present presidency on Bitcoin, drawing from latest occasions, market sentiment, and skilled analyses.

Trump’s Evolving Relationship with Bitcoin

President Donald Trump has had a fancy and evolving stance on Bitcoin. In his first time period (2017–2021), he was publicly skeptical of cryptocurrencies, famously tweeting in 2019 that Bitcoin was “based mostly on skinny air” and “not actual cash.”

Regardless of this, the crypto market thrived beneath his management, Bitcoin rose from roughly $1,000 in early 2017 to over $33,000 by January 2021, fueled by broader macroeconomic shifts and rising institutional curiosity.

Now in his second time period, Trump’s tone has shifted. Whereas he has not explicitly endorsed Bitcoin as a monetary instrument, he has embraced blockchain-related ventures. His NFT assortment – “Trump Digital Buying and selling Playing cards”, offered out rapidly and generated over 13,000 ETH in buying and selling quantity on OpenSea, reflecting his willingness to interact selectively with crypto applied sciences.

Furthermore, Trump has made fewer detrimental remarks about Bitcoin throughout his present time period. Some analysts interpret this as a strategic transfer to keep away from alienating the rising variety of U.S. crypto traders and blockchain entrepreneurs.

Though he nonetheless emphasizes the significance of U.S. greenback dominance, Trump’s evolving engagement with blockchain alerts a extra pragmatic, much less combative stance on Bitcoin than in years previous.

Trump, Inflation, and Bitcoin’s Secure Haven Standing

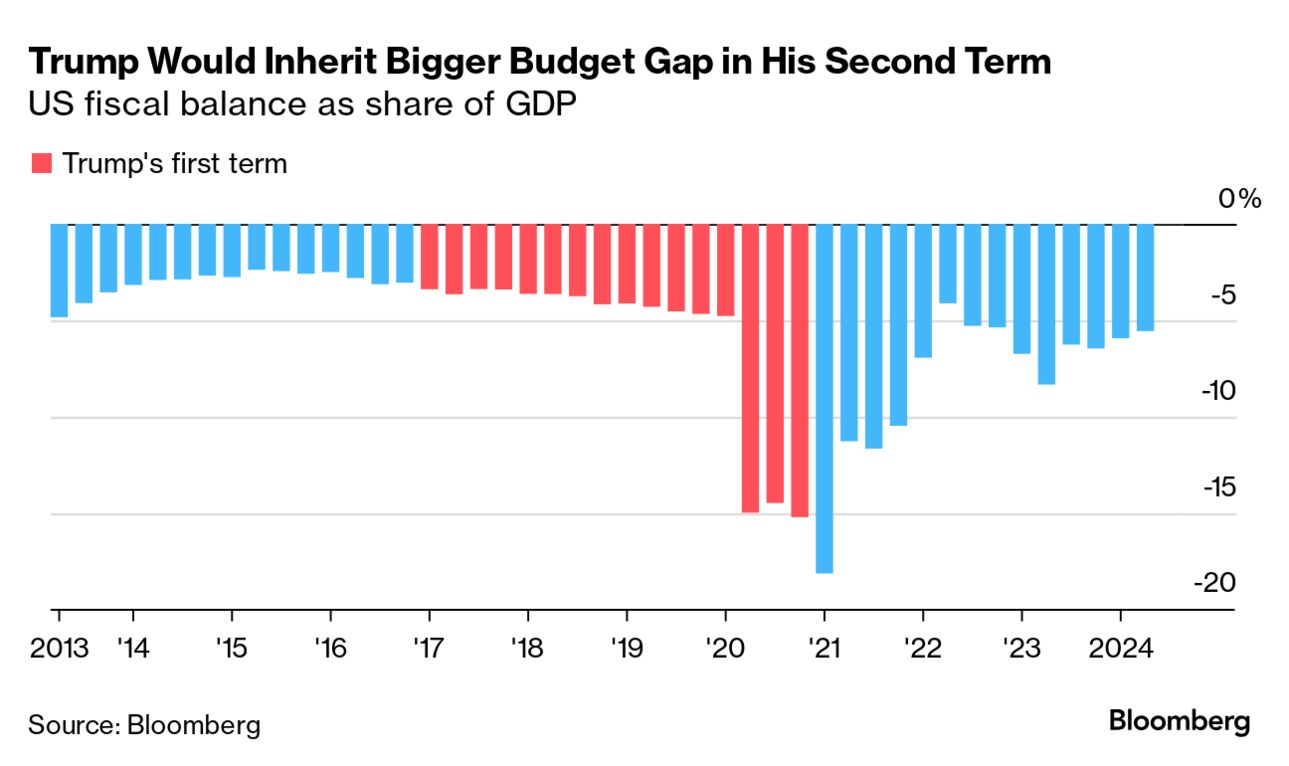

One of the vital vital financial themes beneath President Trump’s management has been his dedication to growth-driven fiscal coverage, even on the threat of inflation. His administration’s continued advocacy for low rates of interest, company tax cuts, and stimulus spending has raised considerations about long-term debt ranges and potential erosion of the greenback’s buying energy.

