The rise of cryptocurrencies has ignited a world dialog round monetary freedom within the digital age. With the overall crypto market cap surpassing $2 trillion, in line with CoinGecko, digital property are more and more seen as a pathway to wealth creation that bypasses the restrictions of conventional monetary methods.

Nevertheless, this inflow of curiosity and capital hasn’t essentially translated into widespread monetary empowerment. Regardless of crypto’s promise of decentralization, the trade continues to wrestle with problems with manipulation, fraud, and systemic instability. These contradictions elevate an pressing query: is cryptocurrency really delivering on its promise of monetary freedom, or is it merely recreating current inequalities underneath a brand new banner?

On this article, we discover this query by 4 essential lenses: monetary inclusion, volatility and threat, regulatory challenges, and the strain between real success tales and overhyped narratives. By analyzing each the chances and the pitfalls, we purpose to grasp whether or not crypto gives an actual likelihood at monetary independence—or if the promise stays simply that: a promise.

Monetary Inclusion: Bridging the Hole for the Unbanked

Cryptocurrency is commonly described as a modern-day equalizer—a decentralized finance answer that may serve unbanked people globally. In contrast to conventional banking methods, monetary freedom with crypto removes limitations like credit score scores, paperwork, and bodily infrastructure. All one wants is a smartphone and web entry—an accessible entry level into the worldwide economic system.

Take Argentina, the place hovering inflation charges exceeding 200% in 2024 have eroded the worth of the native foreign money. Many voters have turned to Bitcoin to protect their wealth. Based on Chainalysis’ 2024 International Crypto Adoption Index, Argentina acquired roughly $91.1 billion in crypto, barely forward of Brazil rating fifteenth globally and showcasing vital grassroots adoption.

This alerts that in locations like Argentina, Bitcoin as a monetary device isn’t only a passing pattern—it’s a monetary necessity.

Nigeria presents the same case. With strict controls over international foreign money entry, crypto has emerged as a dependable workaround. Peer-to-peer platforms like Binance and KuCoin gained large traction, making Nigeria rank prime in P2P buying and selling quantity in accordance to the 2023 Geography of Cryptocurrency Report by Chainalysis. This grassroots development underscores the function of crypto monetary independence in providing monetary alternate options to underserved populations.

The evolution of DeFi additional broadens entry. Protocols like Aave and Uniswap permit customers to lend, borrow, and earn yields with no financial institution. Nevertheless, this promise will not be with out limitations. A 3rd of the worldwide inhabitants nonetheless lacks web entry (ITU, 2023), and digital literacy stays a problem. Understanding personal keys, gasoline charges, and pockets safety requires training that many don’t but have.

Furthermore, community charges might be prohibitive. Ethereum transactions throughout peak intervals can value anyplace from $10 to $50, which is exorbitant for people residing on only a few {dollars} a day. So whereas monetary freedom with crypto holds potential, it’s not but common.

Volatility and Threat: A Double-Edged Sword

Some of the debated facets of crypto is its volatility. Whereas some have fun its high-reward potential, others view it as a serious impediment to real crypto monetary independence. For a lot of, investing in crypto feels extra like playing than securing a future.

As an example, Bitcoin as a monetary device demonstrated its volatility when it surged to $40,000 in April 2022, solely to crash to $16,000 by November of the identical 12 months.

Such dramatic fluctuations are dangerous, particularly for these utilizing crypto as a major financial savings technique. In conventional finance, a 5% market dip is a purple flag. In crypto, double-digit swings are a each day affair, undermining the safety important for monetary freedom with crypto.

Stablecoins like TerraUSD (UST) had been created to handle this instability. However the 2022 collapse of UST—as soon as a prime 10 cryptocurrency—proved that even “steady” property can unravel. Over $40 billion in market worth disappeared virtually in a single day, decimating the financial savings of numerous buyers.

Efforts to mitigate such dangers embody extra sturdy stablecoins like USDC and DAI, that are backed by reserves and overcollateralized property. Nonetheless, these alternate options aren’t invulnerable. USDC’s transient depeg in March 2023 throughout the Silicon Valley Financial institution collapse highlights ongoing fragility.

For low-income earners or these in unstable economies, such dangers are greater than inconvenient—they’re life-altering. The shortage of stability implies that crypto funding dangers stay a central concern, difficult the notion that crypto is a pathway to true monetary freedom.

Regulatory Challenges: A International Authorized Minefield

The fragmented and inconsistent regulatory panorama surrounding crypto is one other vital barrier to widespread adoption and sustained crypto funding methods. The shortage of unified authorized frameworks breeds confusion, deters newcomers, and generally punishes innovation.

China’s crypto crackdown illustrates this completely. After initially embracing Bitcoin mining, the federal government imposed a sequence of bans—from ICOs in 2017 to buying and selling and mining by 2021. These abrupt coverage shifts compelled miners and buyers to flee, considerably impacting international hash charges and consumer confidence.

