Cryptocurrency buying and selling can really feel overwhelming once you’re simply beginning out. Nevertheless it doesn’t need to be. With the precise instruments, a stable plan, and a transparent understanding of how crypto markets behave, you can begin buying and selling digital belongings confidently, at the same time as a newbie. This information reveals you the way to commerce crypto from scratch, masking every part from selecting your first coin to avoiding pricey errors. Whether or not you’re interested by day buying and selling or simply need to discover ways to purchase and promote safely, that is the place you begin.

What Is Crypto Buying and selling?

Crypto buying and selling means shopping for and promoting cryptocurrencies to make a revenue. You attempt to predict worth actions by analyzing market traits—similar to in inventory or foreign currency trading. The aim is easy: purchase low, promote excessive.

Not like conventional markets, crypto trades 24/7. Costs transfer quick, pushed by information, provide and demand, investor sentiment, and broader financial occasions. Merchants use instruments like charts and indicators to identify patterns and time their strikes.

Some commerce day by day, others maintain long-term. Both means, you’re all the time reacting to how the market behaves.

Why Commerce Cryptocurrency?

Buying and selling cryptocurrencies provides alternatives that conventional markets typically don’t. Right here’s why many select to commerce digital belongings:

24/7 market entry. Not like inventory markets, cryptocurrency exchanges by no means shut. You may commerce anytime, together with weekends and holidays.

Volatility creates alternative. Crypto costs transfer shortly. This offers merchants extra possibilities to revenue from short-term adjustments.

Low entry obstacles. You don’t want a big sum to start out. You may commerce with as little as $10.

Various digital belongings. 1000’s of cryptocurrencies provide distinctive options and roles, giving merchants a wider vary of choices.

International market. Crypto buying and selling is borderless. You’re not restricted by country-specific exchanges or enterprise hours.

Grow to be the neatest crypto fanatic within the room

Get the highest 50 crypto definitions you could know within the business totally free

Crypto Buying and selling vs. Inventory Buying and selling

Crypto buying and selling and inventory buying and selling each contain speculating on worth actions, however how they work beneath the hood may be very completely different.

Cryptocurrency markets are decentralized, borderless, and run on blockchain networks. Trades settle in minutes and belongings might be self-custodied. In distinction, inventory markets are centralized, function via brokers, and depend on third-party custodians. Meaning crypto provides you extra management, but additionally extra accountability for issues like safety and threat administration.

With shares, you’re buying and selling fairness—possession in a real-world firm, backed by financials, management groups, and regulatory filings. In crypto, belongings vary from utility tokens, to governance rights, to pure hypothesis. The worth behind every token varies broadly, and also you typically need to do extra due diligence your self.

Regulation is one other key distinction. Shares are closely regulated by nationwide authorities (just like the SEC within the U.S.). Crypto regulation remains to be growing, varies by nation, and in some circumstances, is nonexistent. This makes the crypto market extra versatile—but additionally riskier and fewer predictable for brand new merchants.

How you can Begin Buying and selling Crypto

To begin buying and selling you want the precise instruments and a plan. Right here’s a step-by-step information that covers every part you want, from making a crypto account to creating your first commerce.

Select a Crypto Trade

Begin by selecting a cryptocurrency change. That is the platform the place you’ll purchase, promote, and commerce digital belongings. Search for one that provides low charges, sturdy safety, and a user-friendly interface. It ought to help your native foreign money and most well-liked cost strategies. Respected exchanges like Coinbase, Binance, and Kraken are good beginning factors should you’re not sure.

Setting Up Your Account

When you’ve picked an change, create an account utilizing your electronic mail and a safe password. Most platforms will ask for identification verification via a KYC course of. This often includes importing an official ID and a photograph to substantiate your identification. Some exchanges full this in minutes, whereas others might take longer. After verification, you’ll have full entry to buying and selling options.

Fund Your Account

To begin buying and selling, deposit cash into your account. Most exchanges help funds by way of financial institution switch, card, or third-party providers. Some additionally allow you to deposit cryptocurrencies should you already personal some. Select the funding methodology with the bottom charges and the quickest processing time. As soon as your steadiness is obtainable, you’re able to make your first commerce.

