On-chain knowledge suggests the Bitcoin miners are presently fairly underpaid. May this set off a selloff from these chain validators?

Bitcoin Miners Are Extraordinarily Underpaid In accordance To This Mannequin

As identified by analyst IT Tech in a CryptoQuant Quicktake publish, the Miner Revenue/Loss Sustainability has just lately seen a pointy damaging spike for Bitcoin. The “Miner Revenue/Loss Sustainability” refers to an on-chain indicator that compares miner income with mining issue.

When the worth of the metric is very constructive, it means the miners are incomes a excessive revenue relative to the problem stage imposed by the blockchain for mining new blocks. Such a pattern can suggest that these chain validators could also be turning into overpaid.

However, the indicator being deep within the damaging area can counsel miners could also be underpaid as they’re pulling in a low income regardless of excessive issue.

Now, right here is the chart shared by the analyst that exhibits the pattern within the Bitcoin Miner Revenue/Loss Sustainability over the previous yr:

The worth of the metric seems to have seen a pointy damaging spike in current days | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin Miner Revenue/Loss Sustainability has witnessed a plunge deep into the crimson zone, an indication that miner income has dropped relative to the problem.

The indicator is now flashing an ‘extraordinarily underpaid’ sign for the miners. Traditionally, every time the miners are underneath monetary stress, they take part in some promoting to maintain the electrical energy payments paid. Given the present state of this cohort, it’s doable that BTC might quickly face elevated promoting stress from them.

To date, miner promoting has truly trended down, because the pattern in one other indicator suggests.

Seems to be like the worth of the metric has been sliding down | Supply: CryptoQuant

The chart exhibits the log-scaled knowledge of the Bitcoin Miner Promoting Energy, an indicator that measures the ratio between BTC miner outflows (that’s, the quantity going out of their wallets) in opposition to their whole holdings.

It might seem that the metric has just lately been sharply transferring down, a possible indication that miners have been taking part in decreased promoting relative to their reserves. Contemplating the stress that these chain validators are underneath, nevertheless, it solely stays to be seen how lengthy this steadiness lasts.

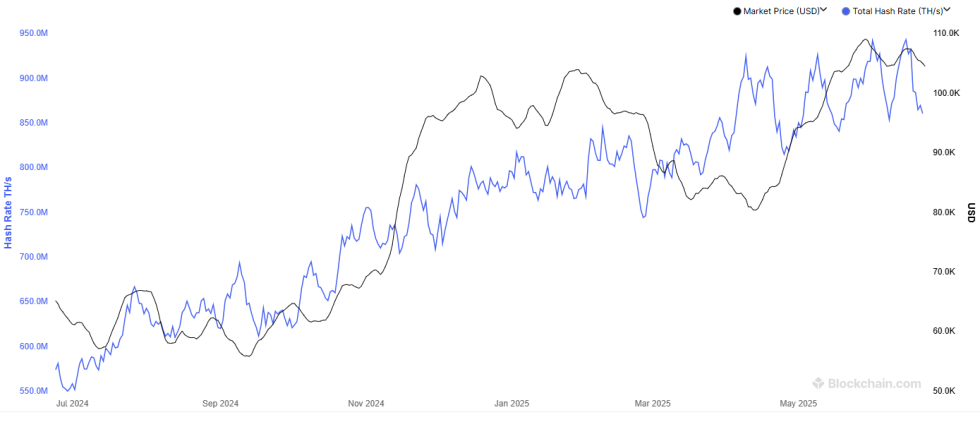

In another information, the entire quantity of computing energy employed by the miners, the “Hashrate,” has crashed, because the 7-day common knowledge of the metric exhibits.

The pattern within the BTC Hashrate over the previous twelve months | Supply: Blockchain.com

Earlier within the month, the Bitcoin Hashrate rose to a brand new all-time excessive (ATH) earlier within the month, however has plummeted since then, that means that the miners haven’t been in a position to maintain their upgrades, offering one other affirmation of the stress the miners are underneath.

BTC Value

Bitcoin crashed near the $98,000 mark yesterday, however its value has since jumped again as much as $101,100.

The value of the coin seems to have plummeted | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Blockchain.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.