Pendle Finance has exhibited a outstanding trajectory of fast improvement and strategic development since its inception, marked by a sequence of great milestones in its protocol evolution and growing market adoption.

Pendle Finance formally launched in June 2021. The foundational concept for Pendle originated from the noticed lack of efficient choices for buying and selling and pricing tokenized yield property inside the present DeFi panorama.

Pendle Finance’s Key Milestones

Pendle’s TVL Statistics

Since its launch, the protocol’s TVL has skilled substantial development. By June 2024, Pendle’s TVL surged to an ATH of $6.72 billion, later stabilizing round $2 billion. Present information signifies a TVL of roughly $4.88 billion, with different sources reporting over $4 billion. The vast majority of this TVL is targeting Ethereum, accounting for almost $4.5 billion.

Supply: DefiLlama

Nevertheless, Pendle’s multi-chain technique is obvious. Its TVL distributes throughout different chains. These embrace Base ($180.34 million), Sonic ($111.78 million), Arbitrum ($49.9 million), Berachain ($32.4 million), Mantle ($12.31 million), BSC ($4.25 million), Avalanche ($57,474), and OP Mainnet ($37,438).

This distribution highlights Pendle’s cross-chain enlargement success. It broadens its consumer base. It additionally reduces reliance on a single blockchain, thereby enhancing resilience and accessibility.