Select a Pockets

Storing your crypto safely is simply as essential as buying and selling it. You need to use the change’s built-in pockets, nevertheless it’s safer to retailer your belongings in a pockets you management. You have got a number of choices right here. Scorching wallets are linked to the web and are extra handy for lively merchants. In the meantime, chilly wallets are offline and supply stronger safety for long-term holdings. Inexperienced persons typically begin with scorching wallets and later change to chilly storage for higher safety.

Learn extra: Prime Cryptocurrency Wallets

Purchase, Promote, and Swap Crypto

To make your first commerce, choose a crypto buying and selling pair like BTC/USD or ETH/USDT. You may place a market order if you need the commerce to occur instantly on the present worth. In case you’re ready for a particular worth, use a restrict order (hyperlink).

Swapping helps you to change one cryptocurrency for one more with out utilizing fiat foreign money, which is helpful for portfolio changes.

Monitor Your Account and Commerce Historical past

After you make a commerce, you’ll need to monitor your account exercise. Most exchanges provide you with entry to your commerce historical past, open orders, and steadiness adjustments. Use this knowledge to trace your earnings, losses, and buying and selling charges. Reviewing your historical past recurrently helps you enhance your technique and spot traits in your efficiency.

Withdraw Your Cryptocurrency right into a Pockets

When you’ve accomplished a commerce, you’ll be able to depart your crypto on the change or transfer it to a private pockets. To withdraw, go to the withdrawal part, enter your pockets handle, verify the main points, and full the transaction. Transferring your crypto off the change lowers the danger of dropping entry if the platform faces technical points, freezes, or there’s a safety breach.

Sorts of Cryptocurrency Buying and selling

There are two predominant methods to strategy the crypto market: long-term and short-term buying and selling. Don’t mistake these for lengthy and quick positions––this can be a completely different idea.

Your technique is dependent upon how typically you need to commerce, how a lot time you’ll be able to commit, and how much threat you’re comfy with. Consider it like utilizing a checking account: are you saving for years, or transferring cash round day by day?

Lengthy-Time period Buying and selling

Lengthy-term buying and selling means shopping for crypto belongings and holding them for months or years. The aim is to attend for the worth to extend considerably over time. Many inexperienced persons select this methodology as a result of it doesn’t require fixed monitoring of the crypto platform. It’s much like investing in shares or actual property. You consider within the mission behind the coin, corresponding to Ethereum or Bitcoin, and also you anticipate it to develop in worth as adoption will increase.

In case you select this technique, you would possibly commerce Bitcoin as soon as, then maintain onto it whereas ignoring short-term worth swings. That means, you’re much less uncovered to the day-to-day noise of the market, however it’s important to be affected person and prepared to see your funding dip within the quick time period. Safety turns into extra essential right here—you’ll need to retailer your belongings in a personal pockets quite than depart them on the change.

Learn Extra: Greatest Lengthy-Time period Cryptocurrencies for 2025

Quick-Time period Buying and selling

Quick-term buying and selling focuses on making the most of small worth adjustments over hours or days. You make trades often and depend on quick decision-making. This strategy fits people who find themselves comfy spending extra time on a crypto platform, watching charts, and performing on short-term alerts.

A brief-term dealer would possibly purchase a crypto asset within the morning and promote it that night if the worth goes up. Not like a long-term holder, you’re not involved with the coin’s future potential—simply whether or not you’ll be able to earn a revenue from the present worth motion. It’s extra like flipping foreign money than saving in a checking account.

This technique can generate faster features however comes with greater threat. Crypto costs transfer quick, and should you’re not paying consideration, losses can occur simply as shortly as earnings. Inexperienced persons can nonetheless do this strategy, nevertheless it’s important to start out small and deal with it like a talent to develop over time.

Selecting Your First Cryptocurrency for Buying and selling

Selecting your first crypto to commerce is likely one of the largest hurdles inexperienced persons have to beat. Alternative paralysis is already tough once you’re simply in search of your subsequent Netflix present, and now there’s cash concerned!

It’s simple to chase headlines or bounce on a coin that’s all of the sudden trending. However hype shouldn’t be a technique. What you want is a coin that behaves predictably in most situations, with stable infrastructure and sufficient buying and selling exercise to allow you to purchase or promote with out points. One of the best beginner-friendly cash are well-supported throughout main buying and selling platforms, backed by lively improvement groups, and examined by real-world use.