In distinction, El Salvador embraced Bitcoin as a monetary device, turning into the primary nation to make it authorized tender in 2021. The purpose? To spice up monetary inclusion and scale back the price of remittances. Whereas bold, the coverage has confronted criticism for its volatility and uneven adoption.

In the meantime, the US continues to grapple with enforcement-led regulation. The SEC has filed lawsuits in opposition to main exchanges like Coinbase and Binance, alleging violations of securities legal guidelines. These authorized actions generate concern and uncertainty, significantly for retail buyers who battle to grasp which tokens or platforms are thought-about compliant.

India’s method has additionally fluctuated, starting from banking bans to a 30% capital positive aspects tax on crypto, and a 1% transaction tax. These combined alerts discourage long-term crypto funding methods, significantly amongst common customers who can’t afford authorized counsel.

This international inconsistency limits entry, will increase the chance of scams, and additional highlights the crypto funding dangers that customers should navigate. Regulatory gaps additionally empower dangerous actors.

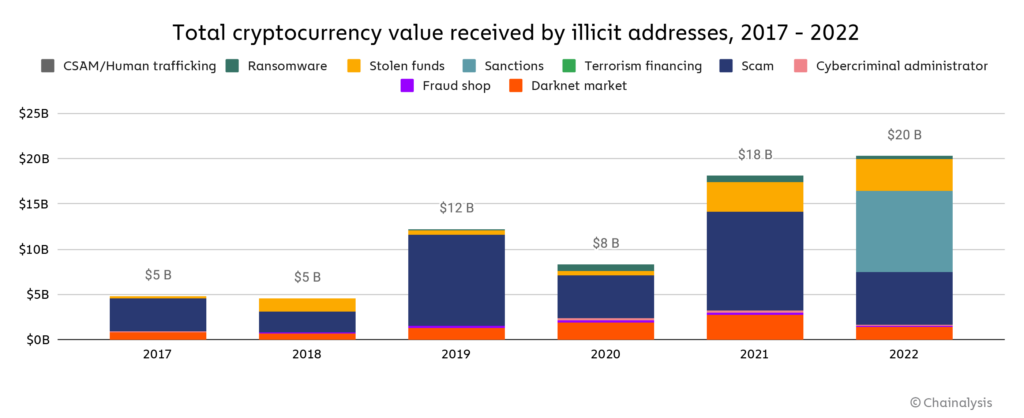

Chainalysis experiences that illicit crypto exercise totalled $20.1 billion in 2022, primarily scams and sanctions violations exacerbated by a scarcity of oversight.

Success Tales vs. Hype: Sorting Sign from Noise

Whereas crypto has generated actual alternatives, it’s equally chargeable for creating unrealistic expectations. The ecosystem is full of tales of in a single day wealth, however for each success, there are way more tales of loss. The fact is that real crypto monetary independence typically requires greater than luck—it calls for data, self-discipline, and time.

We’ve the likes of Cooper Turley, who turned a millionaire by early investments in Ether and Bitcoin. Or Beeple, whose NFT artwork fetched $69.3 million at Christie’s in 2021. These instances showcase the immense potential of Web3. However they’re exceptions, not the rule.

Extra widespread are the tales of customers who fall sufferer to scams, FOMO-driven choices, or exploitative platforms. Crypto funding methods based mostly on social media hype typically finish in disappointment. Market volatility, lack of regulation, and technical complexity make the house dangerous for the uninformed.

Nonetheless, there’s a quieter, extra resilient facet to the crypto world. Builders and long-term customers are leveraging DeFi for remittances, financial savings, and even id administration. These customers prioritize real-world utility over hypothesis.

The promise of monetary freedom with crypto is actual, but it surely’s typically overstated when filtered by the lens of media hype. Success on this house often comes from cautious planning, steady studying, and respect for crypto funding dangers—not viral TikToks or moonshot guarantees.

Conclusion:

So, is monetary freedom overstated with crypto? I’d say sure and no.

Cryptocurrency is sort of a double-edged sword wrapped in alternative: decentralized finance, borderless entry, and digital possession on one facet; volatility, scams, and regulatory chaos on the opposite. It’s not the get-rich-quick machine some crypto bros on TikTok make it out to be—but it surely’s additionally not simply smoke and mirrors.

We’ve seen crypto supply lifelines in locations like Argentina and Nigeria, the place Bitcoin as a monetary device isn’t simply handy—it’s important. We’ve additionally seen complete fortunes vanish within the blink of an eye fixed because of crashes, hacks, or the collapse of so-called “steady” cash.

So, what’s the decision? Attaining crypto monetary independence is feasible, but it surely’s not computerized. It requires real looking expectations, steady training, diversified crypto funding methods, and, maybe most significantly, persistence. The rollercoaster is actual, and never everybody has the abdomen (or bandwidth) for the experience.

Monetary freedom with crypto isn’t a fantasy—neither is it magic. It’s a protracted sport, not a lottery ticket.

Ultimately, crypto gained’t give you freedom. However for those who play your playing cards proper, it would simply assist you earn it.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”