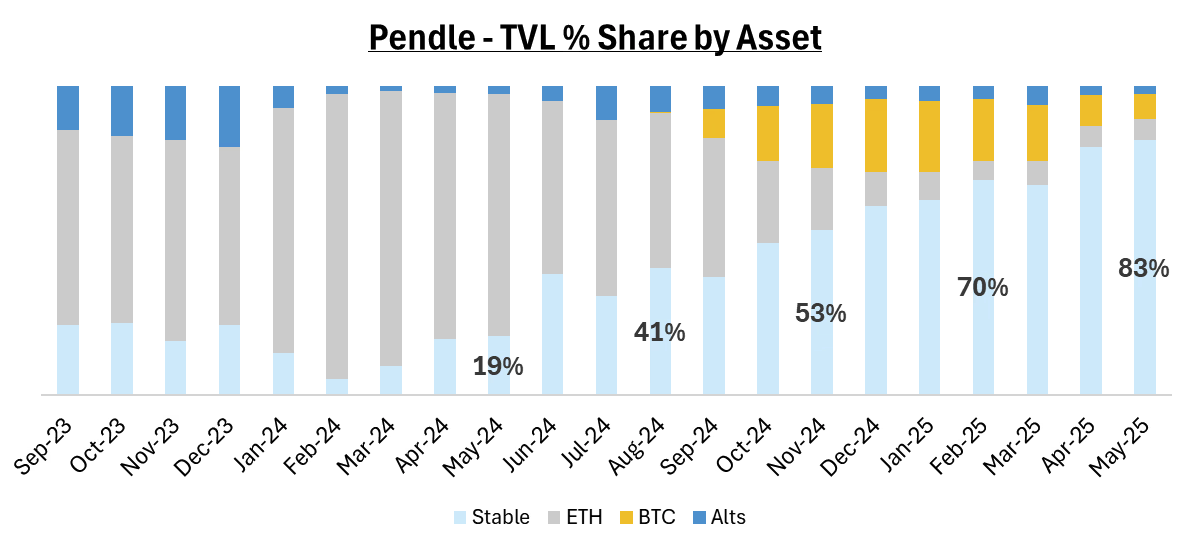

Supply: Pendle

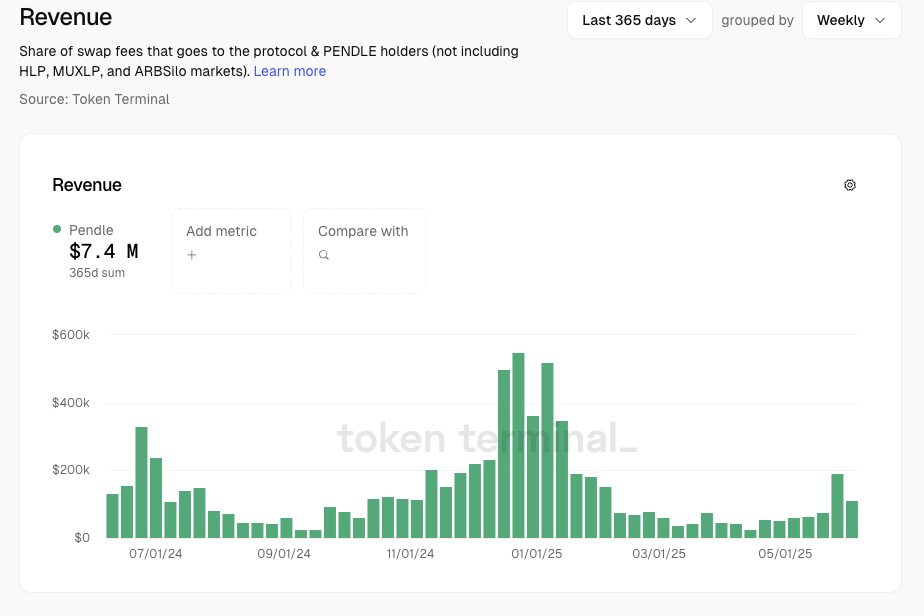

Pendle’s Income

Pendle has additionally demonstrated constant and steady income era since June 2024, averaging over $4 million monthly. Annualized income figures are reported at $22.32 million and $42.88 million, primarily derived from a 5% take charge on the yield generated by property on its platform and from buying and selling charges.

A big milestone was the complete unlock of group and investor tokens in September 2024. The truth that Pendle has maintained “steady income” and “elevated utility driving sustainable demand” after this occasion signifies a strong underlying financial mannequin and natural demand, slightly than dependence on synthetic token incentives.

For institutional traders and long-term stakeholders, this post-unlock stability is a powerful sign of maturity and viability. It considerably de-risks the funding profile of the PENDLE token, addressing issues about “rug pulls” or “capital flight” which have plagued many DeFi tasks. This resilience positions Pendle as a extra dependable and sustainable participant within the fixed-yield DeFi area.

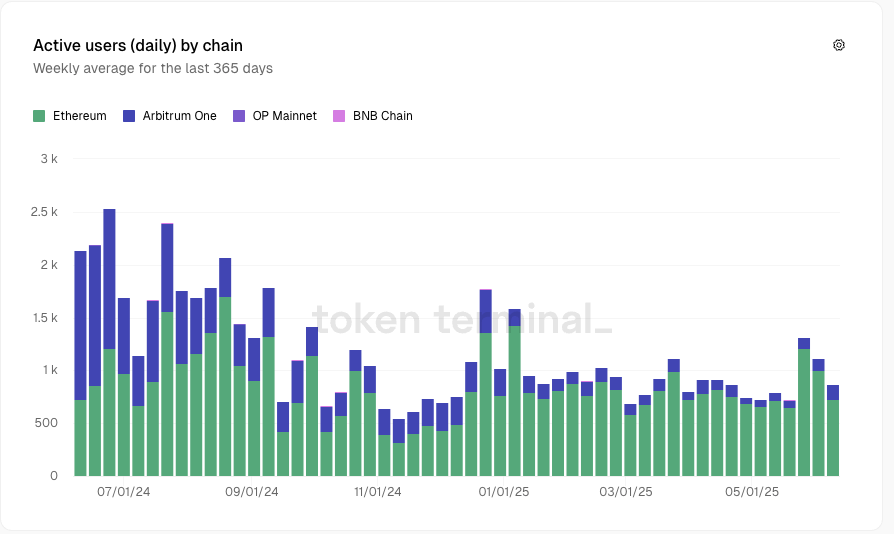

Pendle’s Each day Lively Customers (DAU)

When it comes to consumer engagement, Pendle has roughly 280,000 lively customers. Each day lively addresses are reported at 1,000. It is very important notice these lively handle counts. They sometimes embrace solely customers who work together immediately with the protocol. They exclude those that may use DEX aggregators or different middleman contracts. They’re additionally restricted to particular chains.