Widespread Newbie-Pleasant Cash

These cryptocurrencies are broadly accessible, supported by most platforms, and actively utilized by day merchants and buyers alike.

Bitcoin (BTC). Essentially the most traded and well-known cryptocurrency. It has excessive liquidity and is usually used as a reference for market traits.

Ethereum (ETH). Recognized for good contracts and an enormous developer base. Presents long-term potential and regular quantity.

Litecoin (LTC). A lighter, sooner model of Bitcoin. Usually used for smaller transactions with decrease transaction charges.

USD Coin (USDC). A stablecoin that doesn’t fluctuate a lot. Good for studying how trades work with out heavy threat.

Solana (SOL). Widespread amongst newer merchants because of its quick transactions and rising ecosystem.

What Makes a Good First Funding?

Your first crypto commerce must be easy to execute and simple to handle. That begins with liquidity. A coin that trades on two or three main platforms with constant day by day quantity provides you the flexibleness to enter and exit with out delays or worth slippage. In case you’re counting on a tiny change or struggling to fill an order, you’re already including threat you don’t want.

Equally essential is readability. In case you can’t clarify what the coin truly does in a single sentence, you shouldn’t be buying and selling it. That doesn’t imply memorizing the technical whitepaper, however it’s best to perceive the fundamentals: what the mission is for, who’s behind it, and the way it works. If the final replace was over a yr in the past, take that as a warning. Lively initiatives depart a visual path.

Buying and selling quantity can verify whether or not worth strikes are actual. Excessive quantity means stronger traits and fewer false alerts. That provides you a extra steady surroundings to observe coming into and exiting trades with confidence. Market cap can be value contemplating. Smaller-cap tokens typically transfer sooner, however not all the time for the precise causes. A single rumor can push the worth up or down 20% in an hour. As a newbie, that type of volatility might be deadly on your funds.

Bear in mind: the aim together with your first funding isn’t to search out the subsequent breakout. It’s to construct consolation with the buying and selling course of.

How To Commerce Crypto 101: The Fundamentals You Want To Know

Earlier than you place a commerce, you could perceive how the market works. Crypto doesn’t transfer randomly—there are patterns, instruments, and knowledge that may enable you to make higher choices.

What Drives Crypto Costs?

Crypto costs change primarily based on provide and demand, however the forces behind that demand are distinctive. Information, laws, and macro occasions (like inflation or rate of interest adjustments) typically set off huge strikes. So does sentiment—concern and hype unfold quick in crypto.

On-chain exercise additionally issues. If extra individuals are utilizing a community (sending tokens, staking, or minting NFTs), that often will increase the worth. Restricted provide, token burns, or halving occasions (like Bitcoin’s) can scale back accessible cash and push costs greater.

Lastly, giant merchants (whales) can transfer markets with a single transaction. In a low-liquidity market, which occurs very often for cryptocurrencies, that issues greater than you assume.