Current inflation readings stay elevated in early 2025, with the Client Value Index (CPI) up 4.1% year-over-year in April – increased than the Federal Reserve’s 2% goal. These macroeconomic pressures have bolstered Bitcoin’s attraction as a retailer of worth amongst each institutional and retail traders.

Supply: Haver Analytics

Bitcoin is commonly described as “digital gold” for its fastened provide and decentralized nature. In environments the place conventional fiat currencies could lose worth as a consequence of expansionary financial coverage, Bitcoin tends to see larger inflows.

The mix of fiscal stimulus and geopolitical uncertainty beneath Trump’s management has strengthened the narrative round BTC as a hedge towards inflation.

As Trump ramps up infrastructure investments and tax incentives in his second time period, some analysts argue that inflationary tailwinds may additional speed up Bitcoin’s adoption, significantly if the Federal Reserve stays sluggish to tighten financial circumstances.

Supply: Bloomberg

Regulatory Strategy in Trump’s Second Time period

One of the vital vital elements traders are watching intently is Trump’s potential method to cryptocurrency regulation. Trump’s earlier administration had a combined regulatory stance.

Whereas the President himself expressed skepticism, his appointed SEC chair, Jay Clayton, took cautious but largely permissive actions towards crypto markets, significantly in approving merchandise like Bitcoin futures contracts.

Below Trump’s present administration, regulatory uncertainty could persist, given Trump’s normal ambivalence in direction of crypto. Nonetheless, market contributors speculate that the broader Republican platform, emphasizing innovation and financial freedom, may mitigate extreme regulatory restrictions.

Furthermore, some Republican lawmakers aligned with Trump, similar to Senator Cynthia Lummis have been vocal supporters of Bitcoin. Their affect could result in extra favorable legislative developments.

