Goldman Sachs is planning to ask junior analysts to confirm each three months that they do not have a job lined up elsewhere, in a periodic pledge of loyalty, Bloomberg experiences.

The loyalty oaths are supposed to get forward of personal fairness corporations, which may provide candidates jobs as much as two years earlier than a possible begin date. These corporations have been extending gives to junior bankers firstly of their job coaching at Goldman Sachs, or earlier than they even start coaching, in a course of often known as on-cycle recruitment.

Associated: Right here Are the Odds of Touchdown a Summer season Internship at Goldman Sachs or JPMorgan

Goldman Sachs is not the one financial institution on Wall Avenue to crack down on poaching from personal fairness corporations. Final month, JPMorgan Chase, the biggest financial institution within the U.S. with $3.9 trillion in property, warned incoming analysts in a leaked e-mail that they might be fired in the event that they accepted a future-dated job provide earlier than becoming a member of the financial institution or inside the first 18 months of their employment.

JPMorgan mentioned that the coverage was meant to stop any attainable conflicts of curiosity.

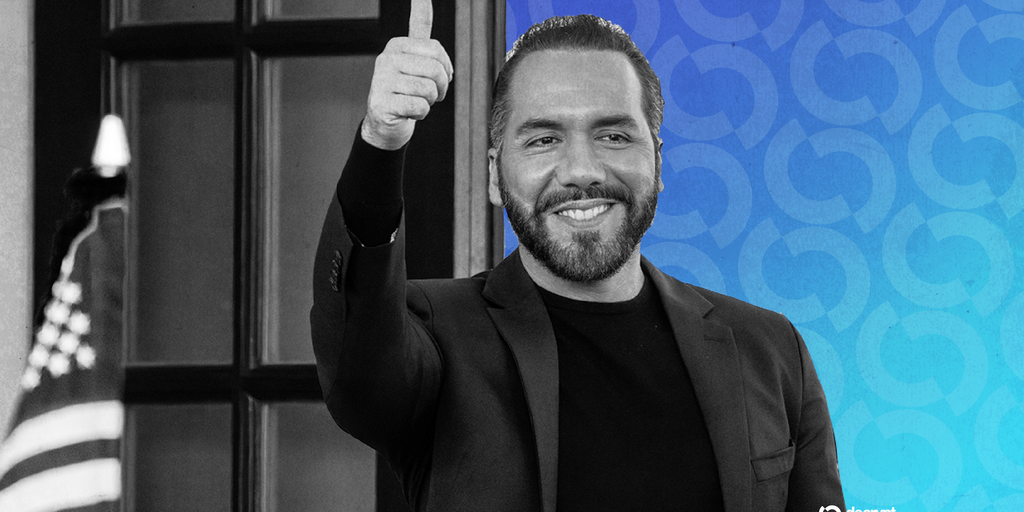

Goldman Sachs CEO David Solomon. Photographer: Naina Helén Jåma/Bloomberg through Getty Photos

JPMorgan CEO Jamie Dimon, 69, beforehand mentioned that the observe of shedding expertise to non-public fairness was “unethical.” At a chat at Georgetown College in September, Dimon mentioned that shifting to non-public fairness places JPMorgan “in a conflicted place” as a result of workers are already pledged to a different agency whereas they deal with confidential data at JPMorgan.

“I feel that is unethical,” Dimon mentioned on the speak. “I do not prefer it.”

Main personal fairness agency Apollo International Administration introduced final month that it could not conduct formal interviews or lengthen job gives to the category of 2027 in response to criticism in regards to the personal fairness hiring course of starting too early.

Associated: Goldman Sachs Asks Some Managers to Transfer From Main Hubs Like New York Metropolis to Rising Areas Like Dallas — Or Stop

Apollo CEO Marc Rowan informed Bloomberg in an emailed assertion final month that “asking college students to make profession selections earlier than they really perceive their choices does not serve them or our business.”

Apollo and Goldman Sachs provide comparable compensation packages. In keeping with federal filings pulled by Enterprise Insider, Apollo pays analysts a base wage of $115,000 to $150,000. Associates make wherever from $125,000 to $200,000.

As compared, Goldman Sachs pays first-year analysts $110,000 and first-year associates $150,000. Second-year analysts make $125,000.

Goldman Sachs is planning to ask junior analysts to confirm each three months that they do not have a job lined up elsewhere, in a periodic pledge of loyalty, Bloomberg experiences.

The loyalty oaths are supposed to get forward of personal fairness corporations, which may provide candidates jobs as much as two years earlier than a possible begin date. These corporations have been extending gives to junior bankers firstly of their job coaching at Goldman Sachs, or earlier than they even start coaching, in a course of often known as on-cycle recruitment.

Associated: Right here Are the Odds of Touchdown a Summer season Internship at Goldman Sachs or JPMorgan

The remainder of this text is locked.

Be part of Entrepreneur+ right this moment for entry.