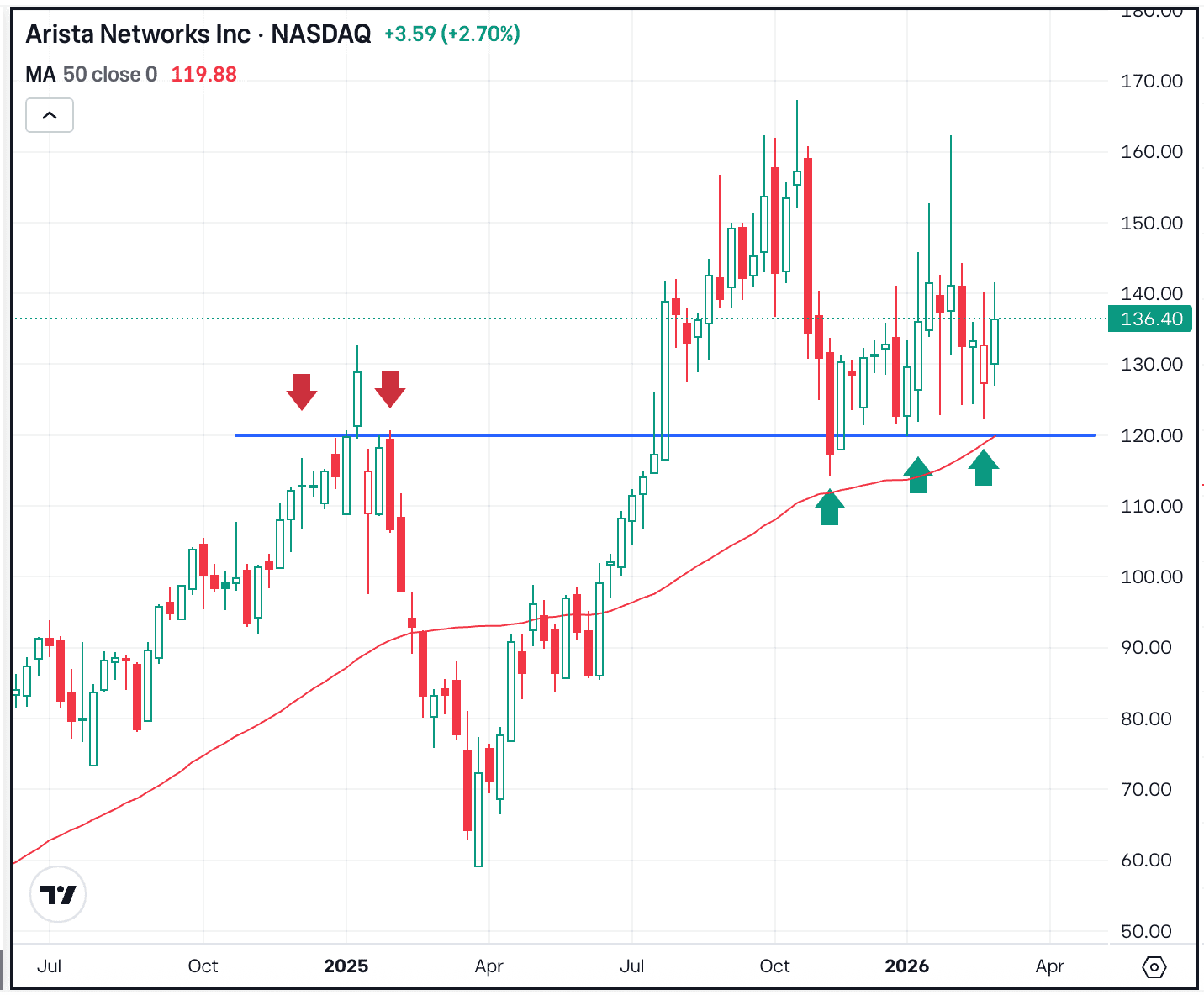

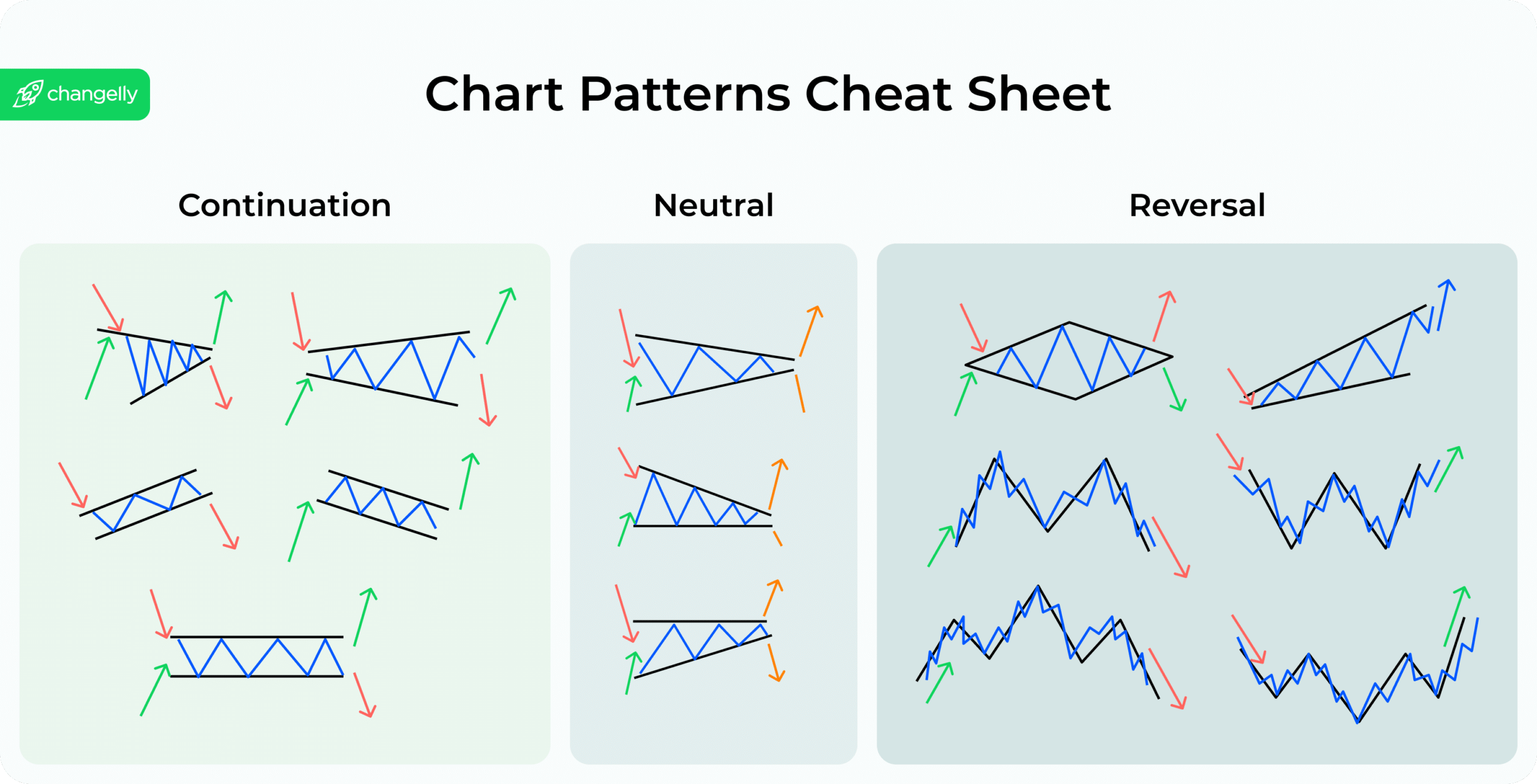

Fundamental Chart Studying

Charts enable you to see what the worth has executed, and what it would do subsequent. You’ll largely use candlestick charts, which present how costs transfer over time. Inexperienced candles imply the worth went up throughout that time-frame; purple means it went down.

You’ll additionally see help and resistance ranges—these are zones the place the worth tends to stall or reverse. Studying to identify them provides you an edge when deciding the place to enter or exit.

Technical Evaluation

Technical evaluation means utilizing chart patterns, quantity, and indicators to search out buying and selling alternatives. It doesn’t predict the longer term, nevertheless it helps you make extra knowledgeable choices primarily based on previous worth conduct. Widespread instruments embrace RSI, transferring averages, MACD, and Fibonacci retracements. These might help you time trades and handle threat extra successfully.

Order Varieties

Each crypto commerce begins with an order, however not all orders are the identical. The kind of order you select determines how and when your commerce is executed.

Market orders are the best. You purchase or promote on the present market worth. It’s quick, however you would possibly pay extra (or get much less) than anticipated in a unstable market.

Restrict orders allow you to set a particular worth. The commerce solely occurs if the market hits that worth. It provides you extra management, however there’s an opportunity your order received’t be stuffed.

Cease-loss orders assist defend your draw back. If the worth drops to a sure degree, the cease order turns right into a market order and sells your asset routinely.

Take-profit orders work the identical means, however on the upside. As soon as the worth hits your goal, the asset sells and locks in any features.

You may open a protracted place should you anticipate the worth to rise: you’re shopping for low to promote excessive later. In case you anticipate a drop, you’ll be able to take a brief place, which suggests borrowing an asset to promote it now and shopping for it again at a lower cost. Shorting includes extra threat and often requires a margin account.

Utilizing the precise order sort—and realizing when to go lengthy or quick—helps you commerce smarter, handle threat, and keep away from emotional choices.

When To Promote

Figuring out when to promote is simply as essential as realizing when to purchase cryptocurrency. Promoting too quickly means you miss potential features. Promoting too late may wipe out your earnings.