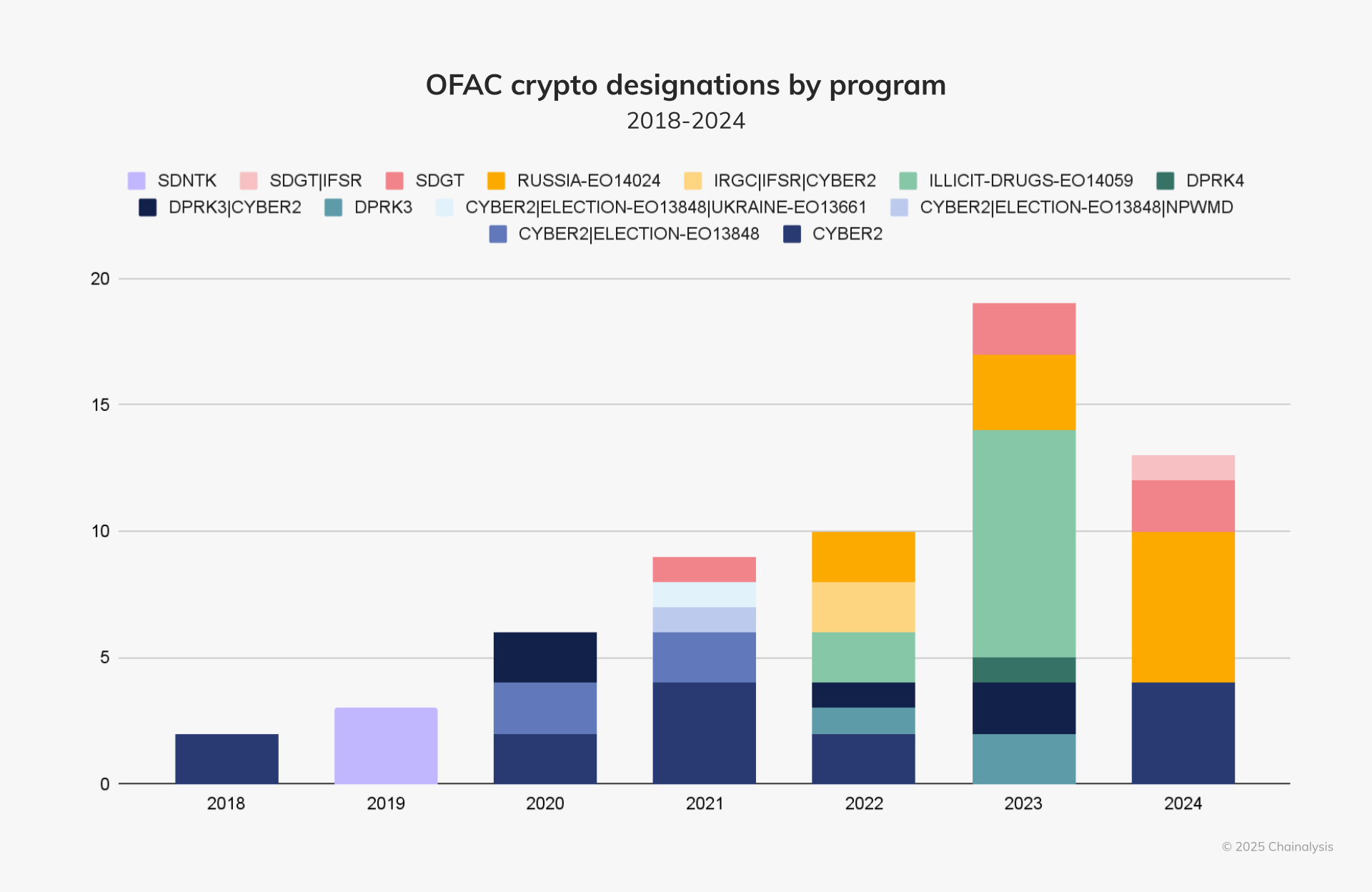

Nonetheless, Trump’s return to energy has reignited scrutiny from businesses just like the Treasury’s Monetary Crimes Enforcement Community (FinCEN), particularly if illicit crypto use turns into a headline political challenge.

Trump’s Communication Fashion and Bitcoin Volatility

Trump is famously recognized for his market-moving statements and tweets, contributing considerably to short-term volatility in conventional markets. Cryptocurrencies, already extremely delicate to sentiment-driven buying and selling, may expertise elevated volatility in response to Trump’s public feedback and coverage bulletins.

For example, any direct criticism or assist from Trump relating to Bitcoin may set off speedy, sharp actions in BTC’s value. Merchants would possible brace for heightened volatility if Trump’s marketing campaign features additional momentum.

Throughout his presidency, Trump’s tweets affected all the pieces from Federal Reserve coverage to grease costs and Bitcoin was not immune.

A re-election may convey again this unpredictable communication model, forcing crypto traders to think about not simply financial knowledge, but in addition political noise.

Bitcoin in International Energy Dynamics

Past home financial insurance policies, Trump’s method to worldwide relations and sanctions may additionally not directly impression Bitcoin. Trump’s administration beforehand imposed stringent sanctions on international locations similar to Iran and Venezuela, which subsequently boosted Bitcoin adoption as these nations turned to cryptocurrencies to avoid restrictions.

In line with a 2021 Chainalysis report, Venezuela and Iran have been among the many prime international locations by Bitcoin quantity progress during times of elevated U.S. sanctions.

Bitcoin, with its censorship-resistant properties, usually turns into a most popular medium of trade beneath geopolitical stress.

Ought to Trump resume his earlier aggressive stance on world commerce and sanctions, Bitcoin may expertise renewed curiosity as a geopolitical device, each for sanctioned international locations and people looking for impartial monetary avenues.