Pendle DAU chain breakdown. Supply: Token terminal

Pendle Yield Bearing Stablecoin Market Shares

Pendle additionally holds a major place within the yield-bearing stablecoin market. It captures 30% of all yield-bearing stablecoin provide. The general yield-bearing stablecoin market has reached a price of $11.3 billion. This accounts for 4.5% of the overall stablecoin market. Pendle’s share is anticipated to stay round 25%. This give attention to a rising and comparatively steady section of the DeFi market contributes to its sturdy TVL.

Supply: Pendle

Pendle Cross-Chain Enlargement and Adoption Traits

Multi-Chain Technique and Future Enlargement

Pendle has pursued an aggressive multi-chain technique and cast key partnerships to broaden its attain and utility inside the decentralized ecosystem. This enlargement is essential for enhancing accessibility, lowering transaction prices, and tapping into numerous liquidity swimming pools.

Past its preliminary deployment on Ethereum, Pendle has expanded its operations to a number of Layer 2 options and various blockchains. Its present presence consists of EVM chains equivalent to Ethereum, Arbitrum, Base, and Sonic.

The protocol has concrete plans for additional enlargement, with Solana assist anticipated for Q3 2025, and extra integrations deliberate for Hyperliquid and TON. This multi-chain strategy is designed to reinforce accessibility and cut back transaction prices for customers, attracting a wider consumer base.

Key Integrations: Aave v3 & Pendle Finance

A big integration is Pendle’s assist for PT-USDe as collateral inside the Aave v3 protocol. This integration permits holders of Pendle’s fixed-yield PT-USDe token to make use of it as collateral on Aave, both for capital effectivity or to re-deposit and leverage up yields.

Aave v3 & Pendle. Supply: Aave DAO Governance Discussion board

Since this integration went reside, roughly $1 billion in PT-USDe has been deposited into Aave, along with an present $500 million on Morpho. This transfer is pivotal because it integrates Pendle into Ethereum’s largest lending protocol, considerably increasing its capital entry and ecosystem participation.

Ethena & Pendle Finance Partnership

Pendle has additionally established a key partnership with Ethena and its new Converge blockchain. Ethena’s EVM chain will incorporate a local Know Your Buyer (KYC) functionality. This permits compliant entry for establishments to Pendle’s yield merchandise and platform. This enables Pendle to take part within the development of permissioned yield-bearing stablecoins, equivalent to iUSDe by Ethena.

Supply: 0xCheeezzyyyy

Ethena additionally leveraged Pendle when its USDe stablecoin launched in February 2024. This was to bootstrap preliminary utilization and liquidity. In simply 4 months, Pendle helped Ethena scale from zero to over $3 billion in issuance. It drove 50% of Ethena’s development and exercise. This was by facilitating mounted yield locking on USDC deposits for customers who most well-liked to not work together immediately with Ethena.

Permissionless Listings and Different Integrations

Moreover, Pendle is transferring in the direction of permissionless listings of property on its market. In March 2025, the protocol took step one to have the primary externally listed asset on its platform. Whereas official property are underneath “Pendle Prime,” this initiative permits third events to checklist property with out the group appearing as a bottleneck. That is essential for supporting the complete breadth of property, notably long-tail stablecoins.

Different notable integrations embrace Falcon Finance integrating $sUSDf with Pendle for enhanced on-chain yield era. Coinshift’s csUSDL stablecoin additionally reached $100 million in TVL as a prime passive revenue asset on Pendle. Cygnus Stablecoin wcgUSD additionally not too long ago went reside on Pendle.