Set a transparent goal before you purchase. Resolve the worth the place you’ll take revenue and persist with it. Emotional promoting results in unhealthy trades.

You need to use technical indicators to search out exit alerts. For instance, if the worth hits a powerful resistance degree or an indicator like RSI reveals the asset is overbought, it could be time to promote.

Don’t ignore fundamentals. If a mission’s management adjustments, improvement stalls, or unhealthy information hits the market, promoting can defend your capital.

Have a stop-loss plan. This routinely sells your place if the worth falls beneath a sure level. It limits your losses and removes the stress to make a split-second determination.

Instruments for Crypto Analysis

You need to use these instruments to remain knowledgeable and spot sturdy buying and selling setups:

CoinGecko / CoinMarketCap. Observe worth, quantity, market cap, and mission stats

TradingView. Charting platform with technical indicators and drawing instruments

Glassnode / IntoTheBlock. On-chain analytics (pockets exercise, flows, and so forth.)

Messari. Deep analysis studies on crypto initiatives

X (previously Twitter). Actual-time updates from merchants, devs, and analysts

Discord/Telegram. Group discussions, however be cautious of hype

Widespread Cryptocurrency Buying and selling Methods

There’s no single technique to commerce cryptocurrency. Your technique is dependent upon how a lot time you need to spend watching the market, how comfy you might be with threat, and what your buying and selling targets are. Under are beginner-friendly methods that enable you to discover optimum entry factors, handle your crypto account, and reply to altering market situations.

HODLing (Lengthy-Time period Holding)

HODLing means shopping for a digital foreign money and holding it for months or years, no matter short-term worth swings. You’re not making an attempt to time the market—you consider within the long-term worth of the asset and belief the community safety and adoption of the mission.

It’s a low-effort, low-stress technique, finest for individuals with a very long time horizon and low buying and selling frequency. Bitcoin and Ethereum are the commonest cash held this manner.

Day Buying and selling

Day buying and selling includes shopping for and promoting crypto inside a single day to revenue from short-term worth actions. You’ll want to remain lively, watch the charts, and study to acknowledge patterns that sign when to enter or exit trades.

This technique requires self-discipline, quick decision-making, and a excessive threat tolerance. It’s not advisable until you’re able to spend time studying how the market reacts minute-by-minute.

Swing Buying and selling

Swing merchants maintain positions for a number of days or perhaps weeks. The aim is to catch “swings” in worth—shopping for after a dip and promoting after an increase. You don’t want to observe your crypto account continuously, however you do must comply with market situations and use primary evaluation instruments.

This technique strikes a steadiness between HODLing and day buying and selling, and it’s a superb entry level for inexperienced persons who need to be extra hands-on.

Greenback-Price Averaging (DCA)

DCA means investing a hard and fast quantity right into a cryptocurrency at common intervals—irrespective of the worth. For instance, shopping for $50 value of Bitcoin each week.

This technique smooths out volatility. As a substitute of making an attempt to time the market, you unfold out your purchases and scale back the impression of sudden worth adjustments. It’s a stable technique to construct publicity with out making emotional choices.

Pattern Buying and selling Technique

Pattern buying and selling means figuring out the route of the market—up or down—and buying and selling in that route. If the worth is rising, you search for a superb entry and trip the pattern. If it’s falling, you would possibly quick the asset or keep out solely.

To make use of this technique, you could perceive the way to acknowledge patterns, comply with information that impacts digital currencies, and ensure traits with technical indicators. It’s extra superior than DCA or HODLing however nonetheless accessible to dedicated inexperienced persons prepared to study.

How To Shield Your Crypto Property

Buying and selling cryptocurrency opens new alternatives, nevertheless it additionally places your digital belongings in danger should you don’t take safety critically. Right here’s the way to defend what you personal, whether or not you’re day buying and selling or holding for the long run:

Use non-custodial walletsCustody providers are third events that maintain your crypto for you (like an change). Non-custodial wallets allow you to maintain your individual personal keys, providing you with full management and full accountability.

Allow two-factor authentication (2FA)This provides a second layer of safety past your password. Use apps like Google Authenticator or Authy, not SMS.

Write down your seed phraseStore it offline in a number of safe areas. By no means put it aside in cloud storage or screenshots.