Institutional Positioning within the Trump Period

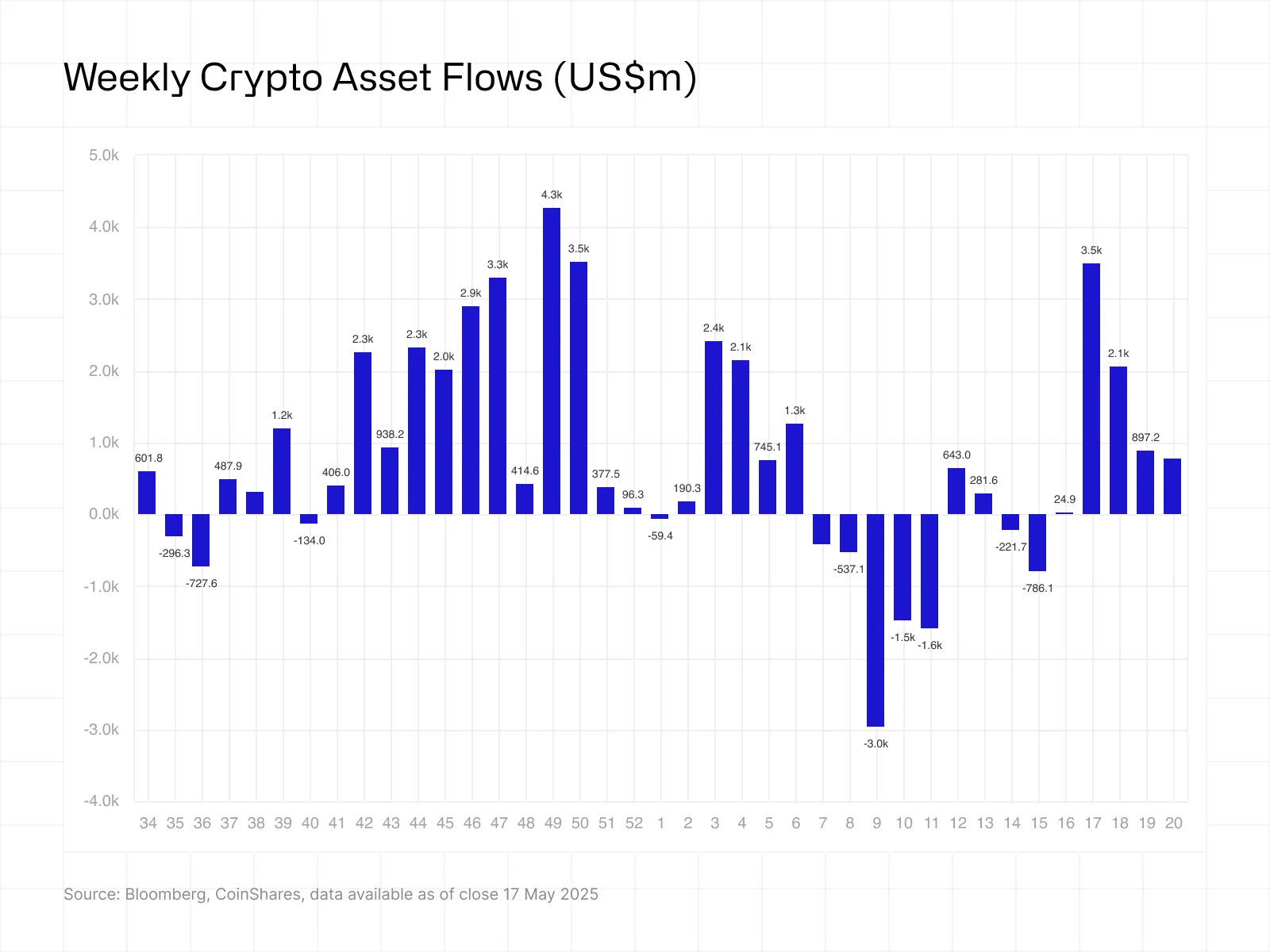

Institutional traders, lengthy thought to be key drivers of crypto market maturity, proceed to regulate their methods in response to Trump’s second-term financial insurance policies. His administration’s emphasis on fiscal growth, deregulation, and nationwide competitiveness has renewed each curiosity and warning from giant capital allocators.

In line with CoinShares’ Might 2025 report, digital asset funding merchandise recorded over $2 billion in web inflows in simply 4 weeks – 72% of which went immediately into Bitcoin. This pattern means that establishments usually are not solely resilient of their crypto publicity however can also see Bitcoin as a macro hedge towards potential volatility triggered by Trump’s aggressive fiscal stance.

A 2024 Constancy Digital Property survey echoed this sentiment, revealing that over 74% of institutional traders globally imagine digital property must be a part of a well-diversified portfolio.

Trump’s second-term insurance policies, particularly these regarding commerce, debt issuance, and rate of interest strain on the Fed are seen as catalysts for elevated publicity to Bitcoin, significantly by hedge funds and asset managers seeking to front-run inflation or greenback devaluation.

As political and financial uncertainty mounts, many establishments are viewing Bitcoin not merely as a speculative asset, however as a foundational element in portfolio threat administration throughout the Trump period.

Knowledgeable Views on Trump’s Bitcoin Influence

Distinguished analysts stay divided on how President Trump’s present time period could affect Bitcoin. Some spotlight the potential for short-term volatility tied to his unpredictable communication model and market interventions, whereas others give attention to the longer-term financial shifts stemming from his inflationary coverage posture.