Look ahead to phishing scamsAlways double-check URLs, emails, and apps. By no means click on unknown hyperlinks or approve pockets entry from untrusted sources.

Use chilly wallets for long-term storageThese offline wallets are resistant to on-line assaults. Units like Ledger or Trezor are good choices.

Preserve software program updatedWhether it’s your pockets app or browser extension, updates patch important safety vulnerabilities.

Danger Administration in Crypto

Danger administration is what separates a fortunate win from a constant buying and selling technique. In crypto, worth adjustments can occur quick, particularly should you’re day buying and selling or reacting to sudden information. With no plan, it’s simple to lose greater than you acquire.

Begin by defining how a lot you’re prepared to threat on every commerce. Many skilled merchants by no means threat greater than 1–2% of their whole portfolio. This limits losses when the market strikes towards you. Whether or not you’re buying and selling Bitcoin or swapping tokens for fiat foreign money, this rule helps protect capital.

Subsequent, perceive the function of stop-loss and take-profit ranges. These instruments allow you to automate your choices as an alternative of reacting emotionally. If a coin drops beneath your threat threshold, you promote. If it hits your goal, you lock in earnings. It’s easy, and it really works.

Don’t depend on borrowing or leverage till you perceive how crypto behaves. Crypto is nothing like conventional currencies—it’s sooner, extra unstable, and fewer forgiving. Brokerage providers might provide superior options, however they received’t defend you from unhealthy trades.

Even long-term holders want a threat plan. You’re nonetheless uncovered to market cycles, regulation shifts, and tech dangers. Diversify your belongings, keep up to date, and assessment your portfolio recurrently. As new alternatives come up, you’ll be in a greater place to purchase and promote with confidence.

Frequent Errors Inexperienced persons Make When They Begin Buying and selling Crypto

New merchants typically repeat the identical avoidable errors. Listed below are the commonest errors:

Assuming day buying and selling is easyMost inexperienced persons lose their cash quick. Timing trades with out expertise is more durable than it appears.

Buying and selling too many coinsFocus on one or two belongings at first, like Bitcoin, Ethereum, or Solana. Spreading your cash skinny results in confusion and poor choices.

Utilizing instruments you don’t understandIndicators received’t assist should you don’t understand how they work. Be taught earlier than you depend on them.

Trusting worth over fundamentalsPrice spikes typically imply hype, not high quality. Take a look at the mission, not simply the chart.

Specializing in the charts too muchThere’s a phenomenon known as evaluation paralysis, a scenario when merchants get overwhelmed by all of the charts and indicators, too afraid to make a mistake and thus not making any merchants. Keep in mind that whereas analysis is essential, charts aren’t every part.

Treating crypto like gamblingRandom trades aren’t a technique. Stick with established guidelines and assessment each transfer.

Neglecting safety early onEven small quantities get stolen. Use sturdy passwords, wallets, and two-factor authentication from day one.

Closing Ideas

Buying and selling cryptocurrency isn’t about luck—it’s about studying how markets transfer, defending your digital belongings, and constructing a technique that works for you. Begin easy. Concentrate on cash with actual utility. Preserve your threat low and your safety tight. As your abilities develop, so will your means to identify alternatives and react with confidence. The crypto market strikes quick, however with the precise basis, you don’t need to fall behind.

FAQ

Is cryptocurrency buying and selling secure for inexperienced persons?

It may be should you begin small and study the fundamentals. Crypto is very unstable, so managing threat is crucial from the beginning.

How a lot cash do I would like to start out buying and selling crypto?

You may commerce cryptocurrency with as little as $10. Most platforms have low entry limits, making it simple to start.

Can I lose all my cash in crypto buying and selling?

Sure, particularly should you ignore threat or strive day buying and selling with no plan. Digital belongings can drop sharply with out warning.

What’s the distinction between investing and buying and selling crypto?

Investing means holding long-term primarily based on a mission’s potential. Buying and selling focuses on short-term worth strikes to earn rewards extra often.

How do I do know which crypto is value shopping for?

Begin with belongings which have excessive buying and selling quantity, are listed on main exchanges, and behave predictably—like Bitcoin or Ethereum. In case you can’t clarify what the coin does or who’s utilizing it, don’t commerce it.

Disclaimer: Please observe that the contents of this text should not monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.