Anthony Pompliano, a famous crypto investor and commentator, remarked in Might 2025: “Trump’s financial agenda – anchored in progress and financial stimulus, could drive extra traders towards exhausting property like Bitcoin. Previously, we’ve seen BTC thrive beneath related macro pressures.”

Conversely, economist Nouriel Roubini continues to warn towards underestimating Trump’s skepticism of digital property.

Nonetheless, even Roubini admits the broader Republican surroundings could show extra innovation-friendly in comparison with the regulatory crackdowns seen beneath the Biden administration. This political realignment, some argue, may create a extra fertile floor for digital asset adoption within the U.S.

Trump’s Embrace of NFTs and Crypto Innovation

Regardless of his earlier criticisms of digital currencies, President Trump has more and more signaled a selective openness towards blockchain applied sciences. A pivotal instance was the launch of his NFT sequence, “Trump Digital Buying and selling Playing cards,” in December 2022.

The gathering offered out inside hours, and based on OpenSea knowledge, it has since generated greater than 13,000 ETH in buying and selling quantity, underscoring each its business success and cultural impression.

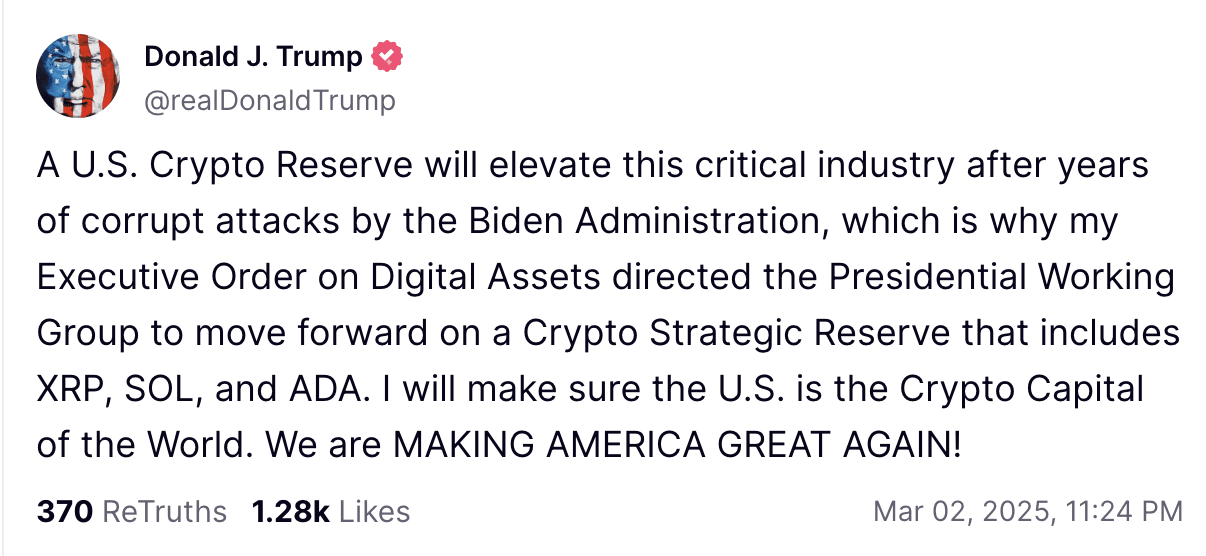

Now in his second time period, Trump has not solely avoided direct criticism of crypto, however has additionally expressed curiosity in exploring blockchain for presidency transparency and marketing campaign fundraising mechanisms.

Sources near his administration have hinted at doable pilot applications leveraging tokenization to modernize monetary infrastructure and digital identification techniques.

Whereas Trump stays cautious about decentralized currencies like Bitcoin changing the U.S. greenback, his evolving engagement with tokenized property suggests a extra pragmatic and opportunistic view of the crypto ecosystem.

Many analysts see this shift as a strategic try to align with the rising demographic of Web3-savvy voters and entrepreneurs.

Conclusion

President Trump’s second time period has reshaped the panorama for Bitcoin, mixing fiscal growth, regulatory ambiguity, and selective engagement with crypto innovation. Whereas uncertainty persists, Bitcoin seems more and more positioned as each a hedge towards inflation and a strategic asset amid evolving world energy dynamics.

From heightened volatility pushed by Trump’s communication model to a softening stance on blockchain innovation, the present administration’s method continues to affect institutional positioning and public sentiment round Bitcoin.

Learn extra: Trump Crypto: Every little thing You Have to Know About Donald Trump’s Involvement in Crypto